Topexchangeinvestment.live Update

In the sprawling world of online investment platforms, distinguishing between legitimate opportunities and fraudulent schemes isn’t always easy. One website that has recently drawn intense scrutiny and strong warnings from independent watchdogs and regulatory bodies is topexchangeinvestment.live. What appears at first glance to be a cutting-edge financial platform promising high returns quickly raises serious red flags upon closer inspection. This comprehensive review breaks down why Topexchangeinvestment.live should be approached with extreme caution — and why you should consider steering well clear of it altogether.

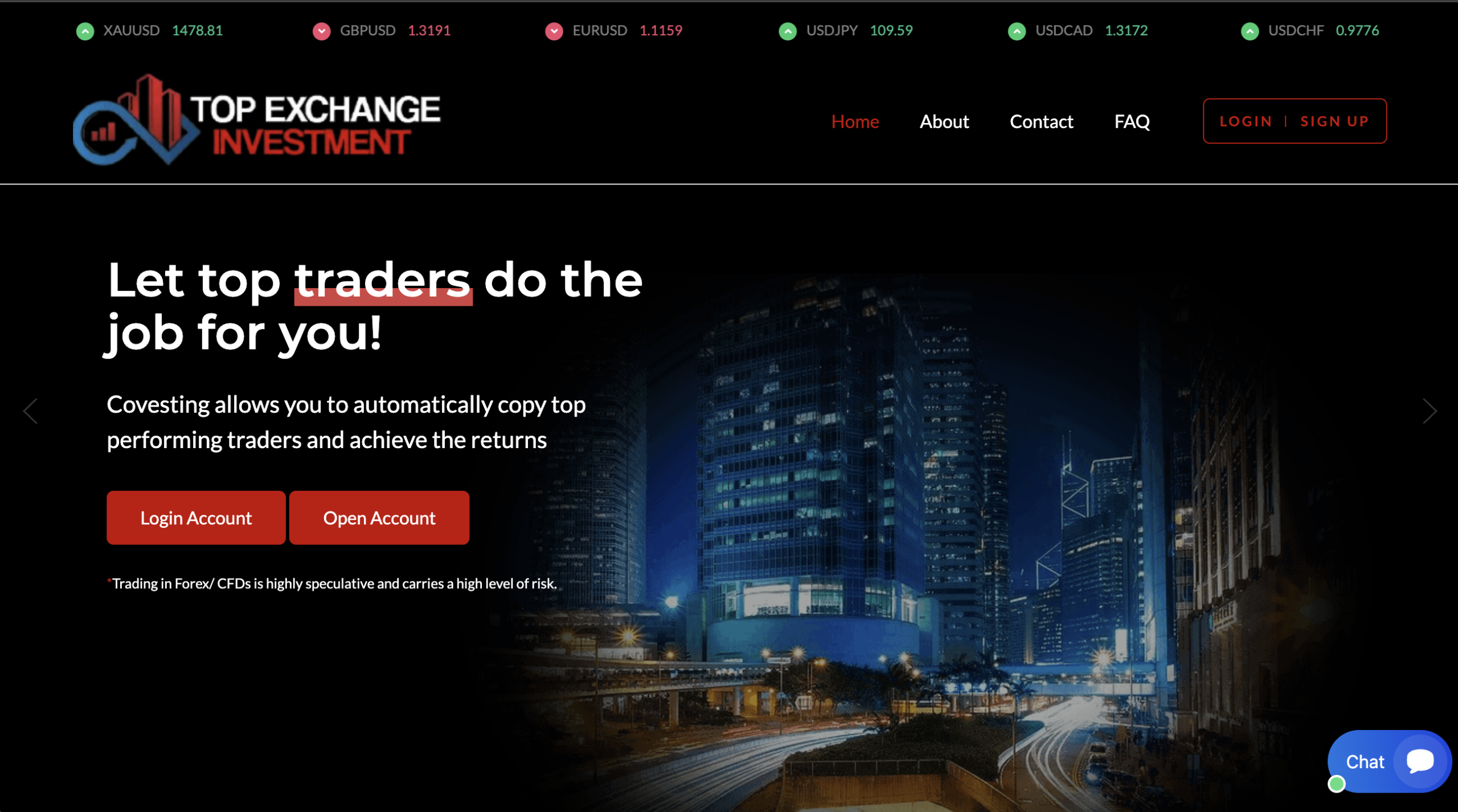

Overview: What Is Topexchangeinvestment.live?

