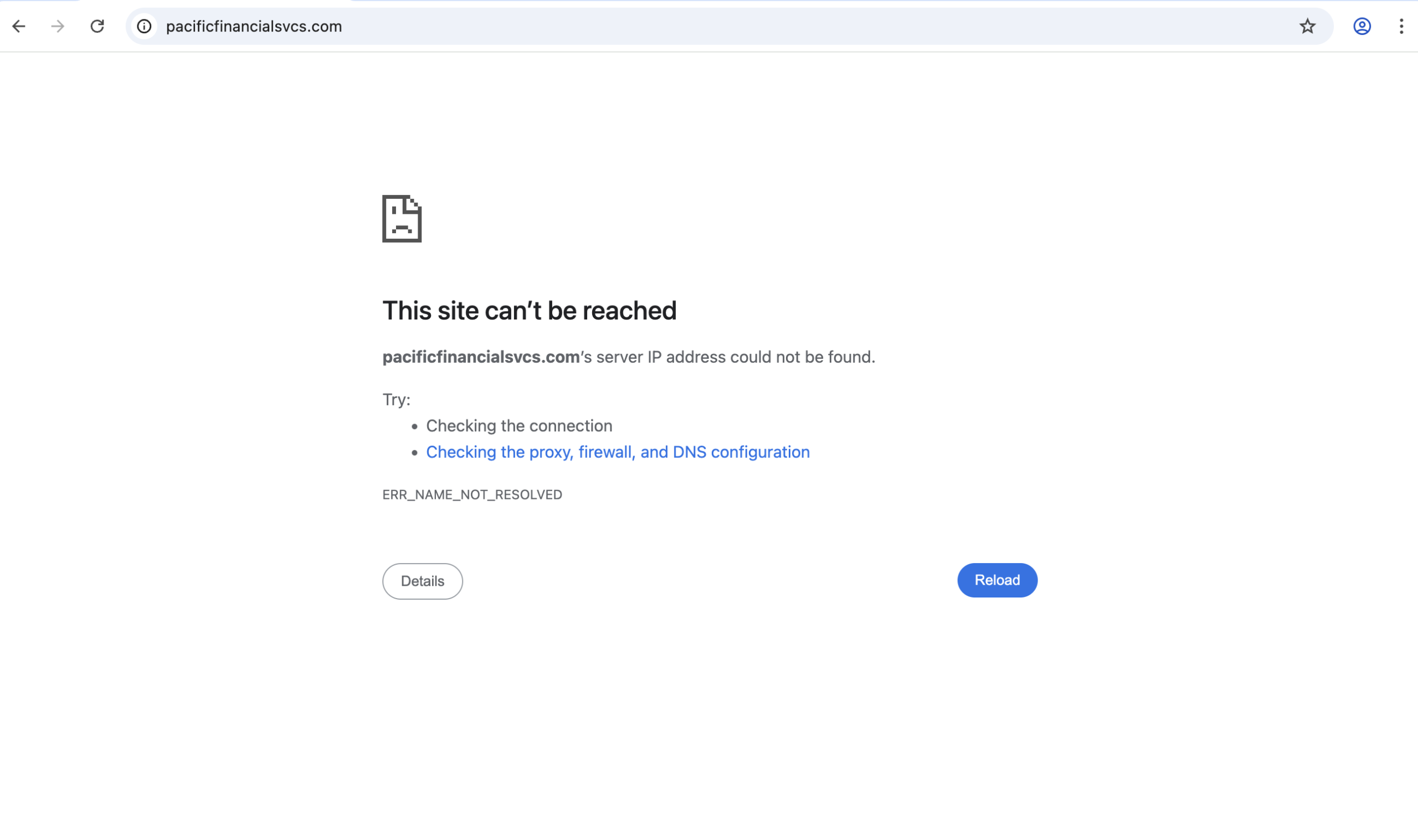

Pacificfinancialsvcs.com Before You Invest

In the online financial services landscape, legitimacy and regulatory oversight matter enormously. Unfortunately, pacificfinancialsvcs.com emerges from available evidence not as a credible financial institution but as a platform surrounded by questions that investors should take seriously. From official regulatory warnings to a lack of transparency and user reports of suspicious programmes, there are multiple reasons to be wary. Here’s a thorough breakdown of what’s going on and why this platform warrants avoidance.

