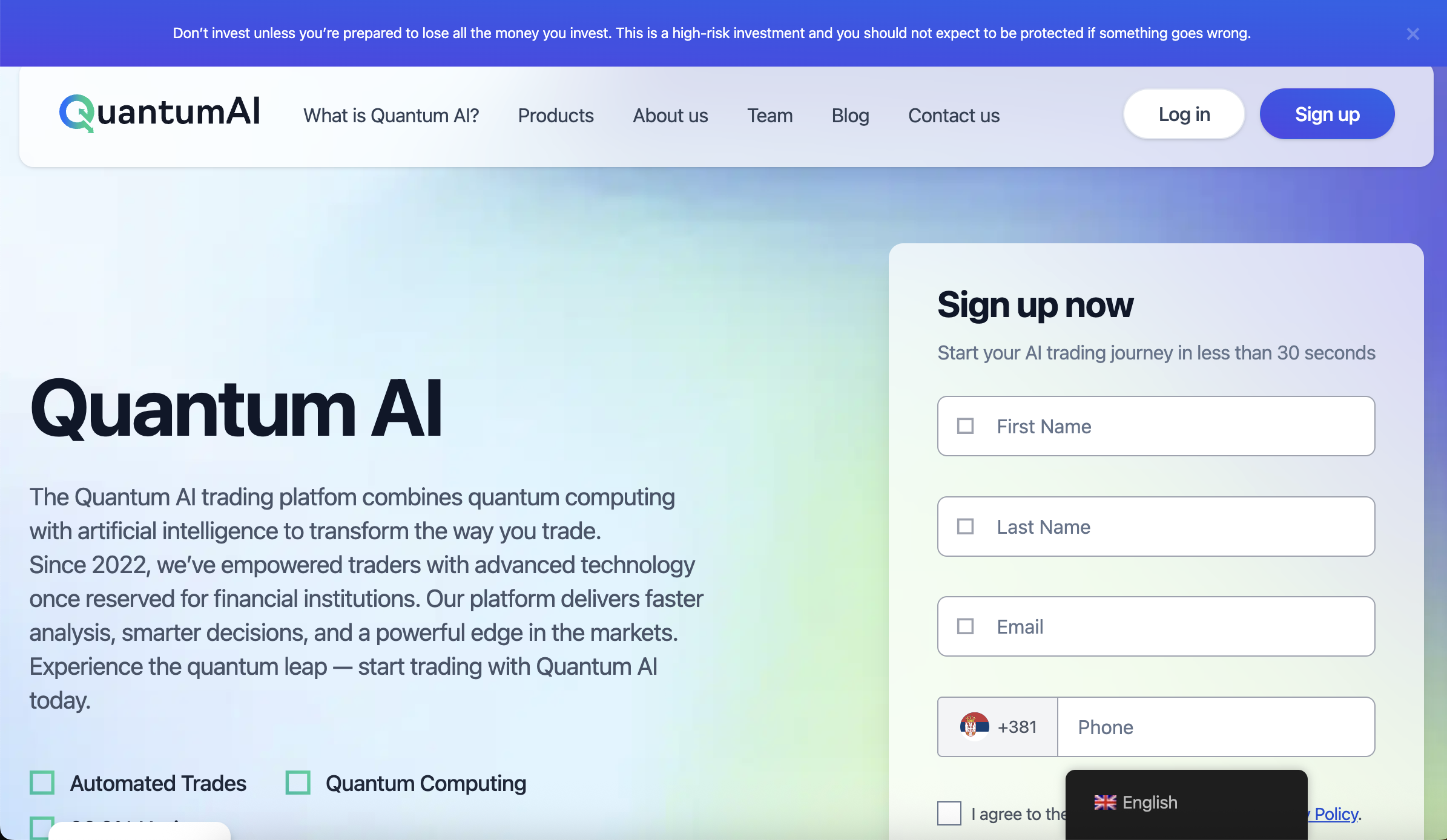

QuantumAI.co Scam Review – A Comprehensive Exposé

In the vast and sometimes murky world of online investment platforms, sites that promise effortless gains through advanced technologies are often too good to be true. One platform that has raised serious red flags is QuantumAI.co. Marketed as an elite, AI-driven trading platform offering guaranteed profits with minimal effort, it resembles a blueprint for modern scams. Below is a thorough examination of how it operates, the deception tactics it uses, and why you should steer clear.

