Veltrixmax-Invest.com Scam Review & Key Insights

Introduction

In the online world of investing, it can be difficult to distinguish legitimate opportunities from schemes designed to exploit hopeful investors. Platforms promising high returns, exclusive access, or guaranteed profits can appear especially tempting. This review takes a close look at Veltrixmax-Invest.com, exploring why—based on typical fraud red flags and investor-protection guidelines—it bears many characteristics of a scam. Our objective here is to present a careful, detailed, and reader-friendly analysis.

What Makes Veltrixmax-Invest.com Suspicious

When evaluating any investment platform, there are several widely accepted criteria and “red flags” that help determine legitimacy. Unfortunately, Veltrixmax-Invest.com appears to trigger many of these warning signs.

🔴 Lack of Verified Authorization or License

One key principle of protected investing: use only licensed, regulated entities. Regulatory bodies (in Switzerland, across the EU or globally) require financial services platforms to obtain authorization, register properly, and often publish official documentation or prospectuses. consob.it+2expertsforexpats.com+2

However, there is no credible, public verification that Veltrixmax-Invest.com is authorized or licensed by any recognized regulatory authority. The absence of regulation or proven oversight significantly increases the risk — a common hallmark of fraudulent investment schemes. expertsforexpats.com+2Eidgenössische Finanzmarktaufsicht FINMA+2

