RedmayneCapital.com Key Facts and Platform Details

The online investment world is filled with legitimate brokers and financial services firms — but it’s also rife with deceptive schemes that mimic real companies to mislead and defraud unsuspecting individuals. One such site that has recently drawn attention from financial regulators is RedmayneCapital.com. Despite using a name that sounds authoritative and professional, this platform is not a legitimate financial services provider. It has been officially flagged by the UK Financial Conduct Authority (FCA) as a clone firm, meaning fraudsters are using the identity of a reputable regulated company to trick investors.

This review will break down the critical issues with RedmayneCapital.com, explain how its clone operation works, and outline the key indicators that make it unsafe and untrustworthy.

1. Official Regulatory Warning: Clone of a Legitimate Firm

The most important piece of information about RedmayneCapital.com comes from the UK Financial Conduct Authority (FCA), which maintains a public warning list of unauthorised and clone investment platforms. On January 23, 2026, the FCA added RedmayneCapital.com to its warning list because the domain is being used by fraudsters to impersonate a legitimate regulated company.

According to the FCA:

-

The entity behind RedmayneCapital.com is not authorised to provide financial services in the UK.

-

It is a clone operation, designed to look like a real regulated firm.

-

The site may provide false contact details, fake emails, and misleading information.

-

The genuine authorised company has no connection to the clone site.

This alert is serious because regulators do not add companies to the warning list unless there is strong evidence that they are impersonating a legitimate authorised firm to lure in investors.

2. What Is a Clone Firm?

A clone firm is a fraudulent operation that uses the name, branding, contact details, or regulatory information of an existing regulated financial services company to deceive the public. Fraudsters often copy elements such as:

-

Company names that look very similar to the real entity

-

Logos and website design styles

-

Regulatory references that appear legitimate

-

Partial or altered versions of real contact information

These tactics aim to create a false sense of legitimacy, leading investors to believe they are dealing with a regulated firm when they are not. Clone firms frequently change email addresses or phone numbers to avoid detection and make verification difficult without checking official records.

