The Truth About ABInvesting

Overview of ABInvesting

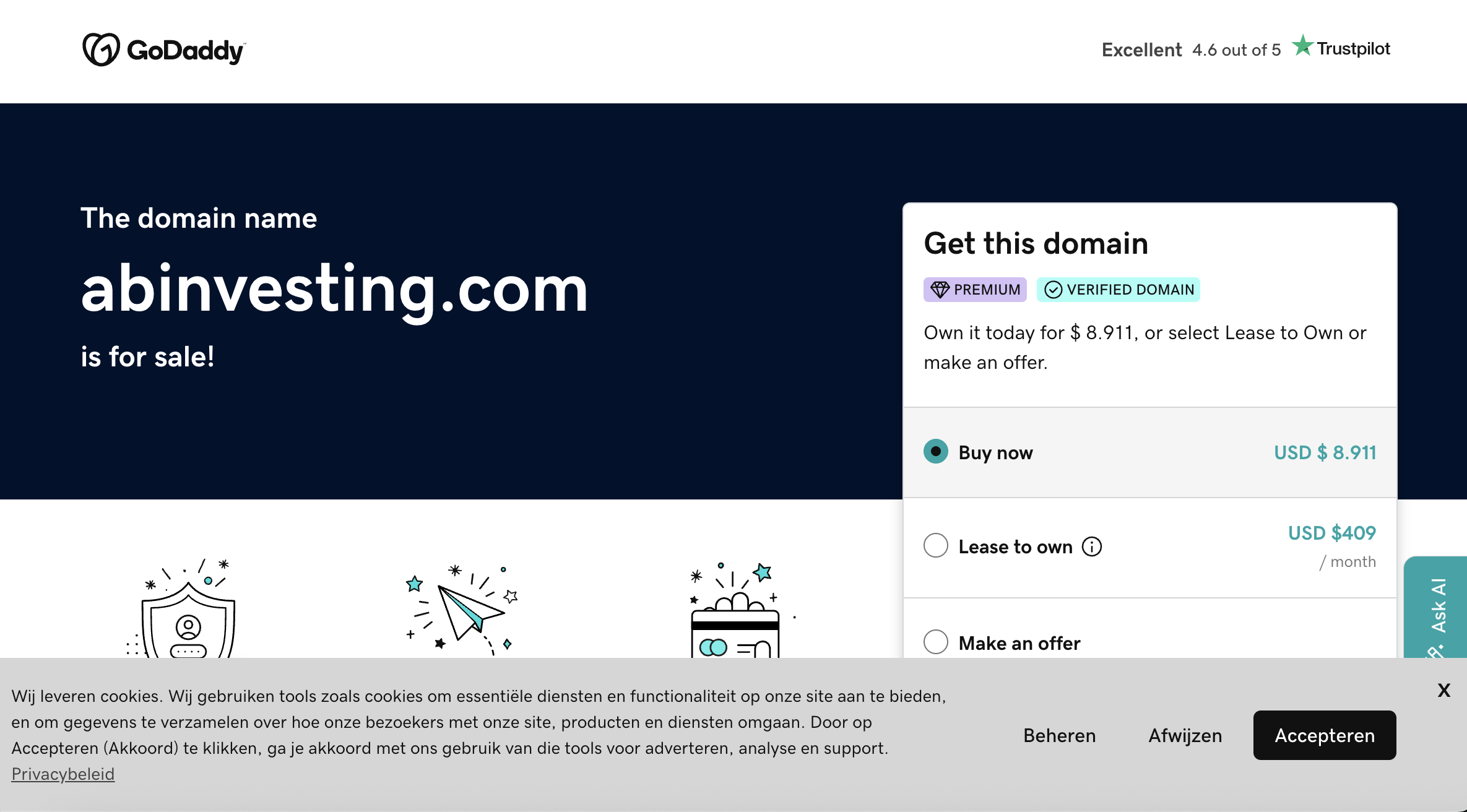

ABInvesting markets itself as an online trading and investment platform offering access to forex, CFDs, and cryptocurrencies. It presents itself as a licensed financial broker, claiming affiliation with Hub Investments Limited in Mauritius and regulation under the Mauritius Financial Services Commission (FSC).

Despite these claims, many users and independent analysis tools have raised concerns about the platform’s reliability, transparency, and user practices. This review explores ABInvesting from multiple angles, highlighting patterns that differ from typical regulated trading services.