The Illusion: What QuantumAI.co Claims to Be

QuantumAI.co positions itself as a sophisticated trading solution powered by artificial intelligence and cutting-edge algorithms. According to its marketing messages:

-

Users can earn high daily or weekly profits through fully automated trades in crypto, forex, or stocks.

-

No trading experience or knowledge is required; the AI handles everything.

-

The platform claims exclusive access to institutional-grade trading systems and proprietary technology.

-

Enrollment is supposedly limited—only a select few are invited or pre‑approved.

These claims are polished and inviting. They play on the allure of effortless wealth and the sophistication of AI-driven finance. But as seductive as the narrative sounds, deeper scrutiny reveals critical inconsistencies and numerous warning signs.

The Deception Blueprint

Celebrity Names and Technical Buzzwords

QuantumAI.co frequently references advanced terms like “artificial intelligence,” “quantum-level analysis,” or “smart algo-engine.” Some of these buzzwords might include nods to well-known figures or institutions (sometimes implicitly), designed to imply credibility. The actual basis for these claims is never provided. No whitepapers, no technical documentation, no independent verification. In reality, such buzzwords serve as smoke and mirrors.

Pressure to Act Immediately

Once visitors are on the site, they are encouraged to register right away—often with promises of “limited spots,” “bonus account upgrade,” or “special early access.” Within minutes, several forms of persuasion begin: landing pages, pop‑up messages urging fast decision-making, or immediate contact from supposed “investment consultants.”

These tactics aim to override rational analysis by invoking urgency and fear of missing out.

How It Works in Practice

Initial Registration and Contact

First, users input their contact details—often just phone and email. Shortly after, they receive calls or messages from “account managers” or “financial advisors.” These callers claim to represent the platform and outline enticing details about returns, bonuses, and fast payouts.

Deposit Encouragement

The account manager pushes for an initial deposit—typically around $250 to $500—to “activate your account” or “unlock exclusive trading capabilities.” You are told the deposit is secured and will begin generating returns immediately. If you hesitate, the representative may suggest additional benefits, such as higher bonus percentages or VIP status.

Seeing Apparent Growth

Once money is transferred, users are granted access to a dashboard that appears to show growing balances, active trades, and daily profits. The numbers often climb quickly, sometimes doubling or tripling within a day or two. This simulated growth is calculated to build trust and stimulate further deposits.

Attempts to Withdraw and a Dead End

When users try to withdraw their funds or reset the balance, they are faced with a barrage of excuses: there are “processing fees,” “taxes,” “compliance checks,” or “account upgrade charges” required before any payout. Some users are allowed to withdraw a small amount initially to maintain credibility—but once larger withdrawals are requested, the issues escalate. Usually, communication stops entirely, access to the dashboard is denied, and the site may even disappear or rebrand.

Red Flags That Signal a Scam

No Regulatory Information

A legitimate trading platform should clearly display licensing info (e.g., from the Financial Conduct Authority, SEC, or other regulatory body). QuantumAI.co does not list any valid license number, regulatory body, or public record. This absence of oversight means there is no legal recourse for users if funds disappear.

Anonymous Operators

Real trading companies provide transparency about ownership, team members, business addresses, and corporate details. QuantumAI.co offers none of this. Typically, there is no physical address, no verifiable leadership listed, and no public company registry details.

Guarantees of Profit

Any business guaranteeing a fixed return—especially high returns—is suspicious. In the real world of finance, no investment is without risk. Genuine firms clearly articulate risk disclaimers. In contrast, QuantumAI.co promises high yield with minimal risk—a red flag that suggests fraudulent intent.

