Leedsbloom.com: Proceed With Caution

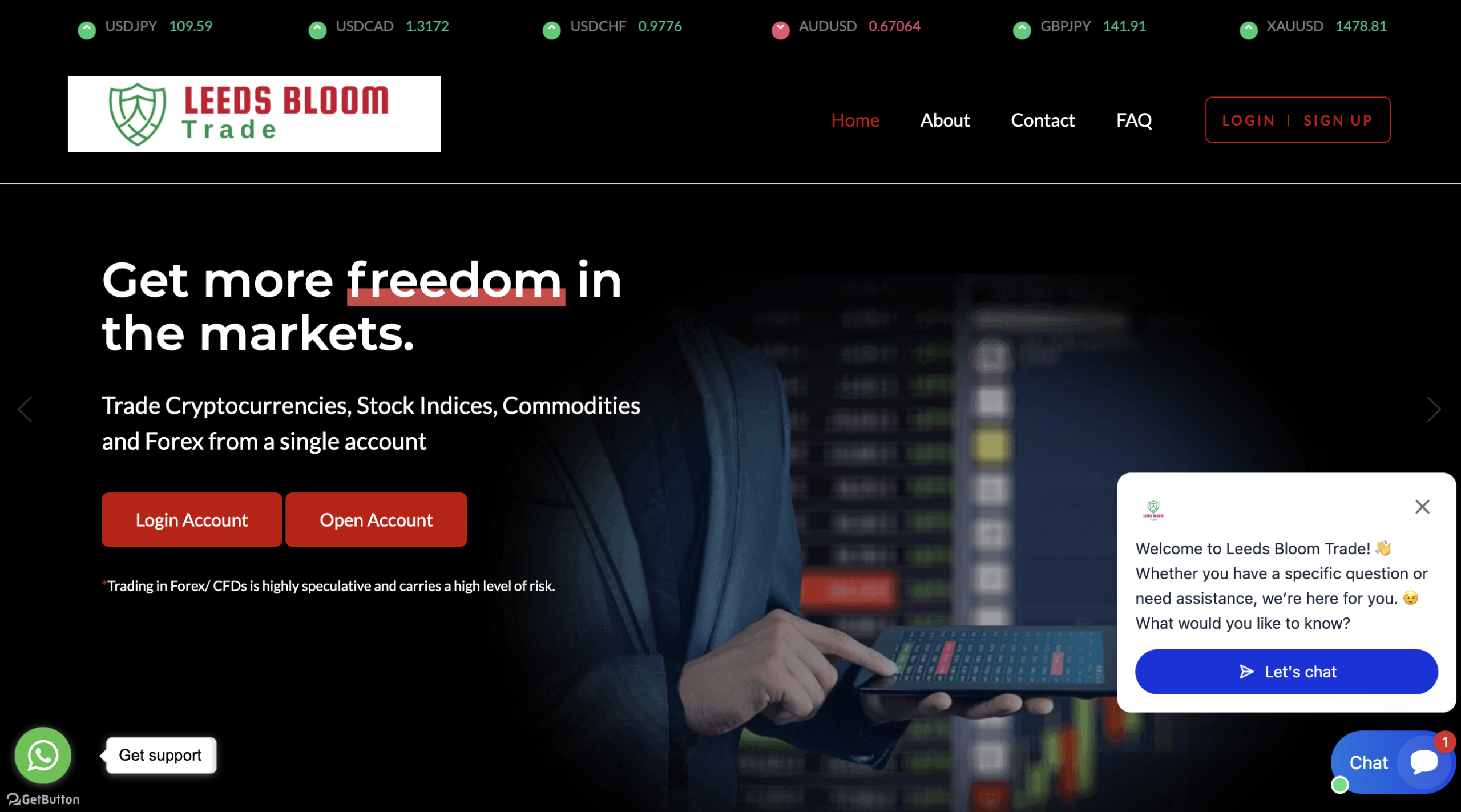

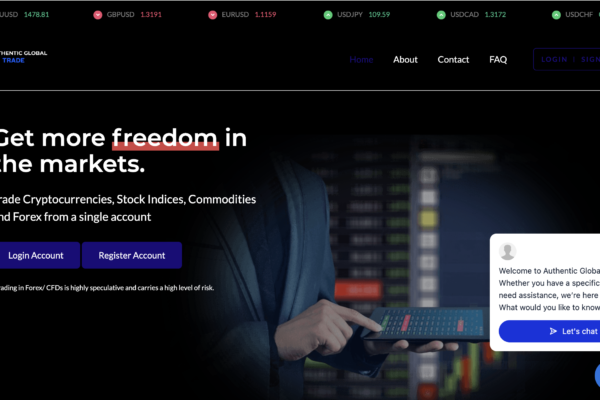

In the crowded world of online trading platforms, new names and services emerge daily, each promising exceptional returns, advanced tools, and an easy path to financial freedom. Among these is Leedsbloom.com (often referred to on the site as Leeds Bloom Trade), a platform that markets itself as a gateway to trading forex, cryptocurrencies, indices, commodities, and more. At first glance, its slick design, bold graphics, and earnings claims can impress an inexperienced visitor. However, a closer examination reveals multiple red flags that suggest this platform is best avoided — especially if you’re considering depositing real money.

