NexusCapitalTrades.com Review: What We Found

Online trading platforms continue to proliferate as amateur and seasoned investors alike pursue access to global markets. While many established brokers operate legitimately under strict regulatory oversight, others engage in marketing that obscures serious credibility and compliance issues. One name that has been generating confusion and concern among traders is NexusCapitalTrades.com. Despite a polished website and promises of broad market access, there is substantial reason for caution regarding this platform.

This review explores key concerns about NexusCapitalTrades.com — from regulatory inconsistencies to misleading claims — and aims to help prospective users make informed decisions. The conclusion is clear: this platform carries significant risk and should be approached with extreme caution.

Regulatory Credibility: What the Regulators Say

A cornerstone of trustworthy financial services is formal approval by recognised regulatory bodies. In the UK, where many users reside, the Financial Conduct Authority (FCA) is the authoritative regulator for firms offering investment and trading services. When a firm is not authorised, regulators typically list it publicly as unregulated, and caution the public against engaging with it.

In the case of Nexus Capital Trades, the FCA has recently published a warning indicating that the firm may be providing or promoting financial services or products in the UK without the necessary authorisation. This means that, according to the regulator, the company is not authorised or registered to offer regulated financial services within the UK. Such warnings are issued only when a firm’s regulatory status is unverified or defendant to legal requirements for consumer protection. Dealing with an unauthorised platform exposes traders to substantial uncertainty regarding fund safety and legal oversight. FCA

Regulatory warnings serve as important early indicators that an entity may not be operating under recognised financial safeguards. Without authorisation, users have no assured access to formal complaint processes, investor compensation frameworks or enforcement by oversight authorities — protections that are fundamental to regulated brokers.

Claimed Licences Appear Contradictory

On its own website, NexusCapitalTrades.com presents detailed claims of regulatory compliance and client fund protections, including assertions that it is registered with authorities and that client funds are segregated in secure accounts. However, these claims are inconsistent with publicly available regulator information, including the FCA’s alert. The platform’s own disclosures also reference various regulatory regimes in multiple jurisdictions, suggesting a complex corporate structure with overlapping claims. nexuscapitaltrades.com

This mix of regulatory references without clear corroboration raises questions about the authenticity and applicability of those claims. A legitimate broker typically provides transparent, easily verifiable licensing details such as license numbers, specific regulatory frameworks and access to official registries where these credentials can be independently confirmed. When licensing claims are ambiguous or unmatched with regulator databases, that is a strong indicator that due diligence has not been completed by prospective users.

