TradeVantageCapital Operational Insights

Online investment platforms continue to multiply, many of them presenting polished websites, bold performance claims, and assurances of professional expertise. While some platforms are legitimate and properly supervised, others rely primarily on marketing language rather than verifiable substance. TradeVantageCapital.com is a platform that fits this second category. Despite appearing professional on the surface, a closer review reveals multiple indicators that should cause potential users to pause and reassess before engaging.

This article examines TradeVantageCapital.com’s claims, operational transparency, and structural shortcomings, and explains why caution is strongly warranted.

How TradeVantageCapital.com Presents Itself

TradeVantageCapital.com positions itself as an online investment and trading service offering access to financial markets such as cryptocurrencies, forex, and other digital or speculative assets. The website promotes concepts such as portfolio growth, expert trading strategies, and simplified investment access for both beginners and experienced users.

The messaging focuses heavily on opportunity and convenience, often using aspirational language designed to appeal to individuals seeking passive income or rapid portfolio expansion. However, while the platform emphasizes potential outcomes, it provides limited concrete information about how those outcomes are achieved or who is accountable for managing user funds.

Lack of Verifiable Company Identity

One of the most immediate issues with TradeVantageCapital.com is the absence of clear, verifiable corporate identity. Legitimate investment firms typically disclose:

-

A registered legal entity name

-

Jurisdiction of incorporation

-

Regulatory license numbers

-

Named directors or executives with traceable histories

TradeVantageCapital.com offers little in the way of independently verifiable business credentials. Company details are either vague, incomplete, or entirely absent. Without a clearly identifiable legal entity, users have no reliable way to confirm who operates the platform or which laws, if any, govern its activities.

This lack of accountability is a major red flag in financial services.

Regulatory Silence Is a Major Issue

Another critical concern is the absence of disclosed regulatory oversight. Platforms that provide investment services, asset management, or trading access are typically required to register with recognized financial authorities in their operating jurisdictions.

TradeVantageCapital.com does not clearly state that it is licensed or authorized by any well-known regulator. There are no license numbers, no regulator names, and no links to official registers. This omission matters because regulation is what enforces standards such as fund segregation, fair marketing, dispute resolution, and consumer protection.

Without regulatory supervision, users are left without formal safeguards if disputes arise or funds become inaccessible.

Marketing Claims Without Supporting Evidence

TradeVantageCapital.com relies heavily on promotional claims related to performance, strategy effectiveness, and financial expertise. However, these claims are not supported by independently verifiable data.

There are no audited performance reports, no third-party assessments, and no transparent explanations of risk management practices. Statements about consistent returns or expert trading appear to be purely marketing-driven rather than evidence-based.

In the investment sector, credible firms substantiate claims with data, disclosures, and risk warnings. When promises are emphasized without documentation, skepticism is justified.

Opaque Investment Structure

Another troubling aspect of TradeVantageCapital.com is the lack of clarity around its investment structure. Key questions remain unanswered:

-

Where are client funds held?

-

Are funds segregated from operational accounts?

-

What trading mechanisms are used?

-

How are profits or losses calculated?

The platform does not provide sufficient detail about these fundamentals. Users are expected to commit funds without fully understanding the mechanics of how their money is handled, which introduces unnecessary and avoidable uncertainty.

Transparency is not optional in financial services—it is essential.

Withdrawal and Control Concerns

Platforms of this nature often emphasize deposits and account creation, while providing minimal detail about withdrawals and fund access. TradeVantageCapital.com does not clearly outline its withdrawal process, timelines, or conditions in a way that is easily accessible and unambiguous.

When withdrawal policies are unclear or buried in vague terms, users may encounter unexpected barriers later. A legitimate platform makes fund access rules explicit from the outset, not after funds have been deposited.

Minimal Independent User Feedback

Another point of concern is the lack of credible, independent user feedback. Established investment services typically accumulate reviews, commentary, or discussion across public forums and review platforms.

TradeVantageCapital.com has little to no verifiable user history in reputable financial communities. The absence of organic discussion or long-term user experience reports makes it difficult to assess real-world outcomes and reliability.

A platform that claims active users and success stories should leave a visible footprint beyond its own website.

Common Patterns That Raise Alarm

When assessing TradeVantageCapital.com holistically, several recurring patterns emerge that are commonly associated with problematic platforms:

-

Strong emphasis on opportunity with limited disclosure

-

Vague or missing company and regulatory information

-

Lack of third-party validation

-

Minimal transparency around fund handling

-

Sparse independent user presence

Individually, some of these issues might be explained away. Collectively, they form a profile that warrants serious caution.

Final Thoughts

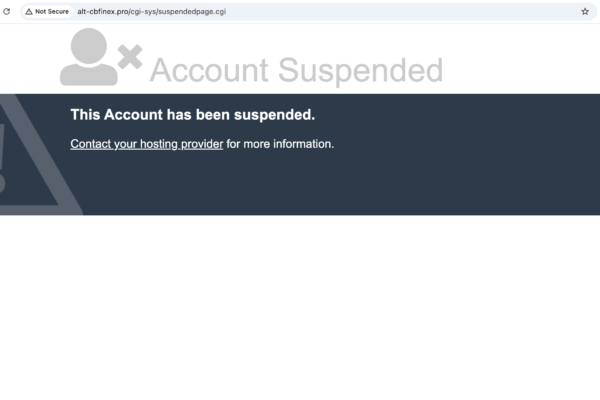

TradeVantageCapital.com presents itself as a modern investment solution, but its presentation does not substitute for transparency, regulation, and accountability. The platform offers promises without proof, services without clear oversight, and opportunities without sufficient explanation of the underlying risks and structures.

For individuals considering online investment platforms, due diligence is essential. That includes verifying regulatory status, confirming corporate identity, understanding fund custody, and reviewing independent user experiences. TradeVantageCapital.com does not currently meet these fundamental standards.

Until clear evidence of legitimacy, regulatory compliance, and operational transparency is provided, engaging with this platform carries significant uncertainty. Caution is not only advisable—it is necessary.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to tradevantagecapital.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as tradevantagecapital.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.