PlusCoin Review – Uncovering the Risks Behind the Project

The rise of cryptocurrency has attracted countless investors seeking high returns, yet it has also given rise to numerous high-risk projects and scams. Among the controversial digital assets generating concern is PlusCoin. This review examines the platform, its operations, claims, and the risks investors may face, providing a thorough analysis for anyone considering involvement.

What Is PlusCoin?

PlusCoin is a digital currency project that markets itself as a revolutionary cryptocurrency with potential for substantial profits. It claims to leverage innovative blockchain technology and promises rapid growth for early investors.

Despite these claims, PlusCoin lacks verifiable information regarding its core technology, business model, or long-term strategy. Investors are presented with ambitious promises, yet little evidence exists to support the platform’s claims of sustainable value creation.

Team and Leadership Transparency

Transparency is a key factor in evaluating the legitimacy of a cryptocurrency project. Unfortunately, PlusCoin provides minimal information about its founders, developers, or advisory board. The identities of those behind the platform remain largely unknown, and public records do not confirm their experience or credibility in the crypto industry.

The absence of verified leadership raises concerns about accountability and the overall reliability of the project. Projects without credible teams are often more susceptible to unethical practices or operational failures.

Regulatory Compliance and Legal Concerns

Cryptocurrency platforms must adhere to regulatory standards to protect investors. PlusCoin has drawn scrutiny due to its aggressive marketing tactics and high-return promises.

Operating without proper oversight or regulatory registration creates substantial risks. Lack of licensing and adherence to securities laws often signals potential legal and financial problems for investors.

Unrealistic Profit Promises

A hallmark of high-risk crypto projects is the promise of guaranteed or extraordinary returns. PlusCoin heavily advertises the potential for rapid gains, enticing investors with impressive figures and short-term profit projections.

While some legitimate cryptocurrencies achieve growth, guaranteed high returns are unrealistic and often indicative of schemes designed to attract inexperienced investors quickly.

Token Sales and ICO Concerns

The primary method for investing in PlusCoin is through its token sale or Initial Coin Offering (ICO). Although the ICO promotes lucrative returns, it offers limited transparency regarding token allocation, fund usage, and long-term strategy.

Legitimate crypto projects provide detailed whitepapers, clear tokenomics, and comprehensive plans for fund allocation. PlusCoin’s lack of such documentation is a significant red flag for investors.

Marketing and Promotion Strategies

PlusCoin employs aggressive marketing strategies to capture attention. These include flashy social media campaigns, high-pressure advertisements, and promises of instant profits.

These tactics often encourage rushed investment decisions without adequate research. High-pressure marketing is commonly associated with fraudulent or unsustainable projects in the cryptocurrency industry.

