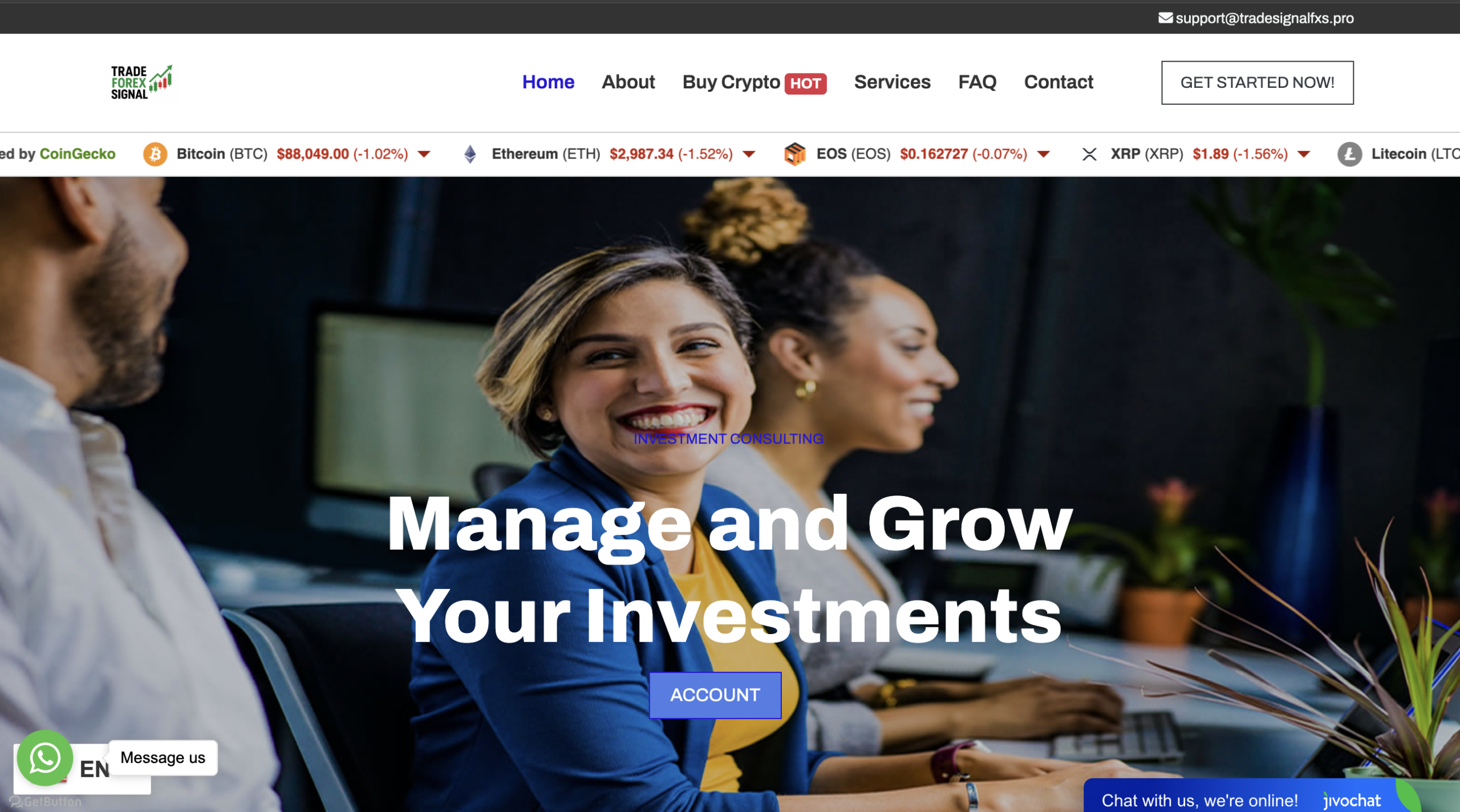

TradeSignalFXs.pro Risk Analysis for Investors

The rise of online investment platforms has given individual investors access to global financial markets like never before. However, this increased accessibility also attracts fraudulent operators who use polished websites and persuasive marketing to lure unsuspecting investors. TradeSignalFXs.pro is one such platform that appears to offer trading services and purported profit opportunities but exhibits numerous traits associated with high‑risk or potentially fraudulent schemes. This review explores the red flags surrounding TradeSignalFXs.pro and explains why investors should avoid this platform.

Aggressive Marketing and Unrealistic Promises

Upon visiting TradeSignalFXs.pro, prospective investors are greeted with bold claims of advanced trading technology, smart signals, and easy profits. The site uses persuasive language that suggests users can quickly generate substantial returns by leveraging its tools and systems. Promises of high profitability, minimal risk, and automated success are common throughout the platform’s promotional material.

While such claims may seem appealing, they should immediately raise suspicion. Financial markets are inherently unpredictable, and no legitimate service can guarantee profits or imply that investment outcomes are reliably positive. Unrealistic return claims without transparent methodology or disclosures about risk are classic hallmarks of risky investment propositions.

Lack of Credible Regulation and Oversight

One of the most crucial aspects of a legitimate investment platform is transparency about its regulatory status. Reputable financial services companies operate under licenses issued by recognised authorities, which enforce standards for transparency, capital protection, and conduct.