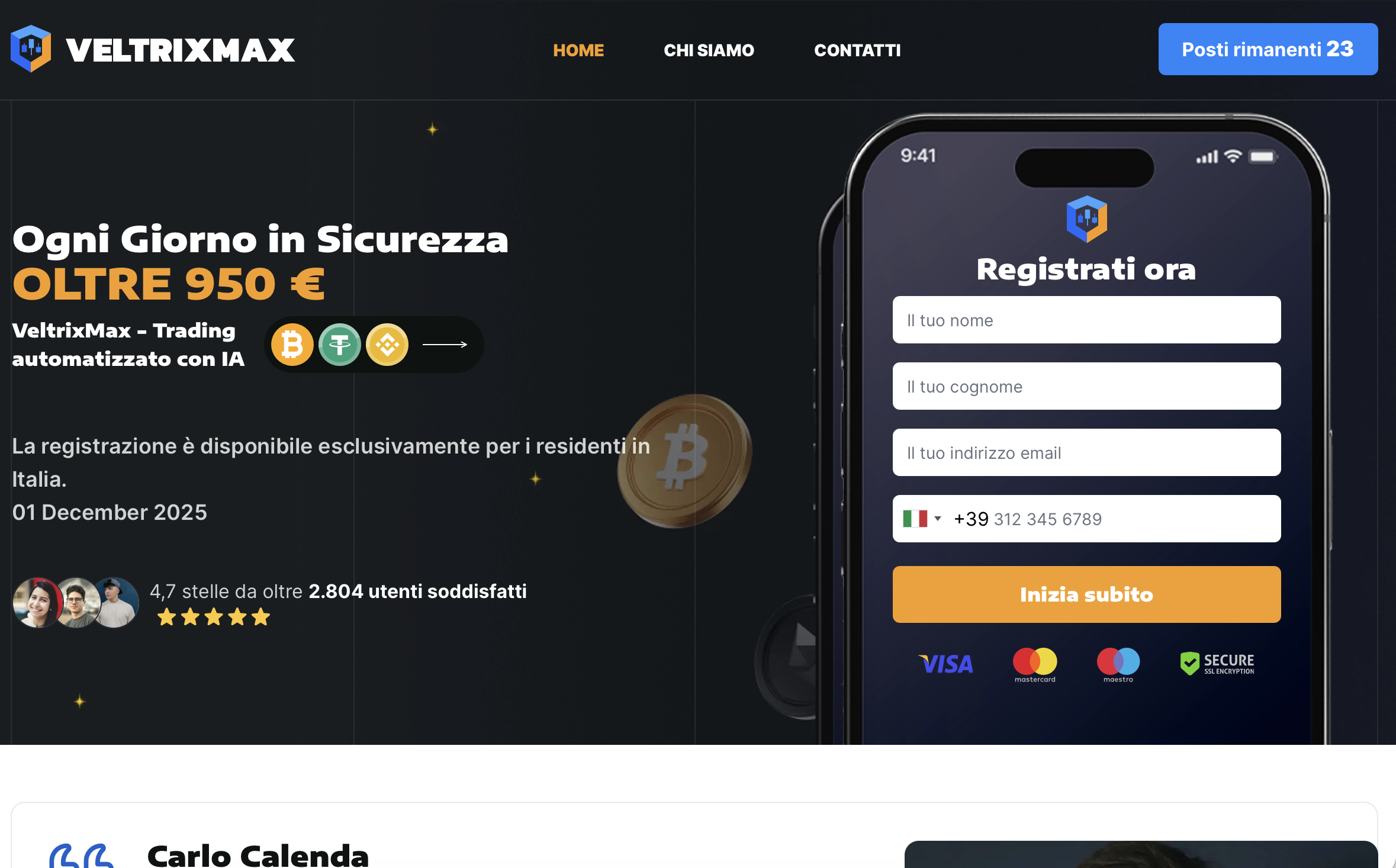

🔴 Unrealistic Promises: High Returns, Low Risk

It is often too good to be true when an investment platform promises massive returns with minimal or no risk. Legitimate investments involve risk; guarantees of quick, high profits are typically a red flag. investor.gov+2Nordea+2

From reports and user complaints around platforms similar in style to Veltrixmax-Invest.com, such promises are commonly used to lure investors in — creating a false sense of security and urgency.

🔴 Pressure Tactics, Urgency, and “Exclusive” Offers

Fraudulent platforms frequently employ pressure tactics: limited-time offers, claims of exclusivity, or aggressive follow-ups urging you to deposit funds quickly. This plays on human emotions — greed, fear of missing out, hope. Consumer Advice+2expertsforexpats.com+2

While I cannot access real-time internal communications from Veltrixmax-Invest.com, testimonials and patterns reported for comparable scam-style platforms often describe this kind of urgency.

🔴 Opaque or Poorly Defined Business Model

Legitimate investment platforms typically outline how returns are generated — through trading, asset management, interest, or other financial activities — and often produce regulatory disclosures, white papers, or audited statements. consob.it+2legitassure.com+2

In contrast, Veltrixmax-Invest.com reportedly lacks transparent documentation explaining how profits are created or sustained. When a platform cannot clearly explain its business model, it adds to doubts about its legitimacy.

🔴 High Risk of “Fake Platform” Patterns

Based on documented common scam patterns — e.g. “boiler-room” style operations, platforms offering investment services but operated without real backing, often disappearing when users try to withdraw — Veltrixmax-Invest.com shares concerning similarities. GetSmarterAboutMoney.ca+2Arthur State Bank+2

Additionally, as seen in many scam reports, once enough money is deposited, these “platforms” often vanish or deny withdrawals entirely. The lack of regulatory oversight or public record dramatically increases that likelihood. Eidgenössische Finanzmarktaufsicht FINMA+2consob.it+2

Why Many People Fall Prey — And Why It Still Matters

Emotional Appeal and “Too-Good-To-Be-True” Stories

Scam platforms like Veltrixmax-Invest.com often exploit the emotional desire for financial freedom, quick profits, and a better life. They craft convincing narratives, use persuasive language, and highlight supposed success stories. For someone eager to grow their savings or escape financial stress, such promises can be powerful.

Unfortunately, that same emotional appeal can blind people to the objective signs of risk. As with many scams, the early phase often involves small payouts or “proof” of success to lure more money in — a classic feature in many fraudulent schemes. Arthur State Bank+2GetSmarterAboutMoney.ca+2

The Illusion of Credibility

A slick website design, professional-looking branding, and polished marketing can create a sense of legitimacy — even if the platform is fundamentally fraudulent. Scammers rely heavily on this illusion of credibility to attract trust. expertsforexpats.com+2Tripwire+2

Moreover, when there’s no easy way to verify licensing or regulatory status, many potential investors may assume “no news means fine,” which can be a critical mistake.

