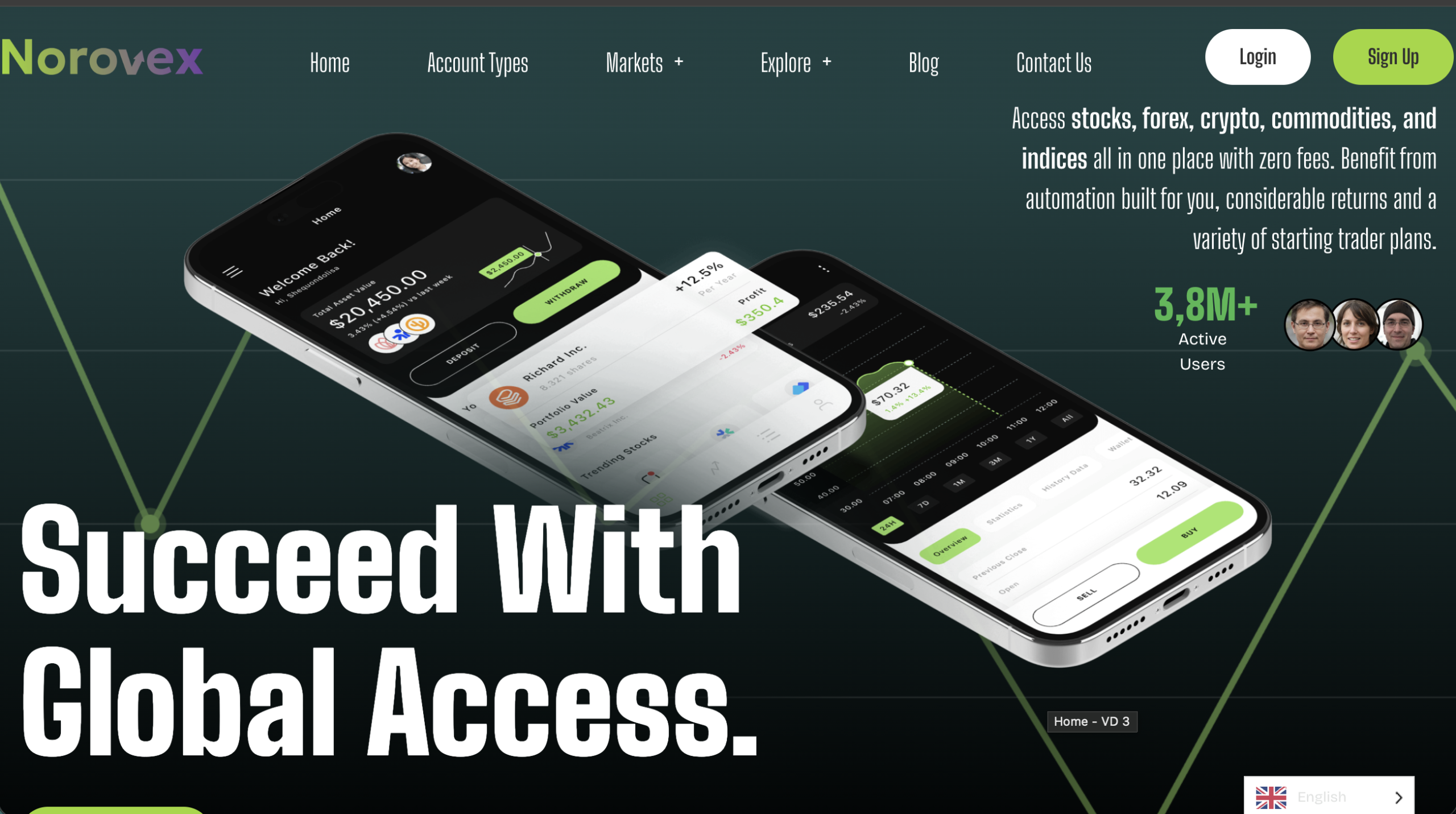

Norovex Investment Site Overview

Online trading platforms promise accessibility, fast execution, and a route to financial growth — but not all of them are legitimate. One such platform that has generated controversy, conflicting reviews, and serious warnings is Norovex. On the surface, Norovex presents itself as a modern, all-in-one online investing and trading solution. But when you dig into how it operates and what real users are saying, red flags begin to pop up everywhere.

In this review, we’re going to examine what Norovex claims to be, the issues raised by users, and why you should avoid this platform entirely.