No Regulation or Authorisation from Key Financial Authorities

One of the most fundamental indicators of a trustworthy investment or financial service is clear regulatory approval from recognised authorities — bodies like the UK’s Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), or similar global regulators. According to official warnings from the FCA, Pacific Financial Services — the name linked to pacificfinancialsvcs.com — is not authorised to provide or promote financial products or services in the UK. The FCA explicitly alerts consumers that this firm may be providing financial services without permission and cautions against dealing with it.

Without this authorisation, clients of the platform lose essential consumer protections. There is no access to the Financial Ombudsman Service, and no protection through schemes like the Financial Services Compensation Scheme (FSCS). These protections exist precisely to give investors recourse and a measure of compensation if something goes wrong — but with this platform, regulatory safeguards are absent.

Opaque Business Structure and Lack of Transparency

Reliable financial firms typically publish clear and verifiable information about their ownership, management team, physical headquarters, and registration details. This transparency enables potential clients to verify claims directly with regulators or public business registries.

In the case of pacificfinancialsvcs.com, there is no verifiable registration number, credible documentation of leadership, or clear operational background available in authoritative databases. Independent reviews and watchdog platforms note that Pacific Financial Services lacks documentation proving licensing with any major oversight body.

This absence of transparency makes it difficult — if not impossible — to determine who is behind the platform or how client funds are held and managed. Without these basics, there’s no reliable way to assess whether the operation is legitimate.

Questionable Investment Programmes Promoted Online

Discussion threads on independent online forums reveal details about investment plans associated with the pacificfinancialsvcs.com ecosystem that closely resemble high-yield investment programmes (HYIPs). According to user posts, offerings have included excessively high monthly returns — such as 14%, 17%, or even 21% over 12 months — coupled with cryptocurrency, electronic payment systems, and referral commissions.

These types of plans, especially when promised with high steady returns and without clear risk disclosure, are commonly associated with speculative or predatory models rather than institutional financial products. Real financial services emphasise the risk inherent in markets and provide detailed prospectuses, disclosures, and regulatory oversight — none of which appear to be present here.

No Meaningful Track Record or Independent Verification

Legitimate platforms usually have a track record that can be traced through third-party finance sites, verified market data, and consistent user experiences documented across reputable industry sources. In contrast, pacificfinancialsvcs.com shows no meaningful presence in established financial registries or comparison platforms.

Independent risk assessment sites broadly identify that the domain is linked to unverified or unauthorised activities and that the company itself has no public regulatory license from recognised bodies.

This absence of a verifiable operational footprint suggests the platform may rely on aggressive marketing and speculative user attraction rather than audited, regulated financial services.

Red Flags: Aggressive Returns and Referral Programmes

In many fraudulent operations, operators design programmes that promise steady, above-market returns and incentivise participants to recruit new depositors through referral bonuses. This structure can resemble Ponzi-style dynamics, where funds from new participants are used to pay earlier investors, creating a fragile sustainability model that collapses when new investors slow down.

Discussion threads associated with pacificfinancialsvcs.com detail exactly this type of structure — high monthly gains and multi-level referrals — which are not typical of regulated brokers or institutional investment platforms.

User Reports and Industry Sentiment

While there are no official financial authority findings published about customer complaints specific to pacificfinancialsvcs.com, the absence of regulation combined with user-generated critiques on independent investment forums and thread discussions points to widespread scepticism among seasoned investors. Posts about HYIP-like plans and unusual payout structures fuel broader concerns about legitimacy.

Summary: Multiple Indicators Suggest Avoidance

Given the evidence available from regulatory warnings and independent reporting, pacificfinancialsvcs.com is a platform that should be approached with extreme caution — or better yet, avoided entirely. Key unresolved issues include:

-

Lack of regulatory authorisation: The FCA has made clear the entity linked to this domain is not authorised to provide financial services in the UK.

-

Absence of verifiable licensing: There is no confirmed registration with major financial regulators.

-

Opaque operational structure: No clear leadership or credible business history.

-

Investment programmes with unrealistic returns: These raise significant scepticism about the nature of the offering.

Final Thought

In the world of online finance, due diligence isn’t optional — it’s essential. A platform that lacks transparent regulation and verifiable credentials is not a suitable place to entrust your money. If you are considering any kind of investment, always check official regulator registers, review audited financial disclosures, and prefer firms with long histories of compliance and oversight.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to pacificfinancialsvcs.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as pacificfinancialsvcs.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.