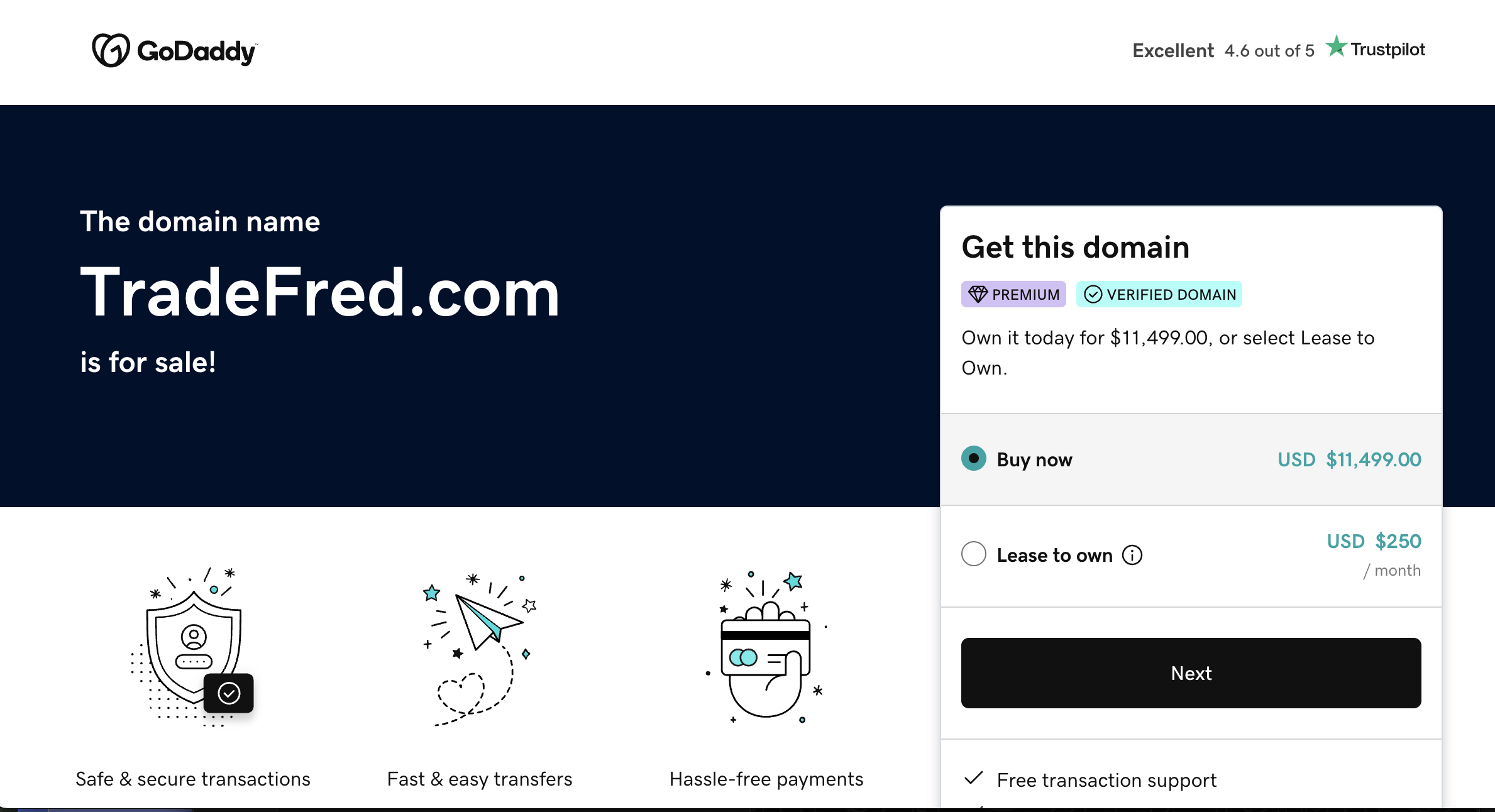

TradeFred.com Scam Alert: What Traders Should Know

In the world of online trading platforms, investors constantly seek trustworthy brokers that can facilitate smooth trading experiences and provide transparency. Unfortunately, the digital financial landscape is rife with scams and fraudulent schemes that exploit inexperienced traders. TradeFred.com has recently come under scrutiny, with several concerns being raised about its legitimacy and reliability. This review delves deep into TradeFred.com, exploring the issues investors may encounter, its operational practices, and why potential users should exercise extreme caution.

Overview of TradeFred.com

TradeFred.com presents itself as a modern online trading platform offering a range of financial instruments. These instruments typically include forex, commodities, cryptocurrencies, and other derivatives. The platform markets itself as user-friendly, promising competitive spreads, quick execution, and high returns. At first glance, TradeFred.com seems attractive, especially to novice traders looking to enter the online trading space. However, closer examination reveals several red flags that question the credibility of the platform.

Company Background and Registration

A critical factor in evaluating any trading platform is the legitimacy of its registration and regulation. Trusted brokers are usually registered with recognized financial authorities, such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC). TradeFred.com claims to operate under certain licenses, but verification of these claims raises concerns.

Many reports suggest that the company lacks transparent regulatory documentation or verifiable licensing. In some cases, platforms display registration numbers that either do not exist in official records or correspond to unrelated entities. Without proper regulatory oversight, traders have little legal protection if issues arise, making any investment highly risky.

