KLCServices.com Review

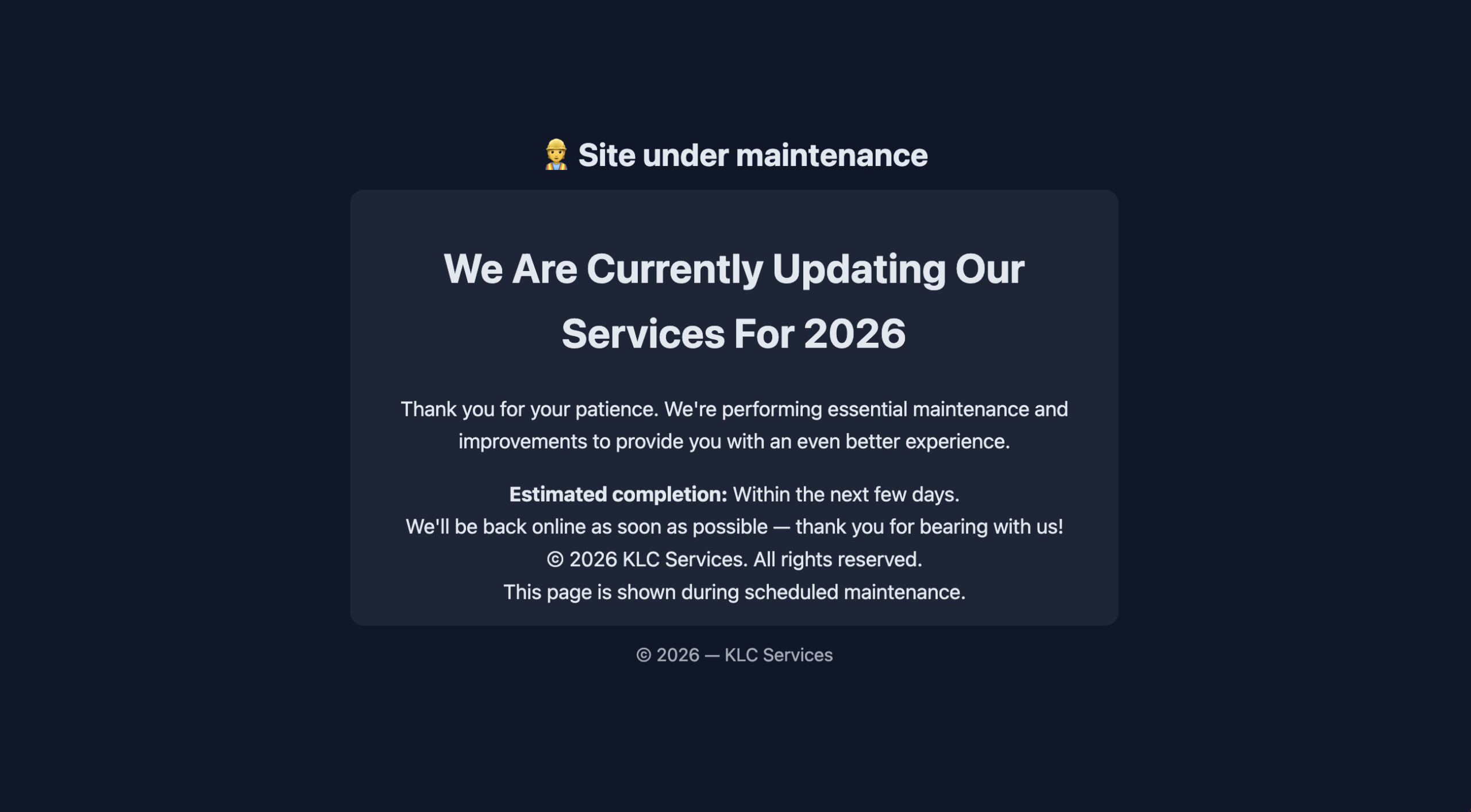

klcservices.com markets itself as a comprehensive financial planning and investment services provider, promising personalised strategies, portfolio management, and lifelong financial support. Its slick homepage presents reassuring language about building wealth and achieving financial goals. On the surface, it resembles many legitimate financial advisory websites.

