Pearlnova Trading Platform Scam Alert

Pearlnova Trading presents itself as a professional online trading platform offering access to forex, cryptocurrencies, and other financial instruments. The website promotes attractive profit opportunities, smooth trading tools, and guidance that supposedly helps users succeed regardless of experience level. At first glance, the platform appears polished and convincing. However, a deeper examination reveals multiple warning signs that strongly suggest Pearlnova Trading is a high-risk and potentially deceptive operation. This review breaks down the concerns and explains why people should avoid this platform.

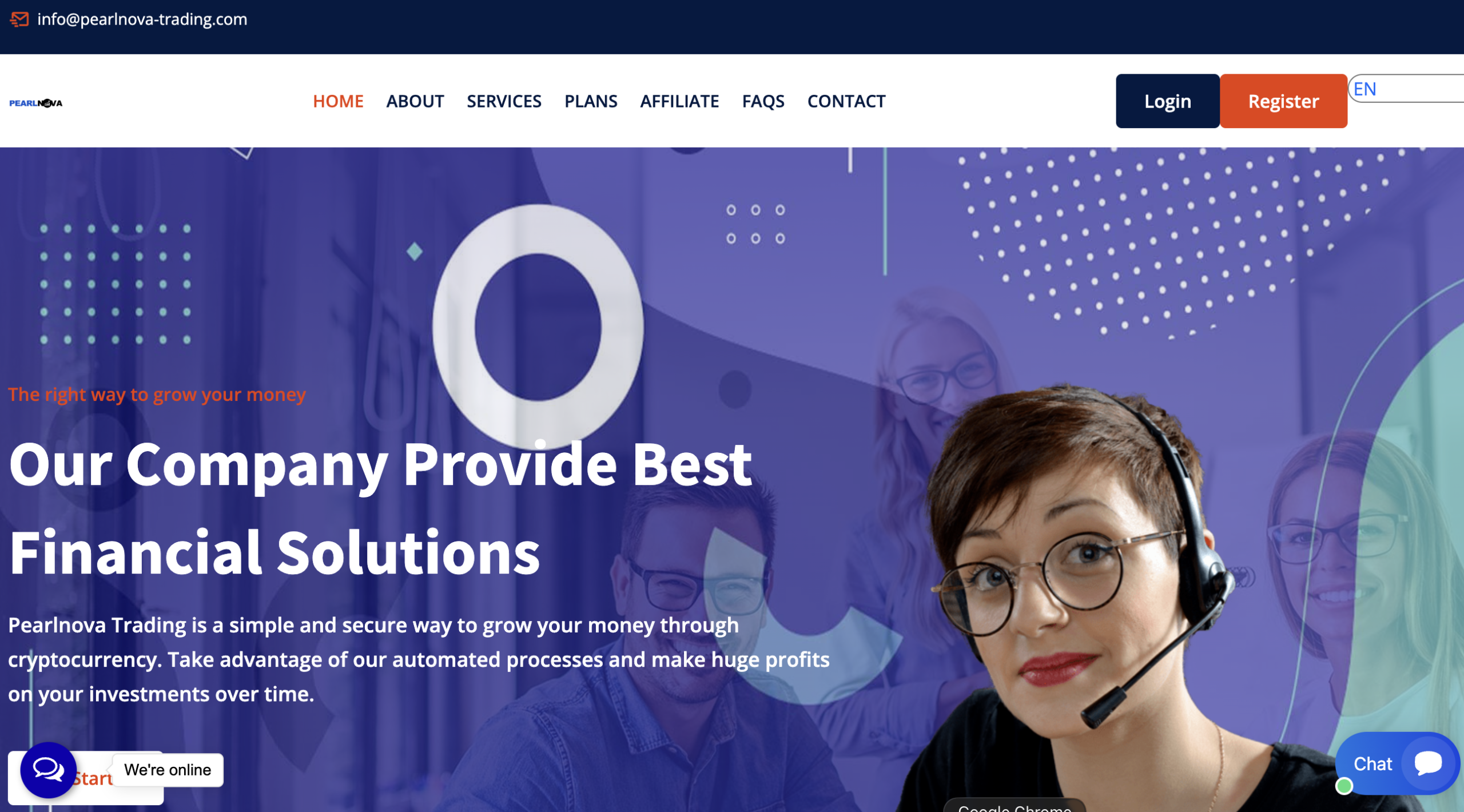

How Pearlnova Trading Markets Itself

Pearlnova Trading claims to provide a reliable trading environment supported by expert analysis and advanced technology. The platform suggests that users can grow their capital quickly by following trading signals or managed strategies. Promotional language focuses heavily on profitability, ease of use, and personalized support.