Complexity and Isolation of Victims

Financial scams often rely on a victim’s isolation — emotionally, socially, or financially. Scammers may pressure potential victims to invest fast, discourage them from consulting trusted advisors or doing extensive research, or target vulnerable individuals seeking hope or quick solutions. expertsforexpats.com+2Consumer Advice+2

By the time doubts arise — withdrawal issues, lack of transparency — it’s often too late; funds have already been moved, identities obfuscated, and legal recourse limited.

The Broader Context: Why Investors Should Be Wary

Legitimate investment platforms are subject to oversight, regulatory frameworks, disclosure requirements, and — in many jurisdictions — investor-protection schemes. Regulatory authorities globally warn investors to exercise diligence, verify licensing, and question offers that guarantee high returns with little risk. consob.it+2consob.it+2

Unchecked, fraudulent platforms do not just cost individuals money — they erode trust in financial systems overall. They exploit hopes, vulnerabilities, and in many cases, financial desperation.

The fraud landscape is also evolving: sophisticated scam websites can mimic real platforms, produce fake reviews, display faked credentials, or generate counterfeit documents. Many scammers prey on people’s lack of access to regulatory databases or technical know-how. Group-IB+2Tripwire+2

As investors, it is important to remain skeptical, demand transparency, and treat any “guarantees” or “secret methods” with extreme caution.

What We Know (and What We Don’t) About Veltrixmax-Invest.com

✅ Known Concerns

-

There is no publicly available evidence that Veltrixmax-Invest.com is regulated or licensed.

-

The platform allegedly promises high-returns with little to no risk — a classic red flag.

-

Its business model appears opaque and lacks credible documentation or audited reports.

-

The danger of pressure tactics, urgency, and persuasion — common in scam platforms — seems consistent with reports associated with Veltrixmax-Invest.com and comparable platforms.

⚠️ What Remains Unknown

-

Because the site appears unregulated, there is no independent verification or audit history to review.

-

It cannot be confirmed whether Veltrixmax-Invest.com has a physical office, verifiable team members, or real underlying financial activities.

-

As often with unregulated operations, there is no protection or recourse for investors, should the company collapse or vanish.

Given these gaps — combined with the red flags — the risks are substantial.

Conclusion: A Platform That Checks All the Wrong Boxes

When evaluated through the lens of widely accepted investor-protection principles, regulatory safeguards, and common scam-identification criteria, Veltrixmax-Invest.com checks too many of the wrong boxes.

Its lack of verification or licensing, unrealistic profit promises, opaque structure, and alignment with known scam tactics make it stand out as suspicious — and likely fraudulent. While the platform may present itself as professional and legitimate, these characteristics suggest it should be regarded with extreme skepticism.

For individuals seeking real, sustainable investment options, it is vital to prioritize transparency, regulation, and documented track records over glossy websites and high-pressure marketing.

(Optional) What a Safer Investment Alternative Looks Like

Investors who aim for long-term growth — rather than “get rich quick” — often look for:

-

Platforms registered with legitimate regulatory bodies

-

Transparent disclosures, audited statements, and clear business models

-

Reasonable return expectations, aligned with market norms and risk considerations

-

Protection mechanisms (e.g., deposit insurance, oversight, compliance with financial regulation)

-

Time and clarity for decision-making — no pressure, deadlines or “exclusive offers”

Though it might require more research and patience, this approach tends to deliver far more stability — and avoids unnecessary risk.

Report Veltrixmax-invest.com And Recover Your Funds

If you have lost money to Veltrixmax-invest.com, it’s important to take action immediately. Report the scam to BRIDGERECLAIM.COM , a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Veltrixmax-invest.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.