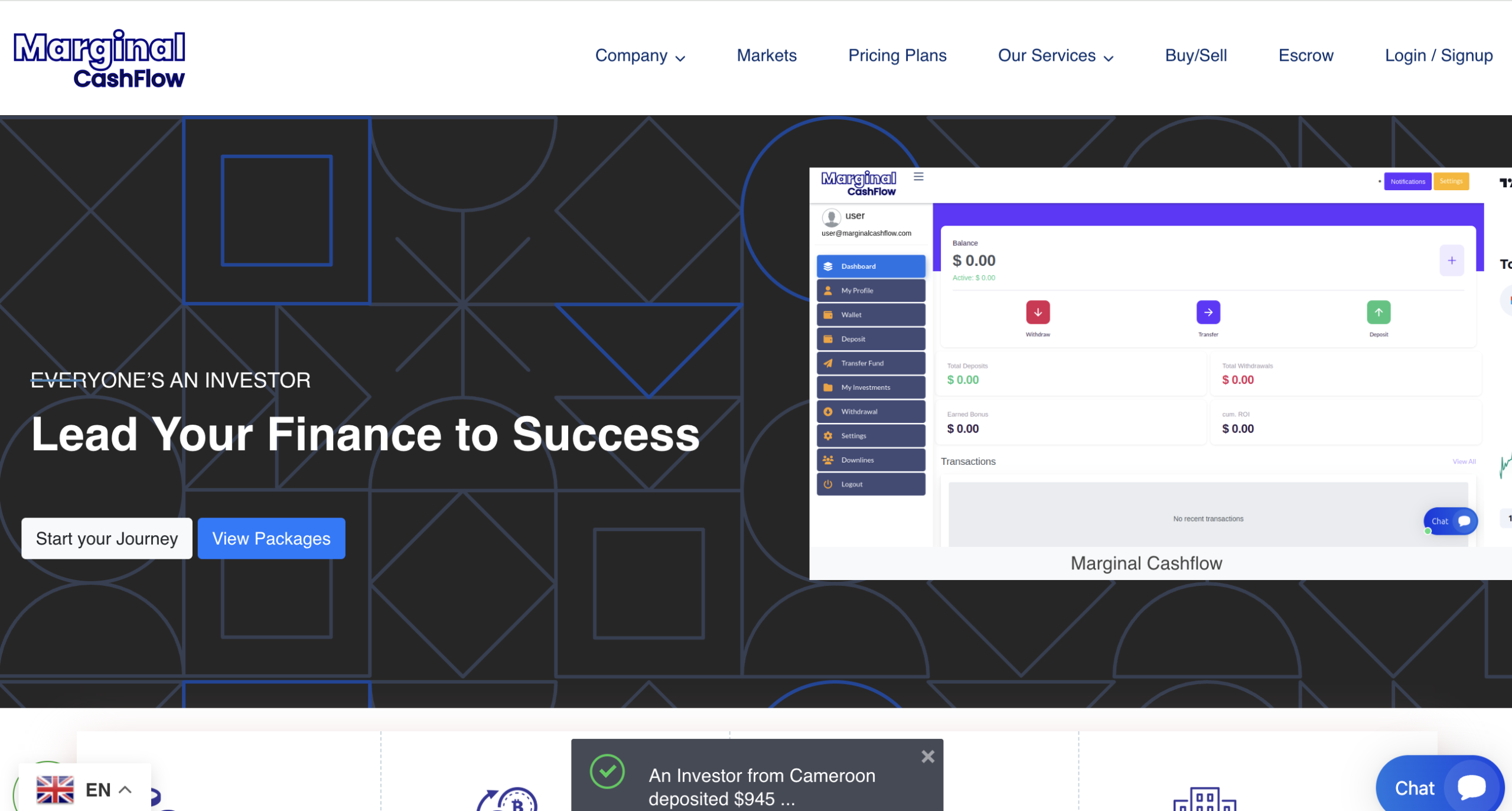

MarginalCashflow.com: Understanding Its Operations Clearly

In today’s fast‑moving digital investment landscape, anyone seeking to grow their wealth online deserves clarity and transparency. Unfortunately, MarginalCashflow.com — a platform that presents itself as a high‑income investment provider — lacks both. While the site markets itself as a global financial firm offering access to major markets like stocks, forex, cryptocurrency, real estate, and more, a deeper inspection reveals serious concerns that suggest this platform should be avoided by anyone looking to protect their capital.

Glossy Claims, Fleeting Substance

MarginalCashflow.com appears designed to impress. Its website contains broad claims about investment opportunities in cryptocurrency, forex, real estate, gold mining, NFTs, and multiple other asset classes, and asserts that the company helps investors achieve significant profit through “qualified professional traders.” The site also states it has existed since 2013 and positions itself as an established financial services provider.

