Sicodice.com Scam Review: A Detailed Investigation

The rise of online trading platforms and cryptocurrency exchanges has brought both opportunities and risks for investors worldwide. While some platforms provide legitimate services, others exploit the growing interest in digital trading to mislead users and attract funds under false pretenses. Sicodice.com is one such platform that has drawn skepticism due to its aggressive marketing, unverifiable claims, and investor complaints. Marketed as an online trading platform offering cryptocurrency and forex opportunities, Sicodice.com has raised questions about its legitimacy.

This review takes a comprehensive look at Sicodice.com, analyzing its claims, operations, warning signs, and why potential investors should exercise caution.

Understanding Sicodice.com’s Claims

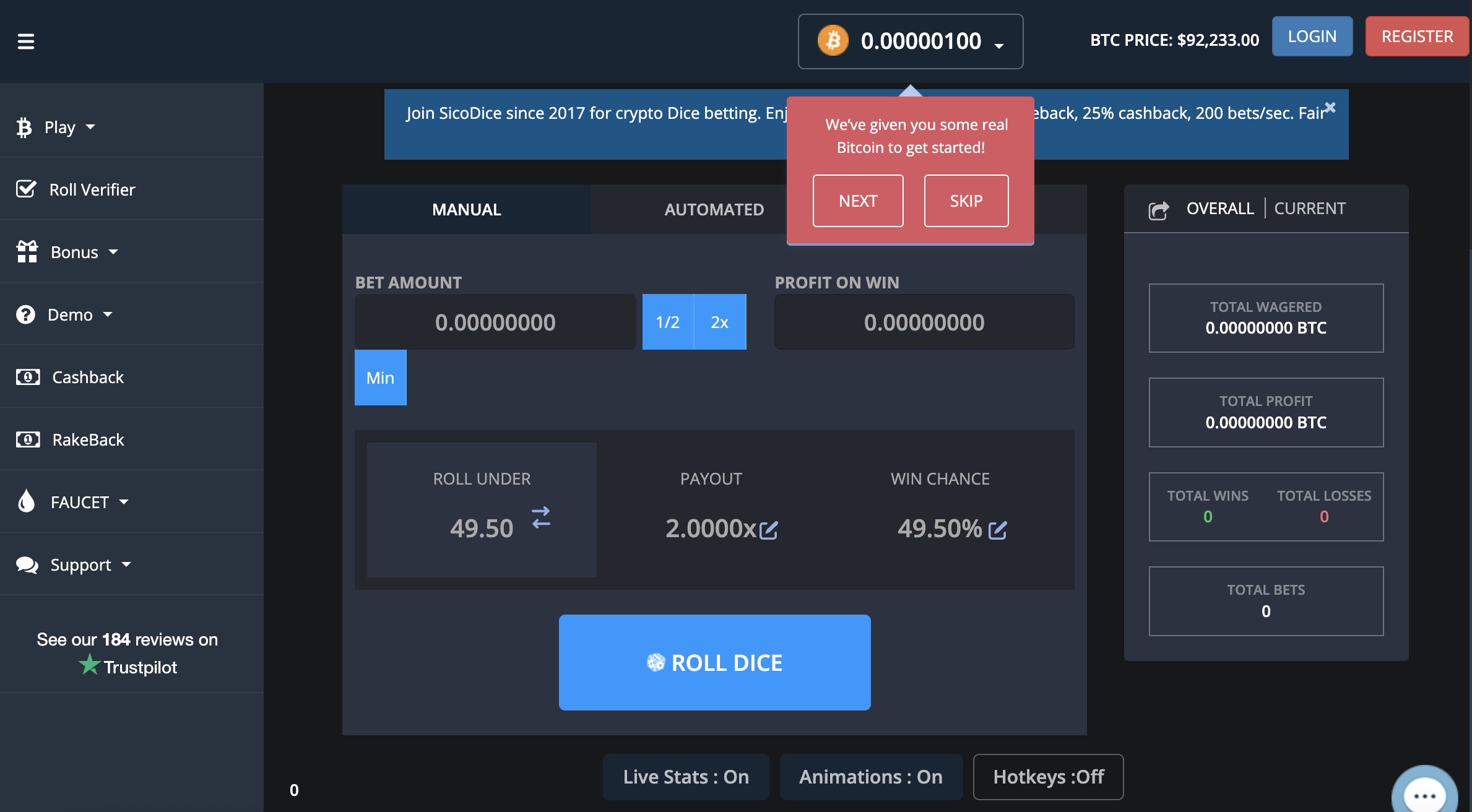

Sicodice.com promoted itself as a modern trading platform designed to provide users with access to cryptocurrencies, forex, and other digital assets. According to its marketing materials, the platform offered high-speed trading, professional-grade charts, and easy access to financial markets for beginners and experienced traders alike. The website also claimed to provide tools and features that would maximize profits while minimizing risk.

The platform emphasized fast registration and deposit processes, promising that users could start trading immediately with minimal effort. Sicodice.com also marketed itself as a user-friendly platform, suggesting that both new and seasoned traders could navigate the platform without difficulty.

Key Red Flags

Despite the appealing claims, several aspects of Sicodice.com raised significant concerns among analysts and users. These red flags indicate potential risks for those considering the platform.