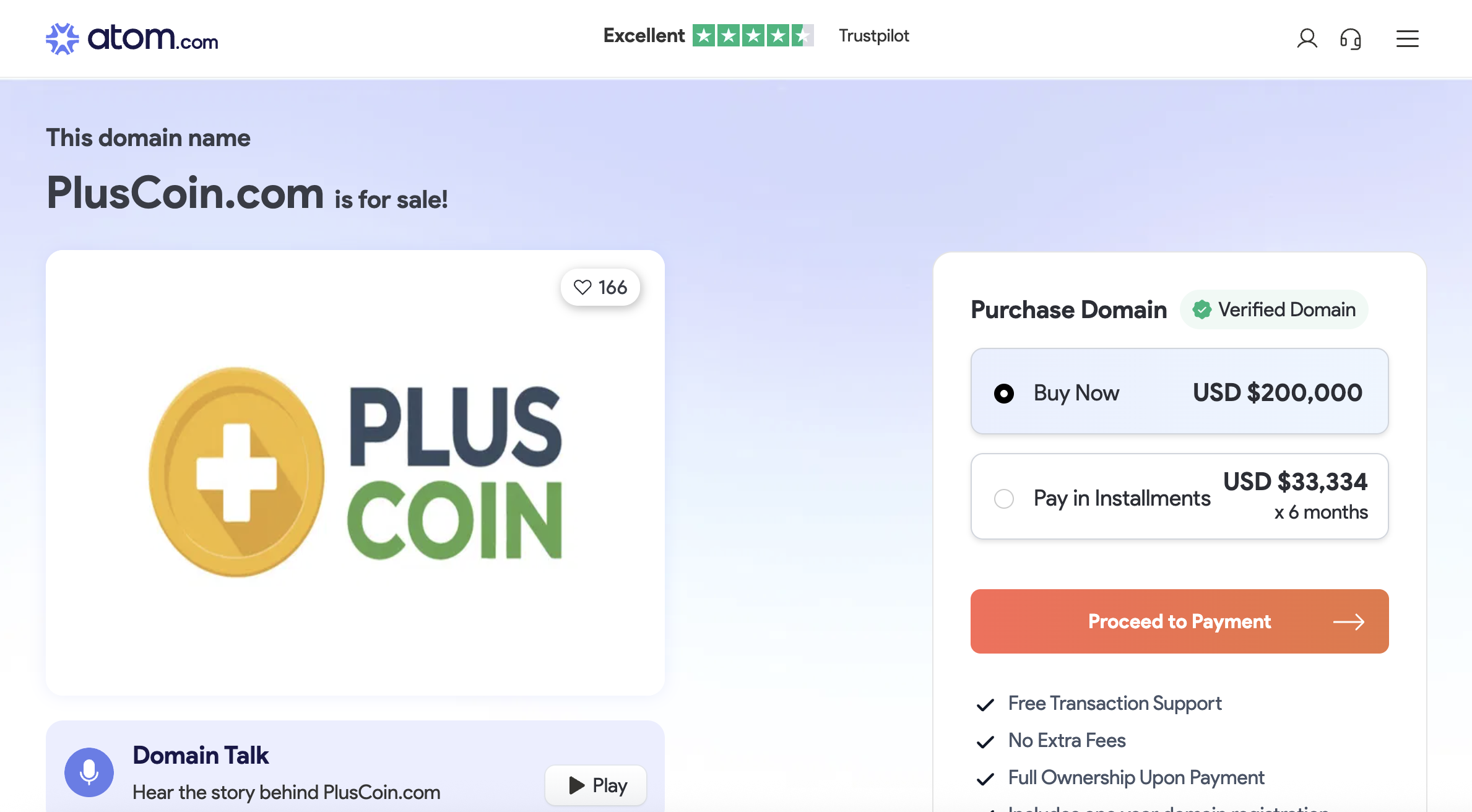

Website Quality vs. Substance

While PlusCoin’s website features modern design, animations, and professional aesthetics, it lacks detailed operational insights or verifiable technical information.

A visually appealing website can create a sense of legitimacy, but it does not guarantee transparency or reliability. Investors should prioritize verifiable data, credible leadership, and detailed project explanations over aesthetics.

Customer Support and Communication

Customer support is crucial for any investment platform. Reports indicate that PlusCoin has limited and inconsistent communication channels, making it difficult for investors to get responses to inquiries or resolve issues.

Poor support can signal underlying operational problems and raises doubts about the platform’s commitment to investor protection. Reliable projects provide accessible, responsive, and transparent support systems.

Investor Feedback and Complaints

Several users have shared negative experiences related to PlusCoin:

-

Difficulties or delays in withdrawing funds

-

Ambiguous or misleading investment terms

-

Lack of transparency about token performance

-

Minimal communication from the platform regarding issues

Such complaints highlight a trend of unreliability and indicate that the project may not operate in investors’ best interests.

Red Flags and Risk Indicators

Several warning signs suggest that PlusCoin carries significant risk:

-

Anonymous or unverified leadership

-

Regulatory scrutiny or lack of compliance

-

Exaggerated profit promises

-

Unclear tokenomics and ICO structure

-

Aggressive and high-pressure marketing tactics

-

Limited customer support and poor communication

-

Negative user experiences and complaints

-

Vague website content lacking verifiable information

Investors should approach these red flags with caution, as they are often associated with unsustainable or fraudulent cryptocurrency projects.

Conclusion

Despite its claims of innovation and high returns, PlusCoin displays characteristics commonly linked to high-risk crypto projects. The platform lacks transparency regarding leadership, token distribution, and operational strategy, while promoting unrealistic profit expectations. Regulatory concerns and inconsistent communication further amplify the risks.

Investors should prioritize cryptocurrencies with verified leadership, clear value propositions, regulatory compliance, and documented technical foundations. PlusCoin’s operations and history highlight the importance of thorough research and skepticism in the crypto market.

Engaging with PlusCoin without complete due diligence exposes investors to substantial financial risk. Focus on credible, established digital assets with verified track records to minimize exposure to fraudulent or high-risk schemes.

Report. PlusCoin And Recover Your Funds

-

If you have lost money to plusCoin, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like plusCoin continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.