Prime-Loans 2026: 5 Key Insights

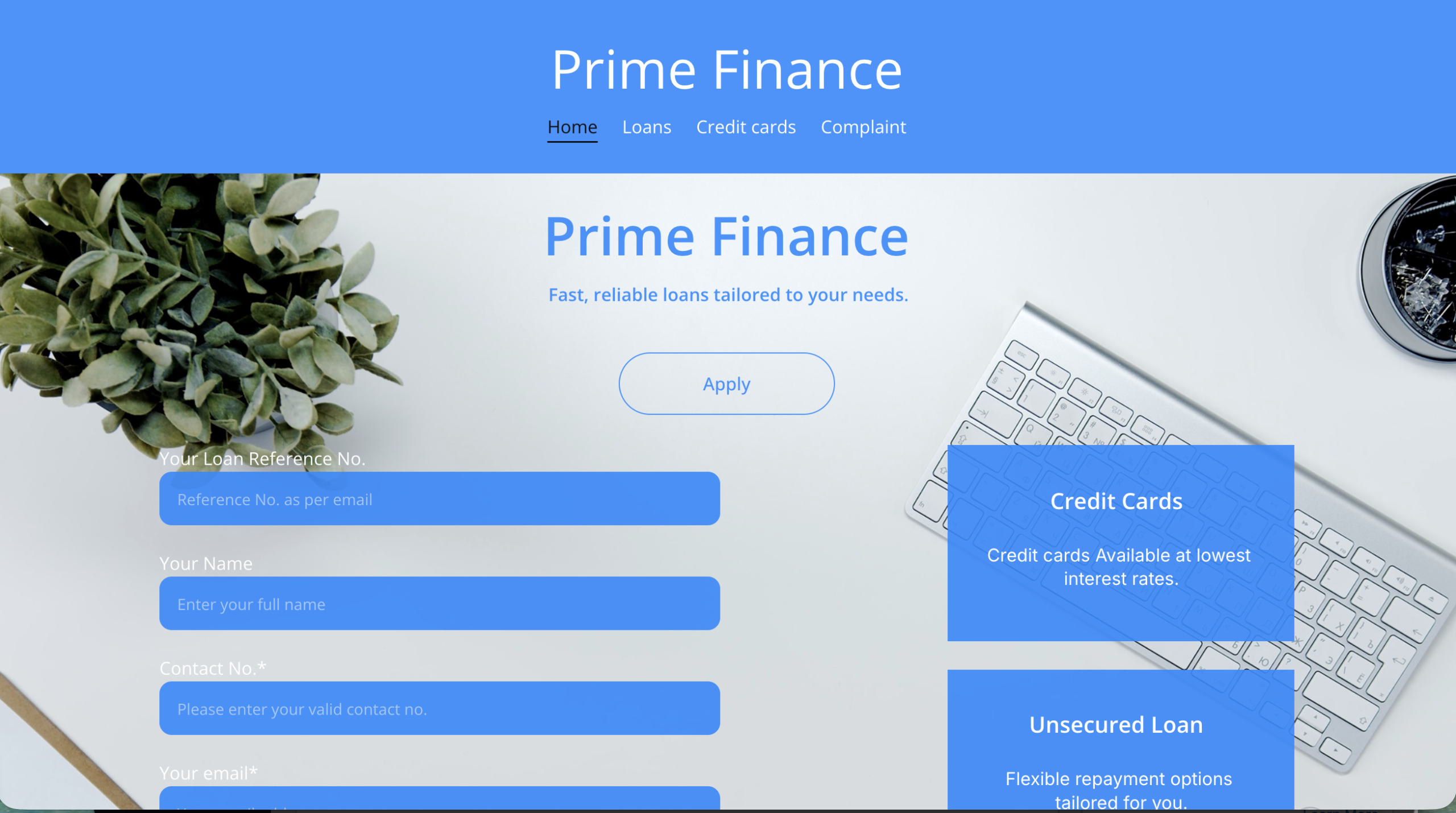

With the rise of online financial services, many lenders have launched websites claiming to offer fast loans, personal credit, and other financial products. Some are genuine and regulated, but others use polished webpages to present an illusion of legitimacy. prime‑loans.online (prime-loans) is one such platform that, on the surface, appears to be a lender — but a deeper look reveals serious concerns that every potential user should understand before considering any engagement.

