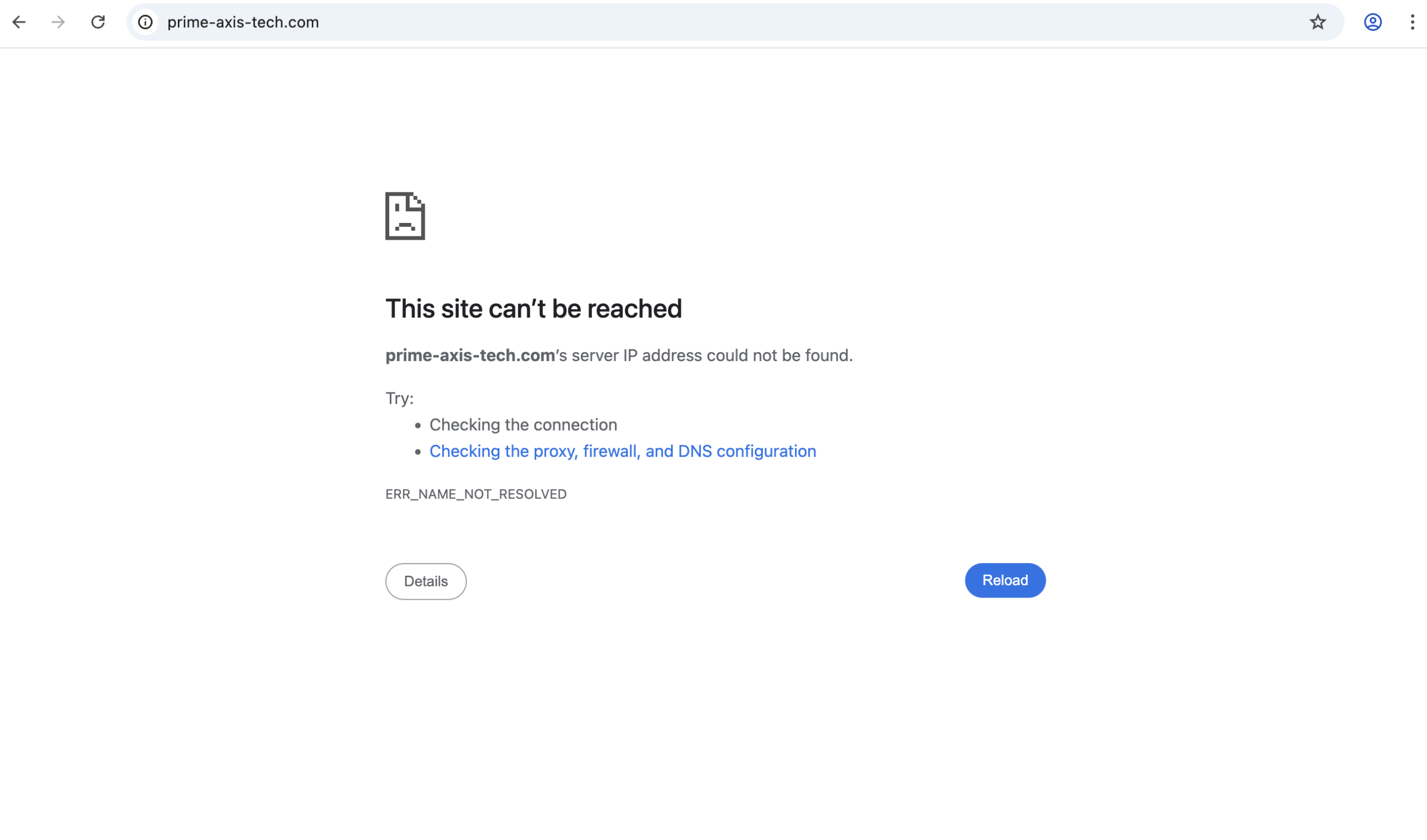

PrimeAxisTechAI Review: Serious Transparency Issues

In the growing world of online investing and financial technology services, platforms claiming advanced trading tools and high returns can seem appealing. However, many of these sites operate with little oversight, minimal transparency, and significant risk for users. One such platform that has garnered concern is primeaxistechai.com. While its name suggests cutting-edge financial technology and innovation, a deeper review reveals multiple red flags. This article explains what the platform purports to offer, where it fails to establish credibility, and why investors should steer clear of this risky service.

What PrimeAxisTechAI.com Claims to Be

PrimeAxisTechAI.com appears to present itself as a sophisticated online investment platform, possibly focused on automated trading, artificial intelligence investment strategies, or multi-asset financial products. The website often highlights concepts like “advanced technology,” “AI-driven performance,” and “streamlined user experience,” all of which are popular terms in legitimate fintech marketing.

On the surface, these claims can sound persuasive. However, attractive language and sleek design do not replace concrete information. At the heart of any trustworthy financial service are clear operational details, verified credentials, and an accountability framework that ensures users understand exactly where their money is going and under what protection it operates. PrimeAxisTechAI.com offers none of these elements in a verifiable way.

Lack of Clear Corporate Information

One of the first indicators of a risky online investment platform is the absence of transparent corporate identity. Legitimate platforms provide openly accessible information about who owns the company, where it is registered, and which legal entity is responsible for providing services. In contrast, PrimeAxisTechAI.com does not clearly disclose any of this information.

