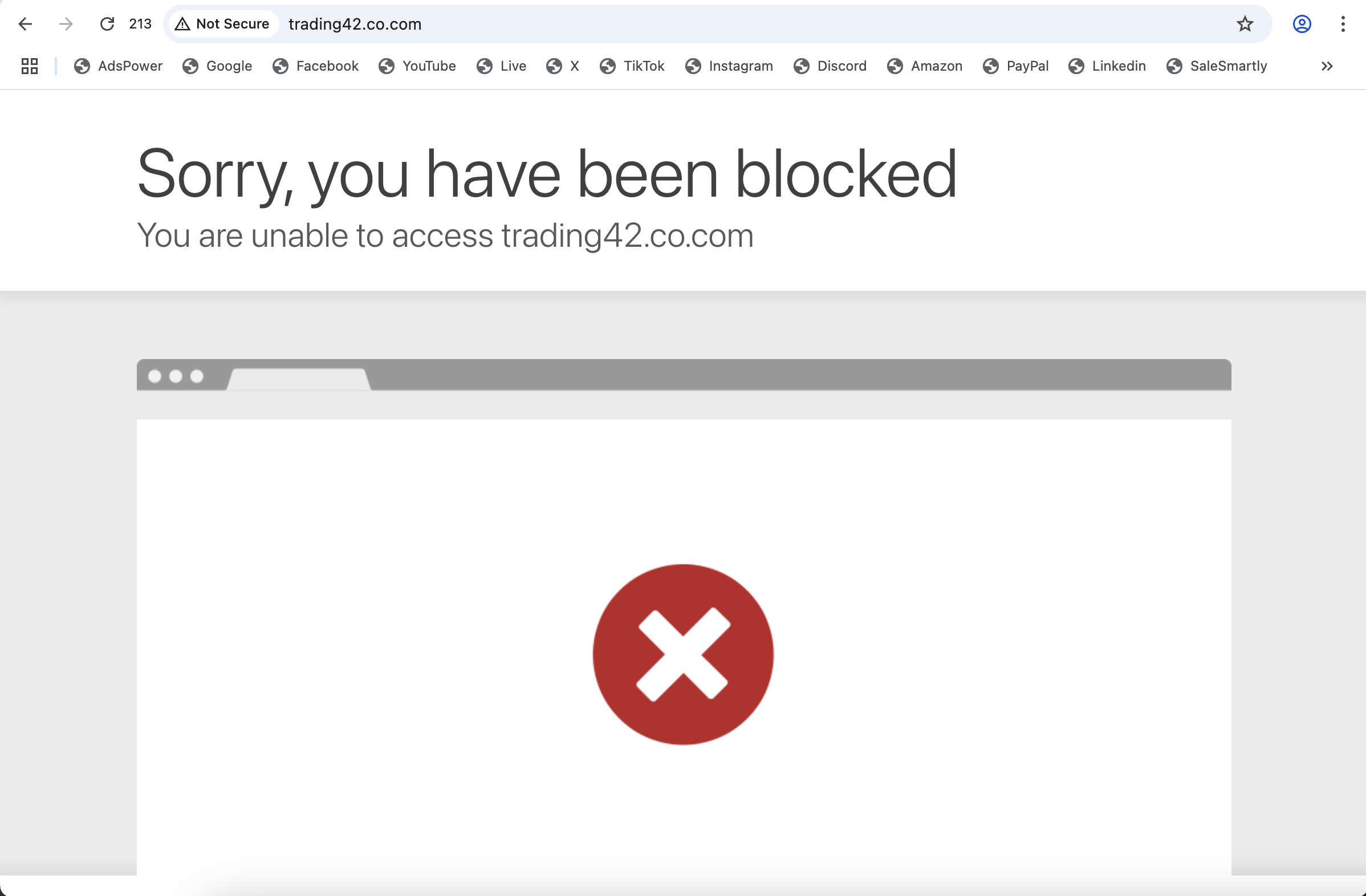

Trading42.co.com Scam Review – A Deceptive Trap Disguised as an Investment Platform

In an era where online trading has become increasingly accessible and widely embraced by both seasoned and novice investors, the market has also witnessed an alarming rise in fraudulent platforms. One such deceitful operation masquerading as a legitimate investment gateway is Trading42.co.com. While it presents itself as a sophisticated and promising online trading platform offering access to a wide array of financial instruments, closer inspection reveals a well-constructed scam built to exploit the hopes, ambitions, and capital of unsuspecting users.

This blog delves deep into the operations of Trading42.co.com, shedding light on its deceptive tactics, fraudulent setup, and manipulative schemes that have led many individuals into financial ruin. It is a cautionary exposé for anyone considering using the platform or others like it.

A Glamorous Facade Hiding a Dark Truth

At first glance, Trading42.co.com attempts to establish credibility by boasting a slick, modern website interface filled with trading charts, professional language, and claims of cutting-edge tools. The homepage is typically adorned with buzzwords like “AI-powered trading,” “real-time market access,” and “24/7 expert support.” To a casual observer or a beginner investor, it can seem like the ideal place to kickstart their trading journey.

However, beneath this glossy exterior lies a dark and manipulative agenda. The platform is not registered with any credible financial regulatory body, and there is no transparency about the company’s ownership, location, or operational procedures. These are the first red flags for anyone with even a basic understanding of legitimate financial services.

The Bait: Luring in Victims with False Promises

Trading42.co.com employs classic social engineering techniques to lure in unsuspecting users. Victims are typically approached through:

-

Cold emails or social media DMs with promises of guaranteed profits or insider tips.

