UnitedKingdomLoans.co.uk: Insights for Borrowers

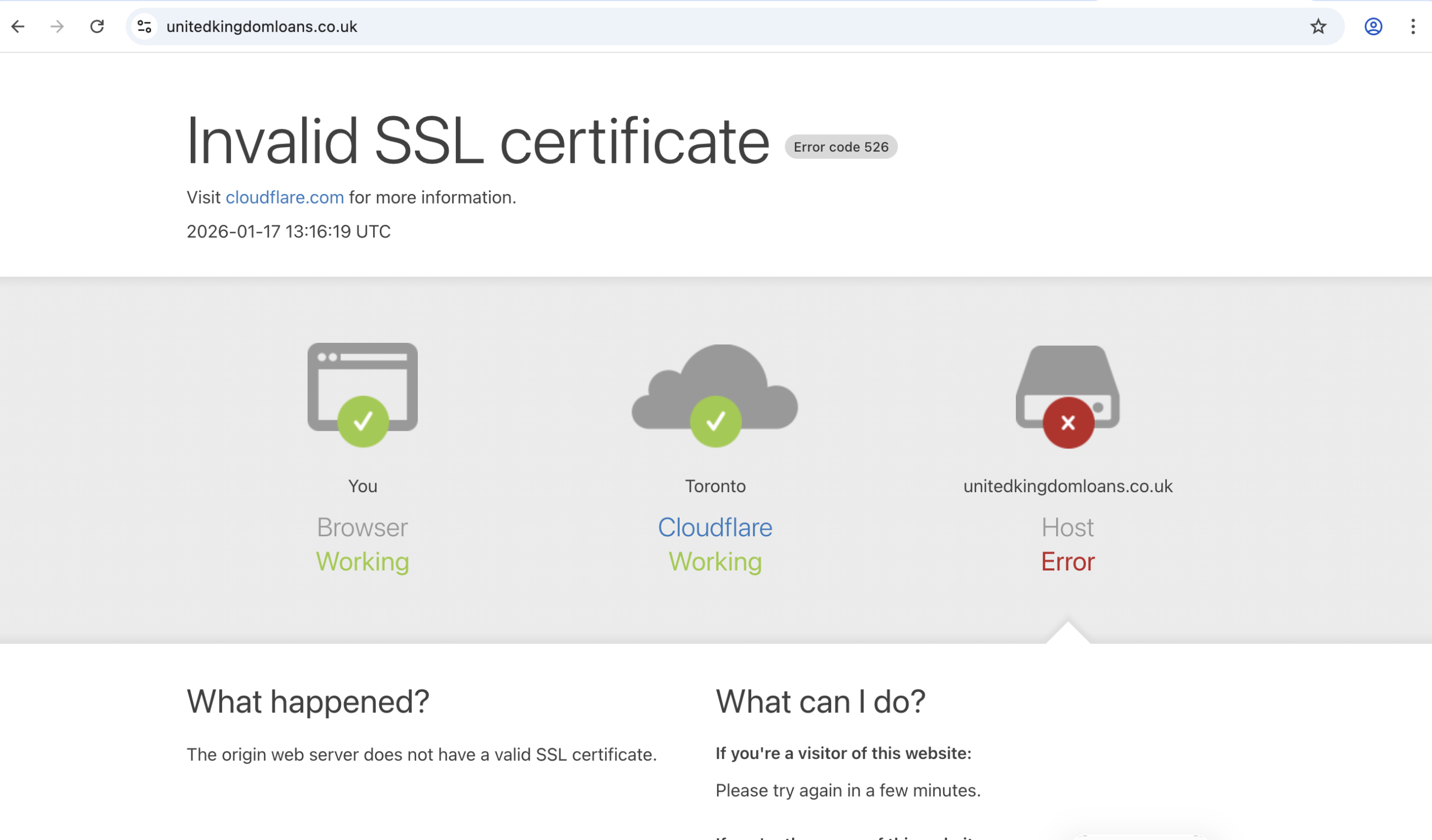

In today’s digital age, online loan platforms have become a popular way for individuals to access quick financing. However, not all platforms operate with integrity or transparency. UnitedKingdomLoans.co.uk is one such platform that has raised significant concerns. This detailed review explains why it is advisable to avoid this platform and highlights the reasons for caution.

