Wealthexa.com: Truth Behind the Promises

In the ever-expanding world of online investment platforms, discerning legitimate services from fraudulent operations is increasingly difficult. Sadly, many scammers are deploying polished websites and professional-sounding messaging to lure unsuspecting people into handing over their money. Wealthexa.com appears to be one such operation — and this review breaks down the warning signs, user patterns, and regulatory red flags that strongly suggest it is a scam you should avoid at all costs.

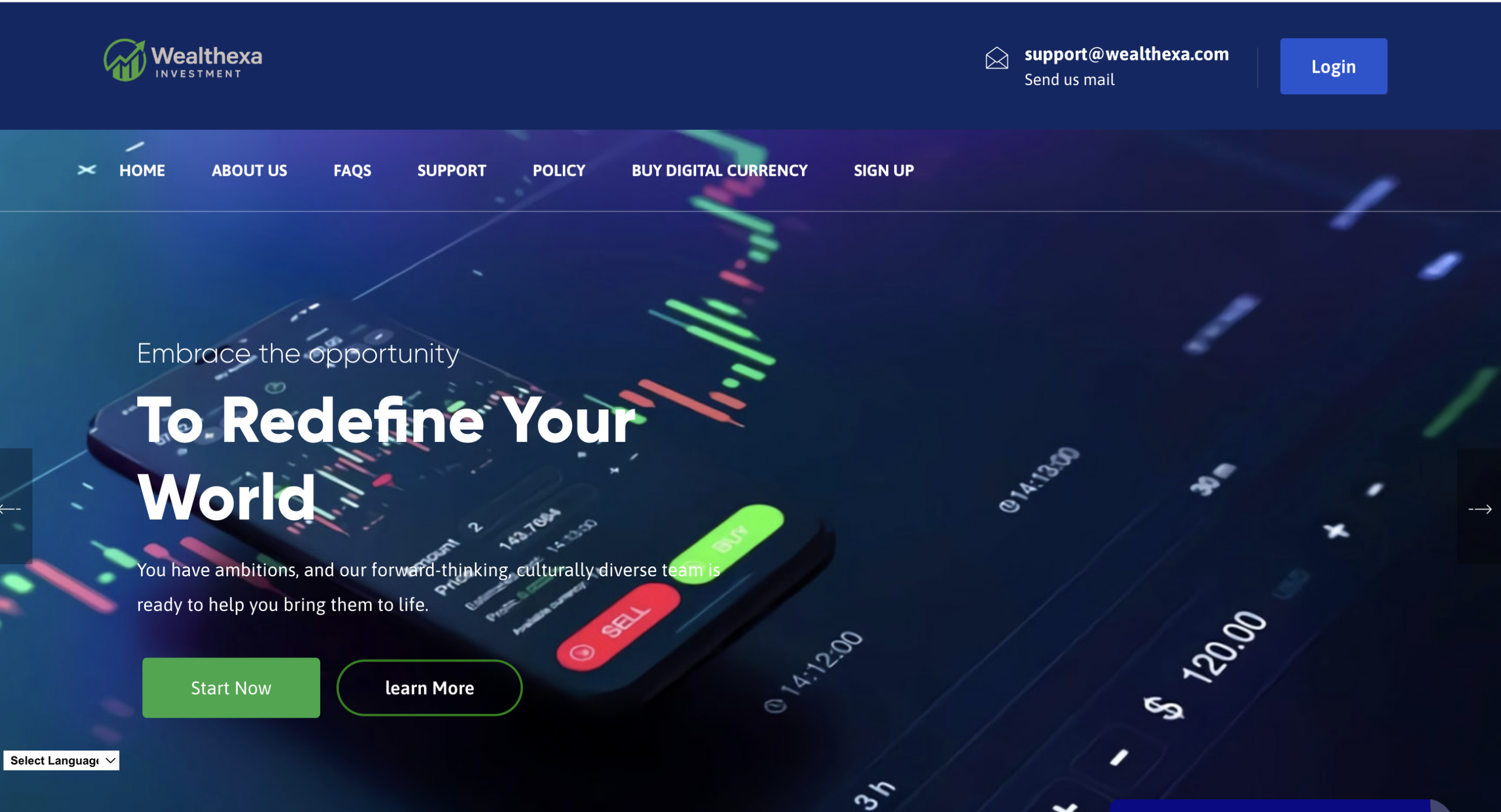

1. What Is Wealthexa.com Claiming to Be?

Wealthexa.com markets itself as a modern investment hub, promising access to a wide array of financial markets including cryptocurrencies, forex, commodities, indices, stocks, and even pre-IPO assets. Its website is designed to look sleek and professional, complete with claims of “expert trading teams,” “innovative strategies,” and purported millions of dollars in assets under management.

