IFMSecurities.com Website Evaluation Breakdown

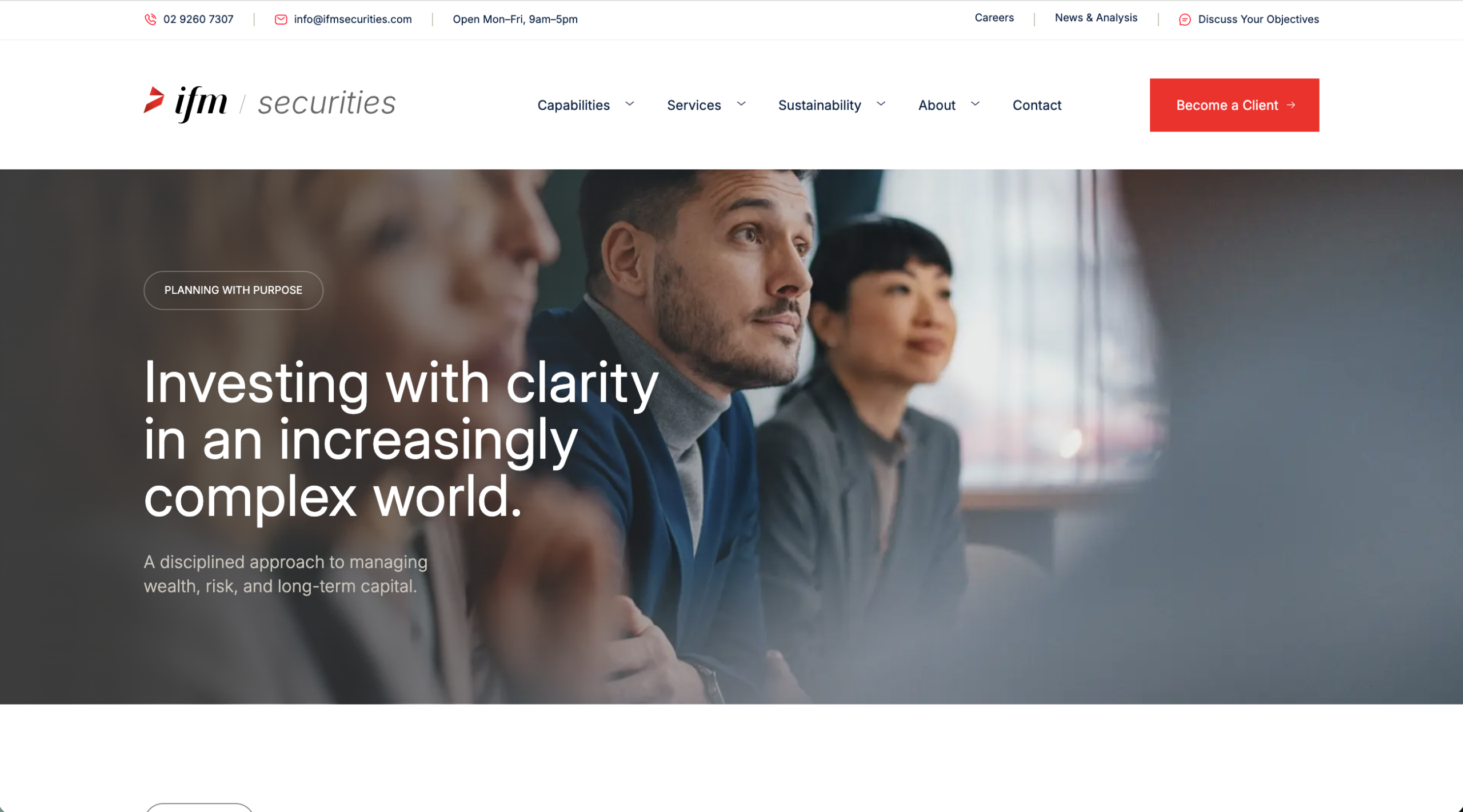

ifmsecurities.com presents itself as an online financial services platform where users can trade or invest in various markets. On the surface, it looks like a polished site for wealth and asset management. But when evaluated against standard criteria for trustworthy financial platforms, there are several layers of concern that make it clear this platform is not suitable for use without extreme caution and verification.