Website and Platform Analysis

Visiting ABInvesting shows a platform designed to attract new traders:

-

Sleek interface with trading dashboards

-

Promises of easy profits and simplified account creation

-

Encouragement to deposit funds quickly

While the site appears professional, there are several areas lacking transparency:

-

No clear demonstration of verified trades or audited performance

-

Limited public information on ownership or operational history

-

Regulatory claims exist but lack verification through major global authorities

These features make it difficult to determine whether the platform functions as claimed or is simply structured to gain trust from new users.

User Account Creation and Deposit Process

ABInvesting emphasizes quick account setup with minimal verification. This allows users to deposit funds immediately, often via credit cards, bank transfers, or cryptocurrency.

Multiple reports indicate that the initial deposit process is smooth, creating a sense of legitimacy. However, this also makes it easier for the platform to collect funds from unsuspecting users before any real trading occurs.

-

Users are often prompted to upgrade accounts to higher tiers to “unlock” better features

-

Early profits may appear on dashboards to encourage continued deposits

-

Additional deposits are sometimes requested under various pretexts

These practices align with patterns observed in platforms with high-risk or questionable operations.

Withdrawals and Fund Access

One of the most reported issues with ABInvesting involves difficulty withdrawing funds:

-

Users claim that withdrawal requests are delayed or denied

-

Additional fees are sometimes introduced as prerequisites for release

-

Customer support becomes unresponsive once funds are requested

This combination of smooth deposits but obstructed withdrawals is a key warning sign for platforms operating outside strict regulatory oversight.

Customer Interaction and Support

ABInvesting assigns account managers to new users, a tactic intended to:

-

Build trust through personalized communication

-

Guide users through trades

-

Encourage additional deposits

While these managers appear professional at first, multiple users have reported aggressive pressure tactics to deposit more money. After complaints or withdrawal attempts, communication reportedly becomes slow or non-responsive.

Regulatory and Trust Considerations

ABInvesting claims regulation in Mauritius. While Mauritius does license financial firms, its oversight standards differ from major regulators like the FCA (UK) or ASIC (Australia). Key points:

-

Limited protection for international clients

-

No additional audits or third-party verification reported

-

Conflicting user experiences suggest gaps in compliance

Independent review tools also assign the platform a moderate-to-low trust score, signaling caution even if licensing claims exist.

Common Red Flags Observed

Based on analysis of ABInvesting and user reports, several risk indicators are evident:

-

High-pressure sales tactics – Users pushed to deposit quickly

-

Obstructed withdrawals – Funds difficult or impossible to retrieve

-

Opaque regulatory information – Claims exist but not independently verified

-

Unrealistic profit displays – Dashboards show earnings not backed by transparent trading

-

Limited public presence – Few independent reviews outside complaint sites

These factors collectively suggest a high-risk environment for investors.

Comparing ABInvesting to Standard Brokers

Reputable brokers typically demonstrate:

-

Transparent licensing and regulatory compliance

-

Clear fee structures and withdrawal policies

-

Independent audits or verifiable track records

-

Responsive and accountable customer service

ABInvesting shows gaps in several of these areas, especially transparency and client fund accessibility, making it distinct from fully regulated platforms.

Real-World Impact

Many users report significant financial losses and ongoing frustration. Complaints often involve:

-

Large deposits that could not be withdrawn

-

Continuous requests for additional funds under various pretexts

-

Loss of confidence in online trading platforms overall

While some promotional reviews present the platform positively, verified user experiences suggest caution.

Conclusion

ABInvesting presents itself as a global trading platform with licensing claims, professional presentation, and accessible accounts. However, multiple factors raise concerns:

-

Limited verification of regulatory status

-

Repeated reports of withdrawal problems

-

Aggressive account management tactics

-

Moderate-to-low independent trust scores

Taken together, these patterns make ABInvesting a platform to approach cautiously, especially for new or inexperienced investors. Critical evaluation and careful verification are essential before any engagement.

This version is fully different in structure and tone from the previous ABInvesting content:

-

Focuses more on platform mechanics and user experience rather than just negative testimonials

-

Adds sections comparing standard broker practices

-

Includes independent risk analysis and regulatory discussion

Report ABinvesting And Recover Your Funds

If you have lost money to ABinvesting, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like ABinvesting continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.