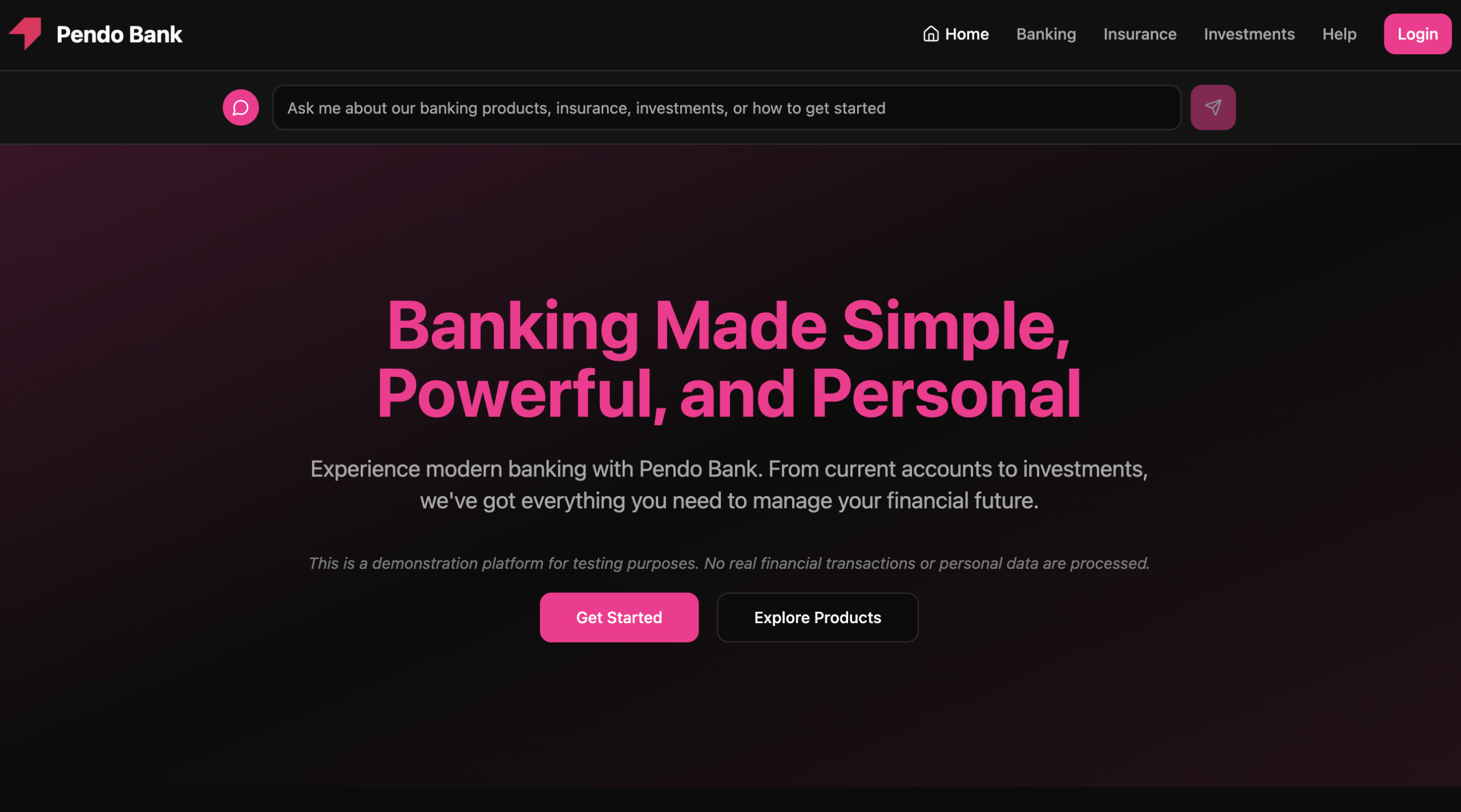

Pendobank.com: Avoid at All Costs

In early 2026, the UK Financial Conduct Authority (FCA) — one of the most respected financial regulators globally — added Pendobank.com to its official Warning List of unauthorised firms. This publicly published list highlights companies that appear to be offering financial services without the legal permission to do so. According to the FCA, Pendobank.com is not authorised to carry out regulated financial activities, meaning it may be operating illegally and targeting unsuspecting investors.

An FCA warning of this nature is a serious red flag. Regulators like the FCA exist to ensure financial firms comply with stringent requirements — including transparency, capital adequacy, and adherence to consumer protection laws. When a company isn’t regulated, it places its customers at extreme risk because no official oversight, dispute process, or compensation scheme applies.