1. Lack of Regulatory Oversight

One of the most critical factors in evaluating any online trading platform is regulatory compliance. Legitimate trading platforms are typically registered with financial authorities and comply with industry standards. Sicodice.com, however, did not provide clear evidence of regulatory licenses or oversight. Operating without regulatory approval exposes users to a high risk of financial loss, as there is no external authority ensuring the platform adheres to ethical or legal standards.

2. Unrealistic Promises of High Returns

Sicodice.com frequently advertised the potential for substantial profits in a short period. While trading can be profitable, guarantees of high returns with minimal risk are unrealistic and often a hallmark of deceptive platforms. Promising fast profits is a common tactic used to lure inexperienced investors into depositing funds without fully understanding the risks involved.

3. Aggressive Marketing and Pressure Tactics

The platform’s marketing strategy heavily emphasized urgency and exclusivity. Users were often encouraged to deposit funds quickly to secure “limited” opportunities, creating a sense of fear of missing out (FOMO). These pressure tactics are commonly observed in fraudulent investment schemes and are designed to prompt impulsive decisions rather than careful evaluation.

4. Anonymous or Unverifiable Team Members

A trustworthy trading platform typically discloses clear information about its founders, management team, and operational staff. Sicodice.com provided minimal information about its team, and many of the listed individuals lacked verifiable credentials or professional backgrounds. The absence of a transparent, accountable team is a major warning sign for potential investors.

5. Withdrawal and Transaction Issues

Multiple user reports indicated difficulties with withdrawing funds from Sicodice.com. Complaints ranged from delayed transactions to unresponsive customer support when withdrawal requests were submitted. Reliable trading platforms prioritize liquidity and transparency, and issues with withdrawals are a strong indicator that the platform may not operate in good faith.

Investor Experiences and Complaints

Several users who interacted with Sicodice.com reported negative experiences. Common complaints included:

-

Difficulty accessing deposited funds: Many investors reported being unable to withdraw their funds in a timely manner.

-

Unclear investment terms: Users highlighted a lack of transparency regarding trading rules, fees, and profit calculations.

-

Unresponsive support: Customer service channels were often slow or unhelpful when addressing user concerns.

These reports contribute to growing skepticism about the platform’s legitimacy and operational practices.

Psychological Tactics Used to Attract Investors

Sicodice.com employed several strategies to attract and retain users, many of which are commonly associated with high-risk or deceptive platforms:

-

Fear of Missing Out (FOMO): Marketing emphasized limited-time opportunities to encourage rapid deposits.

-

Appeal to Authority: Claims of professional trading tools and supposed industry expertise created an impression of legitimacy.

-

Complexity and Jargon: Technical language about trading instruments and strategies created a sense of sophistication, making it harder for users to evaluate the platform objectively.

-

High Return Promises: The platform emphasized the potential for significant profits rather than practical insights into trading risk.

These psychological tactics often prompt impulsive decision-making, leaving investors vulnerable to financial loss.

Transparency and Communication Concerns

Transparency is crucial for any financial platform. Sicodice.com showed significant shortcomings in this area. Project updates, policies, and operational details were limited, and questions from users were often addressed vaguely. Legitimate trading platforms provide clear terms, transparent procedures, and regular communication to maintain user trust. The lack of transparency on Sicodice.com raises serious doubts about its credibility.

Regulatory and Legal Considerations

Operating an online trading platform without proper licensing or regulatory oversight presents substantial risks. Regulatory authorities enforce rules to protect investors and maintain the integrity of financial markets. Sicodice.com did not provide sufficient information regarding compliance with financial regulations in any jurisdiction. Users engaging with unregulated platforms face the risk of losing their funds without any legal recourse or protection.

Lessons from Sicodice.com

The Sicodice.com case provides several key lessons for anyone considering online trading or cryptocurrency investment:

-

Verify Regulatory Compliance: Always check for licenses and oversight from reputable financial authorities.

-

Be Skeptical of Guaranteed Returns: Unrealistic promises of high profits are often red flags.

-

Evaluate Team Transparency: Ensure the platform’s management and operational staff are credible and verifiable.

-

Check Withdrawal Policies: Test the platform’s processes for deposits and withdrawals before committing large amounts.

-

Conduct Due Diligence: Research independent reviews, user experiences, and financial reporting before investing.

Conclusion

Sicodice.com serves as a cautionary example of the risks associated with unverified online trading platforms. Despite its claims of professional trading tools, high returns, and advanced cryptocurrency and forex services, the platform displayed multiple warning signs, including lack of regulatory oversight, unverifiable team members, aggressive marketing, and withdrawal issues. Investor complaints and inconsistent transparency further reinforce concerns about its legitimacy.

While online trading offers genuine opportunities, Sicodice.com illustrates the importance of careful evaluation, skepticism, and due diligence. Investors must prioritize platforms that provide verifiable credentials, regulatory compliance, transparent operations, and realistic expectations. Enthusiasm for digital trading should never override the need for prudence and informed decision-making.

Report. Sicodice.com And Recover Your Funds

-

If you have lost money to sicodice.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like sicodice.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.