ProdiviaGroup Review: Major Red Flags to Avoid

Introduction

Online trading, investment, and consultancy websites continue to multiply, and while some platforms are legitimate, many others operate with questionable practices that put users at risk. In this detailed ProdiviaGroup.com review, we examine the troubling signs surrounding the platform and why its structure, transparency, and behavior raise serious concerns.

Although the site presents itself as a professional financial service provider, a deeper look reveals multiple inconsistencies, unclear details, and warning signs that anyone considering the platform should not ignore. Whether you are a new investor or an experienced one, understanding these red flags is essential before trusting any online financial platform with your personal information or money.

Lack of Verified Regulation

One of the most important factors when evaluating a financial platform is its regulatory status. A regulated company must follow strict rules, maintain high transparency, and operate under oversight from a recognized authority.

ProdiviaGroup.com does not display clear or verifiable evidence of regulation. There is no confirmed:

-

License number

-

Regulatory agency listing

-

Compliance certificate

-

Public registration details

This lack of visible regulation raises major concerns. Unregulated platforms operate outside the legal frameworks designed to protect investors. Without regulation, users have no guarantee that their funds are handled properly, securely, or ethically.

Any platform offering financial services without clear regulatory proof should be approached with extreme caution.

Unverified Company Information and No Transparency

Trustworthy financial companies always provide transparent corporate details. This includes:

-

A real and verifiable company name

-

A complete physical office address

-

Names of directors or executives

-

A legitimate customer support structure

ProdiviaGroup.com offers none of these clearly or confirmably. The information provided is either vague, incomplete, or impossible to verify independently.

This anonymity is a major red flag. When a platform refuses to disclose who is running the operation, it removes all accountability. Users have no way of knowing who is controlling the funds or who is responsible for the platform’s activities.

A company asking you to trust them with your money should never be hiding key information.

