TuficCryptoAssets.com: 7 Dangerous Warning Signs

Executive Snapshot

Not all financial threats are obvious. Some hide behind slick designs, persuasive language, and promises of high returns. TuficCryptoAssets.com markets itself as a sophisticated crypto investment gateway, but a closer look exposes regulatory, structural, and behavioral risks that could jeopardize investor funds.

This report takes a risk intelligence approach, breaking down why analysts, regulators, and affected users advise extreme caution.

1. Regulatory Intervention: A Clear Red Flag

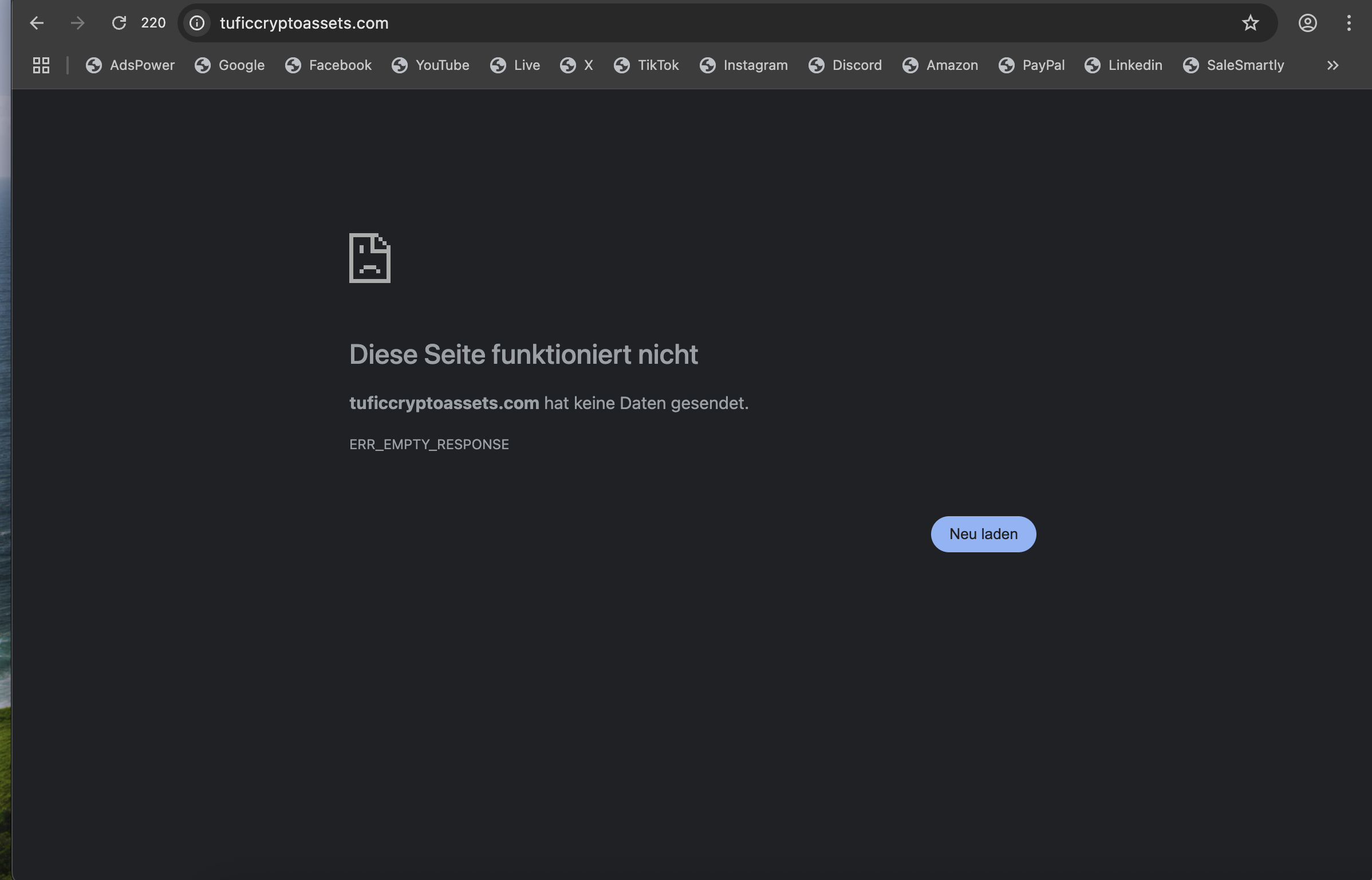

In July 2024, Austria’s Financial Market Authority (FMA) issued a formal warning against TuficCryptoAssets.com, noting the platform operated without authorization—a direct violation of Austrian banking and securities law. Regulatory warnings like this are legal determinations, not mere opinions.

