Primevault-Assets.com Platform Investor Guide

In a time when online investment platforms proliferate, distinguishing between legitimate financial services and potentially deceptive operations is more important than ever. Primevault-Assets.com is one such platform that has drawn attention — not for transparency or credibility — but for a host of red flags that strongly suggest it may not be a trustworthy destination for investors. What appears to be an investment portal turns out to be a site with significant indicators of unreliability, lack of oversight, and structural opacity. This review dissects the available evidence and explains why prudent investors should avoid engaging with Primevault-Assets.com.

Surface Claims vs. Absence of Transparency

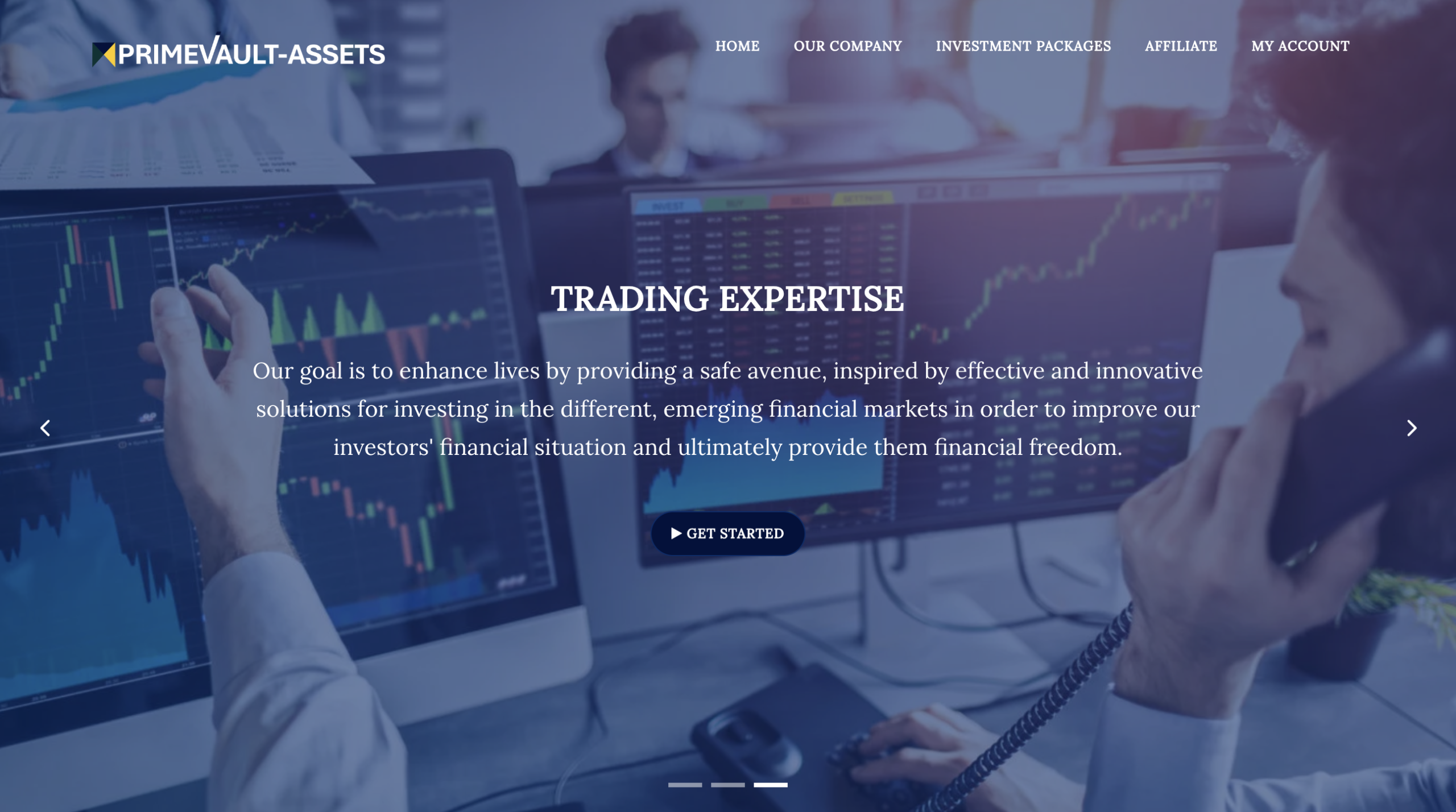

At first glance, Primevault-Assets.com markets itself as a financial services provider, presumably offering opportunities related to asset growth, investment markets, or digital finance. However, a closer look reveals a platform that lacks even the most basic hallmarks of a legitimate investment provider. Notably, there is no credible disclosure of its ownership, corporate identity, or leadership team anywhere on the site. This absence of transparency is a critical concern; reputable financial firms always clearly state their corporate structure and operational oversight. Moreover, key contact information — such as official business addresses, telephone contacts, or verifiable email support — is either missing or suspiciously generic, raising questions about who is truly behind the platform.

