Servelius.com Review: A Deep Scam Investigation

Introduction

The online trading world continues to expand rapidly, attracting millions of new users who are eager to explore opportunities in forex, stocks, crypto, and other asset classes. Unfortunately, this growth has also created fertile ground for deceptive platforms that hide behind professional-looking websites while operating with questionable intentions. One such platform drawing increasing attention is Servelius.com.

Although Servelius promotes itself as a modern, multi-asset online brokerage, the details surrounding its operations paint a much more troubling picture. From undisclosed ownership to questionable licensing claims and concerning user experiences, several warning signs suggest the platform is not what it appears to be.

This in-depth review examines Servelius.com from every angle — structure, transparency, trading conditions, user reputation, and operational behavior — to help readers understand why this platform has become heavily associated with scam-like activities. The analysis uses clear, inclusive language to ensure accessibility for both new and experienced online traders.

What Servelius.com Claims to Offer

Servelius presents itself as a full-service trading platform, highlighting access to forex pairs, cryptocurrencies, commodities, indices, and global stocks. The website promotes:

-

Multiple trading account tiers

-

Professional trading tools

-

“Low fees” and “tight spreads”

-

Convenient funding and withdrawal options

-

A user-friendly interface for traders at all stages

These features, on the surface, resemble those offered by reputable online brokers. However, the platform’s credibility depends not on what it claims, but on what it can prove. This is where Servelius quickly begins to unravel.

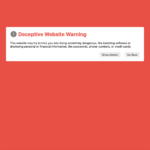

Lack of Regulation — The Most Serious Red Flag

Any brokerage handling client funds must be regulated by a recognized financial authority. Licenses ensure oversight, accountability, and compliance with safety standards. They also provide users with avenues for dispute resolution and fund protection.

Servelius.com, however, shows no evidence of holding a legitimate license from any recognized regulator such as:

-

FCA (United Kingdom)

-

FINMA (Switzerland)

-

ASIC (Australia)

-

CySEC (Cyprus)

-

CFTC or SEC (United States)

Claiming an office address or listing a country on a website does not equal regulation. The absence of regulated status drastically increases the risk of misuse of client funds, unfair trading practices, or withdrawal manipulations.

This single issue alone is enough to classify Servelius as an unsafe and high-risk platform.

Hidden Ownership and Questionable Corporate Identity

Legitimate financial platforms always provide:

-

Company registration numbers

-

Names of directors or founders

-

Physical office locations

-

Corporate documents

-

Regulatory references

Servelius offers none of this transparency. Instead:

-

Ownership information is concealed

-

Corporate registration details are missing

-

No verifiable physical headquarters exists

-

The domain is relatively new and lacks long-term credibility

This lack of accountability makes it difficult to determine who operates the platform, where it is managed, or whether it is legally compliant in any jurisdiction. Anonymous companies are a major warning sign in the online trading world.

Unclear Fees, Conditions, and Trading Rules

A legitimate trading service clearly publishes:

-

Spread tables

-

Commission lists

-

Withdrawal timelines

-

Deposit conditions

-

Margin and leverage details

-

Risk disclosures

Servelius provides incomplete or vague information about these essential elements. Users report:

-

Unpredictable charges

-

High or unexplained fees

-

Changing withdrawal requirements

-

Non-transparent trading execution

-

Conditions that are not clearly stated at signup

This uncertainty leaves traders vulnerable to unfair practices and prevents them from making informed decisions.

Reports of Difficulties Withdrawing Funds

A recurring issue mentioned by individuals who interacted with Servelius is the challenge of withdrawing money. Many describe a pattern typical of untrustworthy trading platforms:

-

Easy deposits but complicated withdrawals

-

Requests for additional documentation

-

Delays without clear reasons

-

“Account manager” pressure to continue trading instead of withdrawing

-

Withdrawal cancellations or unexplained rejections

These experiences align with behavior commonly associated with high-risk or fraudulent platforms.

Aggressive Deposit Tactics and Pressure to Invest More

Some traders have noted that Servelius uses persuasive strategies to push users into investing larger amounts. Tactics may include:

-

Frequent calls from “account managers”

-

Promises of higher profits

-

Claims of insider opportunities

-

Urgency-driven language (“limited time opportunity”)

-

Emotional pressure

Such behavior is not standard for regulated brokers and suggests the platform prioritizes collecting deposits above providing a fair trading environment.

No Evidence of Secure Trading Infrastructure

Every trustworthy trading platform invests in technology that ensures:

-

Fast and secure trade execution

-

Encrypted transactions

-

Verified liquidity providers

-

Risk management systems

-

Clearly audited financial statements

Servelius does not present verifiable information about:

-

Its trading engine

-

Liquidity partners

-

Market data sources

-

Execution speed guarantees

-

Risk controls

-

Security certifications

A platform that cannot demonstrate how its trading systems work cannot be relied upon for safe or transparent trading.

Website Warning Signs and Technical Concerns

A closer look at the Servelius website reveals several issues often associated with scam platforms:

-

Generic design templates

-

Minimal educational content

-

Overly polished but substance-light visuals

-

Missing legal disclosures

-

No independent contact or support verification

-

Short domain age

-

No proven company history

Fraudulent trading platforms frequently use these tactics to appear modern and professional while disguising weak operational capacity.

User Reviews Indicate a Pattern of Negative Experiences

Publicly accessible feedback describes Servelius as a platform that:

-

Fails to process withdrawals

-

Disconnects users during profitable trades

-

Applies unexpected charges

-

Ignores support requests

-

Provides misleading information

-

Uses pressure sales tactics

These types of complaints often emerge when a company’s real priority is acquiring deposits rather than providing genuine trading services.

Comparison With Legitimate Trading Platforms

To understand Servelius’ shortcomings, it helps to compare it with credible brokers.

Legitimate brokers offer:

-

Full regulatory licensing

-

Clear and public company registration

-

Real office locations

-

Verified contact channels

-

Transparent fee documentation

-

Stable and respected domain history

-

Third-party audits

-

Fair customer protection policies

Servelius instead shows:

-

No verified license

-

No documented ownership

-

No consistent customer support

-

No transparent trading conditions

-

Negative user experiences

-

Withdrawal concerns

-

Unverifiable company existence

This contrast highlights why Servelius is widely viewed as an unreliable and unsafe platform.

Why Servelius.com Fits the Profile of a Scam Platform

After reviewing all available details, several core features strongly indicate that Servelius operates in a deceptive or unethical manner:

-

No regulation

-

Hidden ownership

-

Domain anonymity

-

Negative user experiences

-

Unfair withdrawal behavior

-

High-pressure deposit strategies

-

Lack of transparency in operations

-

No verified trading framework

Combined, these characteristics align closely with the structure and behavior of known scam platforms in the online trading industry.

Final Verdict — Is Servelius.com a Scam?

Based on all available evidence, Servelius.com appears to be a high-risk, low-credibility platform that shows numerous signs consistent with online trading scams. It lacks the regulatory framework, transparency, safety measures, and operational stability required of legitimate brokers.

Anyone evaluating Servelius should approach the platform with extreme caution due to its:

-

Poor transparency

-

Unverifiable identity

-

Unclear financial operations

-

Negative feedback patterns

-

High potential for financial loss

Servelius.com does not demonstrate the standards expected of reputable trading services and therefore cannot be considered a trustworthy or reliable platform.

Report servelius.com And Recover Your Funds

If you have lost money to servelius.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like servelius.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.