Protradealliance.com Warning: Read This

🚩 Introduction: Why People Should Be Cautious

In an era when online investment platforms promise easy, high-yield returns, many people are tempted by slick marketing and quick profits. One website that has drawn attention — and serious concern — is protradealliance.com. Based on publicly available data, automated risk-assessments, and patterns commonly observed in dubious trading platforms, protradealliance.com raises multiple red flags. This blog post examines those warning signs — from suspicious domain history to lack of transparent regulation — helping readers understand why this platform should be treated with caution.

What is Protradealliance.com?

Protradealliance.com presents itself as an online trading and investment platform, offering users access to forex, cryptocurrencies, and other financial instruments. Supposedly, it allows individuals to open accounts, deposit funds, and trade assets or invest in various instruments for profit. On the surface, it appears like many legitimate brokers — but a closer look at its infrastructure and trust metrics reveals serious concerns.

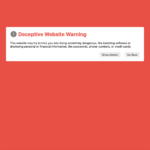

One independent website security scanner lists Protradealliance.com as a “suspicious website,” giving it a trust score of just 8 out of 100. Gridinsoft LLC

That extremely low rating reflects several technical and operational red flags: short domain age, unclear ownership information, weak reputation, potential blacklisting, uncertain SSL / security setup, and questionable content practices. Gridinsoft LLC+1

These are not just minor issues — they are hallmarks often associated with scam platforms and unregulated brokers.

Key Warning Signs & Risk Factors

1. Very Low Trust Score and New Domain

According to the security analysis, protradealliance.com was registered only recently (domain age ~1.4 years as of 2025) — making it a newcomer to the market. Gridinsoft LLC

New domains are not automatically fraudulent, but in the financial world, they warrant extra scrutiny. Established, regulated brokers tend to have long-standing domain registrations, credible track records, and verifiable histories. A short lifespan could mean the platform disappears or changes identity once negative feedback mounts.

2. Opaque Ownership and Lack of Transparency

The domain registration details of protradealliance.com are privacy-protected — the registrant is “REDACTED FOR PRIVACY,” and no verifiable address or credible background information is publicly available. Gridinsoft LLC+1

Legitimate brokers typically provide detailed company information, physical addresses, regulatory licenses, and compliance documentation. The absence of such transparency is a common warning sign of high-risk or fraudulent operations.

3. Unclear or Missing Regulatory Oversight

Reliable investment platforms operate under financial regulation by recognized authorities (e.g. in EU, UK, US). However, publicly available reviews and broker-comparison databases do not show credible regulation or licensing for protradealliance.com. WikiFX+1

Without oversight, there is no guarantee of fund protection, client rights, or legitimacy of operations. In many reported reviews, this lack of regulation is one of the key arguments labeling Protrade Alliance as a scam rather than a legitimate broker. amdarklimited.com+1

4. Reports of Fake Profits, Misleading Claims, and Scam Behavior

Several independent analyses and reviews describe Protrade Alliance as “a scam disguised as an investment platform.” amdarklimited.com

Common complaints involve promises of high returns, unrealistic profit projections, and pressure or emotional manipulation to deposit funds. Some users reportedly experienced difficulties withdrawing funds or discovered that promised profits were illusory. While those individual reports are anecdotal, the pattern aligns with known scam tactics used by fraudulent brokers worldwide.

5. Technical and Security Weaknesses

The site’s security scan flagged it for possible security vulnerabilities: blacklisting, poor reputation, potentially unsafe or malicious content — including the possibility of distributing malware or misusing personal data. Gridinsoft LLC

Such technical vulnerabilities compromise the safety of anyone who interacts with the site, even before any monetary transactions occur.

6. Lack of Independent Transparency or Verifiable Track Record

A legitimate financial service provider will leave verifiable traces: external reviews, audited performance data, regulatory filings, disclaimers, compliance statements, and user feedback across multiple platforms. For protradealliance.com, publicly available data is extremely scarce, contradictory, or negative.

Even on specialist broker-review platforms the feedback is unanimous: the platform is flagged as high-risk. WikiFX+1

Why Many Experts & Security Tools Flag It as Unsafe

Automated security tools and independent reviewers do not rely on hearsay or a few complaints. Rather, they evaluate based on technical, legal and structural criteria that tend to reflect long-term legitimacy of financial platforms. As for protradealliance.com:

-

It fails on domain age and security score. Gridinsoft LLC+1

-

It lacks publicly verifiable licensing or regulatory compliance. WikiFX+1

-

It presents limited credibility, few independent user testimonials, and no real track record.

