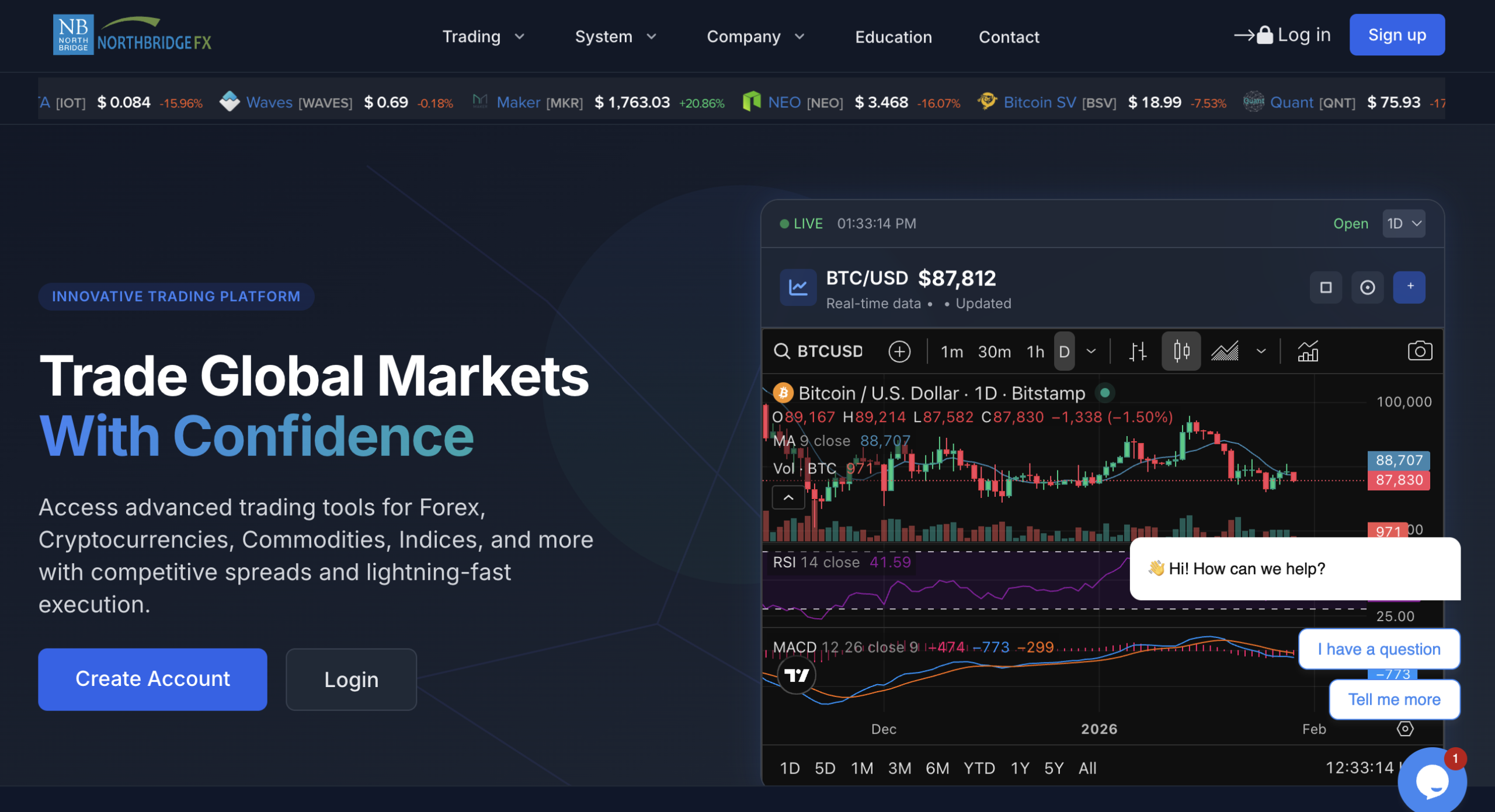

NorthBridgeFX.com: Insights Every Trader Needs

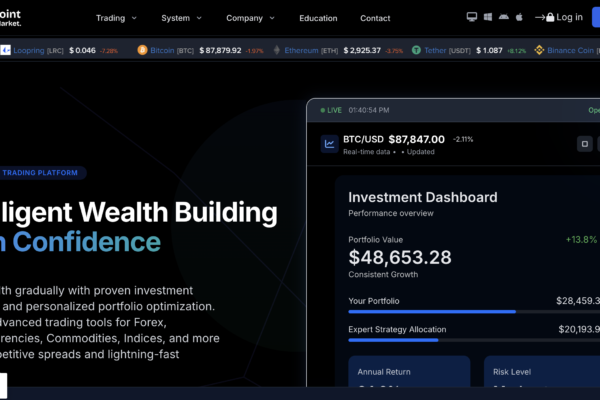

When exploring options for online forex or CFD trading, encountering a slick website with bold promises of profits and professional tools can be tempting. However, in the case of NorthBridgeFX.com, what lies beneath the surface suggests that this platform is not a reliable or trustworthy place to trade or invest your funds.

