Is PayToBit Legit or a Scam? Detailed Review of the Platform

The online investment world has expanded rapidly, especially in the cryptocurrency space, where countless platforms promise easy profits, quick returns, and “guaranteed” earnings. However, not all these platforms operate honestly, and many are designed specifically to deceive inexperienced investors. PayToBit is one such platform that has attracted attention for all the wrong reasons. This review provides an in-depth analysis of PayToBit, its claims, its suspicious operations, user experiences, and the major red flags surrounding the site.

What Is PayToBit?

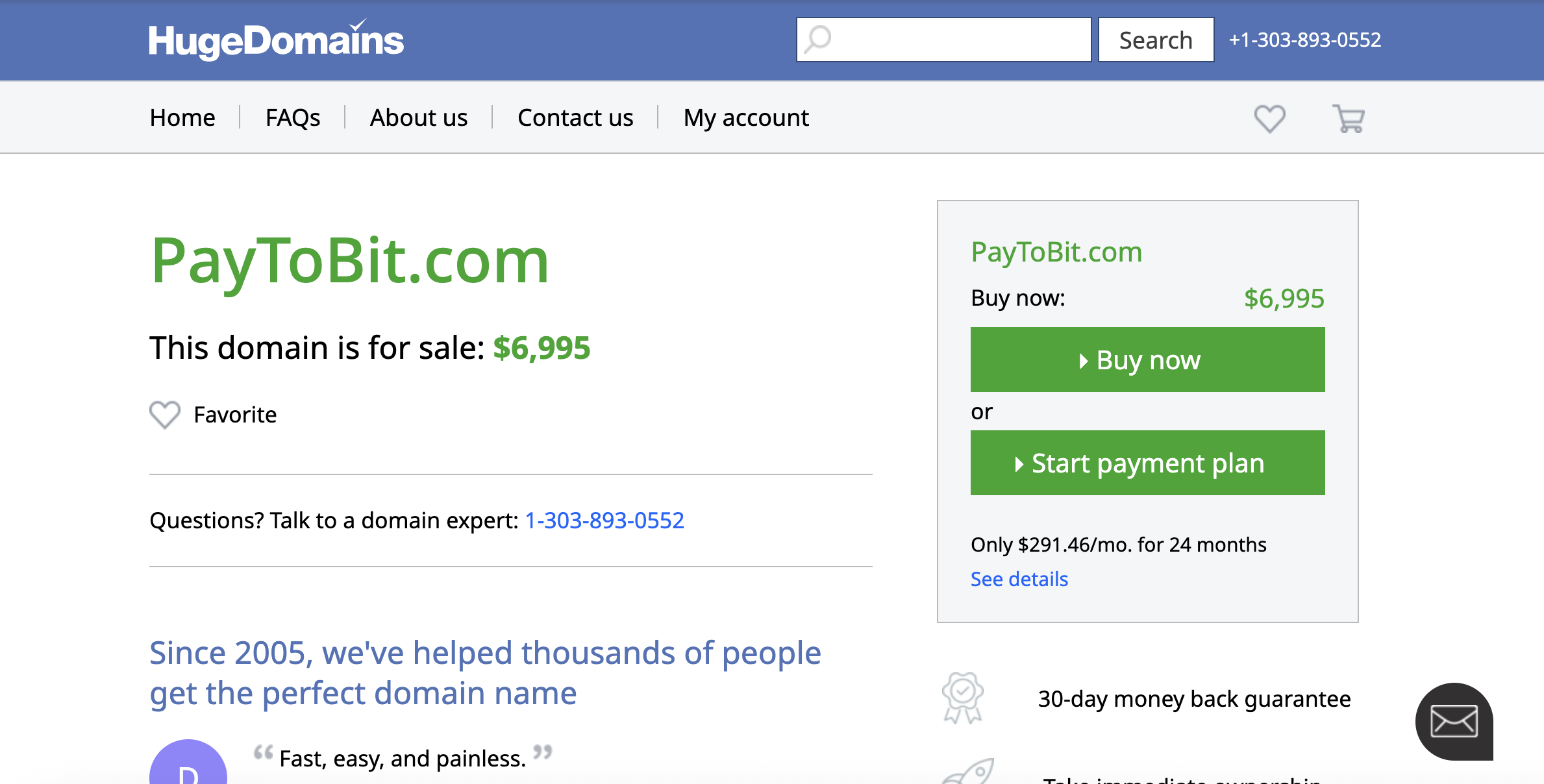

PayToBit presents itself as a modern cryptocurrency investment and wallet platform. It advertises services such as crypto trading, fast payouts, and secure asset management. At first glance, its website gives the impression of a sleek, professional service focused on innovation. However, a closer look reveals that the design, wording, and overall structure closely resemble other high-risk or fraudulent crypto websites.

The platform makes big promises about effortless earnings and high-yield crypto investments, which are common marketing tactics used by unlicensed investment schemes. PayToBit claims to provide users with “financial freedom,” “automatic profit generation,” and “professional trading management,” yet offers no evidence, no licensing, and no identifiable team members.

Lack of Transparency and No Company Information

One of the biggest warning signs with PayToBit is the complete lack of transparency. Legitimate financial platforms provide clear information about their founding team, the company’s location, registration details, and legal compliance. PayToBit offers none of these.

