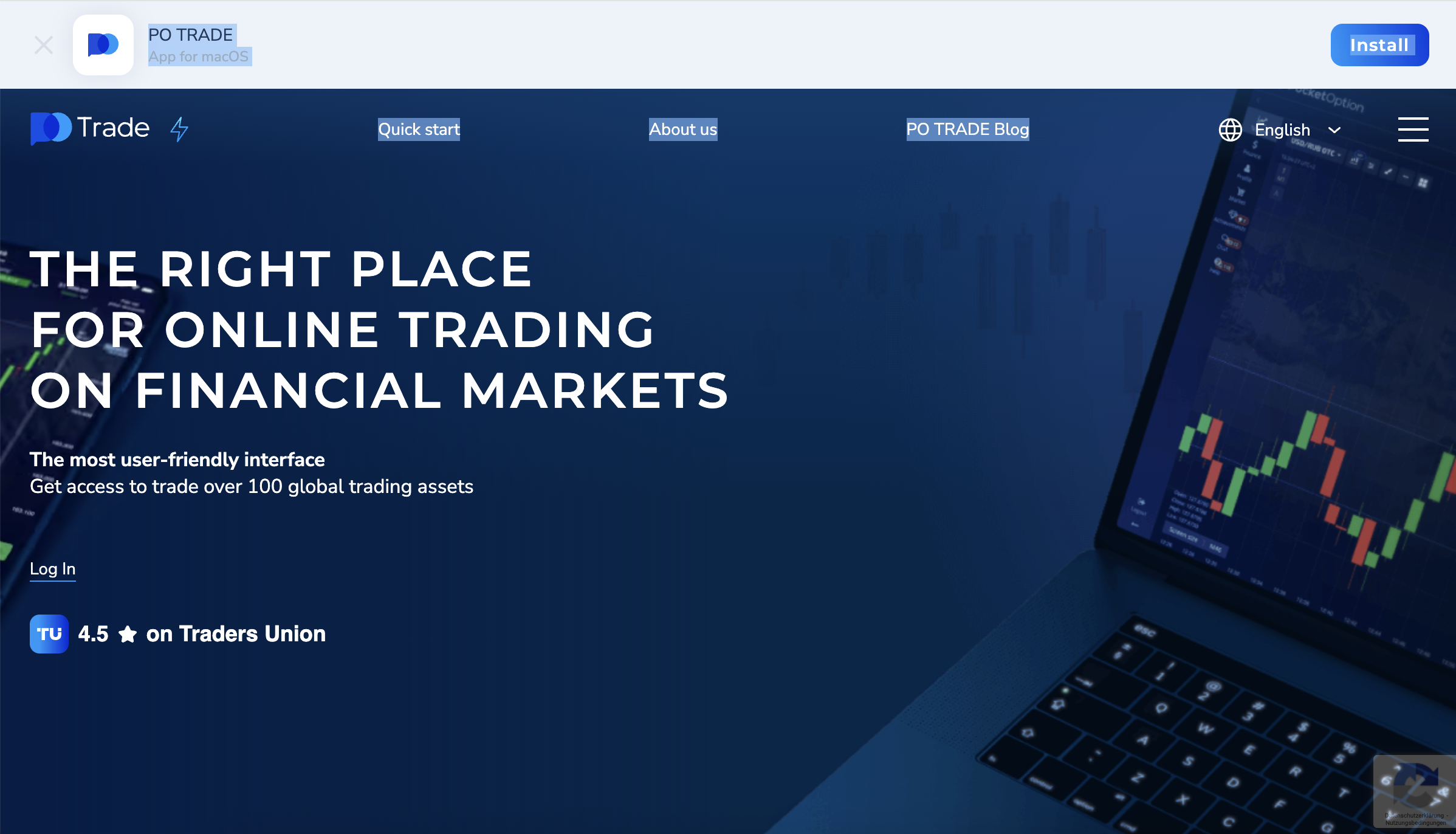

po.life / PO Trade Scam Review – A Thorough Warning

1. What is po.life and How Is It Connected to PO Trade?

po.life is part of the PocketOption / PO Trade trading scheme. This brand operates via a network of domains—including po.life/en, po.trade, and p.finance—under corporate entities in offshore jurisdictions such as Saint Vincent & the Grenadines or Saint Lucia. Regulators in Spain, Italy, France and beyond have issued warnings that PO Trade and its associated domains operate without proper oversight. It is widely flagged as an unauthorized offshore CFD brokerReddit+15fintelegram.com+15scambitcoin.com+15.

2. Lack of Real Oversight or Regulation

Although po.life claims affiliation with a regulator called IFMRRC or Mwali International Services Authority—common in such operations—these entities are offshore and offer no meaningful legal protections. Major regulators like the UK’s FCA, France’s AMF, Italy’s CONSOB, and Spain’s CNMV have listed the platform as operating illegally within their jurisdictions. This absence of legitimate regulation implies your funds are not protected under any legal frameworkfinance.wiki+3fintelegram.com+3forex.wikibit.com+3.