Multiple independent investigations and user reports reveal serious issues with transparency, regulatory compliance, platform integrity, and user experience that make it a platform worth avoiding. This review breaks down those concerns so you understand why caution is essential.

No Evidence of Regulation or Licensing

One of the most critical red flags with NorthBridgeFX.com is the absence of any verifiable regulatory licence from an established financial authority. Legitimate brokers are typically registered and regulated by recognized bodies such as the UK Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), or the U.S. National Futures Association (NFA). These agencies enforce standards that protect traders and help ensure fair dealing.

According to independent investigation reports, searches for NorthBridgeFX.com in official regulatory databases returned no results, meaning the platform is operating outside of recognized oversight.

Operating without an official licence means there is no accountability to a financial regulator, no requirement to segregate client funds, and no external body to enforce standards or resolve disputes — leaving users extremely vulnerable.

Suspicious Website Characteristics

A deeper look into the platform’s digital footprint reveals several concerning technical aspects:

-

The domain appears to be relatively new, with registration details hidden behind privacy protection, obscuring ownership and accountability.

-

The platform is hosted on an overseas cloud server shared with other sites flagged for fraudulent activity.

-

There is minimal external verification about the company’s history or market reputation.

Such indicators are common in schemes set up to collect deposits and then disappear, rather than long‑term, compliant trading operations.

Misleading Trading Claims

NorthBridgeFX.com reportedly advertises unrealistic trading conditions — including ultra‑high leverage and “zero spread” trading — that are inconsistent with what regulated brokers can lawfully offer. Such marketing is often used to lure inexperienced traders into depositing funds quickly before any serious due diligence takes place.

These claims can mask serious issues such as:

-

Hidden fees charged at withdrawal time

-

Slippage and manipulated spreads that reduce the likelihood of actual profits

-

Altered price feeds that do not reflect real market conditions

These practices have been noted in user complaint reports filed on independent review sites.

Consistent User Complaints

Although official user reviews specifically for NorthBridgeFX.com across mainstream sources are limited, the platform’s identifying name appears in discussion threads and complaint zones pointing to:

-

Difficulty withdrawing funds or access being blocked once deposits are made

-

Pressure from sales representatives to fund accounts further

-

Inconsistent or manipulated platform pricing during trades.

Such patterns are typical of fraudulent operations that generate initial interest with promotional claims, but then make it difficult or impossible for users to retrieve money once it is deposited.

How Schemes Like This Typically Operate

Platforms with characteristics similar to NorthBridgeFX.com often follow a well‑documented pattern:

-

Attraction Phase: They advertise lucrative returns, low entry thresholds, or high leverage to attract new traders.

-

Deposit Phase: Traders are encouraged to make their first deposit quickly.

-

Engagement Phase: Through aggressive account management or pressure tactics, users are asked to increase their investment.

-

Blocking Phase: Attempts to withdraw funds are met with excuses, additional fees, or outright denial.

These tactics are not consistent with the way regulated brokers operate, where transparency around withdrawal policies and limits is mandatory.

No Clear Company Identity or Accountability

Legitimate brokerages provide clear corporate information — including registered business names, physical addresses, and licence numbers — that can be verified independently. NorthBridgeFX.com hides ownership details via domain privacy, and there is no authoritative evidence linking the platform to a verifiable corporate entity.

This lack of transparency makes it difficult to hold anyone accountable for misconduct, especially in jurisdictions where enforcement may be limited or non‑existent.

Conclusion: Avoid NorthBridgeFX.com

While the marketing for NorthBridgeFX.com may appear polished and professional at first glance, multiple investigative indicators point to a platform that lacks the fundamental protections expected from a legitimate trading service. Its absence of regulation, opaque operations, questionable trading terms, and consistent user complaints strongly suggest that it is not a platform you should trust with your money.

For anyone interested in trading forex or other financial products, prioritizing regulated, transparent, and independently audited services is essential. NorthBridgeFX.com does not meet these basic criteria, and therefore is a platform to steer well clear of.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to northbridgefx.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as northbridgefx.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.