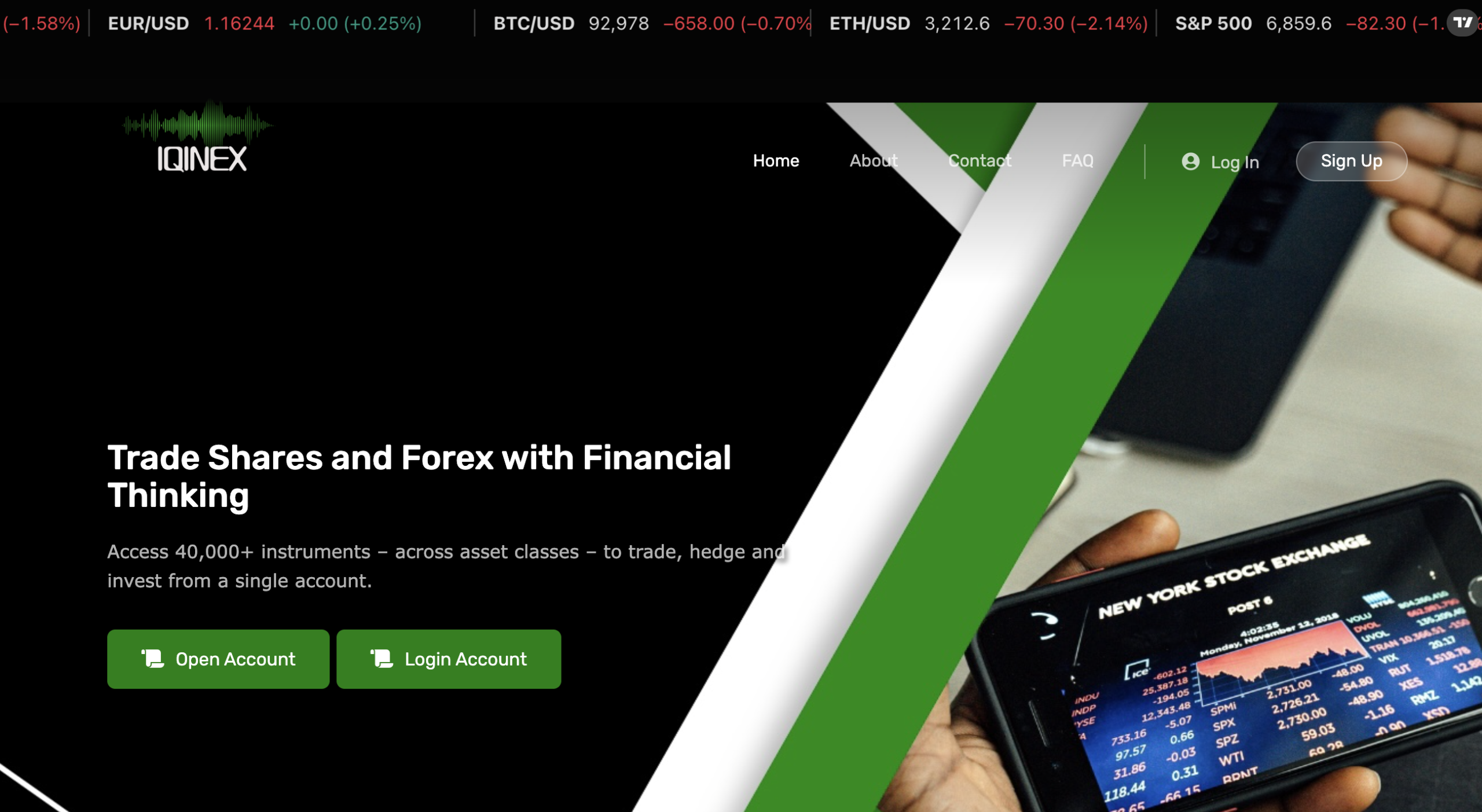

Iqinex.live Full Review for Online Traders

In recent years, online investment services, trading portals, and digital financial platforms have grown rapidly. Unfortunately, this expansion has also created opportunities for unverified operators to attract unsuspecting users with the promise of easy profits, advanced trading tools, or professional investment expertise. One such website currently generating attention—but for all the wrong reasons—is iqinex.live.

This review examines iqinex.live in detail, highlights key issues relevant to potential users, and explains why caution is strongly advised before interacting with this platform.

1. Low Trust and Reputation Indicators

Independent reputation analysis tools consistently return very low trust scores for iqinex.live. According to one automated security assessment, the site has a trust score of 0, meaning it ranks among the least trustworthy domains scanned by the service. This extremely low rating is based on multiple red flags related to ownership, traffic, hosting, and site behavior.