3. Hidden Ownership and Anonymous Setup

Domain data for po.life is fully concealed—WHOIS records show only “Domains By Proxy” with no transparent ownership, address, or contact information. This concealment means there’s no way to hold the platform accountable, pursue legal complaints, or verify the company structure behind the service ScamAdviser.

4. Promises of Easy Profits & Unrealistic Bonuses

po.life and PO Trade use aggressive marketing strategies offering:

-

Deposit bonuses of 50%.

-

Claims of high returns per trade—sometimes a few hundred percent.

-

Social trading features and auto-copy tools.

While appealing, regulators have banned such bonuses as potentially misleading and tied to hidden rules. These extraordinary profit claims lack realistic justification and ignore the fundamental risks of tradingReddit+4forexposed.com+4po.life+4.

5. Fake or Misleading Testimonials

Although po.life features glowing user reviews on its own platform, independent reviews from Trustpilot and similar sites depict a different picture: users report blocked accounts, withdrawal denials, and feeling misled once profits accumulate. In many cases, once they attempt to withdraw beyond small amounts, the platform stalls or shuts down the account entirely Reddit+4Trustpilot+4nz.trustpilot.com+4.

6. Reported User Experiences: A Pattern of Deception

a. Manipulated Outcomes and Price Control

Users in trading forums report charts on PO Trade differing significantly from verified trading platforms like TradingView. They allege price manipulation to make winning trades fail and penalize profitable users. One report stated:

“I compared broker charts with other platforms and found huge discrepancies… They manipulate prices.”Reddit+1forexposed.com+1

b. Suspicious Behavior at Profit Withdrawal

Confirmed traders report that once they begin taking profits, the platform blocks withdrawal attempts, often citing “violation of terms.” As one reviewer put it:

“They are happy when you’re losing money, but once you start making profit they block your account.”nz.trustpilot.com+3Trustpilot+3Trustpilot+3

c. Pig‑Butchering Pattern

Accounts are allowed to grow until they reach a cumulative profit; then withdrawal requests are delayed, new fees are requested, and the account is eventually frozen. This fits the “pig butchering” fraud pattern, where scammers manipulate victims gradually before cutting them off Reddit.

7. Common Scam Mechanics Employed

-

Withdrawal excuses: After deposits and gains, sudden requests for “verification fees,” tax withholding, or system charges are demanded before releasing funds. Funds never arrive.

-

Selective payouts: Small withdrawals may succeed, but later attempts—especially profitable ones—are met with resistance or outright denial RedditTrustpilot.

-

High-pressure marketing: Cold outreach via WhatsApp or emails pushing rapid deposit. No independent proof of past performance.

-

Platform opacity: no business entity, no physical address, hidden domain registration, featuring only scripted testimonials on the site instead of verified independent feedback.

8. Summary of Red Flags

| Warning Sign | Why It Matters |

|---|---|

| Multiple regulators list it as unauthorized | Platform operates illegally in many jurisdictions |

| Offshore licensing only (MISA/IFMRRC) | No meaningful legal oversight or investor protection |

| Anonymous domain ownership | No accountability or transparency |

| Unrealistic profit and bonus claims | Marketing over substance; often leads to hidden futility |

| Complaints about manipulated trades | Allegations of chart manipulation and unfair execution |

| Withdrawal denials after profit accumulation | Classic scheme of luring then freezing user funds |

Multiple red flags are present, painting a consistent picture of deceit.

9. Why po.life Should Be Avoided at All Costs

Considering all available evidence:

-

No transparent regulation—users lack legal recourse.

-

Hidden corporate structure undermines credibility.

-

Manipulated price feeds and refusal to honor withdrawals suggest financial harm rather than trading services.

-

Excessive promises of easy profit engineered to trap users.

-

Regulatory blacklist and user complaints confirm pattern of fraud.

It is clear that po.life exists to attract deposits, promote artificial trust-building, and then block or deny legitimate withdrawal attempts. The absence of oversight or accountability makes it a high-risk trap.

10. Psychological Techniques Used on Victims

Like many modern trading scams, po.life employs emotional triggers:

-

Greed: entices users with high-profit potential and bonus incentives.

-

FOMO: displays urgency and scarcity to push quick decisions.

-

Social Proof illusion: uses fake dashboards, limited testimonials, and staged success stories.

-

Sunk-cost bias: once a user invests and sees initial fake gains, they continue depositing despite doubts.

These tactics manipulate trust, emotion, and commitment to trap users into escalating investments.

11. Final Thoughts

po.life (PO Trade / PocketOption) demonstrates almost every hallmark of a fraudulent investment scheme: from deceptive bonus claims and opaque ownership to manipulated charts and systematic withdrawal failures. Despite glossy branding and attractive onboarding, it lacks any regulatory legitimacy or operational transparency.

Investors are advised not to engage. There is no verified proof of actual trading activity, no open audit of results, no proper licensing, and no credible contact information. Once funds are deposited—and especially once profits are visible—withdrawal hurdles begin, and communication often ceases.

The safe and logical decision is clear: avoid po.life entirely.

-

Report Po.life And Recover Your Funds

If you have lost money to po.life, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like po.life continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.