Unfortunately, multiple independent evaluations and real user feedback raise substantial doubts about the credibility, trustworthiness, and safety of KLCServices.com as a financial services provider — especially for anyone considering investing or entrusting funds with the platform.

1. Questionable Trust and Low Confidence Scores

Independent website analysis platforms assign klcservices.com a low-to-medium trust score, suggesting that the site exhibits characteristics that may be inconsistent with reputable businesses. One such review puts the site’s score at roughly 48.7 out of 100, highlighting concerning signals such as possible spam-related patterns and proximity to suspicious websites.

While this kind of evaluation does not prove wrongdoing, it does indicate that automated risk metrics and industry tools classify the platform as doubtful and in need of scrutiny — a serious consideration for anyone contemplating financial engagement.

2. Anonymised Ownership and Hidden Structural Information

According to independent domain analysis, the ownership details of klcservices.com are masked through privacy protection, and its public WHOIS registration shows only generic “privacy foundation” contact information without any identifiable corporate entity or meaningful physical address.

Legitimate financial firms tend to disclose clear corporate details, licensed offices, verifiable physical addresses, and named executives. The absence of this transparency is a red flag — particularly for sites offering financial services that involve managing or investing client assets.

3. Negative User Reports and Financial Loss Claims

User-generated reviews on major review platforms paint an alarming picture of the experiences some individuals have had with KLCServices.com. Multiple independent reviewers rate the platform poorly, with average scores well below neutral.

One particularly serious complaint describes a user claiming to have lost a substantial amount of money — tens of thousands of dollars — after funding an account and subsequently failing to access funds or receive satisfactory support when attempting to withdraw.

These first-hand accounts are consistent with patterns witnessed on other problematic financial sites, where clients encounter difficulties retrieving capital and receive inadequate support.

4. Cold Outreach and Unsolicited Contact Patterns

Independent reports from community forums (such as r/scams on Reddit) warn that klcservices.com or associated entities have been involved in cold calls and unsolicited investment offers, which is a common method used by deceptive financial operations to lure potential investors.

The community consensus in those discussions is that cold outreach promising high returns or exclusive opportunities should be treated with extreme suspicion, particularly when no verifiable licensing or regulatory presence backs the entity.

5. Website Claims vs. Lack of Independent Verification

The company’s official site presents an image of personalised investment planning, portfolio management services, and professional financial guidance.

However, there is no independent verification that KLCServices.com is regulated by any major financial authority(such as the Monetary Authority of Hong Kong, ASIC in Australia, FCA in the UK, SEC in the US, or equivalent bodies). Without such oversight:

-

There is no assurance that they adhere to investor protection standards.

-

Users have no formal regulatory recourse in disputes.

-

Risk disclosures and client fund protections are not legally enforceable.

This absence of public regulatory verification is a foundational gap that distinguishes this platform from legitimate, overseen financial service providers.

6. Inconsistent or Unverified Testimonials

The site includes testimonials purportedly from clients around the world claiming satisfaction with services and outcomes.

However, unverified testimonials on a company’s own site are not reliable evidence of legitimacy, and without independent corroboration through trusted financial news, verified review networks, or regulated rating agencies, these claims cannot be considered credible proof of trustworthiness.

Conclusion — Treat KLCServices.com With Extreme Caution

When all available independent data points are evaluated together, the overall picture raises serious concerns:

-

Automated risk evaluation tools assign a low trust score.

-

Ownership and registration details are masked and anonymous.

-

Negative user feedback cites financial loss and poor support.

-

Reports of cold outreach and unsolicited contact align with deceptive tactics.

-

There is no confirmed regulatory oversight from reputable financial authorities.

This combination of signals suggests that KLCServices.com may not be a trustworthy financial services platform, and that individuals should be highly cautious before engaging with it in any financial capacity.

Always confirm regulatory credentials, independently verify user reviews, and consult official financial authorities before investing or transferring funds to platforms that lack transparent licensing and verifiable industry reputation.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to klcservices.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as klcservices.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.