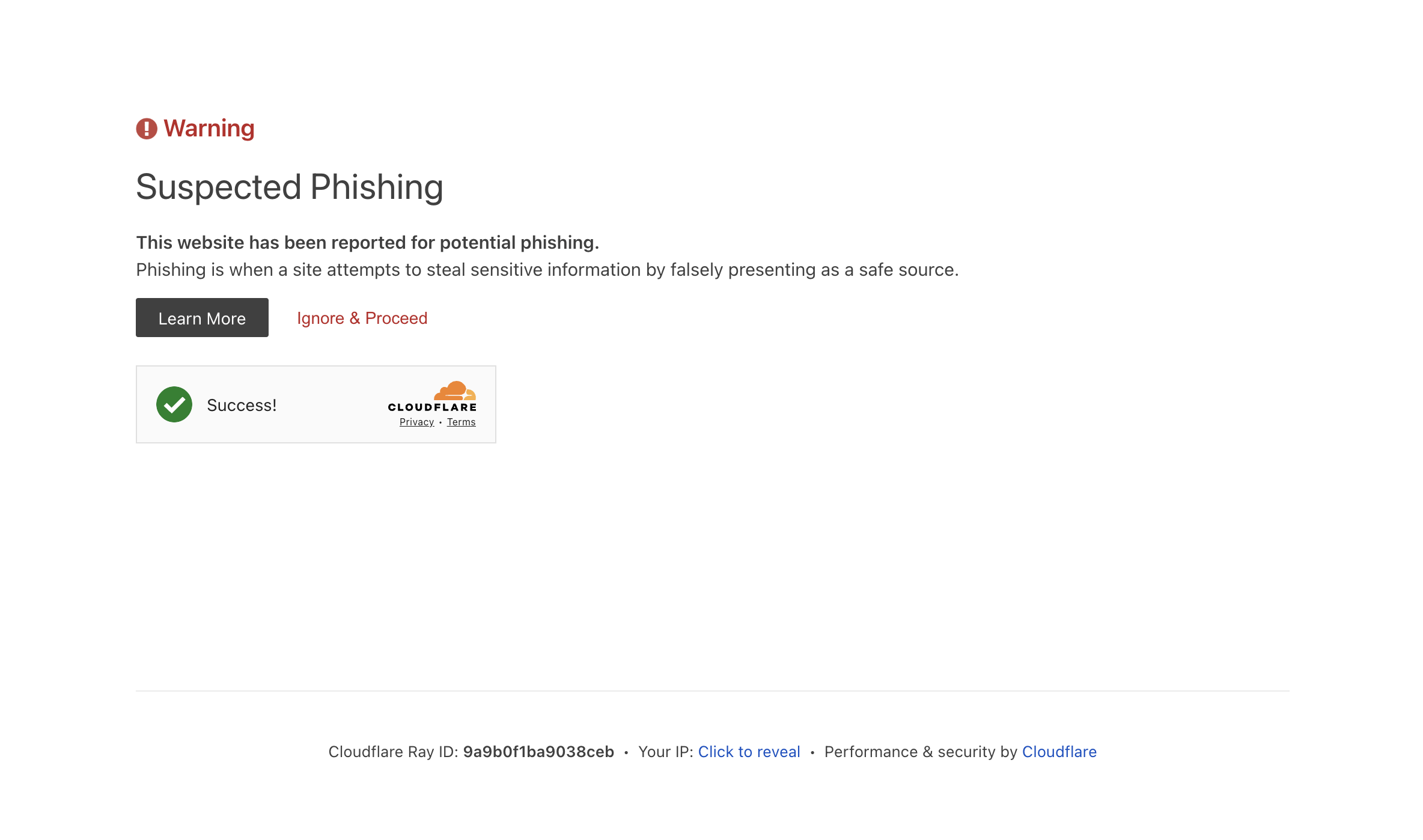

New or Low History Domain – A Common Scam Pattern

A critical element of this ProdiviaGroup.com review is the platform’s digital footprint. Scam websites often use new or short-lived domains because they intend to operate only temporarily before shutting down or rebranding.

ProdiviaGroup.com appears to have:

-

A very new domain registration

-

Very little online history

-

No extensive user reviews

-

No established reputation

-

No long-term operational track record

Legitimate financial organizations typically have years of online presence and reviews that reflect real customer experiences. A new website with bold financial promises and no verified history is a clear risk factor.

Unrealistic Financial Claims

Many unsafe platforms rely on exaggerated claims to attract unsuspecting users. These often include:

-

Guaranteed profits

-

Fast results with little effort

-

“Exclusive” opportunities

-

Promises of extremely high returns

Financial markets are unpredictable. No legitimate company can guarantee consistent profit without risk. If a platform claims otherwise—or presents its services as a guaranteed path to success—it is likely using misleading tactics.

ProdiviaGroup.com’s promotional style resembles platforms known for making unrealistic or overly optimistic promises designed to draw in inexperienced investors.

Vague Service Descriptions and Confusing Structure

A trustworthy financial company describes its services in a clear, detailed, and understandable way. However, on ProdiviaGroup.com, the descriptions of services appear vague, generic, or overly complicated without offering real substance.

Missing elements include:

-

Documented methodologies

-

Real performance data

-

Transparent service breakdowns

-

Clear explanations of how funds are handled

When a platform uses unclear or overly technical language to mask simple concepts, it can be a sign that the service is not genuine or not being described honestly.

If the business model cannot be clearly understood, it should not be trusted.

High-Pressure Tactics Used to Rush Decisions

One common sign of a high-risk platform is the use of urgency or pressure to influence decisions. These tactics may include:

-

“Limited time” investment offers

-

Promises of rapid returns

-

Encouragement to deposit immediately

-

Persistent follow-up messages

Legitimate financial services never pressure clients to deposit money quickly. High-pressure strategies are commonly used to prevent individuals from thinking critically or conducting proper research.

Platforms that rely on urgency should always be treated with suspicion.

Unclear Withdrawal Policies and Hidden Fees

Another major issue across unsafe financial platforms is difficulty withdrawing funds. Many users report problems such as:

-

Withdrawal delays

-

Sudden “fees” required before releasing funds

-

Accounts becoming locked

-

Additional verification demands not listed initially

While this review does not claim that ProdiviaGroup.com engages in these practices, the lack of transparent withdrawal policies creates legitimate concern.

A financial platform should clearly outline:

-

Withdrawal timelines

-

Conditions

-

Fees

-

Verification steps

When these details are vague, clients may face serious challenges retrieving their money later.

No Evidence of Real Financial Operations

Legitimate trading and investment platforms typically showcase:

-

Verifiable trading tools

-

Real market access

-

Third-party audited data

-

Transparent reporting

ProdiviaGroup.com does not provide clear, verifiable evidence of real financial operations. Without such evidence, users cannot confirm whether the platform is genuinely conducting the services it advertises.

The absence of transparency around core operations is a powerful warning sign.

Final Verdict: Avoid ProdiviaGroup.com

After reviewing all available information, ProdiviaGroup.com displays multiple red flags commonly associated with untrustworthy or high-risk online financial platforms.

These include:

-

No verified regulation

-

Hidden ownership

-

A new and unproven domain

-

Vague service descriptions

-

Potentially unrealistic financial claims

-

Lack of transparent policies

-

No independent proof of real operations

Due to these serious concerns, it is strongly recommended that individuals avoid this platform entirely. Trust and financial security must come first, and ProdiviaGroup.com does not meet the standards of transparency or accountability that a safe financial service should demonstrate.

Report prodiviagroup.com And Recover Your Funds

If you have lost money to prodiviagroup.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like prodiviagroup.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.