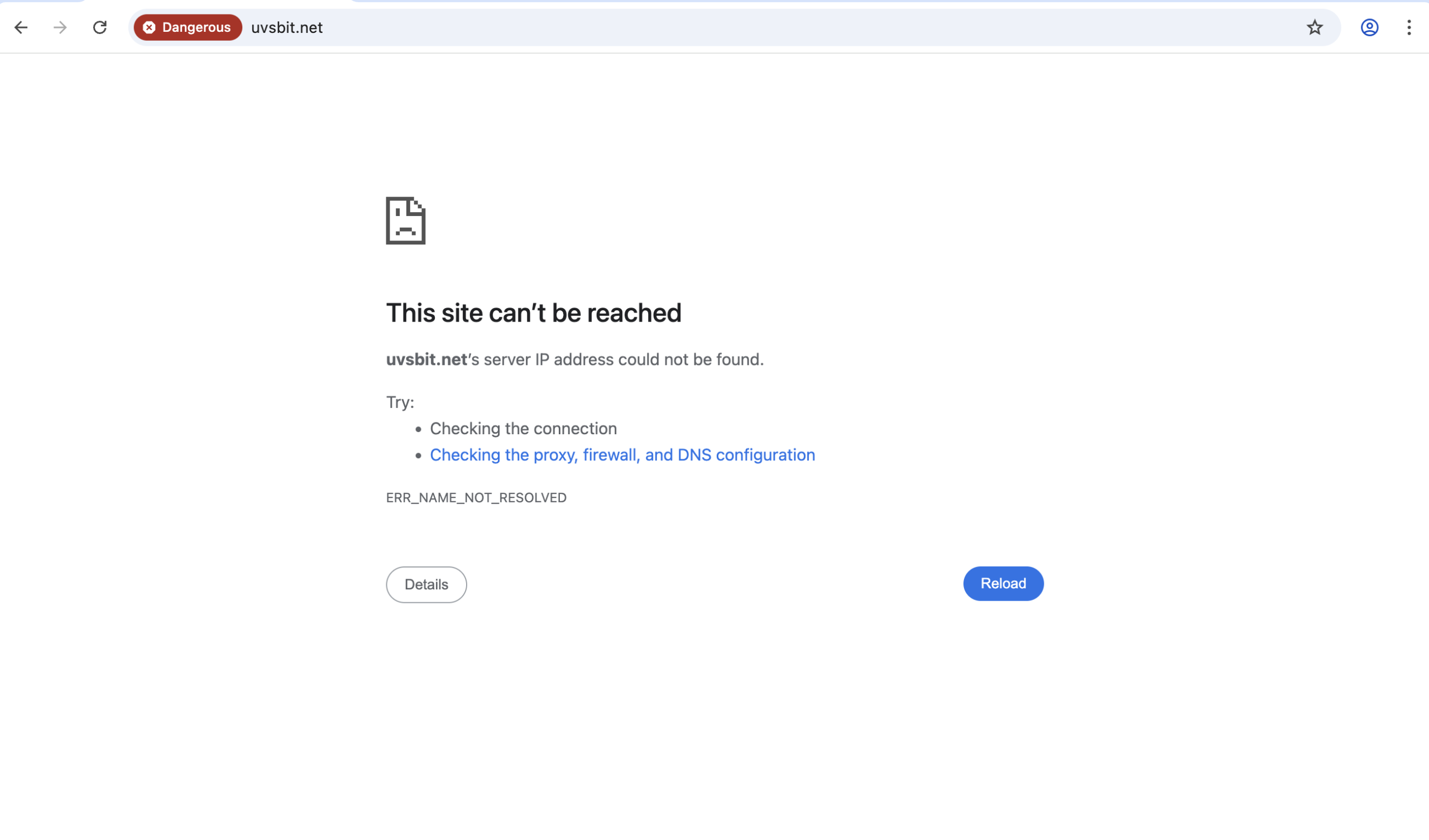

UVSBit.net User Complaints Reviewed

UVSBit.net presents itself as a platform for trading and investment services that target participants across the cryptocurrency and financial markets. On paper, its branding and web interface may give an impression of legitimacy, but a closer look at user experiences, regulatory statements, and public review data paints a worrying picture about how this platform operates. Here’s a detailed look at the major issues that prospective users should be aware of before considering any involvement.

