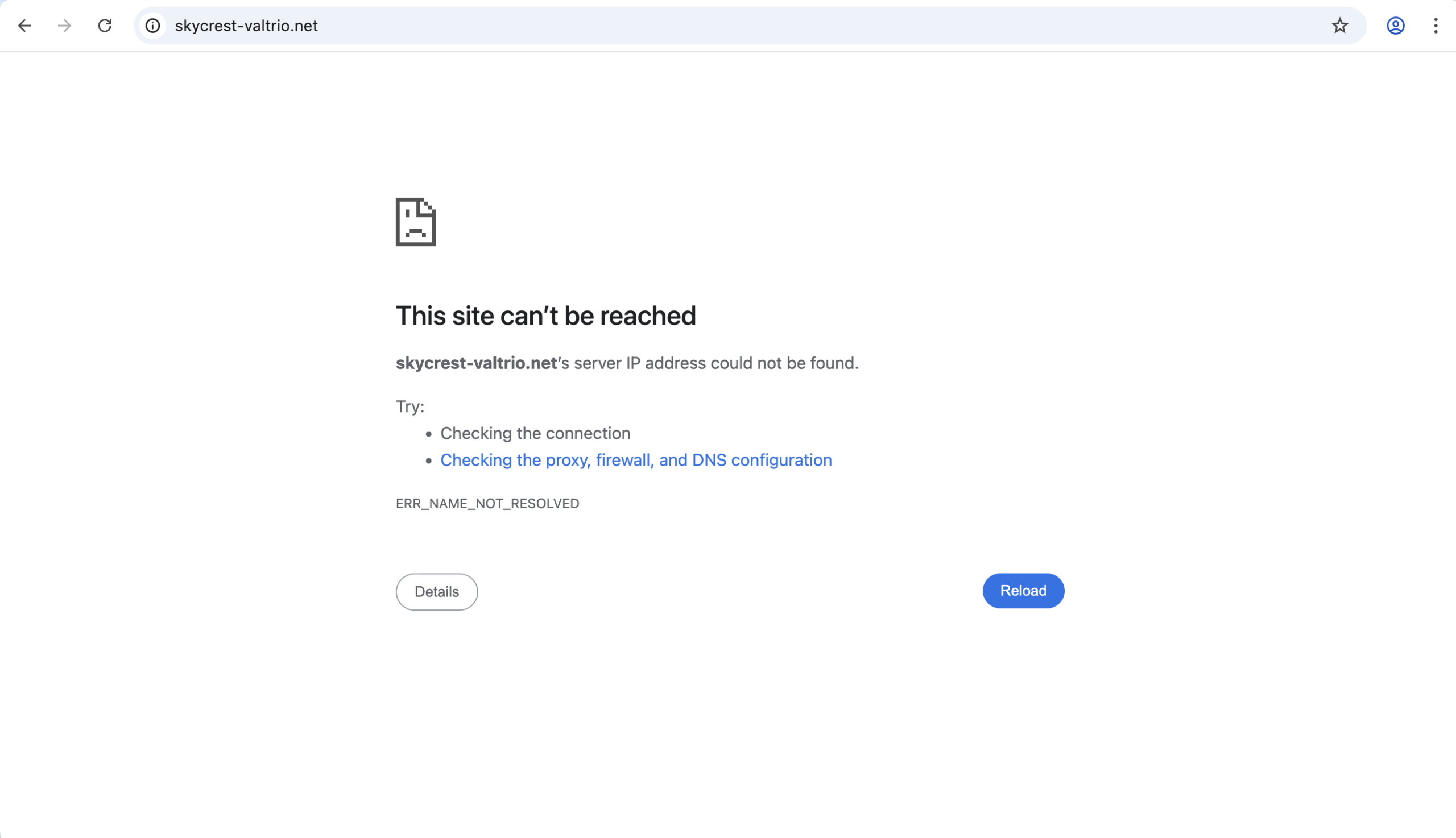

Skycrest-Valtrio.net: 7 Investor Informations

When evaluating online financial services, especially those offering cryptocurrency trading or AI-powered investing, legitimacy and transparency are essential. Skycrest-Valtrio.net presents itself as a modern trading hub with advanced tools — but a deeper look at independent assessments raises significant questions about its credibility, safety, and reliability.