Surface Claims vs. Reality

ifmsecurities.com claims to be a modern Australian wealth and asset management firm focused on long-term strategies and preserving capital. Its marketing materials speak of portfolio strategy, private wealth solutions, and disciplined investment approaches.

The website includes typical finance-oriented language and structured sections on services and governance. However, just because a site uses professional language does not mean the service is legitimate. Fraudulent platforms often copy industry jargon and branding styles to create an illusion of credibility.

Lack of Verified Oversight and Regulation

One of the most important factors in assessing any financial platform is confirmed regulatory status with recognized authorities (such as the U.K.’s FCA, Australia’s ASIC, or South Africa’s FSCA). However, there is no independent evidence confirming that ifmsecurities.com is registered with any respected regulator.

Without regulatory oversight, users have no protections, no dispute resolution channels, and no audited financial disclosures that legitimate firms are required to provide. This absence of transparent verification is a major warning sign when it comes to online investment platforms.

User Experience Reports Raise Alarm

Searches on independent review sites reveal very limited credible feedback, and what does appear is deeply concerning:

A recent review on Trustpilot shows a 1-star review alleging significant financial loss after engaging with the platform. The reviewer described being misled into investing large sums and then experiencing withdrawal difficulties and account issues.

A single bad review does not prove fraud on its own, but when a site oriented around financial services has virtually no positive or balanced user feedback, it strongly suggests that something is not right.

Platform Structure Often Used by High-Risk Sites

Analysis from sites investigating questionable financial services often shows patterns such as:

-

Opaque regulatory disclosures

-

Ambiguous fee structures or hidden charges

-

No clear documentation of licensing

-

Pressure marketing tactics in promotional content

Many scam and questionable trading operations use professional-looking websites to attract investors while keeping critical information hidden from public scrutiny. A site that offers complex investment services without publicly verifiable credentials is inherently suspicious.

The fact that ifmsecurities.com provides only high-level marketing language without transparent, verifiable documentation makes it difficult for users to trust how the platform actually operates.

Independent Review Sites Flag Issues with Similar Names

While ifmsecurities.com itself hasn’t been widely reviewed, other similarly named or structured financial sites (e.g., ifmplatform.com or ifm.us.com) have received low or mixed trust scores from automated evaluators because of minimal online presence, hidden ownership, and potential risks.

Sites with few visitors, hidden WHOIS information, and uncertain domain age often appear legitimate at first glance but lack the public track record and accountability expected of established financial firms. These elements make them ripe for misuse in deceptive operations.

Lack of Independent Reviews is a Red Flag

Most established financial services and brokerages have a presence on major independent review platforms with balanced feedback, including both positive and negative reports. But for ifmsecurities.com, Trustpilot shows almost no credible reviews aside from a strongly negative user account.

A lack of independent reviews usually means there isn’t enough real user data to make an informed decision — and that in itself is a warning sign for potential customers.

Risk of Misleading Marketing and Promises

Platforms with unverified legitimacy often use marketing that promises professional support, advanced tools, or attractive returns without clearly explaining:

-

How users’ funds are managed

-

The regulatory protections in place

-

The credentials of the team behind the platform

Without this clarity, investors are essentially being asked to trust a marketing narrative without any supportable facts. Sites like this have been known to disappear after collecting money or to impose increasingly complex conditions on withdrawals.

There is no publicly available evidence that ifmsecurities.com provides audited financial data, regulated trading services, or verifiable investment outcomes — all of which are critical trust indicators.

Conclusion: Exercise Extreme Caution and Generally Avoid

Based on the above analysis — including the lack of clear regulatory verification, minimal credible user reviews, alarming trust evaluation patterns, and absence of transparent operational details — there is no reliable evidence that ifmsecurities.com is a safe, legitimate financial platform.

Users interested in online investing or trading should be wary of platforms that operate with such ambiguity. Before using any financial service, you should always verify:

-

Official licensing with regulatory bodies

-

Clear and accessible terms and conditions

-

Public, credible user feedback

-

Independent third-party evaluations

Because these essentials are not demonstrably present for ifmsecurities.com, the safest course of action is to avoid using the platform entirely.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to ifmsecurities.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as ifmsecurities.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.