1. Strongly Negative User Experiences

One of the clearest indicators of how a platform functions in practice is the firsthand feedback from people who have interacted with it. On review sites like Trustpilot, UVSBit.net has received extremely low evaluations, with users consistently reporting blocked accounts, aggressive deposit pressure, unresponsive customer service, and withdrawal problems. These complaints are not isolated — all available public reviews on that platform are 1-star ratings describing experiences where users lost access to their funds and felt misled by the service.

For example, reviewers describe being bombarded with calls pushing for deposits and then finding their accounts inaccessible when attempting to withdraw money — a pattern many financial watchdogs associate with exploitative schemes rather than legitimate trading services.

2. Lack of Financial Regulation and Licensing

Regulatory oversight is one of the most critical safeguards for anyone entrusting funds to a trading or investment platform. Without it, users have no formal authority they can turn to if disputes arise or funds are mishandled.

The BC Securities Commission (BCSC) has explicitly placed UVSBit on its Investment Caution List, noting that the entity is not registered with the regulator. This means it is operating outside recognized legal frameworks for financial services in at least some jurisdictions — a significant concern for anyone considering placing money with the platform.

Platforms without clear registration or licensing are typically unable to meet basic compliance standards like segregated client funds, audited financials, and dispute resolution mechanisms — all of which exist to protect investors.

3. Opaque Ownership and Limited Transparency

A reputable financial service typically discloses key details about who runs the business, where it’s headquartered, and how it is regulated. In contrast, UVSBit.net does not provide transparent ownership information. Public domain records show that WHOIS registration data for UVSBit.net is privacy-protected and does not reveal the actual entity controlling the platform, making accountability difficult to establish.

This sort of anonymity may be common for domain privacy protection, but in the context of a platform handling investor funds, it significantly increases the risk for users.

4. Young Domain and Minimal Track Record

UVSBit.net is also a newly registered domain with minimal public history. While a young domain alone doesn’t prove wrongdoing, financial platforms with credible operations typically have a longer public record to assess — including historical performance data, independent evaluations, and user communities. A lack of such context makes it very hard to validate any claims about the platform.

Additionally, low traffic and visibility can sometimes be a sign that a platform hasn’t established a strong user base or trustworthy reputation.

5. Risks in Cryptocurrency and Investment Platforms

The cryptocurrency and online trading space is inherently volatile and complex. Legitimate exchanges and brokers operate within regulatory frameworks, disclose risks, and prioritize clear communication about how funds are managed. When a platform fails to do these basic things, it exposes participants to:

-

Potential loss of deposits

-

Difficulty accessing or withdrawing funds

-

Unresponsive or non-existent support

-

Lack of legal recourse in case of disputes

Negative user reports about withdrawal barriers aren’t just minor frustrations — they are fundamental problems that go to the core of whether the platform can be relied upon to handle user assets responsibly.

6. Patterns Seen in Other Risky Platforms

The operational patterns described by users — aggressive deposit requests, account blocks, and silence on withdrawal demands — are consistent with what consumer protection advocates often label advance-fee or withdrawal-halt tactics. These strategies are common in schemes that are more concerned with extracting funds than executing legitimate trades or investments. While each platform must be evaluated on its own specifics, the consistency of these reports across multiple victims is not something to overlook.

Final Assessment

Considering the evidence from external reviews, regulatory cautions, and public user feedback, UVSBit.net exhibits multiple risk factors that raise serious concerns about its reliability as a financial platform:

-

Predominantly negative user experiences, especially related to withdrawals.

-

Regulatory warnings from an official securities commission, indicating lack of registration.

-

Opaque ownership and lack of transparent business credentials.

-

Little operational history or independent verification.

These issues suggest that prospective users should be extremely wary of engaging with UVSBit.net. Without credible documentation of oversight, clear operational disclosures, and a track record of user trust, the platform carries a high degree of uncertainty — and investors could face significant challenges recovering funds once deposited.

Before interacting with any online trading or investment service, always ensure it is regulated in your jurisdiction, has clear corporate disclosures, and shows a robust body of independent feedback. If any of these key markers are missing — as they are in the case of UVSBit.net — it’s generally best to look elsewhere for safer options.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to uvsbit.net, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as uvsbit.net continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.