3. The Real Firm Being Imitated

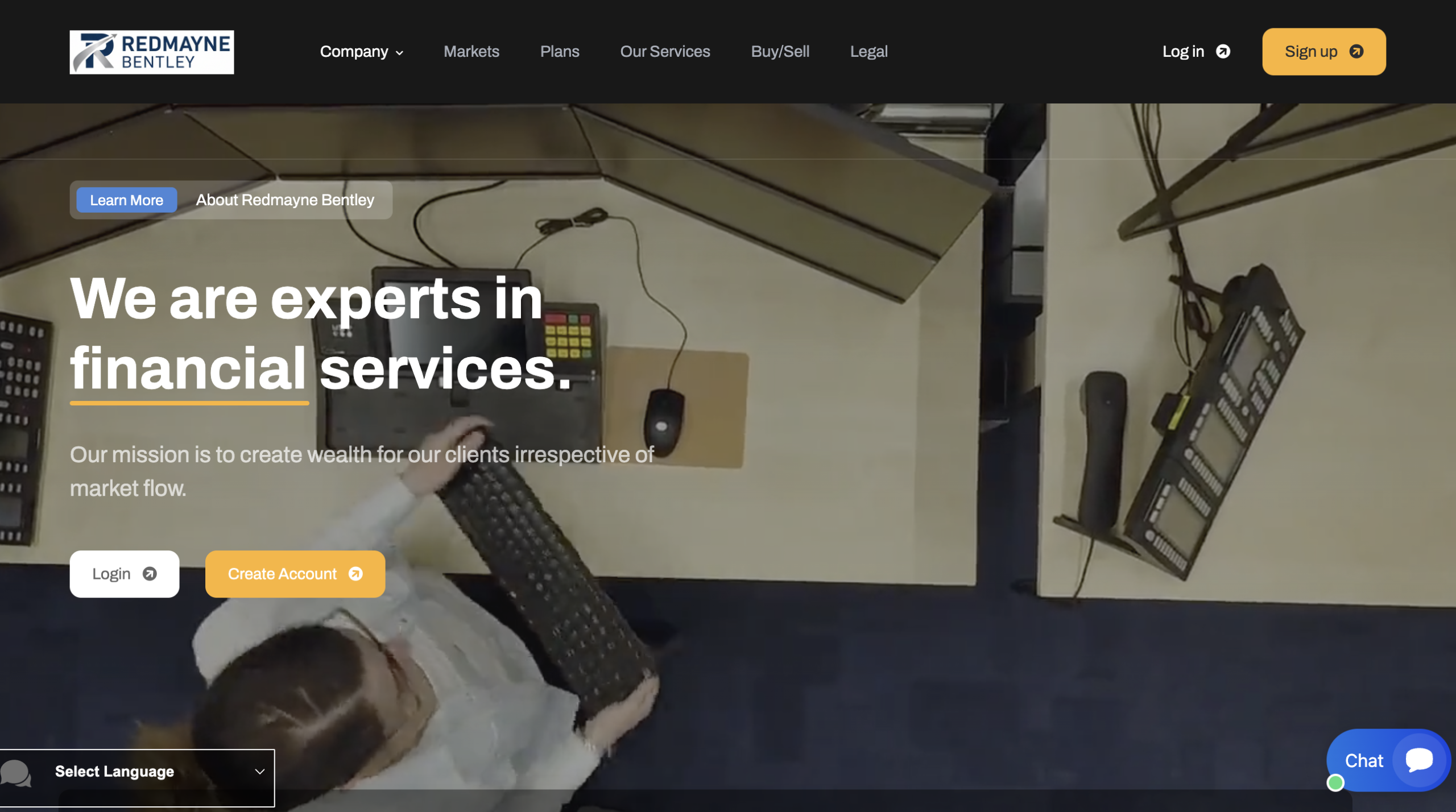

To understand the danger posed by RedmayneCapital.com, it helps to identify the real company being imitated. The legitimate firm is Redmayne‑Bentley LLP, a well‑established financial services provider authorised and regulated by the FCA.

The genuine Redmayne‑Bentley LLP:

-

Is regulated by the FCA with a known Firm Reference Number.

-

Provides stockbroking and investment management services.

-

Maintains clear contact information listed on the FCA register.

-

Has no connection to the clone site.

Clone firms like RedmayneCapital.com often borrow elements of regulated companies’ names and reputations precisely to exploit trust that investors might otherwise have in a legitimate business.

4. How Clone Investment Scams Typically Operate

Once a clone site appears convincing, scammers use a variety of tactics to extract money from their victims. These can include:

a. Professional Design and Misleading Branding

Clone sites are often visually polished and can easily be mistaken for legitimate platforms, complete with logos, “services” lists, and impressive language meant to instill confidence.

b. Fake Contact Information

Although some details may appear correct, scammers often insert subtle variations — such as generic or free email services — that make it difficult to confirm legitimacy without cross‑checking official sources.

c. Outreach and Pressure Tactics

Investors may be contacted via email, ads, or phone calls with aggressive pitches promising attractive returns or exclusive access to services.

d. Problems With Withdrawals or Account Access

Once funds are deposited, users can find it exceedingly difficult to withdraw money, with excuses ranging from “verification issues” to additional fees or processing costs.

5. Lack of Regulatory Protection

Regulatory oversight exists for one core reason: to protect investors. Platforms authorised by bodies like the FCA must meet strict standards designed to prevent fraud, maintain capital adequacy, and safeguard client funds.

With RedmayneCapital.com:

-

Investors will not have recourse to the Financial Ombudsman Service if something goes wrong.

-

There is no coverage under the Financial Services Compensation Scheme (FSCS), which protects client funds up to a specified limit if a regulated firm fails.

This means if funds are lost, frozen, or misused, investors have no formal safety net and recovery options are extremely limited.

6. Psychological and Technical Tactics Used by Cloners

Even when a site looks professional, there are patterns to watch for:

-

Use of names that are close but not identical to the real company.

-

Emails from free or generic domains rather than official corporate ones.

-

Promises or language that focuses heavily on returns or exclusive access rather than detailed disclosures.

-

High‑pressure communication attempts.

Understanding these tactics can help investors avoid falling for well‑designed scams.

7. What Happens When Investors Interact With Clone Sites

Victims of clone investment scams often report the following sequence:

-

They are convinced to open an account and deposit funds.

-

The platform initially shows “profits” or account growth.

-

When attempting to withdraw money, obstacles emerge.

-

Additional “verification fees” or conditions are introduced.

-

Communication becomes sporadic or stops altogether.

Once funds are transferred, there is often no practical way to retrieve them without legal or regulatory intervention, which can be costly and uncertain.

8. Importance of Verification Before Investing

To avoid falling victim to clone operations, experts recommend:

-

Always verifying a firm’s status on official regulatory registers.

-

Confirming that contact information matches that listed on the regulator’s site.

-

Ignoring unsolicited investment pitches or contacts.

-

Consulting qualified financial advisers if unsure.

These steps help ensure that you are dealing with a legitimate, authorised entity rather than a clone operation masquerading as one.

Final Verdict — Avoid RedmayneCapital.com

Based on the official FCA warning and the typical behaviors of clone investment scams, RedmayneCapital.com is unsafe and should be avoided by investors. This platform is not authorised to provide financial services, it impersonates a legitimate regulated company, and it offers no regulatory protections for client funds.

Protecting your financial future begins with due diligence and verification. Never assume a company is legitimate simply because its name sounds professional or because the website looks polished. If you are considering investing online, always confirm licensing status with official regulators and proceed only with established firms that can be verified through independent sources.

Your money and financial security deserve that level of scrutiny—and anything less can lead to serious loss.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to redmaynecapital.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as redmaynecapital.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.