UMICoin Review – A Deep Look at the Risks and Red Flags

Online investing continues to grow rapidly. However, alongside legitimate opportunities, the number of deceptive platforms has also increased. As a result, investors must exercise caution before committing funds to any digital asset project. One platform that has raised concerns among analysts and online watchdog communities is UMICoin.

In this detailed review, we examine UMICoin’s claims, structure, transparency, and warning signs. More importantly, we explain why many experts classify the platform as high risk and potentially misleading.

What UMICoin Claims to Offer

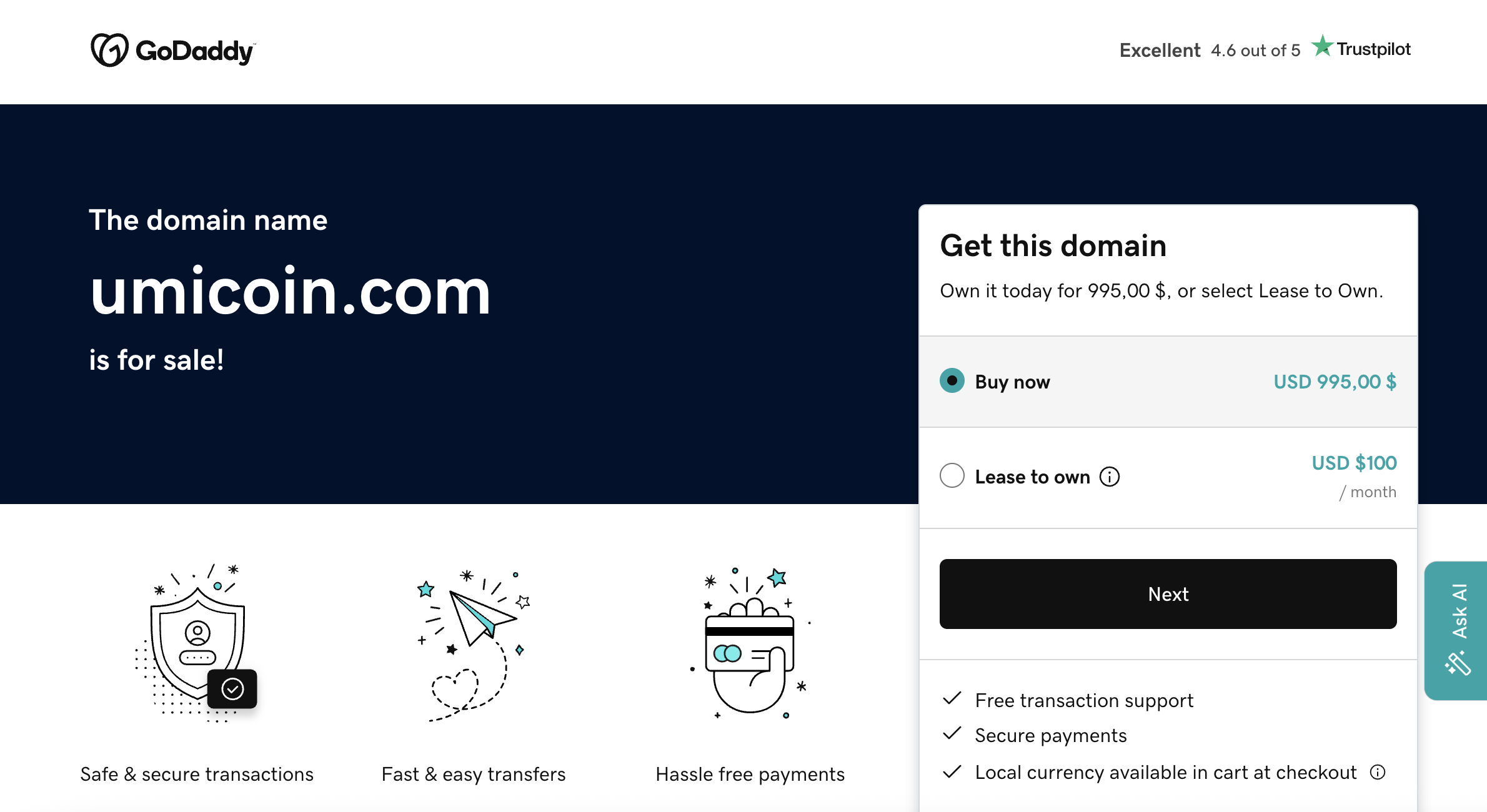

At first glance, UMICoin presents itself as a modern digital asset project. The platform promotes its token as an innovative financial opportunity tied to blockchain technology. In addition, it suggests that users can participate in trading, earn returns, or benefit from long-term growth.

Moreover, UMICoin uses polished visuals, technical language, and market-focused terminology to appear credible. These elements, therefore, create the impression of a sophisticated crypto investment platform.

However, appearances alone do not determine legitimacy. Consequently, investors must look beyond marketing claims and evaluate what the platform actually provides.

Initial Concerns About UMICoin

When investors analyze a platform, they typically expect transparency, verifiable ownership, and regulatory clarity. Unfortunately, UMICoin does not meet these expectations.

Specifically, the platform fails to provide:

-

Confirmed company registration details

-

Regulatory licenses or oversight information

-

Audited financial data

-

Public leadership profiles

As a result, investors cannot easily verify who operates UMICoin or how it manages funds. Therefore, this lack of accountability immediately raises concern.