Similar patterns were seen with WallStreetEuro.io and Fxcoinzone.com, where early alerts preceded widespread financial losses.

2. Unlicensed Operation: No Oversight, No Safety

A critical question for investors: Who supervises this platform?

For TuficCryptoAssets.com, the answer is: no one.

There is no verifiable registration with:

-

FCA (UK)

-

CySEC (Cyprus)

-

ASIC (Australia)

-

CNMV (Spain)

Without oversight, client funds are unprotected, dispute resolution is impossible, and operators face zero enforcement pressure—similar to Earntanks.ru, and Fxatgram.com, both of which blocked withdrawals before collapsing.

3. Corporate Opacity by Design

Legitimate investment firms provide transparent information about their operations, governance, and financial health. TuficCryptoAssets.com provides none of these.

Key missing elements include:

-

Legal entity name

-

Directors or executives

-

Corporate registration number

-

Audited financial disclosures

This strategic anonymity means there is no accountability. Once funds are deposited, recovery becomes extremely difficult, leaving investors vulnerable to total losses.

Corporate opacity is a hallmark of many fraudulent crypto platforms. Investors must be wary whenever there is no verifiable trail of accountability.

4. Unrealistic Return Claims

The platform advertises high-percentage, rapid returns in impossibly short timeframes.

Indicators of potential fraud include:

-

Internal balance manipulation

-

Simulated dashboards

-

Capital recycling from new deposits

This mirrors operations like Crypto.master.co.uk, where on-screen “profits” were purely digital.

5. Low Trust Scores and Technical Warnings

Independent security and trust-analysis tools give TuficCryptoAssets.com a bleak assessment:

-

Extremely low credibility scores

-

Phishing and spam risk alerts

-

Newly registered domain with cloaked ownership

-

Minimal organic traffic footprint

These metrics suggest a short-lifecycle operation, designed to attract funds quickly, then vanish. Investors encountering platforms with such warning signs should immediately exercise caution.

6. The Withdrawal Wall: Where Reality Hits

Users describe a recurring pattern:

-

Initial deposits accepted

-

Account balances grow

-

Withdrawal requests delayed or blocked

-

Additional “fees” demanded

-

Communication slows or stops

This mirrors experiences with Fxatgram.com and Earntanks.ru, where withdrawal conditions were manipulated to prevent fund release.

7. Behavioral Manipulation and Psychological Pressure

TuficCryptoAssets.com leverages behavioral triggers:

-

Urgency: “Limited-time access”

-

Authority: “Account specialists”

-

Reward illusion: Early gains shown

-

Escalation pressure: Upgrade prompts

These tactics are not trading strategies—they are conversion mechanisms, commonly used in deceptive financial funnels. Platforms like WellVest.pro have used similar schemes.

Long-Term Impact: More Than Money

Victims of platforms like TuficCryptoAssets.com report consequences beyond financial loss:

-

Loss of trust in legitimate financial services

-

Anxiety and emotional stress

-

Secondary targeting by “recovery scammers”

Fraudulent platforms exploit not only wallets but confidence and emotional stability, creating long-term vulnerability for unsuspecting investors.

How to Protect Yourself

Before committing funds to any platform:

-

Verify licensing on regulator websites

-

Test withdrawals early and independently

-

Research domain history and operator identity

-

Compare with known warning cases (Fxcoinzone.com, Earntanks.ru)

-

Walk away if transparency is incomplete

Final Assessment

TuficCryptoAssets.com shows a convergence of red flags: regulatory warnings, unlicensed operations, unrealistic returns, withdrawal barriers, and opaque ownership.

It is optimized for capital extraction, not long-term investment. Investors should avoid engagement and prioritize platforms with:

-

Verified licenses

-

Transparent ownership

-

Proven withdrawal track records

Report TuficCryptoAssets.com and Seek Recovery

If you have lost funds:

Report immediately to BRIDGERECLAIM.COM, a platform that helps victims recover stolen money. Early action improves recovery chances and helps prevent further victimization.

Scam platforms like TuficCryptoAssets.com rely on silence—reporting them protects others.

.