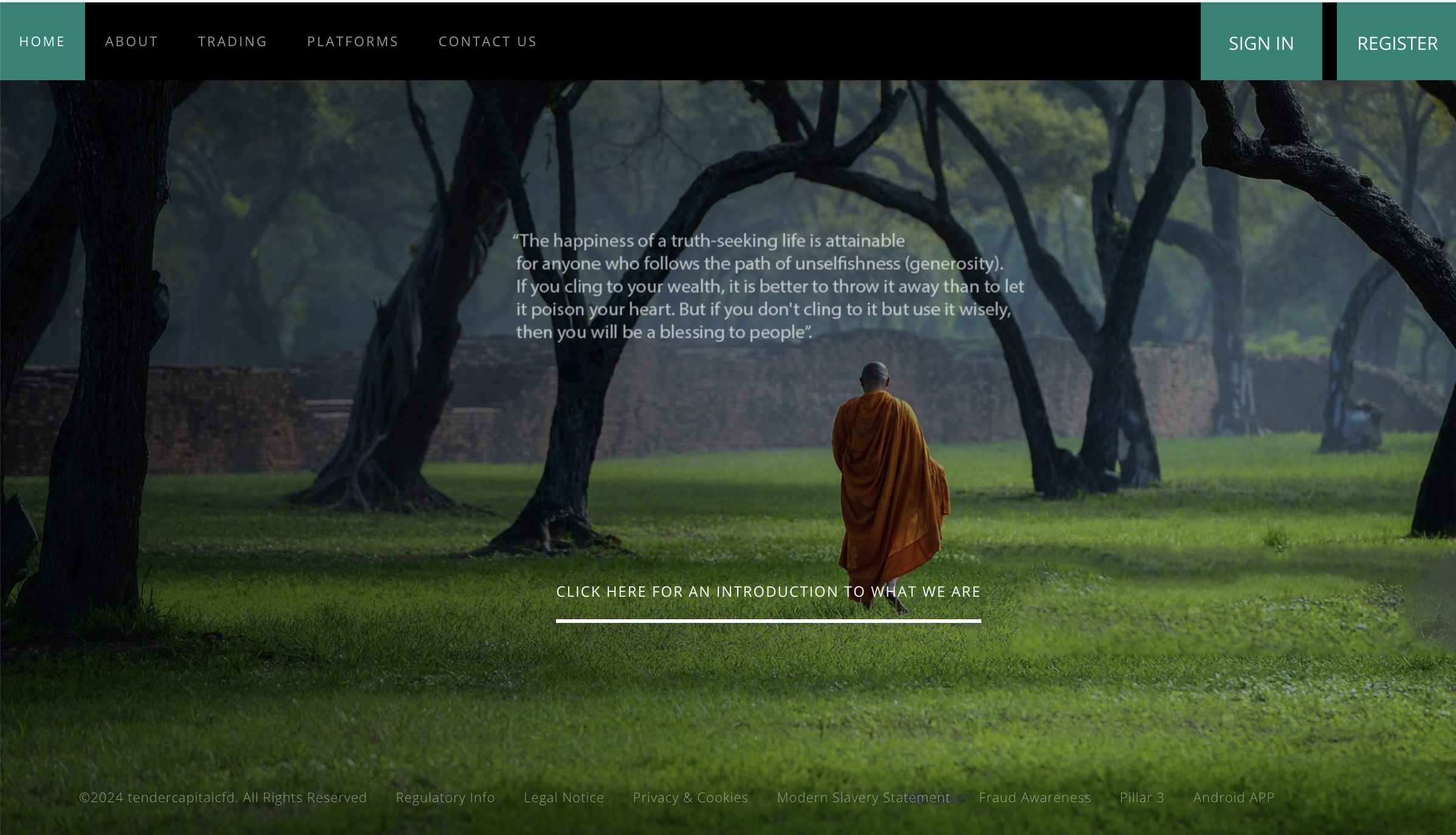

Tender‑CapitalCFD.com Review – A Comprehensive Warning

1. What Is Tender‑CapitalCFD.com Claiming to Be?

Tender‑CapitalCFD.com purports to be an online trading platform offering forex and cryptocurrency contracts‑for‑difference (CFDs). It presents itself as a sophisticated brokerage with high leverage, instant execution, and streamlined deposit/withdrawal processes. The site promises quick profits—often within minutes or hours—and markets heavy use of cutting‑edge trading tools. Such claims appear flashy, but there’s no regulatory badge or legal certainty behind them.

2. No Regulation: A Critical Warning Sign

Perhaps the biggest red flag is that Tender‑CapitalCFD.com has no visible regulation or license from any recognized financial authority. There is no record of oversight from bodies like the FCA (UK), CySEC (Cyprus), ASIC (Australia), or CONSOB (Italy). Without a regulatory framework:

-

No client‑fund separation is guaranteed.

-

No investor compensation scheme applies.

-

Dispute resolution via oversight agencies is unavailable.

Operating without a license means the platform offers zero legal protection—a hallmark of many fraudulent trading sites.