Negative indicators from the same evaluation include:

-

Hidden ownership details in WHOIS records, making it impossible to identify the real operators.

-

Low website traffic and popularity, suggesting the site has limited visibility or external validation.

-

Hosting alongside other low-trust domains, a pattern often associated with networks of suspicious or malicious websites.

-

Detection of cryptocurrency-related language and services, which are frequently used by fraudulent platforms to lure prospective investors.

Although iqinex.live does have an SSL certificate—meaning basic encryption is present—this technical feature alone does not indicate legitimacy. Most scam sites now use SSL because encryption has become a standard requirement for browsers, not a marker of verified trustworthiness.

2. Absence of Transparent Business Identity

Legitimate investment platforms and financial services firms typically disclose clear corporate information, including:

-

Registered legal entity and jurisdiction

-

Executive management and credentials

-

Physical business address

-

Regulatory oversight statements

In contrast, iqinex.live uses privacy protection on domain registration, which obscures ownership, administrative contacts, and physical address. While privacy protection can be legitimate for some small websites, its use by financial platforms without any verifiable business identity is highly concerning.

The inability of users or researchers to independently verify who runs iqinex.live removes essential accountability and makes it difficult to trust any claims made by the platform.

3. Negative User Feedback and Reviews

User review platforms, including Trustpilot, show overwhelmingly negative feedback from individuals who claim to have interacted with iqinex.live. On Trustpilot, the company has a low profile and an average score below expectations, with reviews that describe serious operational and service issues.

Common complaints include:

-

Account closures without explanation or support response

-

Difficulty in resolving customer service issues

-

Allegations of withheld funds or unexplained deductions

-

Frustration over lack of transparency in decision-making

While the number of reviews is limited, the substance of the reported experiences contributes to the overall risk profile of the platform.

4. Lack of Verified Regulation and Oversight

Regulation by a recognized financial authority is one of the most critical factors when dealing with investment or trading platforms. Regulated entities must comply with rigorous standards designed to protect clients, including capital segregation, reporting obligations, dispute mechanisms, and audits.

Independent broker and platform databases indicate that iqinex.live does not hold valid licensing or authorization from major regulators, including well-known agencies in the United Kingdom, European Union, United States, or Australia. One analysis specifically notes the absence of any legitimate forex or financial trading license associated with the platform.

This absence of regulatory oversight means that if users suffer losses, discrepancies, or misconduct, there may be no effective mechanism for dispute resolution or compensation.

5. Early Warning Signals from Industry Trackers

Some financial oversight and broker review resources list iqinex.live in categories associated with unregulated or unsafe operators. These listings often arise when regulatory bodies publish warnings or when industry experts assess risk profiles based on common scam criteria, such as:

-

Young domain with no established track record

-

Hidden ownership records

-

Suspicious content or service claims

-

Lack of verifiable licensing details

While these industry trackers do not always prove malintent, they do classify iqinex.live in ways that suggest users should not engage with the platform as though it were a regulated broker or investment intermediary.

6. Structural and Marketing Concerns

Websites offering financial services need to clearly articulate:

-

Service scope

-

Investment terms (fees, spreads, commissions)

-

Risk disclosure

-

Ownership and legal claims

-

Client support structures

iqinex.live lacks comprehensive publicly accessible documentation on these critical factors, leaving many essential questions unanswered. The absence of transparent terms and conditions is not typical of reputable financial platforms and raises concerns about hidden terms or obligations.

7. Why Users Should Avoid This Platform

Taken together, the data points about iqinex.live form a consistent picture of a platform with substantial unknowns and credibility issues:

-

Unverified business identity and ownership

-

Lack of recognized regulatory oversight

-

Low reputation and trust score from independent scanning tools

-

Negative firsthand reviews from users describing problematic experiences

Investors considering online financial services need platforms that offer transparency, documented legal compliance, third-party verification, and responsive support. Iqinex.live does not currently demonstrate any of these qualities.

For individuals seeking to trade, invest, or allocate capital through online portals, choosing services with clear regulatory approval and established track records is essential. Platforms that fail to meet these basic standards create unnecessary exposure to potential loss, confusion, and poor service outcomes.

Final Verdict

Iqinex.live exhibits numerous characteristics associated with low-trust websites that handle financial information or services. Its anonymous ownership, lack of regulation, negative user reports, and failure to provide critical transparency elements suggest that users should exercise extreme caution and avoid engaging with this platform as a financial intermediary.

If you are exploring online brokers or investment services, focus instead on options with verifiable credentials, senior leadership with public profiles, and regulation from recognized authorities.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to iqinex.live, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as iqinex.live continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.