-

It reportedly employs dubious promotional tactics, promising unrealistic returns, and relying on emotional pressure to attract capital. amdarklimited.com

Taken together, these factors align with typical scam-broker profiles. Experienced analysts of online scams consider exactly these criteria when compiling warnings about risky platforms. bugherd.com+1

Broader Patterns: Why This Is Not an Isolated Case

What we see with protradealliance.com is not unique. Over the past years, many fraudulent or unregulated investment platforms have used similar playbooks: new domains, anonymous registration, aggressive marketing, promise of high returns, crypto or forex services, and minimal transparency.

Scammers often rely on human psychology — hope, greed, fear — to push potential victims into quick decisions. They may even leverage emerging asset classes (like crypto) to exploit the fact that many prospective investors lack deep knowledge or regulators are still catching up. As outlined in broader scam-prevention analyses, these patterns — when combined — are strong signals of fraudulent intent. trustdale.com+2bugherd.com+2

In that sense, protradealliance.com appears to follow a known pattern: a “too good to be true” scheme dressed up with slick website design, vague promises, and minimal verifiable backing.

The Stakes: Why Regular People Should Care

For everyday individuals — investors, savers, people looking for passive income — the risks posed by platforms like protradealliance.com are real and substantial:

-

There is little to no guarantee of fund safety or ability to withdraw capital or profits.

-

Personal data and financial information submitted to such platforms may be vulnerable to breaches or misuse — given the security warnings flagged in technical audits.

-

The lack of oversight means no recourse if the platform folds, disappears, or identity of operators remains hidden.

-

Emotional distress, financial loss and broken trust — consequences that many victims of online investment fraud experience.

In short: engaging with unverified, suspicious platforms can result in direct monetary loss, long-term financial damage, and even exposure to personal or identity risk.

Best Practices for Spotting Risky Platforms — and Protecting Yourself

Given the existence of risky platforms like protradealliance.com, it’s important to adopt a diligent, cautious stance. Here are some of the most reliable signs to check before trusting any online investment offer — and to guide general vigilance:

-

Check Domain Age and Trust Score — Newly registered domains, especially those with low trust ratings or flagged by security-scanners, are immediately suspicious.

-

Verify Regulatory Status — Legitimate brokers should be licensed by recognized financial authorities, with public documentation of their compliance.

-

Look for Transparent Contact & Company Information — Company address, registration data, real names — not anonymously-registered domains — build credibility.

-

Search for Independent Reviews and Reputation — Real user reviews, external audits, credible third-party feedback help gauge trustworthiness.

-

Be Wary of Unrealistic Promises — Guaranteed high returns, pressure to deposit quickly, or emotional pitches (“invest now or lose out”) are classic scam tactics.

-

Assess Security & Privacy Safeguards — SSL encryption, privacy policies, clear data handling — these matter, especially when you share financial or personal data.

-

Trust Your Gut — If Something Feels Off, Pause — Many scams thrive on urgency and fear. If you feel pressured, take your time and verify the facts.

These best practices are widely recommended by cybersecurity experts and consumer-protection guides for evaluating suspicious websites and investment offers. Elementor+2bugherd.com+2

Conclusion: Approach with Extreme Caution — Because the Risk Is Tangible

Based on the available evidence — technical audits, domain history, lack of transparency, external warnings, and user-reported issues — protradealliance.com displays multiple red flags typical of scam investment platforms.

For individuals considering investing, especially those unfamiliar with the complex world of forex, crypto, and unregulated brokers, the risks are real. There is no evidence of regulatory compliance, transparent operations, or a trustworthy track record. Combined with poor security ratings and suspicious domain data, this paints a picture of a high-risk, untrustworthy platform.

Given all of this, it would be wise to treat protradealliance.com with extreme caution. If you — or someone you know — were considering using it, it would be prudent to pause, research thoroughly, and explore better-vetted, regulated alternatives instead.

Report Protradealliance.com And Recover Your Funds

If you have lost money to Protradealliance.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Protradealliance.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.