3. New Domain & Obscured Ownership

Security tools evaluating domain reputations flag Tender‑CapitalCFD.com as newly registered, with WHOIS data masked by privacy services. This is a classic tactic: scammers quickly launch a fresh website, then abandon or rebrand it when complaints arise or once they’ve extracted funds. The lack of transparency around ownership or team identity further erodes trust.

4. Scam Workflow: How Users Are Lured In

Typical scam operations follow a predictable pattern:

-

Cold outreach: callers or chat agents reach out via email, social media, or WhatsApp, often using personal details to create familiarity.

-

Low‑entry deposit incentive: users are encouraged to deposit a small amount (e.g. $250–$500) as a “starter package” with promises of bonuses or VIP access.

-

Simulated profit dashboards: after deposit, the platform shows the account growing rapidly—sometimes doubling in 24 hours.

-

Pushing further investment: users are told higher bonuses or faster returns unlock at higher tiers.

-

Withdrawal issues: when users request funds, the platform begins introducing “mandatory verification fees,” “tax compliance charges,” or “upgrade packages.”

-

Disappearing support and access: communication suddenly stops, dashboards vanish, and the domain disappears or changes.

Users describe it as “Hotel California trading”: you can deposit anytime—but you can’t withdraw.

5. Poor Website Quality & Implausible Offers

Observers note the platform uses generic, auto‑translated language, canned testimonials, and stock images—often inconsistent across pages. Promises of risk‑free returns, guaranteed profits, or minimum spreads with enormous leverage (often 1:500 or more) are unrealistic—and violate typical regulation standards worldwide. No detailed methodology, whitepaper, or audited results is shared. The messaging feels engineered to seduce—not to inform.

6. Independent Scam Ratings & Complaints Alignment

Fraud‑focused services rate websites like Tender‑CapitalCFD.com extremely low for credibility and transparency. Review platforms and watchdog tools highlight:

-

Extremely low trust scores

-

Multiple flagged behaviors indicating scam operation (hidden ownership, new domain, lack of regulation)

-

Complaints about fund withdrawals blocked with endless excuses

These findings align closely with victim testimonials posted across forums—suggesting a consistent, harmful pattern.

7. Psychological Manipulation Techniques Commonly Used

Tender‑CapitalCFD.com relies on well‑documented psychological tactics:

-

Greed: Gearing marketing toward “easy money” and fast returns.

-

FOMO (Fear of Missing Out): Urgency tactics such as “limited VIP slots.”

-

Social proof illusion: Fake testimonials and screenshots of huge account gains.

-

Authority bias: Use of trading buzzwords and professional imagery to feign legitimacy.

-

Escalation of commitment: Small deposits build trust—and then the platform pushes users to invest more to avoid “missing out” on greater returns.

These are tried‑and‑true manipulative techniques aimed to pressure users into escalating investment, even when warning signs appear.

8. Real Risks to Investors

Engaging with platforms like Tender‑CapitalCFD.com exposes users to:

-

Permanent financial loss, as funds are withheld or the platform vanishes.

-

Identity exposure, if users submitted personal documents for “verification.”

-

Emotional stress, due to blocked access and inability to recover assets.

-

Zero avenues for recourse, given lack of oversight or public corporate presence.

Without regulation or legal accountability, users effectively hand over their money to an anonymous operator.

9. Key Warning Signals at a Glance

| Warning Sign | Why It’s Suspicious |

|---|---|

| No financial authority license or oversight | No legal protection or enforcement |

| New, unverified domain; anonymized ownership | Likely a throwaway website meant to disappear after theft |

| Unrealistic profit guarantees and hype | Not consistent with legitimate financial operations |

| Simulated trading dashboard and growth metrics | Deceptive user interface, not real trading engine |

| Withdrawal roadblocks and surprise fees | Designed to prevent users from exiting with their money |

| Generic/trademark-free website content | Lacks credibility, designed to blend in with other scam pages |

Multiple signs combined strongly suggest a coordinated scam operation.

10. Why Legitimate Brokers Operate Differently

Regulated brokers provide:

-

Transparent license numbers traceable via regulator databases.

-

Segregated client accounts, ensuring client funds are separate.

-

Enforced negative balance protection and compensation schemes.

-

Real customer support and formal complaint procedures.

-

Clear legal entity and headquarters information.

Tender‑CapitalCFD.com lacks these critical safeguards—so it fails every test of legitimacy.

Final Verdict

Tender‑CapitalCFD.com appears to be a fraudulent, unregulated, high‑pressure trading platform designed to take deposits—not facilitate legitimate trading. It operates without regulatory approval, hides its identity, makes unrealistic profit claims, simulates account growth, and blocks withdrawal requests once money is deposited.

If you encounter this domain—or similar names—it’s highly likely a scam. Avoid providing any personal details, avoid depositing funds, and steer clear.

Conclusion

Platforms like Tender‑CapitalCFD.com thrive on illusion: fake gains, emotional urgency, and hidden ownership. Without regulation or transparency, users lose all protections. Real brokers operate under strict oversight, publish performance proof, and allow withdrawal of funds without hidden barriers. This platform offers none of that.

Stay safe. Stay alert. And do not engage with Tender‑CapitalCFD.com under any circumstances.

-

Report Tender-capitalcfd.com And Recover Your Funds

If you have lost money to tender-capitalcfd.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like tender-capitalcfd.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.