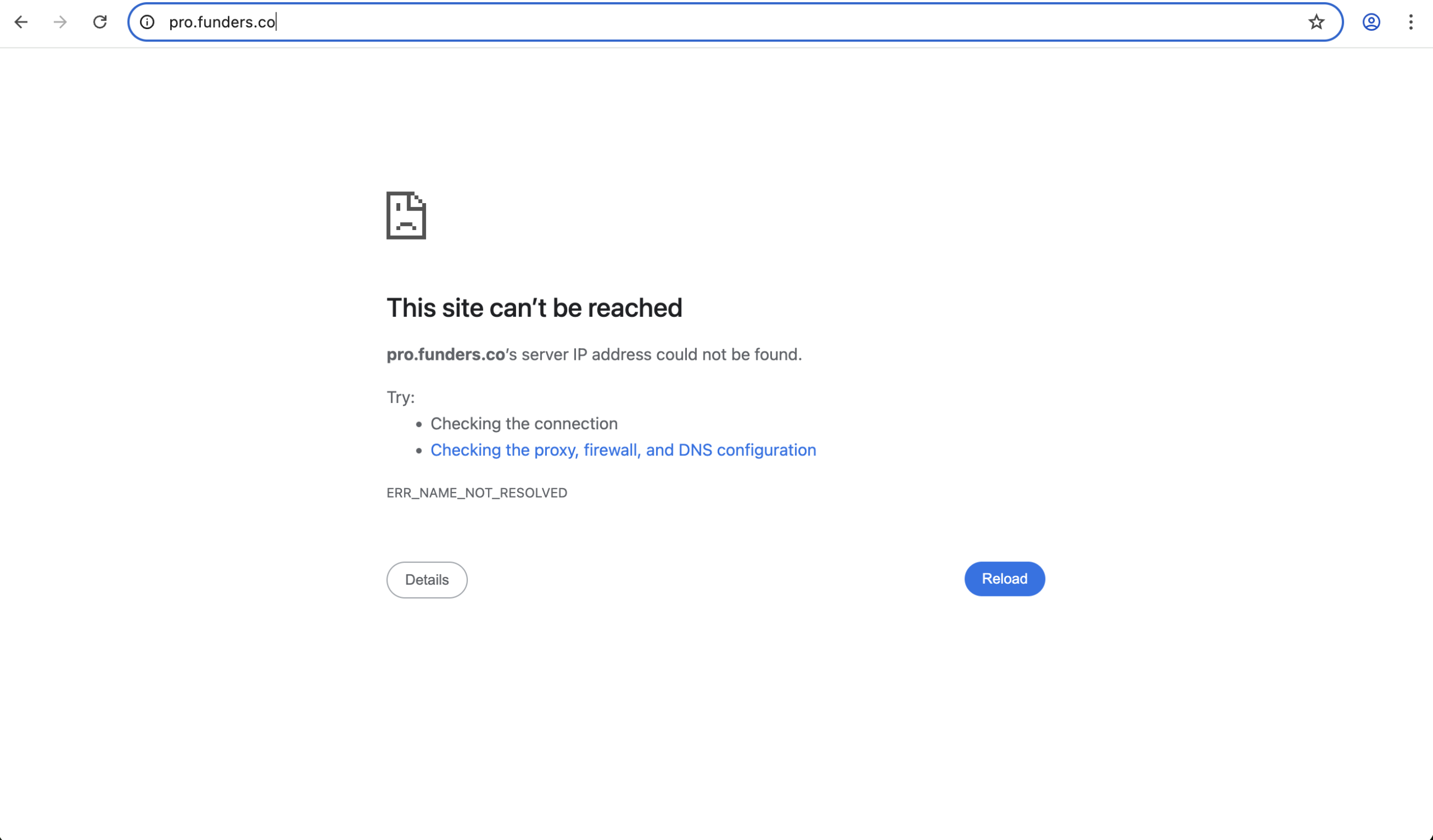

Pro.Funders.Co Scam Review: Major Warning

In today’s digital era, people face an ever-growing number of online platforms promising easy profits, investment growth, or revolutionary financial tools. Unfortunately, many of these sites lack transparency and legitimacy. One such platform generating concern among consumers is Pro.Funders.Co. While marketing itself in a way that may appear credible at first glance, the platform exhibits telltale signs commonly associated with high-risk and potentially fraudulent operations. This in-depth review explains the major warning signs surrounding Pro.Funders.Co, highlights key consumer risks, and explains why avoiding this platform is the safest decision.

What Is Pro.Funders.Co?

Pro.Funders.Co claims to be an online financial and investment service that deals with assets, crypto, or some form of profit-generating activity. However, the platform lacks clear documentation, registration details, company information, and regulatory compliance disclosures. These omissions are central reasons why this site should raise suspicion among prospective users.

A legitimate financial service provider must disclose vital corporate and regulatory details, including official business registration, licensing in relevant jurisdictions, and clear contact information. Pro.Funders.Co fails to provide such basic transparency, which should immediately trigger caution among anyone evaluating the service.

Transparency Gaps and Ownership Issues

One of the foundational elements of trustworthiness in online financial services is transparency. Reputable firms clearly state who owns them, where they operate, and under what regulatory framework they function. They publish certificates, licenses, and compliance statements from recognised supervisory bodies.