What Is UnitedKingdomLoans.co.uk?

UnitedKingdomLoans.co.uk presents itself as an online lending service offering personal loans to UK residents. The website claims to provide fast approvals, competitive interest rates, and flexible repayment terms. It markets itself as a convenient solution for those needing immediate financial assistance.

While the idea of quick and accessible loans is appealing, UnitedKingdomLoans.co.uk exhibits several warning signs that suggest it may not be a trustworthy service.

Lack of Transparency

One of the most significant red flags is the platform’s lack of transparency regarding its ownership and operations. The website provides little to no information about the company behind the service, its physical address, or licensing details. Legitimate lending platforms typically disclose these details to build trust and comply with regulatory requirements.

Without clear information about who operates UnitedKingdomLoans.co.uk, it is difficult to verify the platform’s legitimacy or hold it accountable.

Unclear Terms and Conditions

UnitedKingdomLoans.co.uk offers vague and confusing terms and conditions. Important details such as interest rates, fees, and repayment schedules are not clearly outlined. This lack of clarity can lead to borrowers facing unexpected charges or unfavorable loan terms.

Transparent and fair lending practices require clear communication of all loan conditions upfront. The absence of this transparency is a serious concern.

Absence of Regulatory Approval

In the UK, legitimate lenders must be authorized and regulated by the Financial Conduct Authority (FCA). This regulatory oversight ensures that lenders adhere to strict standards designed to protect consumers.

UnitedKingdomLoans.co.uk does not provide any verifiable information about FCA authorization or regulation. The lack of regulatory approval means there is no external oversight to protect borrowers from unfair practices.

Poor Customer Support and Communication

Reliable lending platforms prioritize customer service and clear communication. However, users report difficulty contacting UnitedKingdomLoans.co.uk for support or inquiries. Unresponsive or evasive customer service is a common trait among unreliable or deceptive platforms.

User Complaints and Negative Experiences

Many users have shared negative experiences related to UnitedKingdomLoans.co.uk. Common complaints include unexpected fees, difficulty canceling loans, and problems with withdrawing funds. These reports suggest that the platform may not operate with the borrower’s best interests in mind.

Why You Should Avoid UnitedKingdomLoans.co.uk

Given the lack of transparency, unclear terms, absence of regulatory oversight, and poor customer service, UnitedKingdomLoans.co.uk poses significant risks to borrowers. Engaging with this platform could lead to financial loss, unfair loan conditions, and difficulty resolving issues.

How to Protect Yourself

- Always verify that a lender is authorized by the FCA before applying for a loan.

- Read all terms and conditions carefully and seek clarification on any unclear points.

- Research reviews and feedback from multiple independent sources.

- Use reputable and regulated lending platforms with transparent practices.

- Avoid platforms that pressure you into quick decisions or upfront payments.

Conclusion: Steer Clear of UnitedKingdomLoans.co.uk

UnitedKingdomLoans.co.uk exhibits many warning signs typical of unreliable and potentially deceptive lending platforms. Its lack of transparency, unclear loan terms, absence of regulatory approval, and poor customer support indicate that it is not a safe choice for borrowers.

For anyone seeking a loan, prioritizing regulated, transparent, and customer-focused lenders is essential. Avoiding UnitedKingdomLoans.co.uk is a wise decision to protect your financial well-being and ensure you receive fair and honest lending services. In the complex world of online loans, vigilance and informed choices remain the best safeguards.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to unitedkingdomloans.co.uk, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as unitedkingdomloans.co.uk continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.