Key missing information includes:

-

No details about the owners or founders

-

No physical office address

-

No proper business registration

-

No regulatory licenses

-

No identification of financial partners or service providers

This level of anonymity is a major red flag because it prevents users from verifying whether the platform is real or if the people behind it even exist. Scammers frequently hide behind anonymous websites to avoid accountability.

Suspicious Investment Packages and Unrealistic Returns

PayToBit heavily promotes investment plans with fixed daily or weekly returns. These packages promise profits that are far beyond what can realistically be achieved in legitimate trading environments. Platforms offering “guaranteed returns” are almost always fraudulent because no investment—especially in crypto—can guarantee a specific profit.

These types of plans commonly follow the structure of a high-yield investment program (HYIP), which often works like a pyramid scheme. Users are enticed to invest money with the promise of high returns, but the platform eventually stops paying out, leaving investors with losses.

The investment packages offered by PayToBit appear to follow this pattern. They rely on bold claims without providing audited financial statements, real trading data, or credible proof of performance.

No Proof of Trading Activity

PayToBit does not show any real evidence of trading activity. Legit crypto investment platforms typically display:

-

Trading dashboards

-

Performance charts

-

Blockchain transaction histories

-

Third-party audits

-

Market analysis tools

PayToBit, by contrast, provides none of these. Instead, it uses generic marketing phrases and stock images to create the illusion of professionalism. This raises serious doubts about whether the platform is actively trading at all or merely taking deposits from users.

Fake Testimonials and Fabricated Reviews

On its website and promotional pages, PayToBit includes glowing testimonials praising the platform’s returns and customer service. However, these reviews appear to be fabricated. Several indicators point to this:

-

The testimonials use generic names and stock profile pictures

-

The writing style is repetitive and overly polished

-

The comments follow the same pattern found on known scam websites

-

No verifiable identities or real user profiles are provided

Real investment platforms have user discussions, reviews on independent sites, and transparent feedback. PayToBit’s suspicious testimonials serve as a marketing tactic rather than genuine user experiences.

Unclear Deposit and Withdrawal Policies

Another red flag is the platform’s unclear or restrictive withdrawal system. Many scam platforms allow easy deposits but make it extremely difficult—or even impossible—for users to withdraw their funds. Common tactics include:

-

Sudden fees added at the time of withdrawal

-

Unexpected “tax payments”

-

Frozen accounts

-

Ignored support requests

-

Demands for additional deposits to unlock funds

Based on the structure and website design of PayToBit, it follows a pattern seen in other platforms where users can deposit quickly but struggle to access their money afterward.

There are no clear terms and conditions, refund policies, or user protection mechanisms, which gives the platform full control over user funds.

Unknown and Unverified Wallets

PayToBit claims to be a wallet service, yet there is no transparent blockchain activity associated with the platform. Legit crypto wallets provide:

-

Public wallet addresses

-

Blockchain transaction logs

-

Secure infrastructure

-

Clear documentation

PayToBit hides all of these details, providing no transparency around the handling of user assets. Without clear blockchain records, users cannot verify whether their cryptocurrency is actually stored securely or even exists once transferred to the platform.

No Customer Support or Professional Contact Options

Legitimate companies provide multiple channels of customer service, such as live chat, email support, and phone lines. PayToBit, however, offers very limited contact options, and the communication provided often appears automated or scripted.

Common issues reported by users include:

-

No response after depositing funds

-

Delayed or ignored withdrawal requests

-

Support email addresses that do not work

-

No real human agents available

In many cases, scammers use fake support channels to delay users or pressure them into depositing more money.

Website Structure Matches Common Scam Templates

A closer look at the website reveals that PayToBit uses a predictable layout identical to several known fraudulent investment platforms. Many scam operators purchase inexpensive templates and reuse them to launch multiple fake investment sites quickly.

These templates share characteristics such as:

-

Bold promises of guaranteed returns

-

Vague wording about “our experts”

-

Poorly written content

-

Random technical charts that do not correspond to real market activity

-

Repetitive images

-

Overly simplified dashboards

The recurring design pattern strongly suggests that PayToBit is not an original or professional financial service but part of a broader network of deceptive platforms.

No Legal or Regulatory Compliance

Any platform that handles financial transactions, especially trading and investment services, must comply with the regulations of the jurisdiction in which it operates. PayToBit does not provide:

-

Regulatory license numbers

-

Compliance certificates

-

Information about oversight bodies

-

Mandatory disclosures

Operating without regulation means users have no protection in the event of fraud, platform failure, or loss of funds. This lack of oversight is one of the clearest warning signs that PayToBit is not a trustworthy service.

Final Thoughts: Is PayToBit a Scam?

After reviewing its structure, promises, lack of transparency, and overall behavior, PayToBit displays all the characteristics of a typical online crypto scam. The combination of unrealistic returns, no verifiable company information, unclear withdrawal policies, fake testimonials, and no regulatory oversight makes the platform extremely risky.

Anyone considering investing with PayToBit should take time to evaluate the significant warning signs and reconsider engaging with such an opaque and unregulated service. Transparency, accountability, and regulation are essential when choosing an investment platform, and PayToBit fails in all of these areas.

Report. PayToBit And Recover Your Funds

-

If you have lost money to payToBit, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like payToBit continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.