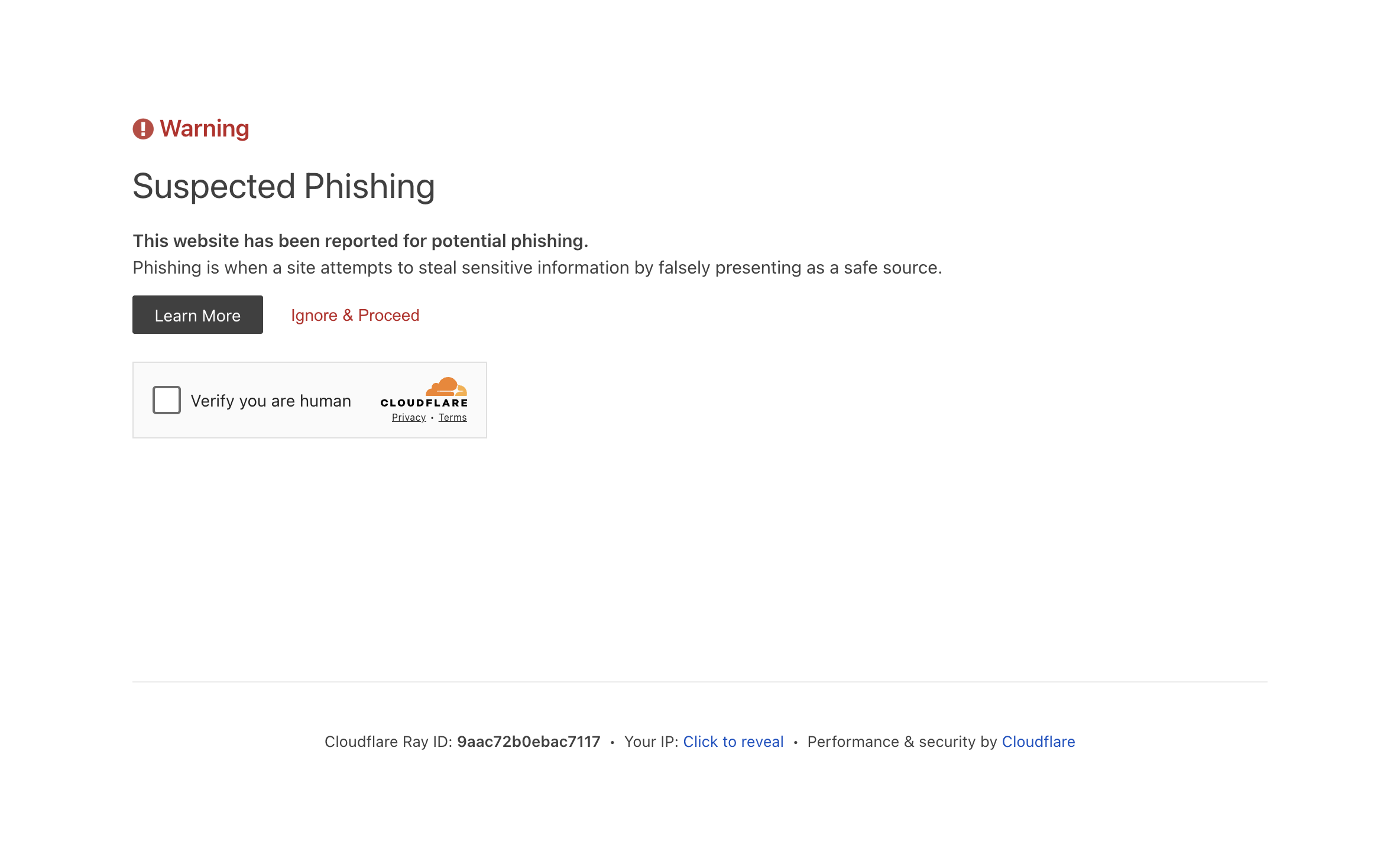

SimplyBit.ai Review: Key Red Flags You Must Know

Online trading continues to attract millions of people, but it has also opened the door to countless risky and unregulated platforms disguising themselves as legitimate investment opportunities. One platform raising serious concern is SimplyBit.ai. Although it promotes itself as an advanced, AI-powered trading service, a closer look reveals multiple warning signs and inconsistencies that make it unsuitable — and potentially dangerous — for any investor.

This comprehensive review outlines the key red flags surrounding SimplyBit.ai and explains why users should avoid the platform entirely.

A Polished Website Designed to Create Instant Trust

At first glance, SimplyBit.ai looks impressive. The website uses:

-

Sleek visuals

-

Futuristic AI-themed branding

-

Professional fonts and clean layout

-

Buzzwords like “smart trading,” “predictive algorithms,” and “automated wealth creation”

These design choices are intentional — they aim to build credibility quickly, especially among new investors who may equate good design with legitimacy.

But experienced analysts know that a polished appearance can be built in hours. In the world of unregulated crypto and forex platforms, an attractive website often hides deeper issues. Unfortunately, SimplyBit.ai fits that pattern.