Pro.Funders.Co does not disclose verifiable corporate ownership or credible regulatory information. Critical elements like business registration numbers or licensing with financial authorities are missing from its platform. When a company omits these basic trust elements, it creates a significant risk: without accountability, users have no way to confirm legitimacy or pursue remedies if doubts arise.

Safety Scores and Online Reputation

Online safety scanners and trust-score evaluations often assess websites based on domain age, historical activity, and technical indicators. While some technical checks may rate Pro.Funders.Co as “legitimate” or assign it an average trust score, these results can be misleading or incomplete. These scanners typically focus on general security signals rather than comprehensive financial legitimacy.

More importantly, a website’s recent registration and minimal history often indicate that it has not stood the test of time as a stable, trustworthy financial service. Financial platforms that target investments or trading should have years of operational history, transparent audit records, and a verifiable track record.

The combination of a brand-new domain and lack of verifiable reputation in independent spaces suggests users should be cautious about trusting this platform with their time, personal information, or money.

Red Flags in Platform Positioning

Pro.Funders.Co uses language associated with high potential returns, financial instruments, and investment growth. This kind of presentation is a classic technique used by high-risk platforms to attract users who may not be familiar with nuanced financial evaluation.

Serious investment providers do not rely on flashy promises or buzzwords. They produce detailed legal documentation, risk disclosures, and independent audits. The absence of such materials on Pro.Funders.Co is a major red flag. When a financial service lacks these critical elements, it becomes nearly impossible for users to verify that any financial activity is legitimate or even functioning as claimed.

Risk Factors for Users

Platforms that show the warning signs exhibited by Pro.Funders.Co expose users to several significant risks. These risks are not theoretical or minor; they represent real harm that can result from engaging with a high-risk financial platform.

1. Personal Data Exposure

By registering or entering personal information, users may inadvertently expose themselves to identity theft, data misuse, or targeted phishing. When sites operate without clear privacy and data-handling policies, users cannot ascertain how their information will be used or protected.

2. Financial Loss

If the platform solicits deposits, investment commitments, or any form of payment, the lack of regulatory oversight means there is no assurance that funds are used as promised. In many scam models, funds disappear once users transfer them, or “profits” are fabricated on account dashboards with no real backing.

3. Misleading Promises and Fake Returns

Many high-risk sites present fabricated account growth figures, showing users unreal profits to entice them to invest more. Once a user becomes emotionally invested, the platform may then impose sudden fees, restrictions on withdrawals, or block access entirely, all under the illusion of complex rules. Fraudulent investment ecosystems often rely on confusion and time pressure to extract as much value from users as possible before disappearing.

Regulatory Warnings and Market Practices

Regulators around the world frequently warn audiences about financial platforms that operate outside legitimate oversight. Financial authorities in various jurisdictions regularly publish lists of unregistered or unauthorized firms that target investors with misleading claims and unverified offerings.

Even in cases where platforms are not yet specifically listed by a regulator, the absence of evidence of registration is itself a warning. Legitimate services actively publish their regulatory relationships to reassure users and to remain in compliance with legal frameworks.

Investors should always consult local regulatory bodies and financial watchdogs before engaging with any platform offering investment services. The presence of unknown or unverified entities should prompt extreme caution. Clear regulatory status is not optional; it is an essential indicator of operational legitimacy.

How Scammers Typically Operate

While each case may vary, online scam platforms often follow a recognizable pattern:

-

Use of vague or confusing financial language to impress and mislead visitors.

-

Minimal corporate identification or hidden ownership structures.

-

Promises of high or easy returns without any meaningful explanation of risks.

-

Lack of independent verification from recognised auditors or industry bodies.

-

Pressure to act quickly or incentives to recruit others.

These tactics exploit basic psychological triggers: fear of missing out, desire for fast profit, and limited understanding of technical finance.

Pro.Funders.Co’s structure aligns with many of these techniques. Without credible information confirming otherwise, it fits more comfortably in the high-risk category than in the legitimate services category.

Comparisons With Legitimate Services

In contrast to platforms with strong compliance records, trustworthy investment and trading services operate under strict legal frameworks. They typically:

-

Publish audited financials and risk disclosures.

-

Are registered with authorities in key markets.

-

Provide verifiable customer service channels with accountability.

-

Maintain transparent fee schedules and terms of operations.

-

Offer independent reviews and third-party evaluations.

None of these trusted marks are present for Pro.Funders.Co in any verifiable capacity. The absence of these markers further supports the position that this platform is not a suitable place for personal funds or data.

Conclusion: Why You Should Avoid Pro.Funders.Co

After a comprehensive examination of Pro.Funders.Co, the evidence indicates that it is a high-risk platform lacking credible transparency, regulatory credibility, and verifiable history. The use of financial language without backing, hidden business details, and lack of legal documentation means users have no reliable way to assess whether the platform operates ethically or safely.

Investing with any platform that fails basic legitimacy tests can expose individuals to substantial financial and personal risk. For anyone seeking to grow their financial assets, the safer path is to work only with fully transparent, regulated, and independently verifiable services.

In the case of Pro.Funders.Co, users should steer clear and consider well-established alternatives that maintain strong licensing, robust consumer protections, and clear public accountability.

Report Pro.funders.co And Recover Your Funds

If you have lost money to pro.funders.co, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like pro.funders.co continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.