Users visiting the website will find limited details about the company’s structure, leadership team, physical address, or registration jurisdiction. Without a named legal entity and verifiable registration information, users have no way of knowing who they are dealing with. This missing information complicates accountability and amplifies the risk for anyone considering depositing funds.

When a platform avoids basic corporate transparency, it also sidesteps the trust that comes from operating within recognized legal frameworks. This lack of clarity alone should make potential investors pause and reconsider.

No Verifiable Regulatory Oversight

Financial services platforms that handle real money, trading activities, or investment products typically fall under the supervision of recognized financial regulators. These regulators enforce rules designed to protect investors, mandate clear disclosures, and provide mechanisms for dispute resolution.

PrimeAxisTechAI.com does not provide credible evidence of regulation by any recognized financial authority. It does not cite a valid license number, name a supervising regulator, or link to a public register confirming its status. A lack of regulatory oversight means there is no guarantee that the platform follows industry standards for fairness, capital segregation, or dispute resolution.

Without regulation, users have no assurance that their funds are held securely or that the platform operates under enforceable legal obligations. This absence of oversight significantly increases the risk of financial loss.

Weak or Non-Existent Public Reputation

Reputable financial platforms cultivate a public presence over time. They appear in industry directories, regulatory databases, and forums where users and professionals discuss their experiences. PrimeAxisTechAI.com lacks this kind of visible credibility.

Online mentions of the platform are sparse and unsubstantiated. There are few, if any, detailed user reviews from established professionals or recognized investor communities. The absence of a well-documented reputation, whether positive or negative, often indicates that a platform either has not operated for long or is intentionally keeping a minimal digital footprint.

In either scenario, potential users face substantial uncertainty about what to expect. A genuine platform typically allows and encourages independent verification of its history, performance, and user feedback. PrimeAxisTechAI.com does not.

Structural Red Flags Common to Risky Platforms

Several patterns repeatedly emerge in high-risk or fraudulent online investment services. PrimeAxisTechAI.com exhibits several of these concerning characteristics:

1. Emphasis on Buzzwords Over Substance

Terms like “AI-powered trading” and “advanced algorithms” can be impressive, but they mean little without transparent methodology, published performance data, or independent audits. When a platform leans heavily on marketing buzzwords instead of tangible proof, it raises questions about the legitimacy of its operations.

2. Missing Core Financial Details

Important elements such as trading conditions, fee structures, withdrawal policies, and risk disclosures are poorly explained or absent. Users cannot accurately assess potential costs or risks when this information is not provided clearly.

3. Limited or No Risk Disclosure

Every legitimate financial service recognizes that investing involves risk and clearly communicates that risk to users. By contrast, PrimeAxisTechAI.com tends to prioritize promises of performance without robust risk explanations.

Together, these issues contribute to an overall lack of transparency and accountability.

The Importance of Regulation and Transparency

Regulation matters because it creates a framework for accountability. Regulated platforms must meet standards for financial stability, accurate reporting, client fund protection, and ethical conduct. These requirements exist to protect investors and preserve trust in financial markets.

When a platform like PrimeAxisTechAI.com appears to operate without clear regulatory compliance, it effectively places all responsibility on the investor. There is no external body to enforce rules, no guarantees about fund protection, and no official recourse in case of disputes. In this environment, users assume all risk without support or safeguards.

Recognizing Common Problematic Behaviors

Risky platforms often follow predictable patterns designed to encourage deposits while minimizing scrutiny. These behaviors can include promoting rapid profits with minimal explanation of risk, creating urgency around limited offers, or obscuring important terms until after funds have been transferred.

Even when these tactics appear subtle, the outcome remains the same: control stays with the platform, and risk transfers to the user. Without clear information about withdrawal procedures, fee schedules, and governance, users can only guess at how the platform operates once money changes hands.

Why the Lack of Information Signals Danger

Some users wrongly assume that limited negative feedback means a platform is safe. Yet, many high-risk operations remain quiet by design, especially in early stages. Investors only hear warnings once significant harm is done and complaints accumulate.

A platform that does not openly share its legal standing, corporate identity, and operational rules cannot be trusted with financial assets. Silence in these critical areas does not equal credibility; it signals avoidance of scrutiny.

Final Assessment

When evaluated as a whole, PrimeAxisTechAI.com raises multiple concerns. The platform fails to demonstrate clear regulation, avoids transparent disclosure of corporate ownership, and lacks a robust public reputation. Its reliance on impressive language without verifiable proof adds to the risk profile.

Trust in financial services should be earned through openness, accountability, and adherence to recognized standards. PrimeAxisTechAI.com does not meet these fundamental expectations.

Final Recommendation

Online investing requires careful evaluation and verification of any platform handling real money. Investors should always confirm regulation, transparent governance, and a documented track record. Platforms that lack these essential features place users at unnecessary risk.

Given the significant gaps in information and the absence of credible oversight, PrimeAxisTechAI.com remains a platform best avoided. Stepping back from engagement with this service protects users from risk that far outweighs any potential reward.

Report Primeaxistechai.com And Recover Your Funds

If you have lost money to Primeaxistechai.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Primeaxistechai.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.