Red Flag #1: No Verifiable Regulation or Licensing

Regulation is the backbone of safe financial services. Licensed platforms must follow strict rules protecting users’ funds, ensuring fair trading conditions, and providing transparency.

However, SimplyBit.ai does not offer any verifiable regulatory information:

-

No license number

-

No regulatory authority name

-

No compliance documents

-

No proof of oversight

This means that:

-

Users have no protection if funds disappear

-

No authority monitors how SimplyBit.ai handles money

-

The platform operates with zero accountability

Any trading platform that accepts deposits without regulatory supervision is inherently high-risk. SimplyBit.ai displays all the hallmarks of an unregulated financial operation.

Red Flag #2: Hidden Company Identity and Anonymous Operators

Legitimate financial companies are transparent about:

-

Their legal business name

-

Their physical location

-

Their directors or leadership team

-

Their corporate registration

-

Their customer support structure

SimplyBit.ai offers none of this in clear, verifiable form. The website provides generic statements about its mission, but gives no real information about:

-

Who runs the platform

-

Where it is headquartered

-

Under what legal entity it operates

-

Whether the company even exists as a registered business

Anonymous operators are a major danger sign. When a platform hides its identity, users have no recourse if something goes wrong. This level of secrecy is unacceptable for any service handling money.

Red Flag #3: Exaggerated Claims With No Transparent Evidence

SimplyBit.ai makes bold promises, such as:

-

Automated profitable trading

-

AI-driven accuracy

-

High returns with minimal effort

-

“Advanced algorithms outperforming human traders”

But the platform provides no proof of:

-

Audited results

-

Real trading history

-

Verified performance metrics

-

Real user case studies

-

Independent evaluations

When a website claims big profits but avoids disclosing risk or performance data, it is a serious indication that the claims may be exaggerated or fabricated. No reputable trading service guarantees profits — yet SimplyBit.ai’s marketing heavily implies this outcome.

Red Flag #4: High Likelihood of Deposit Pressure Tactics

Platforms similar to SimplyBit.ai frequently use psychological tactics to push users into depositing money quickly. These may include:

-

“Limited-time” bonuses

-

Warnings about missing out on market opportunities

-

Promises of higher earnings for larger deposits

-

Messages urging immediate activation of accounts

Whether subtly or overtly, these tactics create a false sense of urgency.

A trustworthy financial institution encourages thoughtful decision-making — not rushed deposits.

Red Flag #5: Unclear or Risky Withdrawal Conditions

A core function of any legitimate platform is the ability to withdraw funds efficiently. But platforms with similar characteristics to SimplyBit.ai often have patterns such as:

-

Long delays for withdrawals

-

Unexpected fees before release

-

Additional “taxes” or “verification charges”

-

Accounts suddenly put under review

-

Customer service becoming unresponsive

SimplyBit.ai does not clearly explain its withdrawal policies, timelines, or conditions. This lack of transparency is one of the most critical red flags.

A platform that fails to guarantee smooth withdrawals cannot be trusted with investments.

Red Flag #6: Suspicious Testimonials and Artificial Credibility

SimplyBit.ai references user success stories, but these reviews:

-

Lack verifiable identities

-

Sound overly generic

-

Do not include real trading data

-

Resemble testimonials seen on other high-risk platforms

Fake testimonials are extremely common among fraudulent or unreliable trading websites. Without independently verified customer feedback, such praise should not be considered credible.

Red Flag #7: New Domain and Weak Reputation Footprint

High-risk trading platforms often:

-

Launch under a new domain

-

Operate briefly

-

Collect deposits

-

Shut down or rebrand

-

Reappear under a similar name

SimplyBit.ai appears to have a short domain history and minimal online presence — a huge concern for any financial service. Trusted trading platforms build reputation over years, not weeks or months.

A short-lived domain with no track record is a major reason to stay away.

Red Flag #8: Generic, Template-Based Content

Several sections of the SimplyBit.ai website contain vague or generic descriptions copied from common trading templates. These include:

-

Repetitive marketing language

-

Ambiguous explanations of “AI technology”

-

No real insight into how the platform operates

-

Lack of detailed risk disclosures

When a platform cannot clearly articulate its service, it signals a lack of real financial expertise — yet another red flag.

Final Verdict: SimplyBit.ai Appears High-Risk — Avoid Completely

After examining the platform’s structure, transparency issues, marketing tactics, and operational risks, SimplyBit.ai shows multiple warning signs that match those of unsafe and unreliable trading platforms.

Here is the full risk summary:

-

No regulatory oversight

-

No verifiable business identity

-

Exaggerated and unproven claims

-

High likelihood of withdrawal problems

-

Possible pressure tactics for deposits

-

Suspicious testimonials

-

Weak online presence

-

Generic and vague content

These red flags make SimplyBit.ai an extremely risky choice for anyone considering investing.

The safest and smartest decision is to avoid SimplyBit.ai entirely.

Choosing a transparent, regulated, and reputable trading platform is essential for financial safety — and SimplyBit.ai does not meet any of these requirements.

Report simplybit.ai And Recover Your Funds

If you have lost money to simplybit.ai, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like simplybit.ai continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.