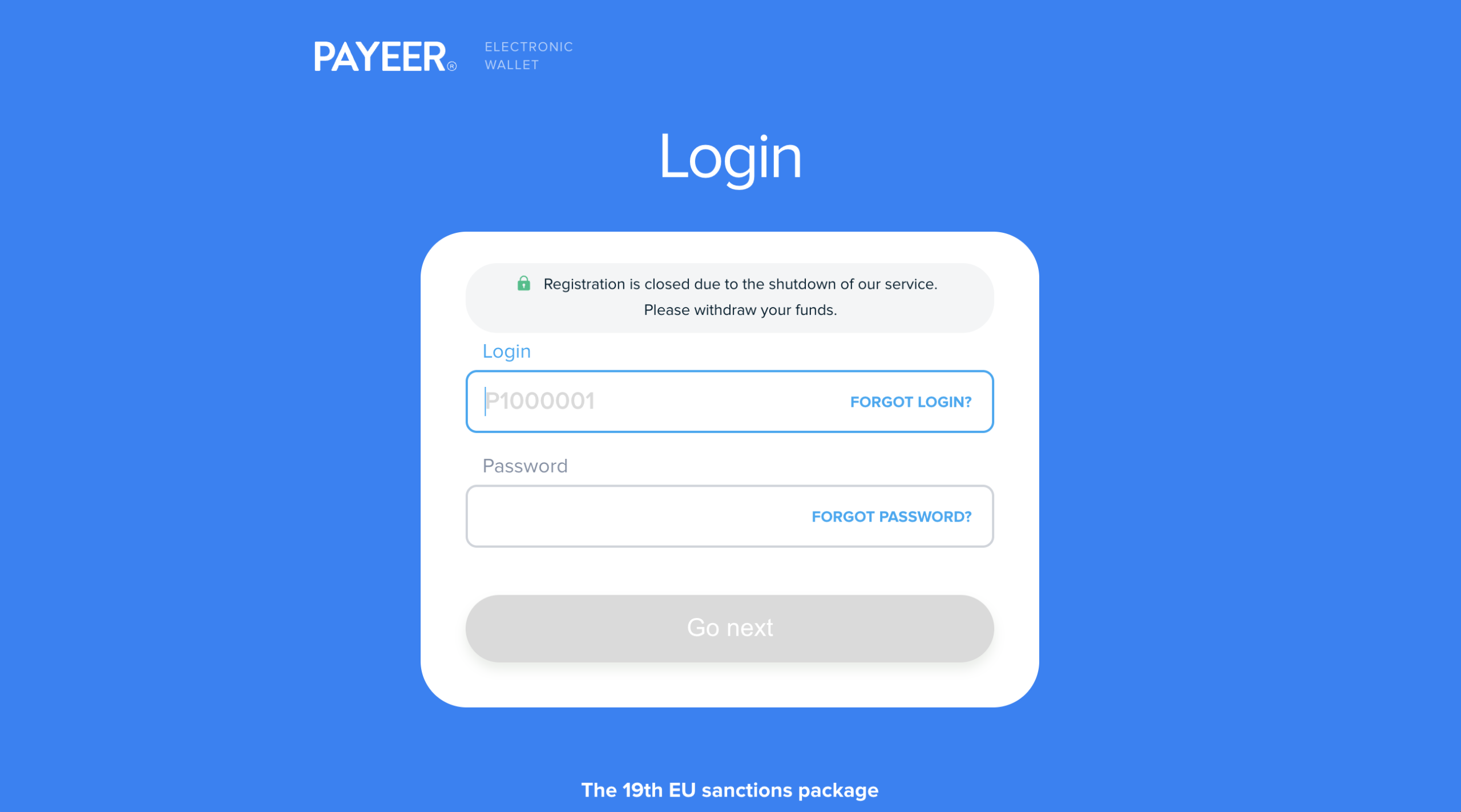

Payeer.com: What’s the Withdrawal Process?

In the crowded landscape of online financial services, platforms offering digital wallets and payment solutions have become increasingly popular. Payeer.com is one such platform that markets itself as a versatile and convenient digital wallet, allowing users to send, receive, exchange, and store various currencies, including cryptocurrencies. However, despite its widespread use and apparent functionality, Payeer.com has attracted a significant amount of criticism and skepticism. This review delves into the concerns surrounding Payeer.com, highlighting reasons why potential users should approach this platform with caution.

What Is Payeer.com?