These claims target inexperienced traders who may not fully understand how financial markets work. Legitimate trading platforms emphasize risk management and realistic outcomes. Pearlnova Trading instead highlights gains while offering little detail on how those results are achieved.

Lack of Regulation and Licensing

One of the most critical issues with Pearlnova Trading is the absence of clear regulatory oversight. Trustworthy trading platforms operate under licenses issued by recognized financial authorities. They disclose this information openly and allow users to verify it.

Pearlnova Trading does not provide verifiable licensing details. There is no clear indication of which authority supervises the platform or which jurisdiction it operates under. This lack of regulation means the platform does not have to follow rules designed to protect clients.

Unregulated platforms can control withdrawals, alter account balances, or impose unexpected conditions without consequence. Users have no external authority to turn to if disputes arise.

Unclear Company Ownership

Another major red flag is the lack of transparency about who owns or operates Pearlnova Trading. The website does not clearly identify a registered company name, physical office address, or corporate registration number. This makes it difficult to determine who is responsible for managing user funds.

Legitimate financial services disclose their corporate structure and contact details. Pearlnova Trading’s vague presentation suggests an attempt to remain anonymous. Anonymous operators often disappear once enough users deposit funds.

Questionable Trading Claims

Pearlnova Trading promotes consistent profits and high success rates. These claims appear throughout its marketing content. Financial markets do not guarantee profits, and no legitimate platform can promise steady returns.

The platform also fails to provide audited performance data or independent verification of its trading results. Without proof, these claims remain marketing statements rather than facts. This approach often misleads users into believing trading is far safer than it actually is.

Pressure Tactics and Account Management

Many risky trading platforms use aggressive communication strategies to push users into depositing more money. Pearlnova Trading follows a similar pattern. Users report frequent calls, urgent messages, and pressure to act quickly on “limited-time opportunities.”

These tactics discourage careful decision-making. A professional trading service allows users to proceed at their own pace. Pressure-based sales methods often indicate that the platform’s primary goal is collecting deposits rather than supporting genuine trading activity.

Withdrawal Issues and Account Restrictions

A common complaint associated with platforms like Pearlnova Trading involves withdrawal difficulties. Users may face sudden fees, additional requirements, or unexplained delays when attempting to access their funds. In some cases, accounts become restricted after a withdrawal request.

Legitimate platforms clearly explain withdrawal rules in advance and process requests within defined timeframes. Unexpected obstacles during withdrawals often signal that a platform is not operating in good faith.

Poor Risk Disclosure

Responsible trading platforms clearly explain the risks involved in trading. They highlight potential losses and encourage users to trade responsibly. Pearlnova Trading provides limited or vague risk disclosures, which downplays the realities of market volatility.

By minimizing risk information, the platform creates unrealistic expectations. This approach increases the likelihood that users will commit funds they cannot afford to lose.

Use of Professional Appearance to Build Trust

Pearlnova Trading uses a modern website design, professional language, and trading-related visuals to appear credible. While appearance matters, it does not guarantee legitimacy. Many scam platforms invest heavily in presentation to gain trust quickly.

Real credibility comes from regulation, transparency, and accountability. Pearlnova Trading relies more on image than substance, which should concern potential users.

Patterns Consistent With Scam Platforms

Pearlnova Trading displays patterns commonly associated with fraudulent or high-risk trading operations. These include unverified claims, lack of regulation, hidden ownership, pressure tactics, and withdrawal barriers. Such platforms often operate for a limited time before rebranding or shutting down.

Once a platform follows this pattern, users face a high likelihood of losing funds with little chance of accountability.

Risks to Users

Engaging with Pearlnova Trading exposes users to several serious risks:

-

Loss of deposited funds with no regulatory protection

-

Limited transparency about how trades are executed

-

Potential misuse of personal and financial information

-

Restricted access to accounts or balances

-

No reliable dispute resolution process

These risks outweigh any potential benefits suggested by the platform’s marketing.

Final Verdict

Pearlnova Trading positions itself as a professional and profitable trading platform. The lack of regulation, unclear ownership, unrealistic profit claims, and pressure-driven tactics strongly undermine its credibility. These factors point to a platform that prioritizes deposits over user protection.

Online trading already involves significant risk, even on reputable platforms. When transparency and oversight are missing, that risk increases dramatically. Pearlnova Trading does not meet the basic standards expected of a trustworthy trading service. For anyone considering online trading, steering clear of this platform is the most prudent decision.

Report Pearlnova Trading And Recover Your Funds

If you have lost money to Pearlnova Trading, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Pearlnova Trading continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.