The site also features investment plans that promise fixed returns — such as 5%–12% gains in just 24 hours — which are exceptionally high compared to realistic market expectations.

Such guarantees are classic hallmarks of fraudulent schemes: legitimate financial markets are volatile by nature, and no credible platform can consistently promise elevated returns within a fixed short timeframe. Regulatory bodies regularly warn that offers of “guaranteed profits” in investment markets are a major red flag of scams.

**2. **Lack of Proper Regulation — A Critical Red Flag

One of the strongest indicators that a financial service may be a scam is the absence of verifiable regulatory oversight. Legitimate investment platforms — especially those offering trading in assets like forex and crypto — are typically licensed by recognized authorities such as the UK’s Financial Conduct Authority (FCA), Australia’s ASIC, Cyprus’s CySEC, or similar regulators.

Independent analysts have manually searched multiple major regulatory databases and found no record of Wealthexa.com being licensed or authorised by any of the globally recognised financial watchdogs.

In fact, industry monitoring groups list Wealthexa on warning lists that specifically flag firms suspected of offering investment services without the required authorisation.

Operating without proper licensing means there is no legal protection for customers. Regulatory oversight exists to ensure client funds are segregated, audited, and protected under financial law. A company that evades this oversight is not playing by the rules, and your money has no safety net.

**3. **No Verified Track Record or Independent Reviews

Credible brokers and investment platforms eventually build a verifiable reputation across independent review sites such as Trustpilot, Reviews.io, or financial forums. Wealthexa.com has no established footprint on these platforms, and where it has been mentioned indirectly, consumer feedback is overwhelmingly negative: users report withdrawal delays, unresponsive customer service, and unexplained losses.

The absence of any real, verified user reviews on independent sites is itself a red flag. Scammers frequently avoid open review ecosystems because negative commentary can quickly expose their activities. Genuine platforms, by contrast, accumulate a diversity of feedback — both positive and negative — that outsiders can evaluate.

**4. **Domain Age Raises Doubt About Credibility

The domain registration date of Wealthexa.com has been identified as very recent. A brand that claims extensive experience and billions in assets but only recently established its online presence should be treated with skepticism.

Scammers often set up short-lived websites, attract deposits, and then disappear or rebrand before authorities or victims realise what’s happened. A lack of historical depth in the domain or corporate identity makes it difficult to verify the company’s operational history or leadership.

5. Typical Scam Patterns Seen in Independent Analyses

Beyond regulation and reviews, Wealthexa.com exhibits behaviours commonly associated with fraudulent investment operations:

-

Unrealistic returns: Promises of high, guaranteed daily profits without transparent risk disclosures.

-

Opaque corporate information: Limited verified details about the company’s legal identity, leadership, and operational jurisdiction.

-

Pressure to deposit or upgrade: Tiered plans that encourage increased deposits without clear substantiation of value.

-

Lack of clear withdrawal policies: Withdrawal conditions and fee structures are vague or absent — another red flag for potential fund trapping.

These elements closely align with typical “high-risk investment scam” profiles that regulators and consumer protection agencies repeatedly warn against.

6. Why You Should Steer Clear

Taking all of the above into account — unverified licensing, exaggerated claims, absence of credible user feedback, and classic scam indicators — the evidence strongly suggests that Wealthexa.com is not a trustworthy investment platform.

Here’s why you should absolutely avoid it:

-

No regulatory safety net: You have little to no legal recourse if funds go missing.

-

Potential for permanent capital loss: Patterns indicate difficulty or impossibility of withdrawing deposited funds.

-

No transparent operations or disclosures: A platform that avoids basic corporate transparency is concealing risk, at best.

-

Increasing regulatory scrutiny: Financial authorities are actively warning about unregulated digital investment services — including names like Wealthexa — that may be targeting retail investors.

Final Word

Investing should always involve careful research, understanding of risks, and trust in the institutions you choose to work with. Wealthexa.com currently fails on almost every objective measure of legitimacy and safety.

Rather than risking your hard-earned money on an unregulated and unverified platform, choose established, properly regulated exchanges and brokers with transparent corporate identities and a long history of independent user feedback.

Your financial security is too valuable to gamble on platforms that make bold claims without the foundations to back them up. Stay informed, stay cautious, and always prioritise platforms that are held accountable by real regulators and real users.

-

Contact Bridgereclaim.com to Review Your Case

If you have lost money to wealthexa.com, it is important to act without delay. You can submit details of your experience to BRIDGERECLAIM.COM, a platform that assists individuals who have been affected by fraudulent online trading activity. Taking prompt action may improve the likelihood of addressing the situation and pursuing accountability for those responsible.

Unregulated brokers such as wealthexa.com continue to target unsuspecting investors. Staying informed, avoiding platforms that lack proper oversight, and alerting the appropriate channels can help protect both yourself and others from financial misconduct.