Fake Testimonials and Misleading Imagery

Some pages may include favorable user reviews or even fabricated media references implying third-party endorsements. But these testimonials are rarely verifiable outside the site itself. Imagery of recognizable personalities or logos is often used without permission to evoke legitimacy.

Opaque Pricing and Hidden Fees

Withdrawal processes are kept vague. Users might only learn of fees when attempting to cash out. These fees are often introduced gradually, with users asked to pay more to unlock funds—yet no payout ever follows.

Psychological Exploitation Tactics

QuantumAI.co, like many scam platforms, leverages psychological manipulation techniques:

-

Greed: Promises of easy profit seduce emotional decision-making.

-

FOMO: Using phrases like “limited offers” and “exclusive access” induces rush decisions.

-

Authority: Using techno-jargon and AI buzzwords mimics institutional credibility.

-

Social Proof: Faux testimonials suggest widespread success.

-

Escalation: Once some money is deposited, users tend to invest more, becoming increasingly committed despite warning signs.

Impact on Victims

The outcome for most users is consistent:

-

Loss of initial deposits and additional amounts requested later.

-

Irreversible financial loss—funds are never recovered.

-

Disappearance of communication and sudden account closures.

-

Loss of personal information shared during registration.

-

Emotional distress, especially when trust is betrayed by seemingly professional individuals.

Key Warning Signs Table

| Warning Sign | Why It’s Suspicious |

|---|---|

| No regulatory certification listed | No legal protection or oversight |

| Anonymous company structure | Lacks credibility and accountability |

| Promises of guaranteed high returns | Financial risk is essential and always disclosed |

| Urgency and limited availability claims | High-pressure tactics aim to prevent thoughtful evaluation |

| Simulated dashboards and fake profits | Designed to build false confidence and prompt additional deposits |

| Withdrawal hurdles with hidden fees | Unrealistic excuses delay payouts indefinitely |

Why You Should Steer Clear

QuantumAI.co is structured like a classic financial illusion. Despite its ostentatious branding and slick interface, it lacks any functional legitimacy:

-

There is no real AI engine, no legitimate trading operations, and no verified results.

-

Users cannot verify the technology, ownership, or trading methods.

-

The platform is not recognized by any regulatory body or financial watchdog.

-

All signs point to deception: phantom profits, hefty deposit demands, and complete withdrawal failure.

Engaging with such a platform puts your money, data, and trust at risk.

What to Do Instead

While not meant as recovery advice, here are steps readers may take to avoid becoming victims:

-

Always research regulatory status before making a deposit.

-

Confirm the company’s identity and location—look for business addresses, names, and corporate registration.

-

Test any platform with a small initial amount and withdrawal before investing more.

-

Avoid uninvited communication, especially from unknown advisors pushing immediate investment.

-

Be skeptical of any platform that avoids providing real proof of performance or audited financial results.

-

Seek out independent reviews and warnings—not just testimonials published on the platform itself.

Closing Thoughts

QuantumAI.co appears to be a highly well-designed illusion built to deceive. It poses as a high-tech trading platform powered by advanced algorithms and AI—but in reality, it employs classic tricks: high-pressure sign-ups, simulated profits, and impossible withdrawal barriers.

The platform lacks all the hallmarks of legitimacy: no licensing, no disclosed ownership, no verifiable performance, and no transparency. Its entire design is to lure, entice, and entrap—before vanishing once victims attempt to exit.

If you encounter platforms like this, it is far safer to walk away, protect your money, and avoid joining scenarios that promise risk‑free riches. There is no gain in engaging with a site that promotes financial opportunity without accountability.

Stay cautious. Stay informed. And avoid QuantumAI.co altogether.

-

Report Quantumai.co And Recover Your Funds

If you have lost money to quantumai.co, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like quantumai.co continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.