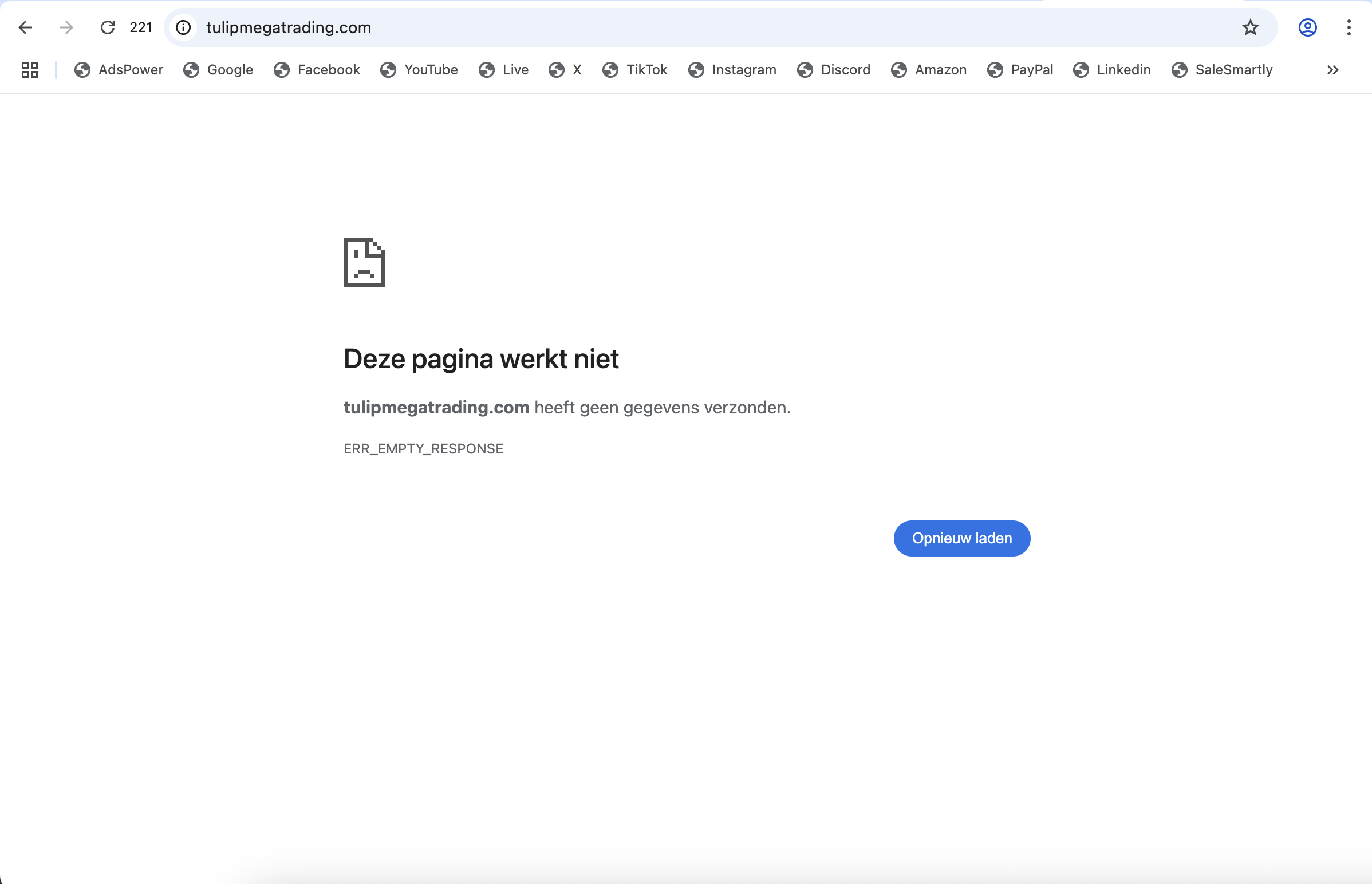

Tulip Mega Trading Scam Review: Recognize the Warning Signs

When evaluating an investment platform, transparency, licensing, and credibility matter most. In the case of Tulip Mega Trading, these fundamental elements are lacking—replaced instead by a facade of legitimacy with no substance.