However, many of the claims on the platform’s pages lack verifiable support. The text appears generic and full of promotional language, while offering little in the way of clear details about concrete investment strategies, regulatory credentials, or audited results. Presenting large‑sounding objectives without substantive backing is a common technique in promotional investment material, but it does not constitute credible evidence of legitimacy.

Hidden Owners and Lack of Transparency

One of the first warning signs with MarginalCashflow.com is its failure to be transparent about ownership. Independent domain and trust checks indicate that the site’s ownership information is obscured through privacy services, making it difficult to determine who is genuinely behind the platform. Sites that hide their registrant details are often trying to avoid scrutiny or accountability — a notable red flag for anyone considering depositing funds.

True financial services businesses typically list clear corporate information, including registration numbers, country of incorporation, and the identities of directors and responsible officers. MarginalCashflow.com does not provide these critical details, making it nearly impossible for potential investors to perform thorough background checks.

Lack of Regulatory Verification

Perhaps the most concerning issue is that MarginalCashflow.com is not properly regulated by authoritative financial regulators. Trusted brokers and investment platforms must be licensed by recognized entities — such as the UK Financial Conduct Authority (FCA), the US Securities and Exchange Commission (SEC), or similar bodies in other jurisdictions. Regulation ensures certain levels of transparency, financial reporting, and investor protection.

Independent reviews indicate that the FCA issued a warning about MarginalCashflow.com, noting that the platform may be offering investment products or services without the necessary authorization. This lack of regulatory oversight means there is no reliable system of protection for those who deposit money in the platform’s accounts.

When a platform operates without licensing or oversight, investors have limited recourse if something goes wrong, and the terms under which funds are held or invested may not be legally enforceable. There is also no guarantee that the platform holds investor funds separately from its own operational accounts — a fundamental requirement for legitimate investment firms.

Sparse and Vague Investment Information

On the surface, the site appears comprehensive, offering multiple investment opportunities across asset classes. But digging deeper, it becomes clear that the platform provides very little specific detail about how these investments are managed. Legitimate investment providers publish transparent descriptions of their strategies, fees, risk disclosures, performance history, and market methodologies. None of those components are clearly available on MarginalCashflow.com.

Furthermore, there is no evidence of audited performance results or disclosures about how returns are generated. A professional, trustworthy investment service should offer detailed data to substantiate claims of profitability, yet this is entirely absent on the platform.

Unverified Testimonials and Questionable Online Reputation

Independent user feedback on public review sites shows conflicting and limited data. Some isolated reviews might appear positive, but there is no robust, verified body of independent testimonials confirming sustained performance or reliable withdrawals from the platform. Without widespread, credible user experiences, it’s difficult to judge whether the platform actually fulfills its lofty promises.

Moreover, certain online review forums echo concerns about the platform’s lack of transparency, minimal substantive content, and incomplete company information. While none of these automatically prove fraudulent intent, they are common characteristics observed in dubious investment schemes.

Terms That Favor the Platform

A review of MarginalCashflow.com’s terms and conditions reveals language designed to limit the company’s liability for losses and place responsibility on users. These terms state that the company is not liable for data loss and that members invest at their own risk. Such clauses are common in many investment services, but without strong regulatory oversight or accountability, they tend to protect the platform disproportionately relative to the investor.

Additionally, the terms appear to discourage users from posting negative feedback publicly before contacting the platform — another indicator of how some operators try to manage public perception rather than resolve underlying issues.

Why Caution Matters

Anyone considering engaging with a platform like MarginalCashflow.com should ask themselves the following:

-

Does the platform clearly disclose who runs the company and where it is legally incorporated?

-

Is the platform regulated by recognized financial authorities?

-

Are the investment strategies and risk factors transparently explained?

-

Are there independent, verifiable performance results?

-

Can you find substantial, trustworthy user feedback outside of the platform’s own promotions?

In MarginalCashflow.com’s case, the answer to most or all of these questions is no. That absence of clarity and regulation makes the platform highly unattractive for serious investors.

Final Thoughts

MarginalCashflow.com may present itself as an international investment hub with diversified opportunities. However, its lack of transparent ownership, absence of regulatory licensing, minimal substantive disclosure about operations, and questionable online reputation combine to create an environment that is unsuitable for prudent investment.

Put simply: the available evidence suggests that this platform is not a reliable place to entrust your money. Anyone seeking to build wealth online should instead work with well‑established, regulated brokers or investment services that adhere to clear financial standards.

Steering clear of platforms like MarginalCashflow.com is not just advisable — it is essential for protecting your capital and ensuring financial security. Before investing through any online intermediary, always perform thorough due diligence, verify regulatory credentials independently, and consider seeking advice from licensed financial professionals.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to marginalcashflow.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as marginalcashflow.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.