Is VenusMining a Scam? Full 2025 Review and Investor Warnings

The rise of cryptocurrency and online trading platforms has created new opportunities for investors looking to grow their wealth. However, alongside legitimate platforms, there are numerous scams that target unsuspecting users. VenusMining is one such platform that has recently attracted attention. While it appears to offer high returns through cryptocurrency mining and trading, closer examination reveals several red flags that investors must be aware of.

This review explores VenusMining’s operations, user experiences, and the key warning signs that suggest caution.

What is VenusMining?

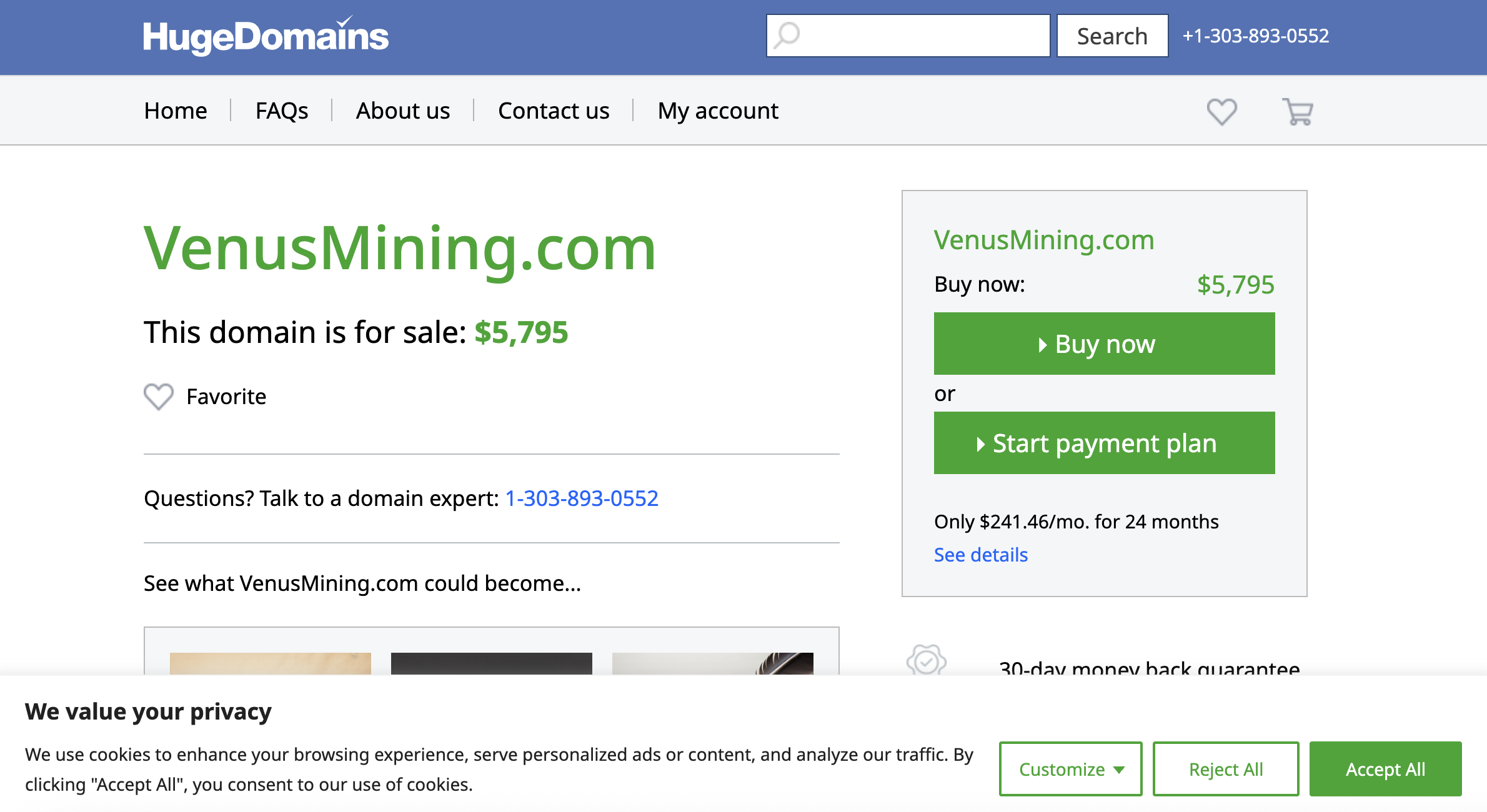

VenusMining presents itself as a cryptocurrency mining and investment platform. The website claims to provide users with access to cloud mining services, allowing them to earn profits without the need to manage physical mining hardware. Additionally, VenusMining promotes itself as a platform where users can trade digital currencies and participate in high-yield investment plans.

The platform boasts a professional design, with detailed dashboards, profit calculators, and multiple account types to cater to different levels of investors. It also emphasizes features like 24/7 support and automated trading tools to create an impression of reliability.