Website and Platform Quality

A closer look at TradeFred.com’s website reveals a polished interface, designed to appear professional and trustworthy. The website showcases modern trading dashboards, educational resources, and promotional content. However, appearances can be deceiving.

Some indicators of potential concern include:

-

Overly Aggressive Promotions: The site frequently emphasizes high returns with minimal risk, a common tactic in fraudulent platforms to lure inexperienced investors.

-

Limited Transparency: Information about the company’s physical address, executive team, and operational history is vague or absent. Legitimate brokers typically provide clear corporate details and proof of regulatory compliance.

-

Generic Content: Educational materials and tutorials appear generic, often recycled from other sources, which raises doubts about the platform’s authenticity.

While the platform may function technically, the lack of transparency in its operations is a significant concern for prospective traders.

Trading Conditions and Offers

TradeFred.com advertises various trading accounts and financial instruments. The platform often promises competitive spreads, leverage options, and bonuses. While these features sound attractive, they may hide underlying risks.

Some points of concern include:

-

High Leverage: High leverage can amplify both gains and losses. While some regulated brokers offer leverage responsibly, unregulated platforms often use it to encourage larger investments quickly.

-

Ambiguous Fees: Hidden fees or unclear withdrawal terms are frequently reported. Investors may experience delays or additional charges when attempting to withdraw funds.

-

Bonus Terms: Many brokers offer trading bonuses, but in unregulated environments, these can be tied to restrictive conditions, making it difficult or impossible for users to access their money.

For new traders, these conditions may appear favorable initially, but the lack of clear, enforceable policies is a significant risk factor.

Customer Feedback and Complaints

One of the most telling indicators of a platform’s reliability is customer feedback. Across various forums and discussion boards, TradeFred.com has received multiple complaints. Common grievances include:

-

Withdrawal Issues: Users frequently report difficulties withdrawing their funds, with delays stretching weeks or even months. Some accounts claim that requests are ignored or rejected without explanation.

-

Aggressive Marketing Tactics: Many traders report being contacted persistently by account managers or brokers, encouraging them to deposit more money or try high-risk trades.

-

Account Freezing: There are instances where accounts were allegedly frozen without clear reasons, leaving investors unable to access their funds.

-

Poor Customer Support: Customers have cited slow, unhelpful, or unresponsive support services, further complicating attempts to resolve issues.

These complaints raise serious questions about the platform’s operational integrity and its treatment of investors.

Security and Privacy Concerns

Security is paramount when dealing with online trading platforms, as users must trust that their personal and financial information is protected. TradeFred.com’s website uses standard SSL encryption, but other aspects of security remain unclear.

Potential concerns include:

-

Data Handling Practices: Limited information about how user data is stored and protected can leave traders vulnerable to identity theft or financial fraud.

-

Payment Methods: Some users report that the platform’s payment channels are limited or involve third-party processors that may not be fully secure.

-

Regulatory Oversight: Without credible regulation, there is no external authority monitoring how TradeFred.com handles funds, making investors’ capital susceptible to misuse.

Online trading requires a high level of trust, and the lack of transparent security protocols undermines confidence in the platform.

Red Flags and Risk Factors

After examining TradeFred.com’s operations, several red flags stand out:

-

Lack of Verifiable Licensing: The absence of legitimate regulatory oversight is a major warning sign.

-

Opaque Corporate Information: Details about the company’s management, headquarters, or operational history are insufficient.

-

Excessive Marketing Promises: The platform heavily promotes high returns, often downplaying associated risks.

-

Negative User Experiences: Multiple reports of withdrawal issues, account freezes, and poor support are consistent across forums.

-

Unclear Terms and Conditions: Policies regarding fees, account types, and bonuses are vague, leaving traders exposed to potential exploitation.

These factors collectively suggest that TradeFred.com may not operate with the level of integrity expected from legitimate brokers.

Why Investors Should Exercise Caution

While online trading platforms can provide profitable opportunities, choosing the wrong broker can lead to significant financial losses. TradeFred.com’s lack of transparency, regulatory oversight, and recurring user complaints make it a high-risk choice.

Investors, especially those new to trading, should prioritize:

-

Verifiable Regulation: Always confirm that a platform is registered with recognized financial authorities.

-

Clear Corporate Information: Legitimate brokers openly share details about their management, office locations, and operational history.

-

Transparent Terms: Ensure account terms, fees, and withdrawal policies are clearly defined.

-

Positive User Feedback: Consider experiences from verified traders to gauge the platform’s reliability.

Choosing a broker that meets these criteria is essential for protecting capital and avoiding unnecessary risks.

Conclusion

TradeFred.com, at first glance, may appear to offer a professional and lucrative trading experience. However, an in-depth review highlights numerous concerns regarding its legitimacy, transparency, and operational practices. From unverifiable licensing to negative user feedback and unclear trading conditions, the platform exhibits multiple red flags that warrant caution.

Investors seeking online trading opportunities should be vigilant, conduct thorough research, and prioritize platforms with proven credibility. TradeFred.com’s pattern of questionable practices and lack of regulatory oversight makes it difficult to trust, and potential users should carefully evaluate the risks before engaging with the platform.

Report. Tradefred.com And Recover Your Funds

-

If you have lost money to tradefred.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like tradefred.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.