Luxepointcap.com Honest Review

In the crowded world of online investment services, luxepointcap.com presents itself as an elite digital wealth management platform. Its website promises advanced trading tools, personalised portfolio strategies, and the kind of professional guidance that appeals to both beginners and seasoned investors. But beneath the glossy marketing language and professional imagery, there are significant issues and troubling indicators that suggest this platform may not be legitimate — and that interacting with it could put your money at stake.

In this review, we’ll detail glaring inconsistencies, common deceptive patterns, and why many financial reviewers urge prospective investors to avoid this platform entirely.

What Luxepointcap.com Claims to Be

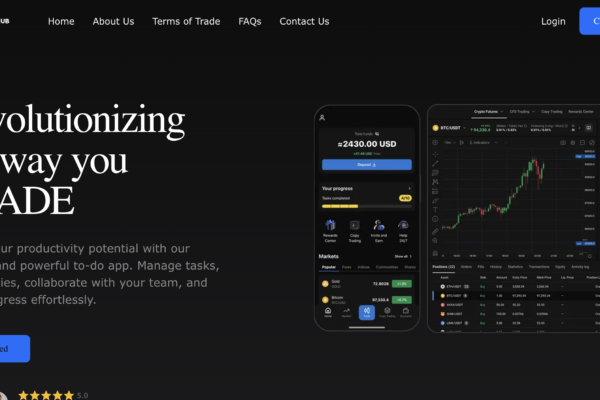

On the surface, luxepointcap.com appears to be a sophisticated investment service. Its homepage includes high-level descriptions of strategies involving AI-powered analysis and personalised wealth planning, with language intended to sound authoritative and institutional. The site also lists services such as asset diversification, real-time trading insights, and bespoke portfolio management. These features, as presented, are designed to evoke trust and attract users who want a cutting-edge platform for managing assets.

It includes professional-looking team pages, contact forms, and an “About” section explaining purported decades of expertise. However, pretty appearances and marketing text are not verified proof of functionality, transparency, or regulatory compliance.

A Major Warning Sign: Regulatory Blacklisting

One of the most alarming findings in external assessments is that Luxepoint Capital has been formally added to a regulator’s blacklist for unauthorized financial solicitation. Specifically, the Autorité des marchés financiers (AMF) in Canada has identified luxepointcap.com as an entity that is not registered or authorized to provide investment or solicitation services within its jurisdiction. This means the platform is operating outside the oversight of legitimate financial regulators, a critical red flag for anyone considering depositing funds.

Licensed financial institutions must meet strict regulatory requirements, including customer asset protections, financial audits, and transparent reports. Operating without such registration suggests the platform lacks accountability and legal safeguards.

Deceptive Tactics and Behavioral Patterns

Multiple independent reviews of luxepointcap.com describe behavioural patterns consistent with known fraudulent operations:

1. High-Pressure Outreach and Unsolicited Contact

Reports suggest representatives may contact individuals directly through messaging apps or social media, presenting themselves as professional advisors. This is a common technique used by fraudulent services to build trust before any real engagement.

2. Manipulated Account Interfaces

Some reports indicate that the platform’s dashboard may show simulated gains to lure users into making larger deposits. Once funds are increased, problems arise in retrieving them — a tactic used to keep investors engaged while restricting real access to their money.

3. Withdrawal Barriers and Fee Extortion

Multiple sources indicate that when investors attempt to withdraw funds, they are told they must pay additional fees or “international taxes” before processing. Reputable platforms do not ask users to send extra payments before releasing their own capital.

4. Remote Access Exploitation

In some cases, users are encouraged to install remote access software like AnyDesk or TeamViewer under the pretext of helping with withdrawal issues. In reality, this can give malicious actors full control over users’ computers, potentially exposing bank details and compromising personal security.

These behaviors are exactly the kind of mechanisms used by fraudulent schemes to extract funds and sensitive information from victims.

Lack of Transparency and Verifiable Information

Another critical issue is the lack of verifiable information about the company’s legal standing, management credentials, and custodial arrangements. Legitimate investment firms typically publish clear disclosures about:

-

registered business entities and licensing numbers

-

financial custodians holding client assets

-

audit reports and compliance history

Luxepointcap.com does not provide this level of transparent, independently verifiable data. This absence makes it difficult — if not impossible — to confirm that client funds are segregated, protected, or handled according to any regulatory standards.

Red Flags That Should Not Be Ignored

Taken together, the following points should raise immediate concerns:

-

Regulatory Blacklisting — Being publicly identified by a financial authority as unauthorized to operate in its market.

-

Aggressive Unsolicited Contact — Contact through social apps under the guise of financial advice.

-

Simulated Gains and Fake Interfaces — Producing misleading account results to entice larger investments.

-

Forced Extra Payments for Withdrawal — Requests for upfront fees before releasing funds.

-

Remote Access Requests — Installation of software that can compromise personal computer security.

Each of these issues, on its own, would justify extreme caution. When combined, they create a pattern that aligns with common traits of deceptive financial platforms.

Final Thoughts

While luxepointcap.com may present itself with professional language and a polished user interface, the substantive problems identified above raise serious doubts about its legitimacy. The fact that a well-established financial regulator has publicly flagged the platform for unauthorized activity is particularly disturbing and should serve as a strong deterrent for anyone considering engagement.

Investing and wealth management require trust, transparency, and legal accountability. Without proven licensing, verifiable operational details, and a track record of satisfied, independent users, luxepointcap.com falls short of the standards expected of a genuine financial service provider.

If you are exploring ways to grow your assets or enter online trading, always prioritise platforms that are fully regulated, transparent about their operations, and widely reviewed by independent customers. Platforms lacking those foundational elements are not worth the risk of losing your savings or exposing your personal information.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to luxepointcap.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as luxepointcap.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.