Topexchangeinvestment.live positions itself as an online investment service, purportedly facilitating trading in assets like forex, commodities, or cryptocurrency. But unlike well-known, regulated brokers that operate transparently, trustworthy platforms subject to strict oversight, this site’s legitimacy is deeply questionable. Algorithms that assess online risk have flagged this platform as high-risk, and independent reviews assign it a very low trust score — a hallmark of potential scam operations.

Red Flags You Can’t Ignore

Here are the most concerning aspects that emerge from objective analyses of Topexchangeinvestment.live and associated sites:

1. Low Trust and High-Risk Ratings

Automated review tools that evaluate things like domain age, server history, and traffic patterns give Topexchangeinvestment.live a very low trust score, suggesting the site may be unsafe or fraudulent. These systems flag characteristics common to scam sites: hidden ownership information, minimal online presence, and hosting on servers shared with other low-reputation domains.

2. Lack of Regulation or Licensing

Legitimate investment platforms — especially those trading financial instruments — must be registered with appropriate regulatory authorities. In the UK, for example, authorised firms must appear on the Financial Conduct Authority (FCA) register. A platform with a name similar to this one (Top Exchange Investment) was explicitly warned by the FCA for offering or promoting financial services without authorisation — a serious compliance failure that investors should never ignore.

3. Hidden or Misleading Company Information

One common tactic among fraudulent platforms is to conceal who owns and operates the site. Topexchangeinvestment.live and related domains often use privacy-protected WHOIS data that hides the real operators. This makes accountability difficult and virtually impossible to verify who is behind the business or whether they have any real financial credentials.

4. Shared Hosting With Other Risky Sites

Shared hosting with other low-reputation or questionable websites is another warning sign. This often indicates cost-cutting and anonymity — two traits common to scam operations. Legitimate financial institutions invest in dedicated infrastructure and maintain strong digital reputations; fraudulent actors tend not to.

Behaviour Patterns Linked to Scam Operations

Even beyond automated scores and technical evaluations, there are behavioural and structural indicators that hint strongly at scam-like tactics:

Promises of Unrealistic Returns

Fraudulent platforms often lure victims with the promise of “high returns with little to no risk.” This is a classic hallmark of investment scams — no credible investment opportunity can guarantee big profits without corresponding risk. Sites that use overly glamorous language and big return figures, without clear strategy or verifiable track records, should be treated with suspicion.

Lack of Verifiable Performance Data

Genuine investment firms provide transparent performance histories, audited financials, or at least verifiable user experiences. Topexchangeinvestment.live lacks these crucial markers of legitimacy, and independent analysis does not find any credible proof of sustained customer success or reliable outcomes.

Opaque Financial Mechanisms

There is no clear information on how your funds are invested, who manages these funds, or whether there is any custodial protection for investor assets. This opacity makes it impossible to understand where your money is going — a structural weakness that fraudsters exploit to siphon funds and disappear.

Why You Should Steer Clear — The Bottom Line

Given the combination of negative trust assessments, regulatory warnings, hidden operator information, and absence of credible financial infrastructure, there is no reason to entrust your money to Topexchangeinvestment.live. Here’s a concise summary of why this platform is so risky:

-

Not verified or regulated by recognised financial authorities.

-

Low trust score from independent risk platforms indicating a high probability of fraud.

-

Hidden ownership and lack of transparency, making accountability impossible.

-

Shared hosting with low-reputation websites, a common trait among scam networks.

-

No verifiable track record or audited financial reporting.

This combination of factors doesn’t just represent “risk” — it points toward a profile consistent with fraudulent investment operations that exist to extract funds from unsuspecting individuals.

Protect Yourself and Your Finances

The online investment ecosystem can be a powerful way to grow wealth when you use trusted, regulated brokers and platforms. But when a site lacks transparency, oversight, and a credible reputation, your money is at serious risk. Platforms that promise effortless gains with little explanation often have motives rooted in deception.

If you’re exploring investment opportunities, always prioritise transparency, regulation, and independent verification before you commit funds. In the case of Topexchangeinvestment.live, all credible signals point to a platform that should not be trusted with any part of your financial portfolio.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to topexchangeinvestment.live, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as topexchangeinvestment.live continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.