TemStarLimited.com Platform Review

In the increasingly crowded landscape of online trading platforms and financial service providers, distinguishing trustworthy brokers from questionable operations is essential. TemStarLimited.com is one such platform that has generated mixed signals—often skewed toward concerns among the investing community. While the website presents itself as a modern financial broker with promising tools and investment opportunities, closer scrutiny reveals multiple aspects that should raise red flags for anyone considering using the service.

This review provides a thorough examination of the platform’s claims, transparency, user feedback patterns, and overall credibility, emphasizing why potential users should approach TemStarLimited.com with caution.

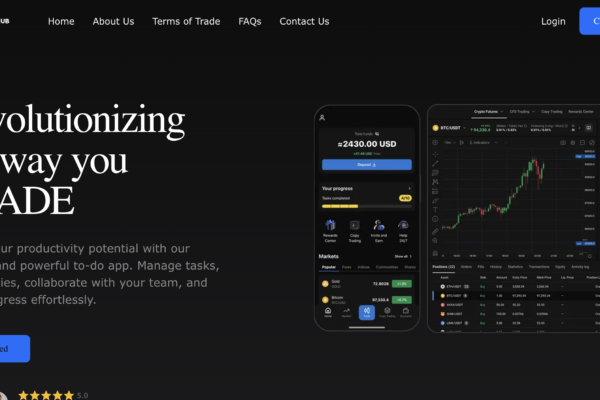

1. How TemStarLimited.com Markets Itself

TemStarLimited.com positions itself as a comprehensive broker, offering trading in various asset classes and tools designed to help users navigate financial markets. Its homepage and promotional content emphasize ease of use, potential profit opportunities, and a sleek user experience.

However, elegant website design and persuasive marketing are not sufficient indicators of legitimacy. Many questionable platforms use polished layouts and professional copywriting to obscure deeper issues—especially where financial transactions and personal data are involved.

2. Lack of Clear Corporate Identity

Legitimate financial brokers typically disclose their corporate structure, including legal business names, physical office locations, and details about directors or founders. These disclosures are vital because they enable users to verify the company’s background and regulatory compliance.

In the case of TemStarLimited.com, this information is not readily available. There is no clear indication of the entity responsible for operating the platform, where it is legally registered, or who is accountable for its services. The absence of transparent company details creates a barrier to trust. Without knowing who stands behind a financial platform, users have no meaningful way to verify authenticity or responsibility.

3. Regulatory Ambiguity

One of the most significant aspects in evaluating any trading or investment platform is whether it is regulated by recognised financial authorities. Regulatory oversight provides a safeguard for investors, requiring brokers to meet strict standards related to fund security, operational transparency, reporting, and ethical conduct.

TemStarLimited.com does not disclose any valid regulatory registrations, licenses, or oversight by recognised authorities. There are no visible regulatory seals, license numbers, or references to financial commissions or boards in jurisdictions known for robust financial governance.

This omission is critical. Without regulatory compliance, users have virtually no protection and no external body ensuring that the platform adheres to established financial rules or ethical norms.

4. User Feedback and Complaint Patterns

User reviews and online community feedback are valuable indicators of how a platform performs in real-world conditions. With TemStarLimited.com, reports from users online reveal a concerning trend.

Many of the critical comments discuss difficulties related to:

-

Fund withdrawal challenges: Several users report that attempts to withdraw deposited funds were unsuccessful or ignored. These stories often follow patterns where initial deposits are accepted without issue, but withdrawal processes encounter complications or delays.

-

Communication breakdowns: Users describe delayed or non-responsive customer support, often after funds have been deposited. Persistent communication gaps can indicate either poor operational structure or a deliberate lack of transparency.

-

Account access issues: A number of users claim that account access became restricted after further deposits were not made.

While not every user report can be independently verified, the recurrence of similar issues across multiple accounts and platforms suggests patterns that should not be dismissed lightly.

5. Terms, Fees, and Hidden Conditions

Transparent brokers make their terms, conditions, and fee structures easy to find and understand. Key elements such as withdrawal rules, trading costs, inactivity penalties, and client fund protections should be presented clearly.

With TemStarLimited.com, many of these important details are either buried in lengthy fine print or entirely absent from the public user interface. Withdrawal terms, for example, are not prominently displayed, and fee descriptions lack clarity. When essential contractual information is obscured, users face a higher risk of being subject to unexpected charges or restrictive conditions.

6. Promotional Tactics and Pressure Techniques

Another concern that emerges from feedback about TemStarLimited.com is the use of aggressive outreach and pressure techniques.

Some users describe unsolicited contact from platform representatives who encourage additional deposits with promises of better returns or priority account statuses. High-pressure communication—especially when pushed repeatedly after initial engagement—can be a tactic to encourage sustained financial input without regard for investor well-being.

Legitimate brokers generally allow users to make decisions on their own timeline and avoid coercive engagement strategies.

7. Absence of External Verification or Audits

Trustworthy financial platforms frequently undergo third-party audits, compliance verifications, or independent reviews that are published publicly. These external assessments help demonstrate operational integrity and reassure users that the platform adheres to industry standards.

TemStarLimited.com does not appear to engage in or publish any such audits or independent evaluations. This lack of external verification deprives users of another layer of assurance that their funds and trades are being handled ethically and transparently.

Conclusion — Important Considerations Before Using TemStarLimited.com

While TemStarLimited.com may present an appealing surface as a modern financial trading service, deeper analysis reveals numerous concerns that users should carefully consider before depositing funds or engaging with the platform.

Key issues include:

-

Lack of transparent corporate identity

-

Absence of valid regulatory oversight

-

Repeated user reports about withdrawal and communication problems

-

Hidden or unclear fee structures

-

Use of aggressive promotional practices

-

No visible external verification or audit history

Taken together, these factors suggest that TemStarLimited.com does not reflect the standards expected of reputable financial service providers. Caution is not only advisable—it is essential.

If you are exploring financial trading or investment platforms, it is generally safer to choose services that disclose their regulatory credentials, provide clear contract terms, and maintain a history of verifiable performance and transparent operations. TemStarLimited.com currently does not meet those criteria, and that is why many reviewers and investors advise careful reconsideration before any engagement.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to TemStarLimited.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as TemStarLimited.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.