Independent risk evaluators have flagged Primevault-Assets.com with a very low trust score, pointing to multiple suspicious technical factors such as recent domain registration, hidden WHOIS data, shared hosting with other high-risk sites, and characteristics commonly associated with unverified investment pages. These details suggest that the platform was established recently and without public accountability, traits that often precede fraudulent activity rather than legitimate operations.

No Regulatory Oversight or Licensing

One of the most fundamental requirements for any investment platform that handles client funds is regulatory licensing. Reputable platforms are typically governed by financial authorities such as the UK’s Financial Conduct Authority (FCA), Australia’s ASIC, or the U.S. Securities and Exchange Commission (SEC). These bodies enforce standards designed to protect investors, ensure transparency, and oversee financial conduct.

Primevault-Assets.com, however, has no verifiable registration with any recognized financial regulator. There is no evidence that it offers regulated investment services or that it is monitored by any official entity tasked with safeguarding investor interests. The absence of regulatory oversight means that there is no guarantee of operational transparency, fund segregation, dispute resolution mechanisms, or compliance with legal financial standards. Investors using platforms without oversight are left without basic protections, a situation that is widely discouraged by financial professionals.

Domain and Technical Red Flags

Another key concern is the platform’s recent domain registration and technical setup. Independent website trust analyses show that Primevault-Assets.com was registered only a short time ago, and its WHOIS registration details are obscured using privacy services. While domain privacy itself is not proof of wrongdoing, the combination of recent launch, no longstanding reputation, hidden ownership, and shared hosting with other low-trust sites is a pattern often seen in potentially deceptive online financial ventures.

Moreover, shared server environments raise cyber-security concerns. Websites that offer financial services should ideally operate on dedicated, secure infrastructure to protect sensitive client information. In contrast, shared hosting — particularly when detected alongside other suspicious sites — increases the chances of data leakage or exposure to cyber threats.

High-Risk Traits and HYIP Signals

Primevault-Assets.com also displays several characteristics that match High-Yield Investment Programs (HYIPs). HYIPs typically promise high returns with minimal explanation of how those returns are generated. While not all platforms with HYIP traits are confirmed scams, the pattern is strongly associated with operations that rely on incoming funds from new investors to pay earlier participants or that collapse shortly after collecting capital.

Analysis tools have detected attributes akin to HYIP models on Primevault-Assets.com. These include the lack of verifiable trading infrastructure, the use of opaque service descriptions, and the absence of audited financial reporting. Collectively, these patterns indicate operations that are far from the transparent brokerage or managed investment services offered by regulated firms.

Lack of Independent User Feedback

A legitimate platform with active investors typically generates independent reviews, discussions, or feedback on reputable sites and forums. For Primevault-Assets.com, there is a conspicuous lack of verifiable user testimonials or detailed reviews on mainstream platforms like Trustpilot, Reddit, or investment communities. This silence can be interpreted in multiple ways, but when combined with other risk markers, it underscores the platform’s obscurity and short track record. The absence of user feedback makes it impossible to assess real-world experiences, pricing transparency, withdrawal processes, or customer service quality.

Common Deceptive Tactics in Similar Platforms

While there may not yet be widespread documented accounts of fund loss with Primevault-Assets.com specifically, platforms with similar profiles often exhibit a range of deceptive behaviors once users engage financially:

-

Unrealistic Profit Claims: Offering unusually high returns without clear, verifiable strategies or risk disclosures.

-

Withdrawal Barriers: Creating hurdles around withdrawals, such as requiring additional fees or conditions before funds can be accessed.

-

Opaque Dashboards: Simulated account interfaces that display profits that are not tied to actual market activity.

-

Pressure to Re-Invest: Encouraging further deposits with promises of higher returns while making it difficult to exit.

These tactics are not proven to be happening on Primevault-Assets.com due to limited public reports, but the platform’s structure and lack of regulatory oversight place it squarely within the category of sites where such practices are known to occur.

Final Verdict: Avoid Engagement

Based on available evidence and independent evaluations, the overall profile of Primevault-Assets.com has multiple red flags typically associated with unregulated and high-risk online investment platforms. This includes very low trust scores, lack of transparent business and regulatory details, recently registered domain with hidden ownership, and structural similarities to high-yield investment schemes.

Even without definitive proof of fraudulent payouts or legal action against the platform, the weight of these risk markers suggests that prudence dictates steering clear of Primevault-Assets.com. Investors should opt for regulated, transparent, and well-established platforms overseen by recognized financial authorities that provide clear documentation, client protections, and verifiable track records.

When it comes to protecting your financial interests, due diligence and regulatory verification are non-negotiable. In the absence of these safeguards, platforms like Primevault-Assets.com present a level of uncertainty and potential harm that serious investors should avoid.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to primevault-assets.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as primevault-assets.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.