Below is a detailed analysis of Pendobank.com — what it claims to offer, why it is widely regarded with suspicion, and the specific reasons you should avoid it completely.

1. Pendobank.com’s Regulatory Status — Unauthorised and Unchecked

When people hear the word “bank” or “finance” in a domain name, they often assume legitimacy. Unfortunately, Pendobank.com does not appear on the FCA’s register of authorised financial firms — a list you can check for every legitimate financial services provider in the UK. In fact, it is explicitly listed as an unauthorised firm on the FCA’s Warning List, along with other known scam or potentially fraudulent entities.

Operating without a licence means:

-

The firm has no legal permission to offer investment or banking services.

-

Funds entrusted to it lack regulatory protection or oversight.

-

Customers have no access to formal dispute or compensation schemes.

-

There is no obligation for transparent disclosure of operations, leadership, or financial reserves.

A company that fails to secure official authorisation cannot be trusted to safeguard your money or deliver on its promises.

2. Scam Characteristics Identified With Pendobank.com

Although detailed user complaints specific to Pendobank.com aren’t widely published yet, its appearance on the FCA Warning List positions it alongside companies that typically exhibit classic scam behavior. Common traits in platforms of this type include:

a) Lack of Regulatory Oversight

Being unlicensed indicates the business model isn’t compliant with legal requirements — a major warning sign for any financial service provider.

b) Anonymous or Hidden Ownership

Scam sites often obscure true ownership details, making accountability impossible and due diligence difficult.

c) Unrealistic Claims or Promises

Many unregulated platforms entice users with guaranteed profits, unrealistic yields, or aggressive marketing — without verifiable performance or legitimate product disclosures.

d) Opaque Terms and Conditions

Reputable financial institutions clearly state fees, risks, and legal liabilities for customers. Scam platforms tend to hide or omit this information entirely.

e) Pressure Tactics

Unverified firms frequently push prospects to deposit quickly or lock in “limited-time” offers — a tactic designed to bypass rational evaluation.

Notably, while Pendobank.com’s specific sales pitch or product offerings may vary, its regulatory status alone aligns with typical patterns seen in fraudulent financial operations.

3. Why Regulatory Warnings Matter

A listing on the FCA’s unauthorised list means regulators have reasonable grounds to believe that the entity is carrying on financial activities without proper permission. Many such firms:

-

Use misleading names to suggest legitimacy

-

Target investors via unsolicited contact

-

Use cloned or copied branding from legitimate companies

-

Take deposits and then fail to honour withdrawal requests

The FCA specifically warns consumers that if a firm is not authorised, there is no obligation for it to comply with financial conduct rules — including safeguarding client funds or key disclosures that protect investors.

Even if a platform claims to be headquartered in a financial hub or to partner with regulated banks, that marketing language does not override the absence of formal authorisation.

4. Additional Red Flags to Watch Out For

Beyond regulatory issues, investors and internet users should be alert to general warning indicators that often accompany platforms like Pendobank.com:

No Valid Licence Information

Legitimate financial institutions showcase licence numbers and regulator names prominently. If a platform omits this, it’s hiding a critical fact.

Anonymous Domain Registration

Many scam sites anonymise domain ownership to avoid being traced or shut down.

Aggressive Recruitment

Unregulated platforms sometimes use social media, influencers, or referral marketing to build trust without transparency.

No Public Audits or Financial Statements

Real finance companies publish financial results or audits by external firms; scam sites do not.

Even without specific customer complaints widely documented, the combination of these signs with an official regulatory warning is enough to justify avoidance.

5. The Bottom Line — Pendobank.com Is Not Worth the Risk

If a financial services provider is listed by a major regulator as unauthorised, that alone is a powerful reason to avoid it entirely. Pendobank.com’s inclusion on the FCA’s Warning List means it is operating outside recognised compliance frameworks — effectively placing any user funds or personal information at significant risk.

Whether you were considering traditional banking services, trading, deposits, loans, investments, or other financial products, there is no legitimate reason to engage with this platform when reputable alternatives with strong oversight exist.

In the world of online finance, your best protections are regulatory transparency, clear licensing, and adherence to consumer protection laws. Pendobank.com lacks all of these, making it an unsafe choice for anyone’s money or personal data.

Steer clear. The risks far outweigh any advertised benefits.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to pendobank.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as pendobank.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.