Quanta Capital Holdings Limited: An In-Depth Scam Alert

1. Regulatory Warnings from Trusted Authorities

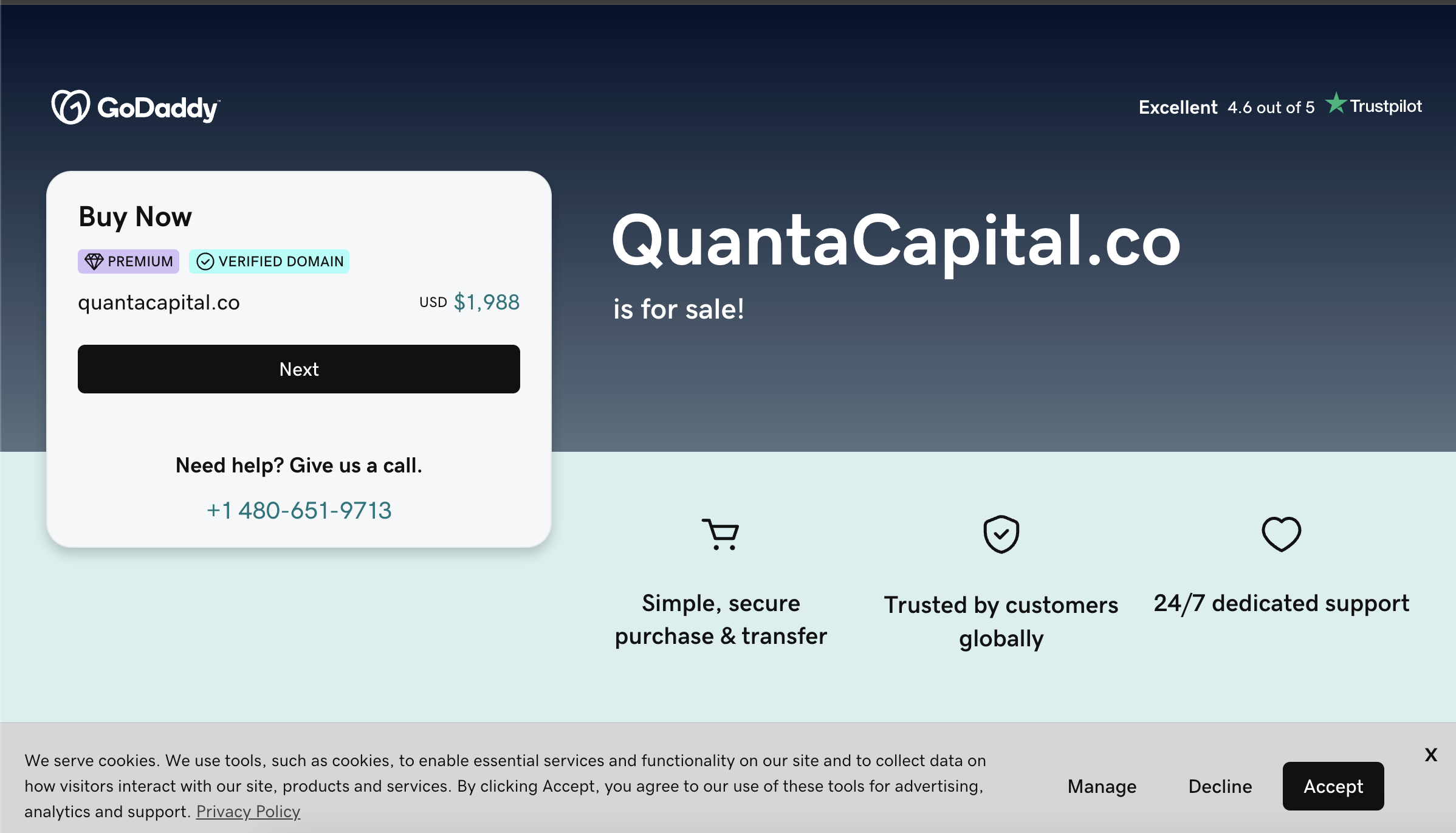

Germany’s financial regulator, BaFin, officially warned consumers in June 2024 that Quanta Capital (operating via quantacapital.co) is offering financial services without proper authorization—meaning it operates outside legal oversight. BaFin confirmed the company is not supervised and has no valid license to provide investment services in Germany.

Further scrutiny revealed that these operations aren’t overseen by other reputable regulators like the UK’s FCA or ASIC in Australia. Independent platforms likewise classify Quanta Capital as scam, citing BaFin’s warning and its unregulated status as key red flags.

2. Dubious Corporate Identity and Hidden Ownership

Quanta Capital claims a UK presence—listing an address in Manchester and referencing “Quanta Capital Holdings Limited.” However, in-depth company filings show that this entity is dormant, with negligible assets (reported as a mere £125) and no active trade or employees. This dormant status, combined with impossibly low financial history, suggests that the company has never been operational.

To make matters trickier, the domain was registered only in early 2024—pointing to a newcomer rather than an established broker. All of this raises serious questions about the authenticity of the business structure and who is actually running it.

3. Blurred Lines, Fake Promises, and Suspicious Operations

The platform markets itself as a modern online broker offering tools and returns—but offers no credible proof, audit, or regulatory disclosure to back the claims. Observers note aggressive marketing tactics, such as bold promises of wealth and quick returns.

When queried, investors on forums and review sites highlight inconsistent communications: flashy promotions up front, followed by silence or excuses when deposit or withdrawal issues arise.

4. Public Complaints and Community Red Flags

On review platforms, Quanta Capital averages a low rating (2.5 out of 5), with many users labeling promises as fake and indicating they lost funds. One reviewer stated:

“Quanta Capital PROMISES ARE FAKE.”

Another bluntly concluded:

“Don’t trust them.”

Instead of constructive responses, critical reviews appear ignored or buried—an indication of avoidance rather than clarity or service.

5. Scam Traits That Match a Troubling Pattern

So why do all signs point toward a likely scam?

-

Unregulated operations: Confirmed illegal by BaFin; unlisted with FCA or ASIC.

-

Dormant corporate shell: No active business, negligible assets.

-

Minimal transparency: New domain, hidden ownership, low visibility.

-

High-pressure marketing: Bold profits promised, credibility assumed, but never justified.

-

Withdrawal issues implied: While specific user complaints are light, typical scam blueprints include refusal to return funds.

-

High negative feedback: Trustpilot reviews warning of false claims and distrust, with no platform rebuttal.

6. Summary Table of Key Warning Signs

| Category | Concern |

|---|---|

| Regulation | No licensing; BaFin warning issued |

| Corporate Status | Dormant UK company with negligible assets |

| Transparency | No owner details; domain only months old |

| Marketing Tactics | Unsubstantiated profit claims and hype |

| User Feedback | Poor ratings, reports of false promises |

| Structural Red Flags | Lacks foundation of a legitimate broker |

Final Thoughts: Proceed with Extreme Caution

Quanta Capital Holdings Limited operates within a framework that lacks regulatory oversight, transparency, legitimacy, and trust. A dormant company, fast-registered domain, and poor reviews coupled with official warnings from BaFin build a strong profile of an operation risking investors’ funds rather than protecting them.

If you’re evaluating online brokers or financial services, keep in mind: lack of regulation plus high returns, minimal transparency, and pressure-based marketing rarely end well. Stonewalling legitimate oversight, combined with poor user feedback, is a reliable signal to steer clear.

-

Report Quanta Capital Holdings Limited And Recover Your Funds

If you have lost money to Quanta Capital Holdings Limited, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Quanta Capital Holdings Limited continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.