Why Analysts View UMICoin as High Risk

Financial analysts and scam-tracking communities evaluate platforms based on patterns rather than promises. For that reason, they examine structure, disclosures, and behavior over time.

UMICoin appears on several high-risk monitoring lists. Furthermore, analysts associate it with common scam indicators seen in previously exposed crypto schemes. While inclusion on such lists does not automatically confirm fraud, repeated flags across multiple databases significantly increase concern.

Consequently, UMICoin’s reputation among security researchers remains poor.

Common Scam Patterns Relevant to UMICoin

To understand the risks, it helps to review common tactics used by fraudulent investment platforms. Notably, UMICoin aligns with several of these patterns.

1. Overemphasis on Profit Potential

Scam platforms often focus heavily on gains while downplaying risk. Similarly, UMICoin highlights growth potential but offers little explanation of market volatility or loss scenarios.

In legitimate investing, returns and risks receive equal attention. Therefore, one-sided messaging strongly suggests manipulation.

2. Absence of Regulation

In most jurisdictions, investment services must register with financial authorities. However, UMICoin does not display proof of regulatory oversight. As a result, users lack formal protection.

3. Unclear Corporate Identity

Legitimate companies publish ownership details, executive teams, and operational addresses. In contrast, UMICoin provides vague or missing corporate information, making verification difficult.

4. Technical Language Without Substance

Although UMICoin uses blockchain terminology, it does not explain its technology in verifiable detail. Consequently, users must rely on trust rather than evidence.

Transparency and Communication Issues

Transparency plays a critical role in financial trust. Therefore, platforms must clearly explain how they operate, how funds are handled, and how users can seek support.

UMICoin’s communication raises multiple concerns:

-

Generic support contact methods

-

No verifiable physical address

-

Limited legal documentation

Moreover, platforms that fail to provide reliable communication channels often struggle with accountability. As a result, users face higher risk if disputes arise.

Community Observations and Platform Reputation

Although UMICoin does not appear on major consumer review websites with extensive testimonials, its presence on scam-monitoring databases remains significant. Importantly, these databases rely on technical analysis, reported behaviors, and platform similarities.

In many comparable cases, early warnings appear before widespread complaints emerge. Therefore, absence of reviews does not indicate safety. Instead, it may signal that the platform operates quietly to avoid scrutiny.

Meanwhile, experienced analysts continue to group UMICoin with other unverified crypto schemes.

How Crypto Scams Typically Operate

Understanding scam mechanics helps investors avoid losses. Generally, fraudulent crypto platforms rely on psychology and urgency rather than transparency.

Selective Information Disclosure

Scammers share only favorable information. Meanwhile, they hide risks, fees, or operational weaknesses.

Professional Appearance

Modern scams often use clean designs and technical graphics. Consequently, visual quality no longer guarantees legitimacy.

Withdrawal Restrictions

In many scam cases, users face withdrawal delays or additional requirements. Eventually, access to funds becomes impossible.

Referral-Driven Growth

Some platforms focus more on recruitment than actual product value. As a result, sustainability depends on new deposits rather than genuine returns.

UMICoin shows similarities to these behaviors, which further increases risk concerns.

Lack of Proof Supporting UMICoin’s Claims

Legitimate platforms support claims with documentation. For example, they publish audits, compliance certificates, and third-party assessments.

UMICoin, however, provides none of the following:

-

Independent security audits

-

Public financial statements

-

Verified partnerships

-

Regulatory filings

Therefore, users must trust marketing claims without evidence. In finance, this imbalance strongly favors the platform and disadvantages investors.

Questions Every Investor Should Ask

Before investing in any crypto project, investors should evaluate key factors. For example:

-

Who owns and operates the platform?

-

Is the business registered and regulated?

-

Are financial results independently verified?

-

Does the platform explain risks clearly?

-

Can users verify claims through third parties?

UMICoin fails to provide convincing answers to several of these questions. Consequently, cautious investors should hesitate.

Specific Red Flags Identified in UMICoin

No Verifiable Registration

UMICoin does not publish a company registration number or legal jurisdiction. Without registration, regulatory accountability does not exist.

Anonymous Management

The absence of named founders or executives prevents users from assessing credibility or experience.

Unclear Revenue Model

UMICoin does not explain how it generates profits. As a result, return claims remain speculative.

No External Audits

Independent audits protect users. Unfortunately, UMICoin offers no such assurance.

Why These Issues Matter

When investors deposit funds, they trust platforms to act responsibly. Therefore, transparency, regulation, and oversight matter deeply.

Platforms lacking these safeguards expose users to:

-

Financial loss

-

Data misuse

-

Lack of legal recourse

Consequently, investing without verification significantly increases risk.

Safer Investment Practices

Instead of engaging with unverified platforms, investors should:

-

Choose regulated exchanges

-

Verify corporate history

-

Review audited results

-

Avoid guaranteed returns

Moreover, taking time to research saves money and stress in the long run.

Final Verdict on UMICoin

Overall, UMICoin presents multiple warning signs that investors should not ignore. Although it markets itself as a crypto opportunity, it fails to demonstrate transparency, regulation, or accountability.

Therefore, based on available information and recognized scam patterns, UMICoin appears to be a high-risk platform that investors should approach with extreme caution.

In conclusion, protecting your capital starts with due diligence. Choosing transparent, regulated platforms remains the safest path in digital investing.

Report Umicoin And Recover Your Funds

If you have lost money to umicoin, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like umicoin continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.