RaisinFinance.com Review for Online Investors

In the crowded and complex world of online finance, distinguishing between credible platforms and fraudulent operations can be difficult. Names that sound familiar or resemble reputable financial services can mislead even diligent savers. One such case that has emerged recently is raisinfinance.com — a website that on the surface appears to offer savings and investment services, but upon closer inspection is not what it seems. This review explains why raisinfinance.com should be treated with extreme caution and avoided altogether.

What Is RaisinFinance.com?

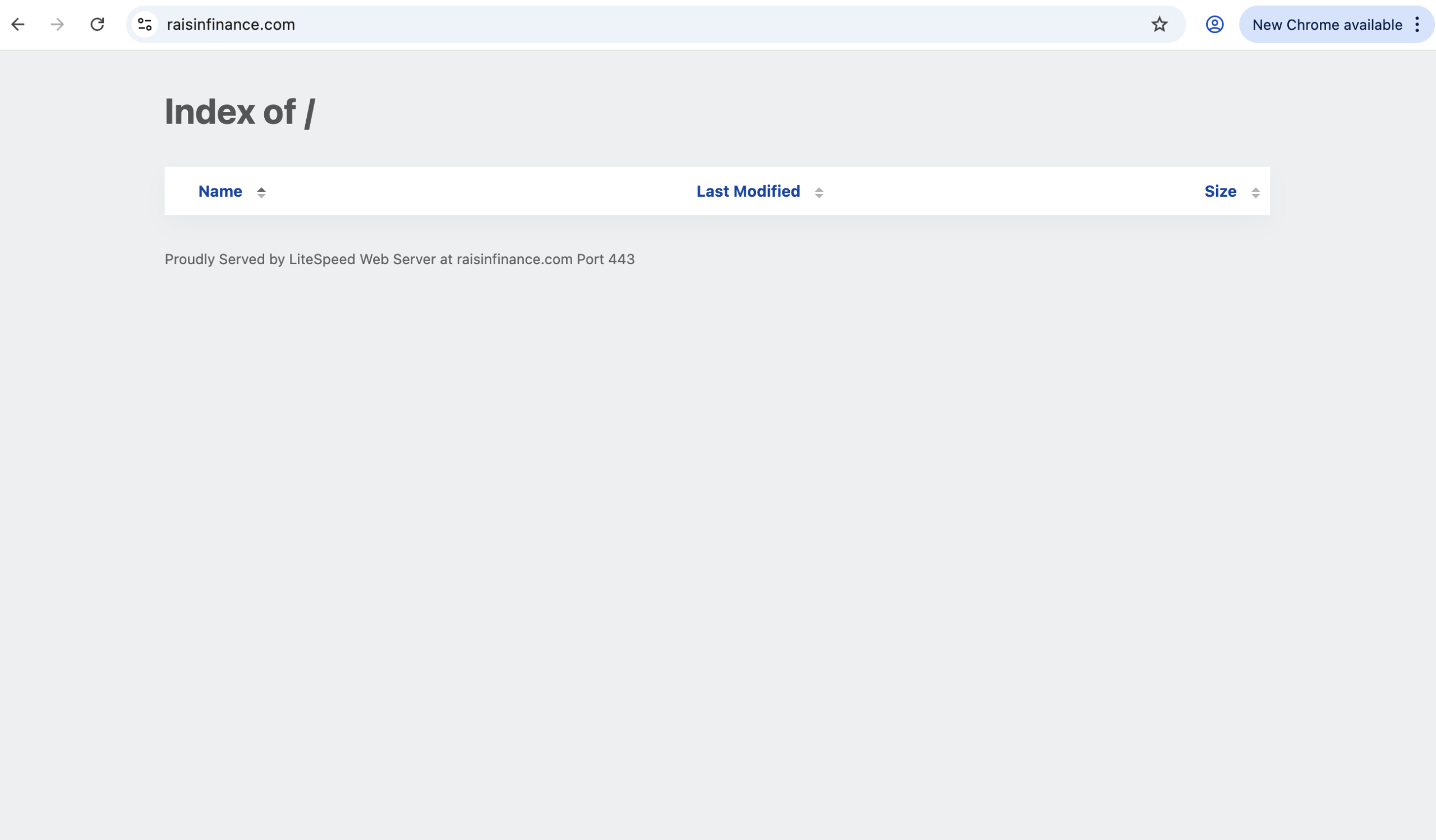

RaisinFinance.com presents itself as an online financial platform, using language that suggests banking capabilities, interest returns, and “financial success” for users. The website features messaging about banking with confidence, earning projected returns, and an online portal to access accounts. To someone unfamiliar with financial licensing requirements or industry players, these claims may appear plausible at first glance. However, the reality behind the platform is very different.

