Spectrecoin Exposed – Truth Behind Its High-Profit Claims

The cryptocurrency and online trading market has experienced tremendous growth, offering investors opportunities to trade digital assets and earn potential profits. However, this rapid expansion has also created space for fraudulent platforms targeting inexperienced investors. One platform that has raised concerns is Spectrecoin. Despite claims of advanced trading tools, professional account management, and high-profit potential, several warning signs indicate it may not be trustworthy.

This review provides a comprehensive analysis of Spectrecoin, examining its features, operational practices, warning signs, and user-reported issues to help investors make informed decisions.

Overview of Spectrecoin

Spectrecoin markets itself as a sophisticated cryptocurrency trading and investment platform offering:

-

Cryptocurrency trading

-

Forex and CFD investments

-

High-yield investment programs

-

Automated trading tools

-

Dedicated account managers

-

Advanced dashboards and analytics

The platform’s website is professionally designed and visually appealing, featuring bold profit claims and sleek graphics. While these elements may attract novice investors, appearances can be deceptive. A closer look reveals multiple red flags indicating potential risks for users.

Unrealistic Profit Promises

One of the most concerning aspects of Spectrecoin is its guaranteed high-profit claims. The platform advertises:

-

Fixed daily and weekly returns

-

“Guaranteed” passive income

-

Rapid doubling of deposits in short periods

No legitimate trading platform can consistently guarantee profits, especially in highly volatile markets like cryptocurrency and forex. Platforms promising guaranteed returns often target inexperienced investors to deposit larger sums, significantly increasing the risk of financial loss.

Lack of Regulatory Oversight

Regulation is a key factor in assessing the credibility of any trading platform. Legitimate brokers operate under financial authorities that ensure transparency, investor protection, and compliance with the law. Some of the most recognized regulators include:

-

FCA (UK)

-

ASIC (Australia)

-

CySEC (Cyprus)

-

NFA/CFTC (USA)

Spectrecoin does not provide verifiable regulatory licenses or oversight information. Operating without regulation exposes investors to potential fund mismanagement, account freezes, and limited recourse.

Anonymous Ownership and Lack of Transparency

Reliable trading platforms typically disclose:

-

Company owners and executives

-

Corporate registration and headquarters

-

Regulatory compliance

-

Contact information

Spectrecoin provides very limited information about its operators. This lack of transparency is a significant red flag, as anonymous ownership allows operators to act without accountability, increasing the likelihood of fraudulent practices.