What Norovex Claims to Be

Norovex markets itself as a global trading hub where users can trade forex, stocks, cryptocurrencies, commodities, and indices from a single account. According to its promotional material, it offers “zero fees,” powerful tools, 24/5 support, and a sophisticated trading experience designed for both beginners and professionals. It boasts big numbers — like millions of active users and billions in traded volume — and frames itself as a trustworthy, secure platform for building wealth.

The website also includes pages on “Security” and “Safety Online,” claiming bank-grade encryption, fraud monitoring, GDPR compliance, segregated accounts, and dozens of industry awards. All of these are presented to suggest legitimacy and trustworthiness.

However, there is no credible evidence that these claims are backed by regulatory licenses, audited financials, or verifiable third-party certifications. In many cases, what you see on the platform’s own website cannot be independently verified — which is itself a caution sign.

Trust and Transparency Issues

Professional, regulated financial platforms must disclose clear information about who runs the company, where it is licensed, and how client funds are protected. Norovex, regardless of the domain you look at (whether .net, .com, .io, or .co), lacks transparent ownership information, and WHOIS records are often anonymized. Websites that hide their registrant details tend to raise suspicion because legitimate trading firms usually want to be easily traceable.

Moreover, third-party trust tools that analyze domain safety have flagged Norovex and its related domains as high risk or uncertain. ScamAdviser, for example, gave low trust scores to norovex.io and norovex.com, citing factors such as new domain registrations, hidden ownership, and association with spammy registrars.

This kind of uncertainty is a significant warning sign in the online investment space, especially for platforms that hold client funds.

Conflicting User Reviews and Experiences

If you look at user-generated review sources like Trustpilot, the picture becomes even murkier. Multiple Norovex-related domains have reviews, but the experiences reported are wildly inconsistent:

-

Some reviews praise the platform’s execution, charts, and ease of use, giving high ratings and positive feedback.

-

Others, however, describe Norovex as a scam that manipulates users into depositing more and then refusing withdrawals.

For example, one reviewer wrote that after being assigned an advisor and making initial deposits, withdrawals were blocked and support became unreachable. They claim the platform changed web addresses multiple times — a known tactic in fraudulent operations to evade detection and complaints.

Another reviewer bluntly labelled Norovex a “total SCAM,” describing pressure tactics and warnings not to deal with phone or unverified identity contacts.

This conflicting feedback makes it difficult to trust the platform’s public “testimonials,” especially since they appear on Norovex’s own marketing site — a space that can easily be curated or fabricated.

Why This Matters: Patterns Seen in Scam Platforms

Several aspects of Norovex and its associated domains resemble patterns seen in known financial scams:

1. Multiple Domain Names With Similar Branding

Scammers frequently rotate domains to dodge complaints, reputation tracking, or legal enforcement. Norovex brands like .net, .com, .io, and .co appear to be used interchangeably, often with different user reports attached. This inconsistency itself is a risk indicator.

2. Promises of Unusually High Returns

Platforms that claim “zero fees,” massive trading volume, or guaranteed profits are often too good to be true. Real trading always involves risk, and no legitimate firm can promise outsized returns without disclosing regulated risk warnings and official licensing.

3. Anonymized Ownership

Hiding the identity of the company behind a financial service is a major red flag. Transparency is a cornerstone of regulated financial institutions.

4. Reports of Blocked Withdrawals

User reports that funds cannot be withdrawn — especially without depositing more — directly align with documented fraud tactics seen on many scam trading platforms.

Final Assessment

When you step back and evaluate Norovex through a critical lens, the risks overwhelmingly outweigh the purported benefits:

-

Lack of verified regulatory licensing.

-

Anonymized ownership and domain registration.

-

Mixed or contradictory user reviews with serious complaints.

-

Third-party analysts flagging domains as high risk or uncertain.

Taken together, these factors paint a picture that is much closer to a scam operation than a trustworthy trading platform.

Conclusion: Steer Well Clear of Norovex

Whether you encountered Norovex through social media, an online ad, or a referral, the evidence suggests that this platform is not a safe or reputable place to trade or invest your money. Real financial services operate with transparency, clear licensing, and consistent user experiences — none of which Norovex reliably demonstrates.

If your goal is to participate in online investing or trading, opt for established, regulated exchanges and brokers with verifiable track records, and always conduct thorough due diligence before sending money to any platform.

When the risks include losing your entire deposit and facing blocked withdrawals with no accountability, the smartest move is simple: avoid Norovex entirely.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to norovex.net, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as norovex.net continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.