Clone Scam Tactics: Mimicking a Legitimate Brand

The core concern with raisinfinance.com is that it is not a legitimate financial institution — it is a clone scam. Financial regulators, including the United Kingdom’s Financial Conduct Authority (FCA), have identified raisinfinance.com (and its related domain raisinrates.com) as an unauthorised clone of a real authorised firm. These clone operations copy elements of a genuine company’s identity to deceive individuals into believing they are interacting with a legitimate and regulated service provider. In this case, the fraudsters targeted the name and implied association with the well-known savings platform Raisin, whose authorised entity operates under a different domain and holds proper financial licensing.

Clone scams are not accidental branding overlaps; they are intentional attempts to exploit brand familiarity so that unsuspecting consumers trust the fraudulent site without conducting due diligence. Common tactics include copying parts of a real company’s design language, brand-adjacent naming, fake contact details, and even falsified contact points presented as official phone numbers or email addresses.

Lack of Regulatory Authorization

Perhaps the most damning indicator of raisinfinance.com’s illegitimacy is the absence of any regulatory authorization. The FCA’s public warning list — a registry of unauthorised firms that individuals should not deal with — includes raisinfinance.com as a clone firm misrepresenting itself as being affiliated with the legitimate Raisin Platforms Limited. That genuine company is registered and regulated, but the clone has no licence to provide financial services, hold customer funds, or offer investment or savings products.

Without regulatory oversight, users of this site have no official protections. Accounts with legitimate financial institutions fall under frameworks like deposit insurance schemes or regulatory complaint mechanisms. By contrast, any engagement with a clone scam exposes funds and personal data to operators who are not accountable to any legal authorities.

Red Flags and Deceptive Practices

Several red flags are typical of clone scams like raisinfinance.com, reinforcing why it should be avoided:

-

Name Resemblance to a Known Brand: The use of “Raisin” in the domain is deliberate to create the false impression of affiliation with the reputable savings platform Raisin.

-

No Clear Corporate Identity or Registered Address: Clone sites often lack transparent ownership or legitimate business registrations. This absence makes accountability and verification impossible.

-

Unauthorised Website Claims: Promotional language touting secure banking or investment returns without clear regulatory backing is a warning sign. Legitimate offerings must disclose licensing and governing authority.

-

Domain Age and History: The site’s domain was registered recently, another typical trait of scam operations that launch quickly to capture funds before regulators or users discover the fraud.

In combination, these factors demonstrate a pattern characteristic of fraudulent websites, not a regulated financial services provider.

Real Versus Fake: A Critical Distinction

It is essential to differentiate between raisinfinance.com and the legally operating Raisin platforms. The legitimate Raisin services — which operate under domains such as raisin.com and country-specific versions like raisin.co.uk — are established marketplaces for deposit accounts and are subject to relevant financial regulations in their jurisdictions. Those platforms have longstanding operational histories and user reviews reflecting general functionality and competitive product offerings.

In contrast, raisinfinance.com is not connected to these authorised services and should not be assumed to offer equivalent protections or legitimacy. Any reviews or feedback referencing raisin.com or other legitimate domains do not apply to the clone site.

The Consequences of Dealing With Clone Scams

Engaging with raisinfinance.com carries serious potential consequences:

-

Financial Loss: Funds transferred to an unregulated clone site are not protected by deposit insurance schemes or regulatory compensation arrangements.

-

Data Exposure: Personal information entered into scam sites may be misused or sold, increasing the risk of identity theft or targeted phishing.

-

No Recourse: Without regulatory licensing, there is no avenue to escalate disputes, seek reimbursement, or lodge complaints through financial ombudsman services.

These outcomes can have long-term financial and personal security implications and underscore why avoiding unverified platforms is critical.

Conclusion: Avoid RaisinFinance.com

In summary, raisinfinance.com does not operate as a legitimate savings or investment platform. It has been publicly identified by major financial regulators as a clone scam that misrepresents itself as affiliated with a legitimate service provider. It possesses no regulatory authorisation, lacks transparent corporate identity, and employs naming strategies designed to mislead potential users.

For anyone considering online financial platforms, the best practice is to verify regulatory registration, check authoritative warning lists, and confirm domain authenticity before transferring funds. In the case of raisinfinance.com, all current evidence points to a fraudulent operation that should be avoided entirely.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to raisinfinance.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as raisinfinance.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.