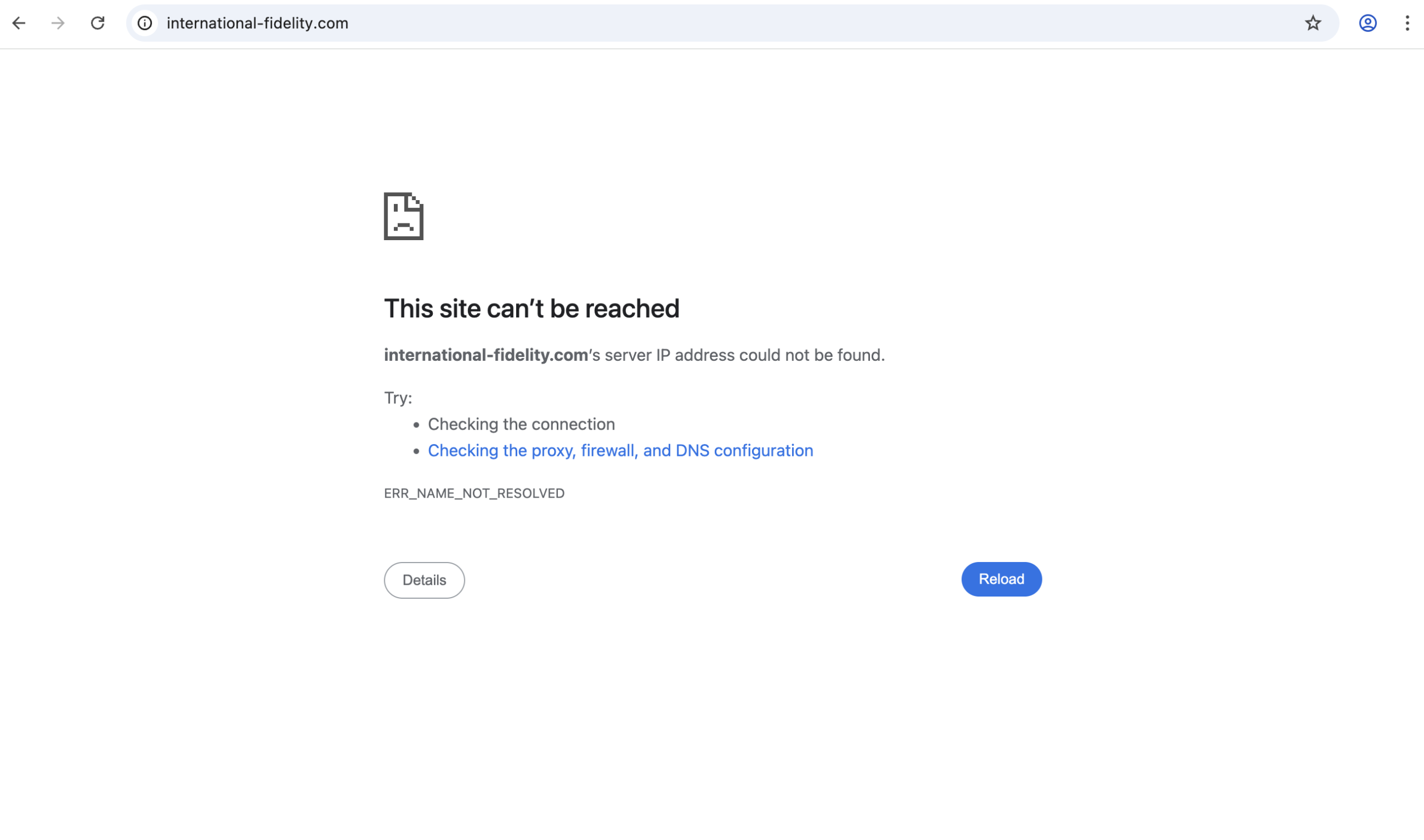

International‑Fidelity.com Detailed Review

When evaluating any online financial service, especially those offering trading, investing, or wealth-management products, it’s essential to verify legitimacy, regulation, and transparency before engaging. International‑Fidelity.com is one such platform that has attracted significant attention — but not for positive reasons. Available evidence and regulatory commentary strongly suggest that this platform should be treated with extreme caution by potential investors.