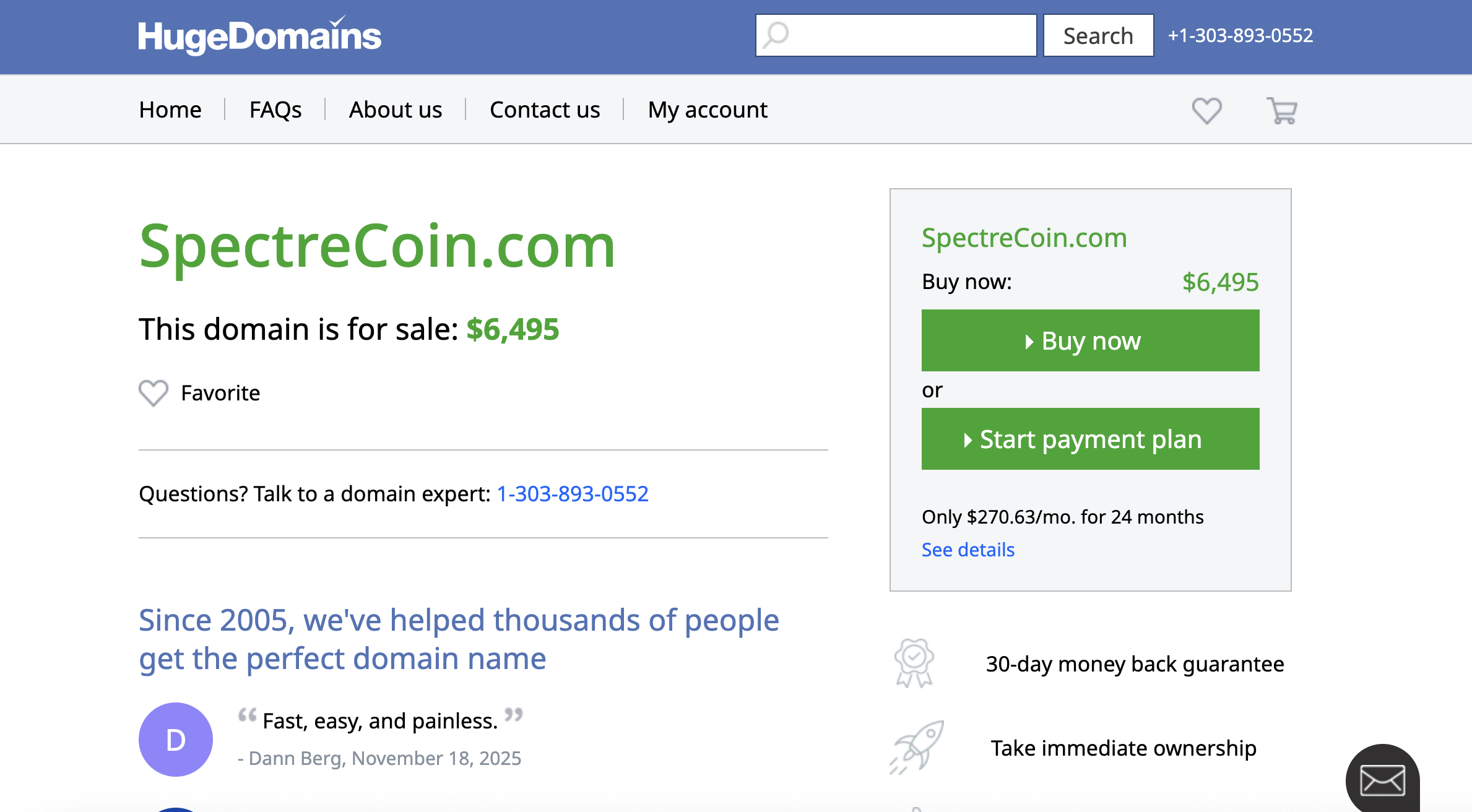

Suspicious Website Features

Despite its professional appearance, several aspects of Spectrecoin’s website raise concerns:

-

Generic templates: The design is similar to other known scam platforms.

-

Vague content: Sections offer minimal explanation about trading operations or fund management.

-

Simulated dashboards: Users report that the trading interface may display profits visually without reflecting actual market trades.

These elements suggest the platform prioritizes aesthetics over actual functionality.

Withdrawal Problems

Withdrawal difficulties are among the most commonly reported issues by Spectrecoin users:

-

Delayed or blocked withdrawal requests

-

Requests for additional verification or fees before releasing funds

-

Accounts frozen after attempting large withdrawals

-

Non-responsive or evasive customer support regarding fund access

Fraudulent platforms often make deposits easy while creating obstacles for withdrawals, keeping investor funds on the platform as long as possible.

Aggressive Marketing and Pressure Tactics

Spectrecoin reportedly employs aggressive tactics to encourage users to deposit more money:

-

Frequent emails, calls, or messages from “account managers”

-

Promises of exclusive bonuses for immediate deposits

-

Pressure to upgrade investment plans or deposit larger sums quickly

-

Warnings about missing out on “limited-time opportunities”

Legitimate investment platforms rely on transparency and verified performance rather than coercion to secure client funds.

Fake Testimonials and Misleading Reviews

The website features numerous positive testimonials, but these are highly suspicious:

-

Generic and repetitive language

-

Stock images used as reviewer photos

-

Lack of verifiable trading results

-

Multiple reviews with nearly identical wording

Fake testimonials are commonly used by scam platforms to create the illusion of credibility and trustworthiness.

Manipulated Trading Environment

Users have reported unusual behavior within Spectrecoin’s trading platform:

-

Prices not matching real market data

-

Trades automatically closing at losses

-

Artificially inflated dashboard balances

-

Profits displayed visually but inaccessible for withdrawal

A manipulated trading environment allows the platform to simulate success while maintaining control over investor funds, a common tactic among fraudulent platforms.

Poor Customer Support

Reliable brokers provide professional and responsive support. Spectrecoin reportedly exhibits:

-

Delayed or no responses to inquiries

-

Scripted or automated replies

-

Support becoming unreachable after deposits

-

Contradictory instructions regarding account issues or withdrawals

Poor customer support signals a lack of accountability and operational transparency.

Misleading Terms and Conditions

Spectrecoin includes terms that heavily favor the platform:

-

Broad rights to freeze accounts without explanation

-

Hidden fees revealed only after deposits

-

Ambiguous withdrawal rules

-

Authority to change terms at any time without notice

One-sided terms allow the platform to maintain control over investor funds while limiting user rights.

Red Flags Summary

After reviewing Spectrecoin, several warning signs are evident:

-

No regulation or licensing

-

Anonymous ownership and lack of transparency

-

Unrealistic profit guarantees

-

Withdrawal difficulties and additional fee demands

-

Aggressive marketing tactics

-

Fake testimonials and misleading reviews

-

Manipulated trading dashboards

-

Poor customer support

-

Misleading terms and conditions

These indicators strongly suggest that Spectrecoin may be unsafe for investors.

Final Verdict – Is Spectrecoin a Scam?

Based on the evidence, Spectrecoin exhibits multiple characteristics of a scam platform. Its lack of regulation, unrealistic profit promises, withdrawal obstacles, anonymous operators, and manipulative practices make it a high-risk option for investors.

Investors seeking online trading opportunities should prioritize platforms that are transparent, regulated, and verifiable. Spectrecoin does not meet these essential standards, and engagement with it carries a significant risk of financial loss.

Caution and thorough research are crucial before investing in any platform displaying multiple warning signs.

Report. Spectrecoin And Recover Your Funds

-

If you have lost money to spectrecoin, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like spectrecoin continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.