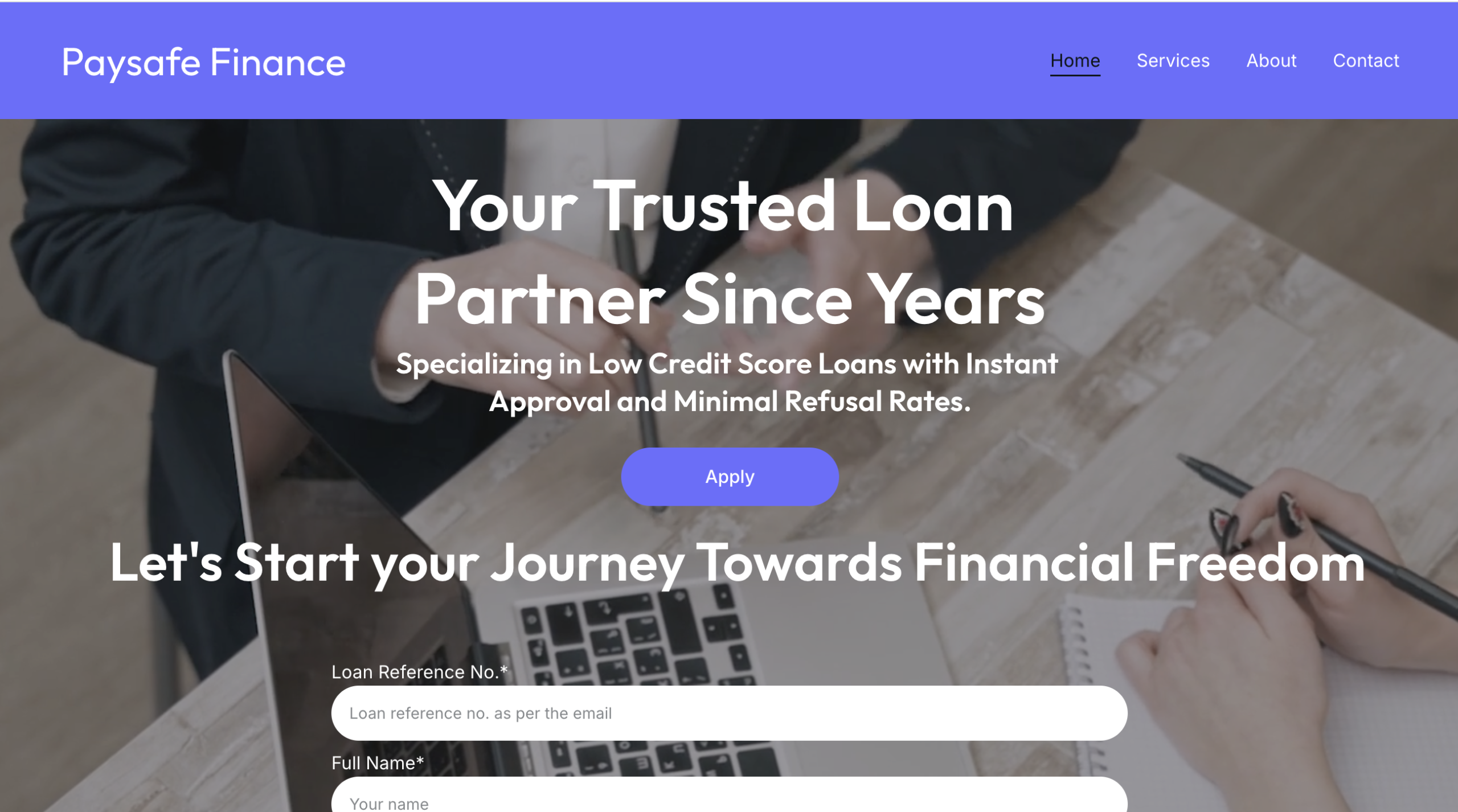

PaysafeUKFinance.online Insights

PaysafeUKFinance.online positions itself as an online loan provider offering unsecured personal loans — even to individuals with low credit scores. It promises quick approvals and accessible financial solutions, but a closer look at user experiences and independent site evaluations raises serious concerns about the platform’s credibility and trustworthiness.

Below is a detailed overview of the key issues surrounding this website.

