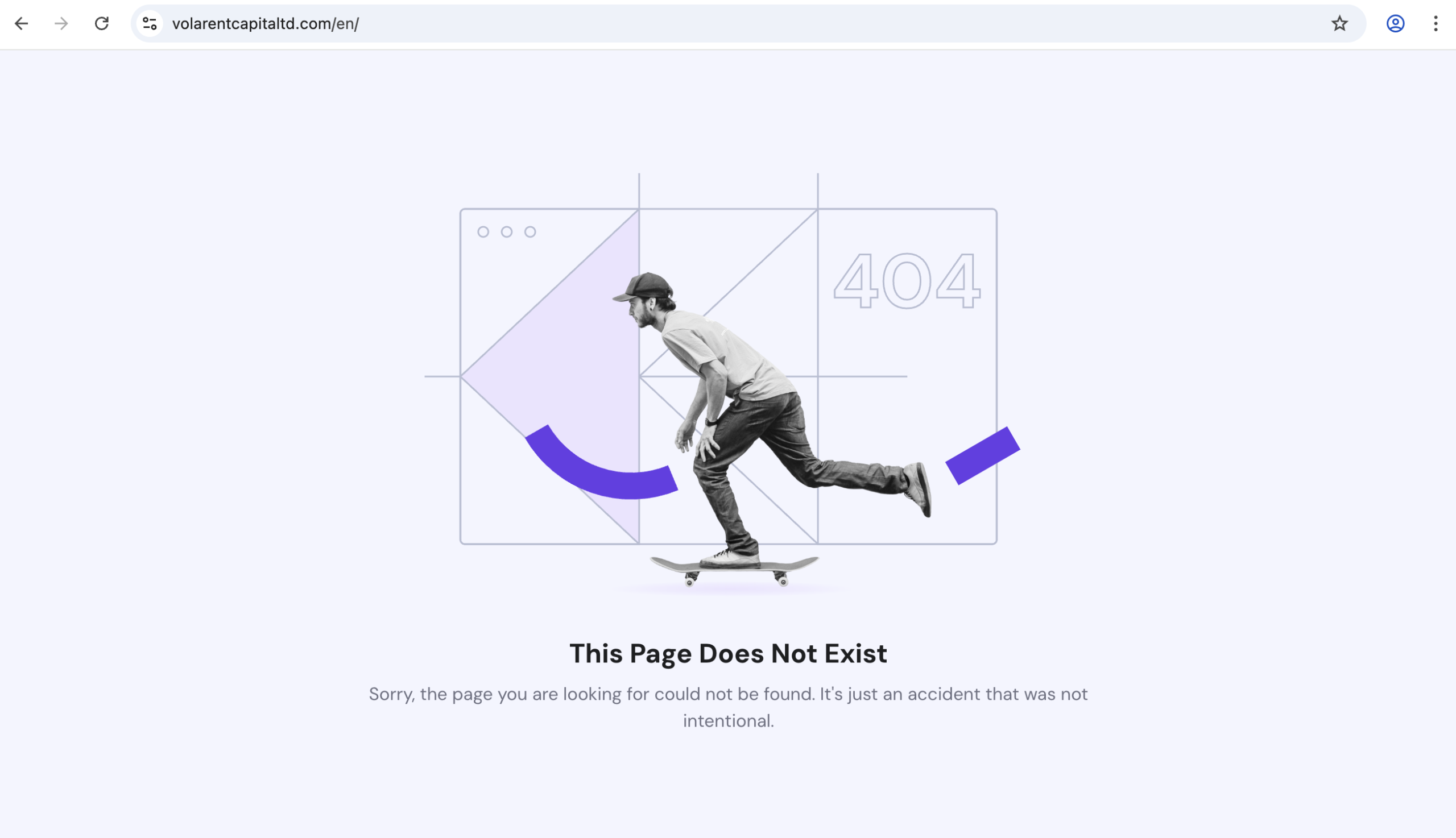

VolarentCapitaLtd.com Company Check

As online investment and trading platforms proliferate, so too do unregulated, opaque services designed to attract unsuspecting users. One such name that has generated widespread concern is VolarentCapitaLtd.com. While the platform markets itself as a capable broker and financial facilitator, deeper analysis and user sentiment suggest serious reasons for caution. This review examines the platform’s claims, questionable practices, user feedback, and structural flaws, and explains why potential investors should think twice before interacting with it.

How VolarentCapitaLtd.com Presents Itself

At first glance, VolarentCapitaLtd.com uses familiar sales language often seen in legitimate financial services. Its homepage discusses “cutting-edge trading,” “professional tools,” and “maximizing returns.” The platform emphasizes accessibility and portrays itself as a modern solution for traders of all experience levels. These kinds of messages are designed to instill confidence, particularly in users who are new to online investing.