Below is a detailed review of the key concerns surrounding International‑Fidelity.com and what prospective users should know.

1. Clone Firm Warning from a Major Financial Authority

The most significant red flag regarding International‑Fidelity.com comes from the UK’s Financial Conduct Authority (FCA). The FCA has issued a formal warning that this website is operating as a “clone firm,” meaning fraudsters are using the identity and branding of a genuine authorised firm to deceive potential customers into believing the operation is legitimate.

In this case, the FCA notes that fraudsters advertising under the International‑Fidelity.com name are falsely claiming association with regulated entities like Financial Administration Services Limited and FIL Investment Services (UK) Limited — both of which have legitimate regulatory details and contact information.

However, the clone firm is not authorised by the FCA, and the genuine authorisations belong to unrelated, legitimately registered companies. This means that if anyone deals with the site and suffers a financial loss or dispute, they will not have access to UK protections such as the FCA’s Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS).

2. Misuse of Reputable Brand Details

By adopting the identity, branding, or similar details of genuinely regulated firms, clone operations like International‑Fidelity.com seek to exploit public trust in established names. This tactic — replicating firm names, registration numbers, or websites associated with legitimate financial services — is a common strategy used by fraudulent operations to deceive unsuspecting investors.

Clone firms may provide contact phone numbers, email addresses, and even imply they are regulated — all of which are carefully crafted to mislead. These details change often, making it harder for victims to trace or verify them.

3. Customer Feedback Indicates Withdrawal and Support Issues

Independent review platforms show some user experiences linked to International‑Fidelity.com that raise significant trust concerns. On Trustpilot, for example, the platform’s listed profile reflects a low average rating, with reviewers mentioning issues that include:

-

Deposits being accepted easily.

-

Withdrawals becoming difficult or impossible.

-

Support responses that are ineffective or unresponsive.

Both available reviews reflect extremely negative experiences, where users struggled to access funds or felt ignored after engaging with the platform.

4. Broader Scam Tactics Highlighted Around “Fidelity”-Branded Impersonations

It’s worth noting that scammers often impersonate well-known brands like Fidelity and other established financial services firms through fake websites, phishing messages, and unsolicited contact. Public safety guidance from legitimate institutions — including official scam alerts issued by established firms — warns consumers to be alert to unsolicited investment opportunities and to always verify contact details through official channels.

While these impersonation warnings relate to a broader pattern beyond International‑Fidelity.com specifically, they illustrate the larger ecosystem in which clone or fake websites operate: trying to exploit public trust in reputable financial institutions to lower guards and extract funds.

5. No Evidence of Regulation or Licensing Transparency

A critical indicator of reliability for any financial platform is clear, verifiable regulation by recognised authorities. In the case of International-Fidelity.com:

-

There is no public record showing that the entity has been authorised by a major regulator like the FCA, ASIC (Australia), SEC (USA), or similar bodies.

-

The FCA warning explicitly states that this domain and site are not authorised representatives — meaning they do not have legal permission to carry out regulated financial services in the UK.

Without such oversight, investors using the platform will not benefit from statutory protections, and there is no assurance that funds are held securely or that fair business practices are followed.

6. Risk of Identity Theft and Misuse

Another implicit danger with clone or impersonator platforms is the potential for data misuse. When consumers engage and provide personal details, fraudulent operators may use that information to conduct identity theft, credential harvesting, or further phishing attacks. While this danger is not unique to International‑Fidelity.com, clone operations by their nature increase these risks because they are not bound by regulatory data protection standards.

Conclusion: Very High Caution Is Warranted

International‑Fidelity.com exhibits multiple critical warning signs that suggest it is not a legitimate, regulated financial platform:

-

A formal clone firm warning from the FCA, indicating it impersonates authorised firms.

-

Misuse of reputable brand identifiers and false regulatory claims.

-

Very low independent user feedback, showing difficulties with basic financial operations like withdrawals.

-

No verifiable evidence of proper licensing or oversight.

Any investor considering engagement with this site should pause and verify independently through official regulatory registers before depositing funds, providing personal details, or conducting financial transactions.

In the world of online financial services, protecting your capital starts with trusting only those platforms that can clearly demonstrate legitimacy, regulation, and transparency — none of which International‑Fidelity.com has convincingly done.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to international-fidelity.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as international-fidelity.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.