Payeer.com is an online payment system that provides users with a digital wallet to manage multiple currencies, including fiat money like USD, EUR, and RUB, as well as cryptocurrencies such as Bitcoin and Ethereum. It offers services including money transfers, currency exchange, and merchant tools for businesses. The platform is popular in certain regions for its relatively easy access and broad currency options.

On the surface, Payeer.com appears to be a convenient solution for digital payments, especially for users who need to handle multiple currencies or engage in international transactions. However, beneath this functional exterior, several troubling aspects have emerged that warrant a deeper look.

Lack of Regulatory Transparency

One of the most significant concerns about Payeer.com is its ambiguous regulatory status. Unlike established financial institutions or regulated payment processors, Payeer.com does not clearly disclose its licensing or regulatory oversight. This lack of transparency raises questions about the platform’s legitimacy and the security of users’ funds.

Regulation is a cornerstone of trust in financial services. It ensures that platforms adhere to strict operational standards, including safeguarding user funds, implementing anti-money laundering (AML) policies, and providing recourse in case of disputes. Without clear regulatory backing, users of Payeer.com face increased uncertainty about the safety and legality of their transactions.

User Complaints and Poor Customer Support

A recurring theme in user feedback is dissatisfaction with Payeer.com’s customer support. Numerous users report difficulties in resolving account issues, delays in processing withdrawals, and unresponsive or unhelpful support staff. In financial services, timely and effective customer support is crucial, especially when dealing with money transfers and account security.

Many users have shared experiences where their accounts were suddenly restricted or funds were held without clear explanations. Attempts to communicate with the support team often resulted in frustration, with extended waiting times and vague responses. This lack of reliable customer service undermines user confidence and raises serious concerns about the platform’s operational integrity.

Security Concerns

While Payeer.com implements standard security measures such as two-factor authentication (2FA), there have been reports of compromised accounts and unauthorized transactions. Some users claim that despite enabling security features, their accounts were hacked, leading to loss of funds.

The platform’s response to these incidents has been criticized as inadequate, with users stating that investigations were slow or inconclusive. In the digital payments ecosystem, robust security protocols and responsive incident management are essential, and any shortcomings in these areas can expose users to significant financial harm.

Unclear Fee Structure

Another point of contention is Payeer.com’s fee structure, which many users find confusing and sometimes excessive. While the platform advertises competitive exchange rates and low fees, actual costs can be higher due to hidden charges or unfavorable conversion rates.

Users have reported unexpected fees during currency exchanges and withdrawals, which were not clearly outlined beforehand. Transparency in fees is critical for users to make informed decisions, and the lack of clarity on Payeer.com’s part can lead to dissatisfaction and financial losses.

Potential for Misuse

Due to its relatively lax verification processes compared to fully regulated platforms, Payeer.com has become a preferred tool for certain illicit activities, including money laundering and fraud. While the platform claims to have AML policies in place, the enforcement appears inconsistent.

This association with questionable activities not only tarnishes Payeer.com’s reputation but also poses risks to legitimate users. Financial services linked to illicit use may face sudden restrictions or shutdowns, leaving users unable to access their funds.

Why Users Should Be Cautious

The combination of regulatory ambiguity, poor customer service, security issues, and unclear fees paints a concerning picture of Payeer.com. For individuals and businesses considering using this platform, it is essential to weigh these factors carefully.

- Funds Safety: Without regulatory protection, users’ funds may not be insured or recoverable in case of platform failure or fraud.

- Customer Support: Difficulties in resolving issues can lead to prolonged access problems or financial losses.

- Security: Potential vulnerabilities could expose users to hacking and theft.

- Transparency: Hidden fees and unclear policies make it hard to understand the true cost of using the service.

Alternatives to Consider

For those seeking reliable digital payment solutions, it is advisable to explore platforms with strong regulatory oversight and positive user reputations. Well-known services such as PayPal, Skrill, or regulated cryptocurrency exchanges offer clearer protections, transparent fees, and responsive customer support.

Choosing platforms that comply with international financial regulations helps ensure that users’ funds are protected and that there is recourse in case of disputes or fraud.

Conclusion

While Payeer.com offers a range of services that might seem attractive to users needing multi-currency digital wallets, the platform’s lack of regulatory clarity, customer service issues, security concerns, and potential misuse make it a questionable choice. Investors and users should exercise extreme caution and consider more transparent and regulated alternatives.

In the evolving world of digital finance, trust and security are paramount. Platforms that fail to provide these foundational elements put their users at unnecessary risk. Approaching Payeer.com with skepticism and prioritizing safer, well-regulated options is the prudent path for anyone serious about protecting their financial interests.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to payeer.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as payeer.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.