What prime-loans Claims to Be

When you first land on prime-loans, the site presents itself as a UK‑based lending service called Prime‑Finance Ltd, offering unsecured personal loans, credit cards, and flexible repayment options. It includes testimonials — purportedly from satisfied customers in London and Manchester — and prominently displays a supposed registration number and claim of being regulated by the Financial Conduct Authority (FCA). It also states membership in a fraud prevention service and compliance with data protection laws.

These elements are designed to make the platform appear professional and trustworthy.

Behind the Claims: Why You Should Be Cautious

Despite the official‑sounding wording on the website, there are significant reasons to question the credibility of prime-loans.

1. Low Trust Score and Limited History

Automated website evaluators such as ScamAdviser have flagged the domain as having a somewhat low trust score and being too new to build a reliable reputation. The domain was only recently registered, and little traffic or independent reviews exist to confirm its legitimacy.

When a site advertises itself as a long‑standing lender but has no established online presence or verifiable track record, it’s a signal that you should proceed with caution.

2. Ownership Information Is Hidden

Part of ScamAdviser’s analysis notes that the WHOIS registration details for prime-loans are concealed, meaning there’s limited transparency about who actually operates the service. This lack of publicly accessible ownership information is a common tactic used by questionable platforms to avoid accountability.

3. Conflicting Reports and Red Flags Around Loans

Although no direct user complaint data specific to prime-loans is widely available online, there are many examples of fake or predatory lenders that use similar tactics — especially sites that ask for upfront “insurance” or processing fees before disbursing funds, or that advertise regulated status without verifiable evidence. In related contexts, real loan fee fraud involves fraudsters taking an upfront fee for a loan that never arrives, and such schemes are well documented by consumer protection sources.

Whether or not prime‑loans.online explicitly engages in this behaviour, its structure — asking for personal details and claiming loan approval while offering little independent validation — fits the pattern of platforms that demand upfront engagement before anything is delivered.

Look Beyond the Website Claims

One of the most important steps before engaging with any online lender is to verify their regulatory status through the official register of financial authorities, such as the FCA in the UK. When you check the FCA’s Financial Services Register directly, only firms that are genuinely authorised appear — and many cloned or misleading sites will claim a reference number that simply doesn’t match any entry on that public database.

In the absence of such verification, and with external trust tools showing a low confidence rating, this suggests that prime-loans should not be treated as a standard, authorised lender.

Practical Issues Potential Borrowers Should Consider

Unverifiable Claims

The site’s narrative about being regulated and compliant is self‑reported. Without independent confirmation from financial authority registers, these statements have no weight.

Sparse User Feedback

Reputable lenders usually show a broad range of verified user feedback — both positive and negative — across multiple independent review platforms. prime-loans does not have this kind of ecosystem of transparent user evaluations.

Hidden Fees and Ambiguous Terms

The sample representative loan example on the site mentions interest figures, but there is limited documentation of full terms, conditions, fees, or loan costs in clear regulatory language. Transparent lenders are legally required in the UK to present these upfront and in detail, including what happens in cases of late repayment. The absence of this detail should be treated as a red flag.

Alternatives and Best Practices

If you are seeking short‑term credit or personal loans, here are safer practices:

-

Use lenders that are verified on official regulatory registers such as the FCA’s Financial Services Register.

-

Compare offers from established banks and credit institutions that disclose full fee structures and loan terms.

-

Avoid sites that require upfront payments, particularly for “insurance”, “processing”, or other fees before any money is delivered.

-

Look for transparent contact details including a physical office address and phone numbers that verify through independent sources.

These steps can help protect your financial information and funds from potential misuse or unfulfilled promises.

Final Thoughts

While prime-loans may look like a legitimate loan provider based on how the website is styled and the claims it makes, the lack of independent verification, limited online presence, and low trust score from risk assessment tools all indicate that this platform falls short of what consumers should expect from a responsible lender.

Before you consider submitting personal or financial information to any online loan site, make sure you have independently confirmed its regulatory status and reviewed transparent terms. That simple precaution can make a significant difference in avoiding misleading or problematic services.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to prime-loans, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as prime-loans continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.