TradeSignalFXs.pro fails to disclose any verifiable regulatory authorization. The platform does not provide details of oversight by credible financial authorities, nor does it present licence numbers or registration documentation. This omission means investors have no assurance that the company adheres to recognised financial laws or industry best practices.

Operating without proper regulation removes key accountability mechanisms. Investors on unregulated platforms have limited, if any, legal avenues for dispute resolution or protection if the company engages in misconduct.

Opaque Corporate Identity and Ownership

Transparency about corporate identity — including legal entity names, business addresses, and key executives — is essential for investor confidence. TradeSignalFXs.pro does not provide verifiable corporate information. No clear details are available about the company’s leadership, registered office, or organisational history.

A legitimate financial firm typically lists its corporate registration, provides contact information, and discloses executive leadership. The absence of these basics makes it nearly impossible for investors to assess who is responsible for the platform and where accountability lies.

Hidden ownership and lack of corporate transparency are common traits of high‑risk platforms. They make it difficult for investors to understand who is managing their funds and whether those individuals have the requisite expertise and integrity.

New and Unverified Online Presence

TradeSignalFXs.pro appears to be a relatively new platform without a well‑established online presence. Its digital footprint is limited, and there is little evidence of independent reviews or credible user experiences. In contrast, reputable trading platforms often have a strong online presence, with documented histories, customer reviews, and visibility across financial forums and professional communities.

New domains with minimal history should be approached with caution. Scammers often create fresh platforms to quickly attract deposits and then rebrand or disappear once issues emerge. A lack of long‑standing operational history makes it difficult to evaluate credibility or performance.

Vague Trading Tools and Performance Transparency

The platform markets various trading signals and tools designed to help users make profitable decisions. However, TradeSignalFXs.pro does not provide transparent details about how these tools function, what data sources they use, or how performance is measured. There are no verifiable performance records or audited results available to demonstrate the effectiveness of the signals or automated systems it claims to offer.

Legitimate trading signal services often publish historical performance data, methodologies, and independent audits to support their claims. Without this level of transparency, investors are left guessing about the value and reliability of the services being offered.

Unclear Terms and Conditions

Clear and detailed terms and conditions are essential for any financial service. They define user rights, responsibilities, fee structures, withdrawal processes, and dispute resolution mechanisms. TradeSignalFXs.pro’s terms appear vague, with limited clarity around key elements such as:

-

Fee and commission structures

-

Withdrawal procedures and limitations

-

Customer support processes

-

Risk disclosures and disclaimers

The absence of detailed operational policies prevents investors from making informed decisions. Platforms that obscure or omit key procedural details often do so to avoid accountability when disputes arise.

High‑Pressure Marketing and Urgency Tactics

TradeSignalFXs.pro employs language designed to create urgency, suggesting that opportunities for profit are limited or time‑sensitive. Terms like “act now,” “limited slots,” or “exclusive access” are commonly used to pressure visitors into making quick decisions without conducting proper due diligence.

When platforms appeal to impulse rather than rational evaluation, they bypass critical scrutiny that investors should apply before allocating capital. Sound investment decisions require evaluation of terms, verification of credentials, and an understanding of risks — none of which are supported by high‑pressure messaging.

Unverified Technology Claims

The platform frequently touts its advanced trading algorithms as key to investor success. However, there is no independent verification of this technology. Claims of proprietary systems and cutting‑edge tools remain unsubstantiated due to lack of evidence or third‑party validation.

Without documented performance data, technical specifications, or credible user testimonials, claims about technology superiority serve more as marketing rhetoric than substantiated facts. Investors should be skeptical of platforms that promise technological advantages without proof.

Why These Issues Are Critical

The combination of aggressive marketing, lack of regulation, opaque ownership, minimal operational history, and unverified performance creates a pattern of risk that investors cannot ignore. Trustworthy investment platforms operate under transparent conditions, disclose regulatory status, provide clear terms, and support their claims with independent data.

TradeSignalFXs.pro lacks these fundamental elements. Users have no reliable way to verify promises made on the site or to gauge whether their funds are handled responsibly and ethically.

Conclusion: Avoid TradeSignalFXs.pro

TradeSignalFXs.pro may appear professionally packaged, but its substance does not match the surface. From unrealistic return promises and vague operational details to missing regulatory oversight and hidden corporate identity, the platform displays multiple red flags associated with high‑risk or potentially fraudulent services.

For anyone considering using TradeSignalFXs.pro, the safest course of action is to steer clear. Choosing a legitimate, regulated investment service with verifiable track record and transparent operations is essential for protecting your financial future. When a platform lacks basic accountability measures and fails to substantiate its claims, the risk far outweighs any perceived opportunity.

Your investment decisions should be based on careful evaluation of regulatory compliance, transparent corporate information, verifiable performance metrics, and clear terms and conditions. TradeSignalFXs.pro does not provide these essentials, making it a platform that investors should avoid.

Report Tradesignalfxs.pro And Recover Your Funds

If you have lost money to tradesignalfxs.pro, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like tradesignalfxs.pro continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.