Despite these appealing features, several aspects of VenusMining’s operations raise concerns about its legitimacy.

Red Flags Surrounding VenusMining

While VenusMining may seem legitimate at first glance, careful scrutiny reveals numerous warning signs that potential investors should consider.

1. Unrealistic Profit Claims

One of the most obvious warning signs of a scam platform is the promise of high, guaranteed returns. VenusMining markets itself as a platform capable of delivering daily or monthly profits that are significantly higher than industry norms. While cryptocurrency can be profitable, no legitimate platform can guarantee consistent high returns. Unrealistic profit promises are a major red flag that suggests the platform may not operate fairly.

2. Lack of Regulatory Oversight

Legitimate investment platforms are typically regulated by recognized financial authorities. Regulatory oversight ensures that platforms adhere to strict rules, protecting investors from fraud. VenusMining, however, does not provide verifiable information regarding licenses or regulatory approval. The absence of such oversight indicates that the platform may operate without accountability, placing users’ funds at significant risk.

3. Anonymous or Unverified Team

Transparency about the individuals behind a platform is critical. VenusMining provides little to no information about its management team or founders. Legitimate platforms usually offer clear details about their leadership to build trust with investors. The lack of transparency regarding the people running VenusMining raises serious concerns about its authenticity.

4. Aggressive Marketing and Recruitment

VenusMining has reportedly used aggressive marketing tactics to attract users. These include unsolicited messages, social media campaigns, and persuasive calls urging potential investors to act quickly. Such tactics are commonly employed by scam platforms to pressure individuals into investing without proper research or consideration.

5. Withdrawal Issues

Several users have reported difficulties when attempting to withdraw their funds from VenusMining. Complaints include delayed transactions, denial of withdrawal requests, or unclear explanations from support staff. Legitimate platforms allow users to access their funds easily, so persistent withdrawal problems are a significant warning sign.

User Experiences

Feedback from users who have interacted with VenusMining highlights several consistent issues. Many former investors report the following problems:

-

Delayed or blocked withdrawals: Users often struggle to retrieve their funds, with support providing vague or conflicting explanations.

-

Pressure to reinvest: Investors are encouraged to deposit additional funds with promises of higher returns, which often do not materialize.

-

Manipulated account balances: Some users describe discrepancies between actual market performance and the platform’s reported profits.

-

Unresponsive customer service: Many users report difficulties in reaching support or receiving meaningful assistance.

These recurring complaints suggest a pattern of behavior that prioritizes retaining user deposits over facilitating genuine investment opportunities.

Comparison with Legitimate Platforms

Understanding the differences between VenusMining and legitimate platforms can clarify why caution is necessary. Established platforms typically:

-

Hold valid licenses and comply with financial regulations.

-

Provide transparent information about their leadership and corporate structure.

-

Offer realistic profit expectations and clearly communicate associated risks.

-

Ensure smooth and timely withdrawals of funds.

-

Maintain responsive and professional customer support.

VenusMining, by contrast, lacks most of these critical features, making it difficult to trust the platform with investments.

The Risks of Investing with VenusMining

Engaging with unverified platforms like VenusMining carries serious financial risks:

-

Loss of investment: There is a high likelihood that deposited funds may become inaccessible or lost entirely.

-

Unauthorized account activity: Users may notice unusual transactions or manipulated account balances.

-

Emotional stress: Financial loss combined with unresponsive support can cause significant anxiety and stress.

Investors must consider these risks before engaging with any platform that lacks transparency and regulation.

Tips for Safe Online Investing

While VenusMining raises multiple red flags, investors can take steps to protect themselves in the digital investment space:

-

Verify regulation: Always check if a platform is licensed by recognized financial authorities.

-

Research the team: Transparent information about management and corporate history is essential.

-

Read reviews critically: Look for patterns in user experiences rather than relying on individual testimonials.

-

Test withdrawals first: Start with a small investment to confirm that the platform allows easy access to funds.

-

Avoid unrealistic promises: Be skeptical of platforms guaranteeing high returns with minimal risk.

-

Seek advice: Consulting experienced investors or financial advisors can provide valuable guidance.

These precautions can significantly reduce the risk of falling victim to scams in the cryptocurrency and online trading sectors.

Conclusion

VenusMining may initially appear attractive due to its professional website and promises of high returns. However, multiple warning signs—including unrealistic profit claims, lack of regulation, anonymous management, aggressive marketing, and withdrawal difficulties—suggest that the platform may not be trustworthy.

Investors should exercise extreme caution when considering platforms like VenusMining. Conducting thorough research, verifying regulatory compliance, and seeking expert advice are essential steps to ensure that investments are made safely.

The risks associated with platforms like VenusMining highlight the importance of skepticism and due diligence in the fast-paced world of cryptocurrency and online trading. By prioritizing transparency, regulation, and realistic profit expectations, investors can make informed decisions and protect their funds from potential scams.

Report VenusMining And Recover Your Funds

If you have lost money to venusMining, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like venusMining continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.