Below is a comprehensive examination of why caution is prudent before interacting with this platform.

1. Very Low Trust Score From Independent Analysts

Credibility checks using independent website evaluation services consistently assign skycrest-valtrio.net an extremely low trust score — including a 0 out of 100 rating on one major platform. These assessments are not arbitrary; they are based on structural risk factors including domain age, hosting environment, and ownership transparency.

A low trust score typically suggests that the site lacks the markers of a mature, transparent financial service and may exhibit patterns associated with unsafe or unreliable operations.

2. Hidden Ownership and Lack of Public Transparency

One of the most basic elements of a reputable financial platform is clear corporate identity and verified ownership information. Skycrest-Valtrio.net uses a privacy-protected WHOIS registration, meaning the real owner’s name and contact details are hidden. This is a common tactic used by fraudulent sites to avoid accountability and oversight.

Without verifiable ownership, potential users cannot confirm whether the entity operating the site is regulated, legally registered, or financially responsible — all of which are critical in financial services.

3. Young Domain With Limited Web Presence

The domain for this platform was registered recently, within the past few months, and has minimal visibility online. New domains can be legitimate — but when combined with other risk indicators, such as low visitor counts and weak presence on reputable review sites, this points to insufficient historical performance or established reputation.

In the investment and trading sector, well-established services typically have longer online histories, user feedback scattered across independent outlets, and broader awareness within relevant communities.

4. Claims of Financial Services on Shared Server

Evaluators also noted that skycrest-valtrio.net is hosted on a shared server alongside multiple other websites of questionable reputation. Hosting sensitive personal and financial data on a shared server increases the risk of cybersecurity vulnerabilities and data exposure.

For platforms that claim to handle financial transactions or sensitive data, isolated and secure hosting environments are expected industry practice. Shared hosting environments, especially those housing other low-credibility sites, can expose users to data leaks, phishing, or malware risks.

5. Conflicting Representations vs. Independent Evaluations

The official marketing for Skycrest Valtrio (on related domains) paints a picture of an AI-driven, transparent trading platform with positive testimonials and strong performance claims.

However, independent trust evaluations tell a different story — one marked by extremely low credibility scores, hidden ownership, and a lack of verifiable third-party validation. This contrast between polished marketing and independent risk assessments should encourage caution, as fraudulent operators often use attractive language to mask underlying risks.

6. Cryptocurrencies and Online Investment Services Are High-Risk Targets

It’s important to appreciate that crypto and digital asset platforms are a frequent target for impostor websites and fraudulent operations. Bad actors often set up convincingly branded sites to lure in users with promises of easy profits or AI-assisted gains, only to restrict withdrawals later or exploit personal and financial data.

Independent evaluations for skycrest-valtrio.net explicitly flag involvement in cryptocurrency-related services as a potential risk factor and advise careful scrutiny before engagement.

7. Lack of Verifiable Regulation and Oversight

Nowhere in the independent assessments does skycrest-valtrio.net demonstrate regulatory oversight by recognised financial authorities. Legitimate trading platforms typically list clear licensing information — including regulator name, licence number, and jurisdiction — to build trust and comply with legal obligations.

The absence of any such public verification heightens the uncertainty around how user funds and data would be protected, if at all.

Final Takeaway: Extreme Caution Recommended

Combined, these factors paint a concerning picture of skycrest-valtrio.net:

-

Very low independent trust scores from reputable evaluation tools.

-

Hidden ownership and anonymity in registration data.

-

Young domain with limited footprint and low traffic.

-

Hosting on shared infrastructure linked to other low-reputation sites.

-

No publicly available regulatory credentials or industry oversight.

Given these concerns, engaging with skycrest-valtrio.net — especially in any financial capacity — carries significant uncertainty and potential risk. When platforms lack transparent credentials and provable legitimacy, interacting with them could expose you to data vulnerabilities or financial loss. Always conduct thorough research and prioritise platforms with clear regulation and established reputations before committing resources.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to skycrest-valtrio.net, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as skycrest-valtrio.net continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.