1. Very Low Trust Score from Independent Website Checks

Reputation analysis tools assign paysafeukfinance.online a very low trust score, often registering as zero out of 100— a strong indicator that the platform may be unreliable or unsafe. Key factors include:

-

The domain was created recently (late 2025), indicating a lack of operating history.

-

The identity of the website’s owner is hidden on WHOIS records, which makes verification of the entity behind it difficult.

-

The website is hosted on a shared server, which is not typical for established financial services and increases information security concerns.

-

The site makes claims about financial services without verifiable licensing or transparent credentials.

These signals combined suggest the site is not recognised as a reputable financial service provider by independent trust analyses.

2. Extremely Negative User Reviews

Customer feedback on independent review platforms — although limited — is overwhelmingly poor:

-

All publicly posted reviews on Trustpilot about this company are 1‑star ratings, with none offering neutral or positive experiences.

-

Users report being asked to pay upfront fees for taxes, insurance, or administrative charges — sometimes even via gift card payments — before any loan is disbursed.

-

Some customers experienced poor customer service, including no response via email and hostile interactions over the phone.

-

One reviewer noted that multiple upfront payments were requested but no loan was ever received.

This pattern of requiring upfront fees is not standard practice for legitimate lenders and is a common sign of questionable or predatory operations.

3. Misleading Use of a Trusted Brand‑like Name

The name “Paysafe UK Finance” may give the impression that the platform is connected to the well‑known payments company Paysafe or to regulated financial entities in the UK. However:

-

There is no verifiable affiliation with legitimate financial firms bearing similar names.

-

Independent trust tools do not link this site to any licensed lender or reputable institution.

-

Similar domain names (such as paysafefinance.online) also have extremely low trust scores, reinforcing concerns about legitimacy.

Using a name that contains well‑known financial terms without clear verified connections can be a tactic for appearing credible when no such connection exists.

4. Highly Suspicious Lending Practices Reported by Users

Several aspects of customer experience raise red flags:

-

Users reported being asked for multiple upfront payments before receiving any loan funds, including requests for gift card purchases to pay supposed admin fees.

-

One reviewer stated they were asked to pay four separate upfront charges — including tax and PPI — yet never received the loan they applied for.

-

Many loan providers — especially regulated ones in the UK — do not require upfront payments before loan disbursement; fees are typically taken from repayment over time, not in advance.

Requiring upfront payments, especially via opaque or unconventional methods like gift card purchases, is a known indicator of predatory or fraudulent lending schemes.

5. Lack of Verifiable Licensing or Regulation

There is no publicly accessible evidence indicating that paysafeukfinance.online is:

-

Registered with the UK’s Financial Conduct Authority (FCA).

-

Listed on any national financial services register.

-

Licensed by any recognised regulatory body.

In the UK, legitimate lenders must be authorised or registered with the FCA — and claim not to be anything else. This platform does not appear in any official lists, and users have reported that regulators confirmed it is not registered with the FCA.

Without regulatory oversight:

-

There is no guarantee of fair lending practices.

-

Users have minimal consumer protection avenues.

-

There may be little accountability if funds are mishandled.

6. Technical and Structural Concerns

Independent analysts have observed characteristics frequently associated with untrustworthy sites:

-

Hidden ownership information, making it difficult to confirm who runs the business.

-

Low traffic and limited external references, suggesting very low recognition from consumers beyond a small set of reviews.

-

Hosting on shared infrastructure, which is more typical of disposable or low‑credibility sites.

These factors combined can signify a lack of operational transparency and credibility.

Conclusion: Exercise Significant Caution

Based on independent analyses and real user feedback:

-

The trust score for paysafeukfinance.online is extremely low, indicating potential unreliability.

-

User reviews are overwhelmingly negative, with reports of upfront fees, non‑delivery of funds, and poor customer service.

-

There is no evidence the platform is a regulated or licensed lender.

-

The use of “Paysafe” in the name may create false impressions of legitimacy without verified affiliation.

For these reasons, individuals should be highly cautious about engaging with this website or submitting personal or financial information. Always verify the regulatory status of any financial service before applying for loans or providing sensitive details.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to paysafeukfinance.online, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as paysafeukfinance.online continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.