-

Fake testimonials and reviews scattered across forums, review sites, and YouTube videos to build an illusion of credibility.

-

Aggressive affiliate marketing schemes, wherein users are offered commissions for bringing in new clients — a classic Ponzi-style model in disguise.

Once a user signs up, they are immediately welcomed by a “personal account manager” — a term used to create a false sense of legitimacy and personalized service. This individual is often a smooth talker trained in manipulation, whose sole task is to pressure the client into depositing funds under the pretext of maximizing profit potential.

The Deposit Trap

The deposit process on Trading42.co.com is suspiciously simplified. Most legitimate platforms require users to go through multiple verification steps to ensure security and regulatory compliance. On this platform, however, all it takes is a quick email registration, and the user is granted access to a dashboard asking for funds.

Users are urged to make a minimum deposit, often starting as low as $250, but this amount quickly escalates. The so-called account managers use psychological tactics to convince users that higher deposits will yield greater returns. In reality, these deposits go straight into the pockets of the scammers running the operation. There is no actual trading happening behind the scenes — only the illusion of market activity simulated through fake charts and fabricated numbers.

Simulated Profits, Fake Gains

One of the most deceptive strategies used by Trading42.co.com is the simulation of account growth. Shortly after depositing, users begin to see impressive gains on their dashboards. These gains are entirely fabricated — not the result of any real market trades.

The illusion of success is crafted to build trust and encourage further investment. Users often feel emboldened to deposit more funds or refer friends and family, believing they’ve struck gold. The scam thrives on this manufactured optimism.

Some victims even report being allowed to make small withdrawals early on, which serves to build further confidence in the platform. However, once larger withdrawal requests are made, things begin to unravel.

The Withdrawal Nightmare

Withdrawal is where the mask truly begins to slip. Users attempting to retrieve their funds encounter endless roadblocks and fabricated complications. These include:

-

Sudden KYC requirements: Despite no verification being required at the time of deposit, users are suddenly asked to provide extensive documentation for identity verification.

-

Bogus withdrawal fees: Requests are often stalled with claims that taxes or fees must be paid upfront before the funds can be released.

-

Unreachable support teams: Communication slows down or ceases entirely. Emails go unanswered, phone numbers become disconnected, and live chat features stop working.

-

Account freezing: Some users are informed their accounts have been flagged for “suspicious activity” and are frozen indefinitely.

In truth, once a substantial sum has been deposited, the scammers have no intention of returning any money. The withdrawal obstacles are designed to frustrate, delay, and ultimately discourage users from pursuing recovery.

Pressure Tactics and Psychological Manipulation

Beyond financial loss, victims of Trading42.co.com often recount emotionally taxing experiences. The scam’s operators are adept at psychological manipulation, using fear, urgency, and false hope to control their victims.

Users are told their funds are at risk unless immediate action is taken — typically another deposit. When victims express doubt or question the legitimacy of the platform, account managers become defensive or even hostile, accusing users of breaching policy or lacking trust.

In some cases, victims report receiving repeated phone calls from different numbers, sometimes using aggressive tactics, threats of account closure, or promises of “last chance” investment opportunities. This calculated pressure campaign aims to extract as much money as possible before cutting all contact.

The Illusion of Legitimacy

What makes Trading42.co.com particularly dangerous is the level of detail the scammers invest in creating the illusion of a legitimate business. They often:

-

Clone elements from real, regulated trading platforms.

-

Use stolen company registration numbers and display them prominently.

-

Feature fake press releases and articles claiming media coverage.

-

Create fraudulent compliance pages with made-up licensing numbers.

These tactics can easily fool even moderately cautious users, especially those who are new to the world of trading.

After the Scam: Silence and Despair

For many victims, the moment they realize they’ve been scammed is emotionally devastating. Months of savings, retirement funds, or emergency cash vanish without a trace. Attempts to contact the platform result in silence, and victims are left with little recourse.

The psychological impact is profound. Victims often experience shame, guilt, and anxiety. Unfortunately, these feelings are compounded by the fact that fraudulent platforms like Trading42.co.com operate from anonymous offshore jurisdictions, beyond the reach of most law enforcement agencies.

Why Trading42.co.com Must Be Avoided

The evidence is overwhelming: Trading42.co.com is not a legitimate investment platform. It is a well-orchestrated scam designed to steal money under the pretense of online trading. Its operators prey on hope, trust, and financial ambition, leaving behind a trail of financial devastation and emotional scars.

Anyone looking to invest in the financial markets should exercise extreme caution and perform thorough due diligence. A legitimate broker will be regulated, transparent, and open about their operations, licensing, and customer policies. Trading42.co.com fails every one of these basic requirements.

Final Thoughts

The internet is both a gateway to opportunity and a minefield of deception. Platforms like Trading42.co.com exploit the average person’s desire for financial growth, using flashy interfaces and empty promises to lure them into a trap. Recognizing the signs of a scam — lack of regulation, high-pressure sales tactics, simulated profits, and withdrawal obstructions — is essential in today’s digital world.

By exposing platforms like Trading42.co.com, we can help protect others from falling victim and encourage vigilance in the pursuit of financial independence. Let this be a warning, and a reminder, that if something seems too good to be true — especially in the world of online trading — it almost always is.

-

Report Trading42.co.com And Recover Your Funds

If you have lost money to trading42.co.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like trading42.co.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.