However, promotional language is not the same as real credibility. What matters in financial services is transparency, regulation, and accountability—areas where this platform falls short.

Opaque Ownership and Lack of Verification

One of the foundational markers of a legitimate investment broker is clear disclosure of the company’s identity, registration details, and regulatory oversight. This includes the legal entity behind the service, names of principals, and any licenses granted by recognised financial authorities.

VolarentCapitaLtd.com fails this basic standard. There is no verifiable ownership information on its site. No corporate address tied to a known business registry, no named executives, and no licensing with financial regulators such as the UK’s Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC), or the Australian Securities and Investments Commission (ASIC). The absence of these disclosures is not a small oversight—it means there is no independent body holding the platform accountable.

Without transparent registration or regulatory oversight, any claims of professionalism are essentially unsubstantiated marketing copy.

User Feedback Shows Strong Patterns of Dissatisfaction

A credible broker typically has a mix of positive and negative user reviews. While complaints are a normal part of any service, the tone and recurrence of issues matter. In the case of VolarentCapitaLtd.com, a consistent pattern emerges in user feedback:

-

Withdrawal Attempts Go Unfulfilled: Multiple users describe situations where they were unable to withdraw funds after depositing. This includes small withdrawal requests that were never completed, or requests that remained unanswered by support.

-

Support Communication Breakdowns: Numerous complaints describe a lack of clear, timely responses from customer service. Users report repeated attempts to contact support that went unanswered or provided vague, evasive replies.

-

Account Blocking or Restrictions: Some users claim that once they stopped adding funds, the platform restricted access to their accounts entirely, making it nearly impossible to manage positions or recover balances.

These are not isolated one-off comments; the same themes recur across multiple reports. While there are occasional positive testimonials, they tend to be short, generic, and lacking detail—unlike the lengthy, specific negative accounts. This asymmetry suggests that many of the positive reviews could be superficial and potentially incentivized, whereas the negative feedback reflects genuine user experiences.

Questionable Transparency in Terms and Conditions

Legitimate brokers make their terms, fees, and policies crystal clear. A user should be able to understand how trading works, what fees are charged, what protections exist, and how disputes are handled. With VolarentCapitaLtd.com, however, many of the key structural details are buried in fine print or expressed in vague, non-specific language.

For example, information about fee structures—such as spreads, commissions, or inactivity penalties—is difficult to locate and not clearly explained. Similarly, withdrawal terms and any associated conditions are not presented in a straightforward way. When a platform makes critical contractual information hard to find or understand, that’s a red flag for transparency issues.

Regulatory Status and Investor Protection

Arguably the most important dimension in evaluating any broker is whether it is regulated by a recognised financial authority. Regulation ensures that the platform adheres to standards of fairness, transparency, and financial accountability. It also means that client funds are held in segregated accounts, not commingled with the company’s operating capital.

In the case of VolarentCapitaLtd.com:

-

No disclosed regulatory license exists.

-

There are no mentioned regulatory body IDs or certifications.

-

There is no evidence of audited financial practices.

Without regulation, funds deposited on the platform are effectively unprotected. There is no mechanism to ensure fair pricing, no requirement for audited financial reports, and no regulatory complaints body to oversee user disputes. This is a significant deficiency for any financial service.

Marketing Techniques That May Be Misleading

Another concern with VolarentCapitaLtd.com is the style of its promotional content. The platform uses urgency-driven language, suggesting that opportunities are limited and that users should act quickly to capitalize on gains. These psychological triggers are common in high-pressure sales tactics and are not typical of reputable financial institutions, which tend to focus on clarity and informed consent rather than urgency.

Additionally, some users report being contacted by representatives who use aggressive follow-up techniques, including repeated calls and emails encouraging further deposits. High-pressure outreach, especially when unsolicited, is another indicator that a platform may be prioritizing asset inflow over service quality.

Conclusion — Why Caution Is Advisable

VolarentCapitaLtd.com presents itself with polished marketing and broad promises, but beneath that surface, significant issues suggest it lacks the hallmarks of a trustworthy financial broker. The platform’s failure to disclose verifiable ownership, its lack of regulatory standing, widespread user complaints about withdrawals and communication, and its opaque fee and terms structure combine to create a track record that cannot be ignored.

For anyone considering a financial services platform, the first question should always be: Can I verify who they are and who oversees their operations? With VolarentCapitaLtd.com, the answer is not clear—and that alone is a strong basis for caution.

In the world of online investing, your capital should only be entrusted to platforms with demonstrable credibility, transparent operations, and regulatory oversight. VolarentCapitaLtd.com does not meet these criteria, and that is why many observers advise steering well clear of the platform.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to VolarentCapitaLtd.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as VolarentCapitaLtd.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.