Marketing Versus Transparency

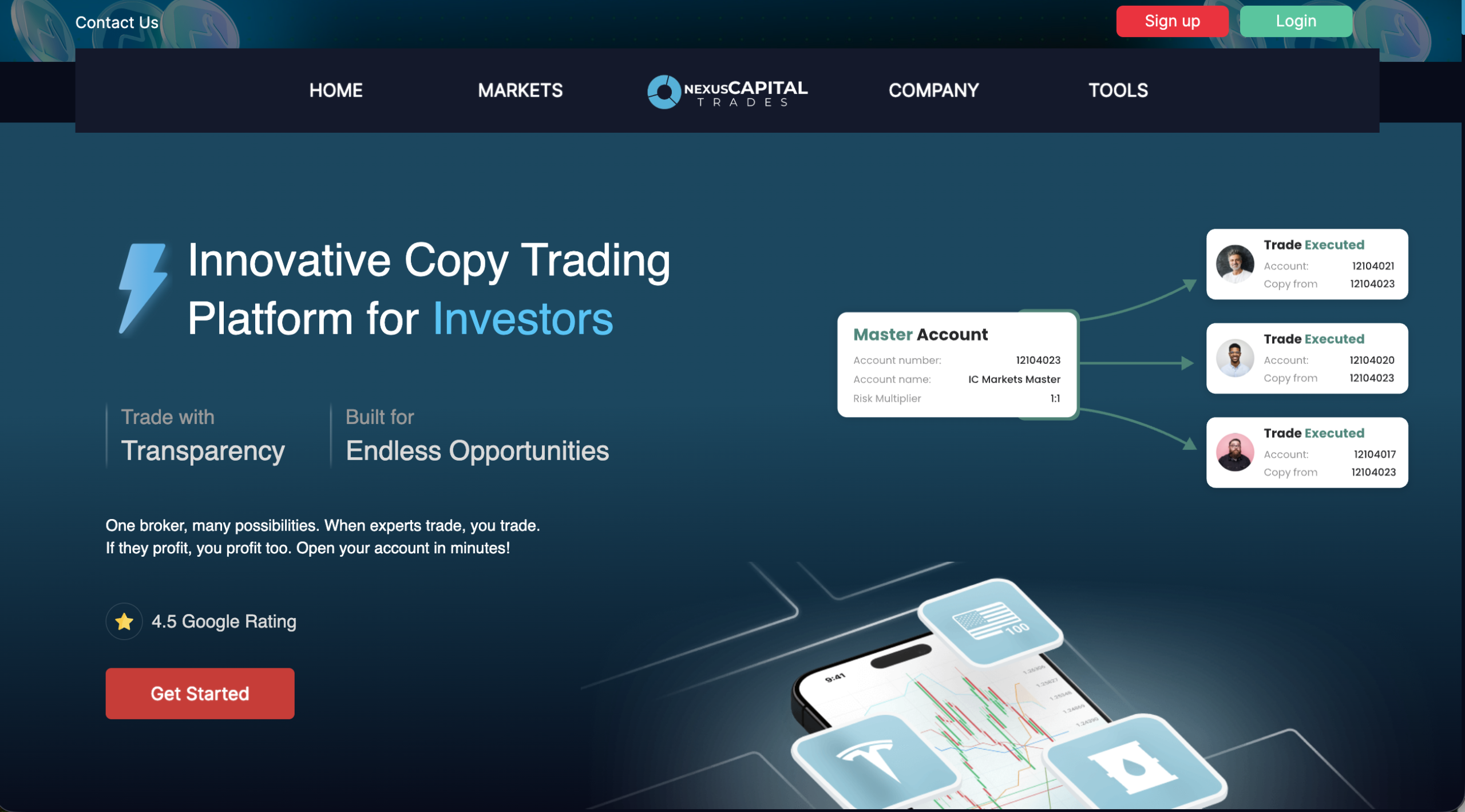

The marketing materials on NexusCapitalTrades.com are designed to attract traders with promises of “fast withdrawals”, “robust security”, extensive asset classes including forex, commodities and cryptocurrency CFDs, and automated trader copying features. The language is highly promotional, stressing ease of access and potentially lucrative trading strategies. nexuscapitaltrades.com

However, when marketing claims are not matched with transparent operational details — such as clear information about corporate ownership, leadership credentials, independent audit reports, verified user reviews, and actual historical price execution performance — the positive framing becomes superficial. In the broader online broker landscape, professional and regulated brokers typically balance promotional language with substantial factual disclosures. They provide clear documentation of how user funds are protected, how client accounts are segregated, and how complaints are handled through an independent authority.

The absence of this level of transparency in NexusCapitalTrades.com’s publicly accessible material — alongside contradictory regulatory claims — suggests that the promotional messaging is intended to build perceived legitimacy rather than reflect verified operational assurances.

User Reviews and Independent Feedback

Independent feedback from third-party review platforms and public forums is a valuable source for assessing the actual user experience with trading platforms. While NexusCapitalTrades.com shows claims of high customer satisfaction and review scores on its own site, these cannot be independently validated using reliable third-party data.

In contrast, similar branding entities in the broader “Nexus” family of trading names have shown mixed to negative user reviews on external platforms. Some reports describe difficulties with withdrawals, poor customer support, and unresolved account issues. Other case reports highlight allegations of promotional tactics that do not align with transparent financial practices.

These anecdotal patterns — even if not specifically tied to NexusCapitalTrades.com — align with common warning signs seen in unregulated broker environments, where complaints of limited customer responsiveness, opaque fee structures, and withdrawal challenges occur more frequently than with regulated brokers.

Domain and Technical Considerations

The use of a domain such as nexuscapitaltrades.com — while visually professional — should not be conflated with legitimacy. Fraudulent and high-risk platforms often deploy carefully designed websites, complete with client portals, risk warnings, and elaborate feature lists to emulate the look of established brokers.

Real financial institutions prioritise regulatory transparency and often operate domains with extended histories and verified business registrations. In contrast, platforms lacking these indicators rely on design and marketing rather than verifiable background information.

Understanding Financial Risk in Trading

Trading leveraged products such as CFDs, forex or crypto instruments inherently involves high risk. Reputable brokers make this clear to prospective clients and provide detailed risk disclosures that are backed by real regulatory compliance and independent audit standards. When a broker’s regulatory status is unclear, those risks are compounded by the lack of enforceable safeguards.

Another key element of responsible trading platforms is clear disclosure of how client funds are protected, if at all. Regulated brokers hold client funds in segregated accounts and submit to routine reporting and audits. Unregulated platforms cannot guarantee these protections, increasing the potential for misuse of funds or operational failures.

Final Assessment: Caution Strongly Advised

Based on available regulatory warnings, inconsistent licensing claims, lack of verifiable transparency and the promotional nature of its marketing, NexusCapitalTrades.com exhibits multiple characteristics commonly associated with high-risk and potentially unreliable trading platforms.

The FCA’s official alert that the firm is not authorised or registered to provide financial services in the UK is a particularly strong signal that prospective users should treat the platform with scepticism. FCA

Individuals considering online trading should prioritise platforms that are fully regulated in recognised jurisdictions, with transparent licensing, verifiable compliance documentation, and third-party oversight. Choosing such platforms helps ensure that trading activities are conducted within a framework of legal accountability and user protections.

For those evaluating NexusCapitalTrades.com, the evidence outlined here underscores the importance of due diligence and the potential dangers of engaging with a platform that lacks clear regulatory backing and transparent operational practices.

Report Nexuscapitaltrades.com And Recover Your Funds

If you have lost money to nexuscapitaltrades.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like nexuscapitaltrades.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.