Below, we dissect the key issues that warrant caution, explain why many professionals view platforms like this skeptically, and offer insights that help any potential trader make safer decisions.

1. Over‑the‑Top Promises and Unrealistic Returns

One of the first things that jump out on Leedsbloom.com is the range of high expected profits tied to fixed deposit tiers. For example, the site lists “expected minimum profits” that are multiples of the initial investment — sometimes many times over — without clearly explaining how those figures are generated or verified.

Legitimate, regulated brokers never publish guaranteed profit figures or set “expected profit” percentages because financial markets are inherently unpredictable. Promises of outsized, easy gains are classic hallmarks of marketing tactics used to lure inexperienced investors.

2. Lack of Recognized Regulation and Transparency

A major red flag with Leedsbloom.com is the absence of credible regulatory oversight. Legitimate brokers that operate in major financial markets must be regulated by recognized authorities — such as the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or equivalent bodies in the EU or US.

The platform itself states that it is not regulated by the Financial Conduct Authority and portrays itself more as an educational company rather than a regulated broker. At the same time, it offers trading, account funding, and trading account services that resemble broker operations more than education. This mismatch between services offered and regulatory status is a serious concern. Regulated brokers are required to comply with rules designed to protect consumers, including segregation of client funds, clear disclosures, and dispute resolution mechanisms. Leedsbloom.com’s claim of being “an educational company” despite offering trading services indicates a lack of proper oversight.

3. Vague Corporate Identity and Management Claims

On the platform’s “About” page, the company promotes a handful of named individuals as industry professionals or top traders. However, there’s no verifiable information about these individuals beyond their names and generic claims of experience. Many scammy or untrustworthy platforms use stock images, invented names, or unverifiable specialist bios to create the illusion of expertise.

In the absence of transparent corporate information — such as a registered business address, licensing details, and verifiable leadership — there’s no reliable way to confirm that the platform is operated by reputable professionals or a legitimate company.

4. Misleading Marketing and Sales Tactics

Another concerning aspect is the aggressive marketing language used throughout the site: claims of “high‑probability trades,” “superfast execution,” and a huge range of instruments available for trading at low spreads. These statements are presented as guarantees rather than educated expectations, and there are no third‑party verifications of these capabilities.

Moreover, the platform includes social‑proof‑style testimonials with exaggerated earnings stories. It’s common for scam operations — whether in binary options, forex, or crypto — to use fabricated testimonials to make a service look more successful and trustworthy than it really is. Without independent reviews on reputable financial forums or consumer protection sites verifying these stories, such testimonials should be treated as unreliable.

5. Confusing Terms and Fee Structure

A red flag in the platform’s Terms and Conditions is the inclusion of dormancy fees and activity charges that can rapidly eat into a trader’s funds. Accounts that are inactive for a period can be charged escalating fees, which is a practice more commonly seen in scammy or predatory operations rather than legitimate brokers. Legitimate brokers are typically transparent about fees upfront and do not impose punitive charges without clear disclosure.

Additionally, the terms grant the company broad rights to adjust or cancel positions, suspend trading, and “not bear responsibility” for technical failures. These clauses heavily favor the provider and leave clients exposed.

6. Risk of Personal Information Misuse

During account creation, Leedsbloom.com requests extensive personal information, including full legal name, address, financial details, and identification numbers. Legitimate brokers also require this information for regulatory compliance, but they do so within a clear framework of data protection and legal obligation. Here, because the platform lacks proper regulatory oversight and data protection transparency, there’s a heightened risk that this sensitive data could be mishandled or exposed.

7. No Independent Reviews or Positive User Feedback

Perhaps the most telling factor in evaluating any online trading platform is independent feedback. A quick web search does not return credible, positive reviews from recognized financial communities or consumer watchdogs regarding Leedsbloom.com. Where independent analysis exists for similar domains, risk scores are often low or nonexistent — a common pattern among dubious online brokers.

In contrast, reputable brokers typically have a clear footprint in trading communities, with third‑party evaluations available on platforms such as BrokerCheck, ForexPeaceArmy, or Trustpilot.

Final Verdict: Proceed With Extreme Caution

Leedsbloom.com exhibits many of the warning signs associated with high‑risk or potentially fraudulent trading platforms:

-

Unverified profit claims and unrealistic earnings projections.

-

Absence of meaningful regulatory oversight.

-

Vague corporate identity and unverifiable leadership bios.

-

Aggressive marketing tactics and questionable user testimonials.

-

Confusing terms and potential for punitive account charges.

-

Lack of independent, credible user reviews.

Even if the platform is not an outright scam in the strictest legal sense, it behaves in ways that expose users to significant financial and personal risk. There are many regulated and transparent brokers available that offer similar trading capabilities while protecting consumers through enforceable standards and clear dispute mechanisms.

For these reasons — and in the interest of safeguarding your funds and personal data — it is strongly advised to steer clear of Leedsbloom.com and similar platforms that fail to meet basic transparency and regulatory benchmarks.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to leedsbloom.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as leedsbloom.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.