1. Formal Regulatory Warning Issued

The UK Financial Conduct Authority (FCA) has officially warned that Tulip Mega Trading is operating without authorization. This means it is not permitted to offer investment services in the UK—and dealing with it could bring legal and financial risks.

wikiinvest.net

Such warnings are not issued lightly. They indicate that the firm is operating outside legal frameworks and lacks proper oversight to protect investors.

2. Extremely Low Trust Score from ScamDoc

ScamDoc gives tulipmegatrading.com a very low trust score of just 6%, citing multiple concerns:

-

Domain was registered recently (April 2024), with an expiration soon pending.

-

Ownership information is hidden, offering no transparency.

-

The associated website is likely to have a short lifespan.

Scamdoc

Domains designed to vanish quickly are a hallmark of scam operations rather than legitimate, long-term services.

3. Lists of Red Flags Confirmed by Multiple Sources

Platforms like WikiInvest and Invest-Reviews call out serious red flags:

-

No proper regulatory licensing in any jurisdiction.

-

Fraudulent claims of being licensed in countries like the USA, UK, Australia, and Canada.

-

No transparency: anonymous operation and absence of verified terms or conditions.

wikiinvest.netInvestReviews

Absence of real licensing and ownership is the core of investment fraud.

4. Nontransparent Trading Terms and No Consumer Protection

According to ForexBrokerz, key trading parameters—such as minimum deposits, withdrawal fees, or volume requirements—are unspecified, making it difficult to trust the platform’s terms.

ForexBrokerz.com

This opaque approach often disguises hidden fees, misleading profit claims, and substantial withdrawal barriers.

5. Lack of Regulation with Elevated Risk Indicators

WikiFX assigns Tulip Mega Trading a score of 0/10, labeling it as “high potential risk” and explicitly mentioning a lack of regulation.

WikiFX

This aligns with the regulatory alert and positions the platform firmly within the high-risk zone for investors.

6. Scam Tactics Match Known Patterns

Common fraudulent maneuvers identified across reports include:

-

Promises of double-digit or guaranteed returns.

-

Anonymous domain ownership and no verifiable staff.

-

Websites with poor uptime or sudden disappearance.

-

Copy-paste terms, generic graphics, and no user reviews.

InvestReviewswikiinvest.net

Ibisik – Reviews Zone

These are textbook warning flags that signal scam platforms rather than legitimate brokers.

7. Community Consensus Reflects Skepticism

Reddit discussions emphasize:

“If the domain is only a few months old, it usually means it’s a scam.”

“If you’re being pressured or contacted via Telegram or social media to invest—very likely a scam.”

Additionally, platforms without verifiable trading records (via Myfxbook or similar services) are essentially untrustworthy in the eyes of experienced community members.

Reddit

These insights reflect real-world wisdom that should guide investing decisions.

8. The Real Risks at Stake

Engaging with a platform like Tulip Mega Trading could expose you to:

-

Total financial loss, with little to no chance of recovery.

-

Personal data misuse, including identity fraud or phishing risks.

-

Emotional distress, from trust violations and lack of recourse.

-

Legal exposure, since you’re dealing with an unauthorized operator.

Without regulation, transparency, or accountability, you’re effectively entering uncharted—and dangerous—territory.

9. How to Protect Yourself

If you’re evaluating an online investment platform, prioritize these steps:

-

Check for regulatory licensing via official authority websites (FCA, ASIC, CySEC, etc.).

-

Look for domain history and transparency—hidden ownership and recent registration are red flags.

-

Read independent reviews from reputable sources—avoid marketing claims.

-

Test your withdrawals with small investments first.

-

Trust your instincts—if something triggers uncertainty, step away.

Final Verdict: Steer Clear of TulipMegaTrading.com

Between the FCA warning, scam analysis scoring, lack of regulatory oversight, vague operating terms, and echoing community skepticism—Tulip Mega Trading is overwhelmingly a high-risk operation that should be avoided entirely.

Your financial security deserves platforms built on integrity, transparency, and legitimacy—this site offers none of that. When in doubt, hesitate. Protect your peace of mind as fiercely as your capital.

-

Report Tulipmegatrading.com And Recover Your Funds

If you have lost money to tulipmegatrading.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like tulipmegatrading.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.